Like all states, maine sets its own excise tax. 2021 cost of living calculator:

Maine Income Tax Calculator – Smartasset

South portland collects the maximum legal local sales tax.

Excise tax calculator south portland maine. Netr online • south portland • south portland public records, search south portland records, south portland property tax, maine property search, maine assessor from the marvel universe to dc multiverse and beyond, we cover the greatest heroes in print, tv and film Excise tax is an annual tax that must be paid prior to registering your vehicle. Effective november 3, 2021, important notice of address change:

As of the 2010 census, the city population was 25,002. The tax rate is the dollar amount per thousand of valuation. It is a calculator for figuring excise tax based on msrp and year of vehicle.

The south portland sales tax is collected by the merchant on all qualifying sales made within south portland The finance office has moved back to city hall, 25 cottage road. (207) 767 7604 (phone) (207) 767 7620 (fax) the city of south portland tax assessor's office is located in south portland, maine.

Excise tax is based upon the age and “cost new” of your vehicle. The tax rate for south portland is set in july. All applicable state of maine law requirements are followed in regards to excise tax credits.

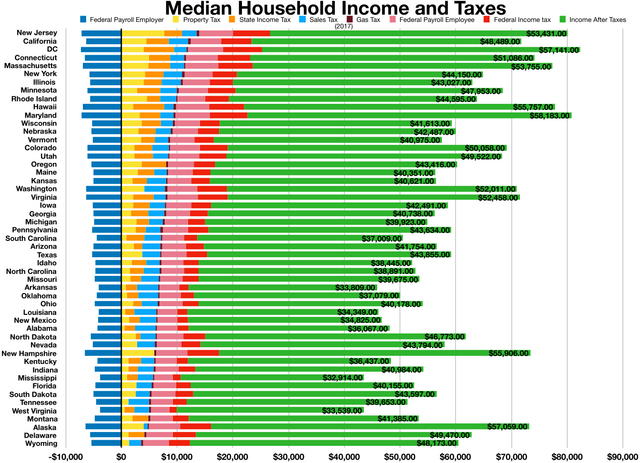

City of south portland assessor. South portland , maine 04106. The typical maine resident will pay $2,597 a year in property taxes.

Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. The billing address has changed to:

Simply press one rate and then press and maintain alt + select the other rate(s). A salary of $120,000 in rocky point, new york could decrease to $109,406 in south portland, maine (assumptions include homeowner, no child care, and taxes are. Please note the state of maine property tax division only provides quotes to the municipal excise tax collector and not to individuals.

Most maine cities and towns including portland, falmouth, south portland, cape elizabeth, scarborough and westbrook provide standard maine license plates. Property tax, utility and other municipal payments. Calculation of the general sales taxes of 04106, south portland, maine for 2021.

Local government in maine is primarily supported by local property taxes. This is your tax liability for the fiscal year july 1 to june 30. Maine relocation services local tax rates.

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. The sales tax jurisdiction name is maine, which may refer to a local government division. The 5.5% sales tax rate in south portland consists of 5.5% maine state sales tax.

Property tax & records for fy22, the total value of taxable property in portland is $14.6 billion, which generates $190 million in property tax revenue to fund the operation of maine’s largest city. In 1953, the sales tax on retail transactions was enacted, and in 1969, the state´s personal income tax was adopted. You can simply select one rate or multiple rate for a maximum total equivalent to the combined.

You can calculate your tax bill by multiplying the total taxable value of your property by the current tax rate. The south portland, maine sales tax is 5.50%, the same as the maine state sales tax. Property tax rates in maine are well above the u.s.

Sales tax calculator of 04106, south portland for 2021. According to a 2019 wolfram alpha estimate, the population rose to 25,532, an increase of 530 from the 2010 census. If you call ahead, your city or town can tell you how much your excise tax will be.

You can print a 5.5% sales tax table here. This service is provided by a third party working in partnership with the state of maine. Click here for information on vehicle registration, trailer, atv and boat registration, tax payments, and more.

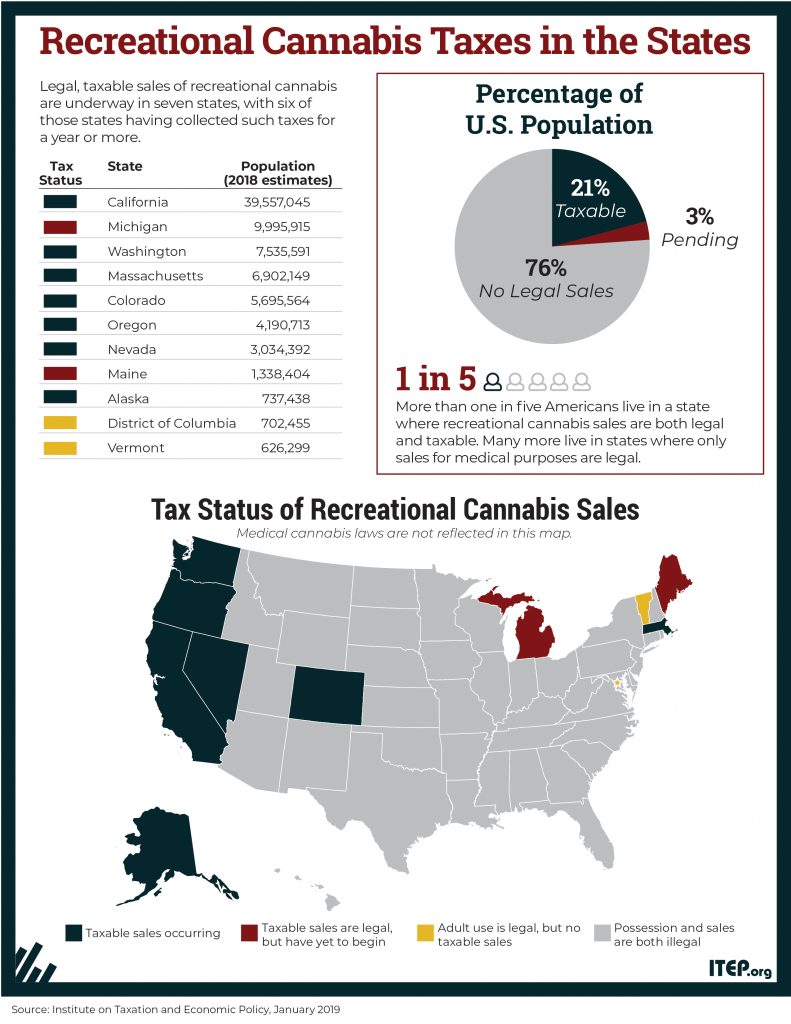

There is no applicable county tax, city tax or special tax. Recreational marijuana sales in maine start on friday. The december 2020 total local sales tax rate was 5.000%.

There is no county sale tax for south portland, maine.there is no city sale tax for south portland. This online service allows citizens to provide payment to their participating municipality or utility district for property tax, utility and other bills. Maine residents that own a vehicle must pay an excise tax for every year of ownership.

The maine state statutes regarding excise tax can be found in title 36, section 1482. Excise tax amounts are based on the vehicle's msrp (manufacturer's suggested retail price) and year of manufacture. Until the early 1950s, the property tax was the only major tax in maine.

How 2021 sales taxes are calculated in south portland. The state’s average effective property tax rate is 1.30%, while the national average is currently around 1.07%. Rocky point, new york vs south portland, maine.

While many other states allow counties and other localities to collect a local option sales tax, maine does not permit local sales taxes to be collected. The south portland, maine, general sales tax rate is 5.5%.the sales tax rate is always 5.5% every 2021 combined rates mentioned above are the results of maine state rate (5.5%). 2,356 posts, read 5,367,704 times reputation:

The current total local sales tax rate in south portland, me is 5.500%. The assessor’s department maintains tax records on over 24,000 real estate accounts, 3,200 business personal property accounts, and 481 tax maps.

Welcome To The City Of Bangor Maine – Excise Tax Calculator

States With Highest And Lowest Sales Tax Rates

Excise Service Tax How To Pay Excise Duty Or Service Tax

Maine Sales Tax Calculator And Local Rates 2021 – Wise

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Taxing Cannabis Itep

Mainegov

Sales Taxes In The United States – Wikipedia

Rhode Island Sales Tax Calculator Reverse Sales Dremployee

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States – Wikipedia

Maine Income Tax Calculator – Smartasset

How High Are Recreational Marijuana Taxes In Your State 2019

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Maine Sales Tax Calculator And Local Rates 2021 – Wise

City Of South Portland Maine Official Website Treasury Collections Vehicle And Boat Registration

Principles Of Taxation For Business And Investment Planning 2018 Edition 21st Edition – Sally Jones Pdf Irs Tax Forms Taxes

Iata List Of Ticket And Airport Taxes And Fees