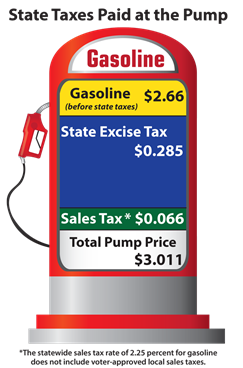

The state excise tax on gas in maine is 30 cents per gallon of regular gasoline. If you have any questions.

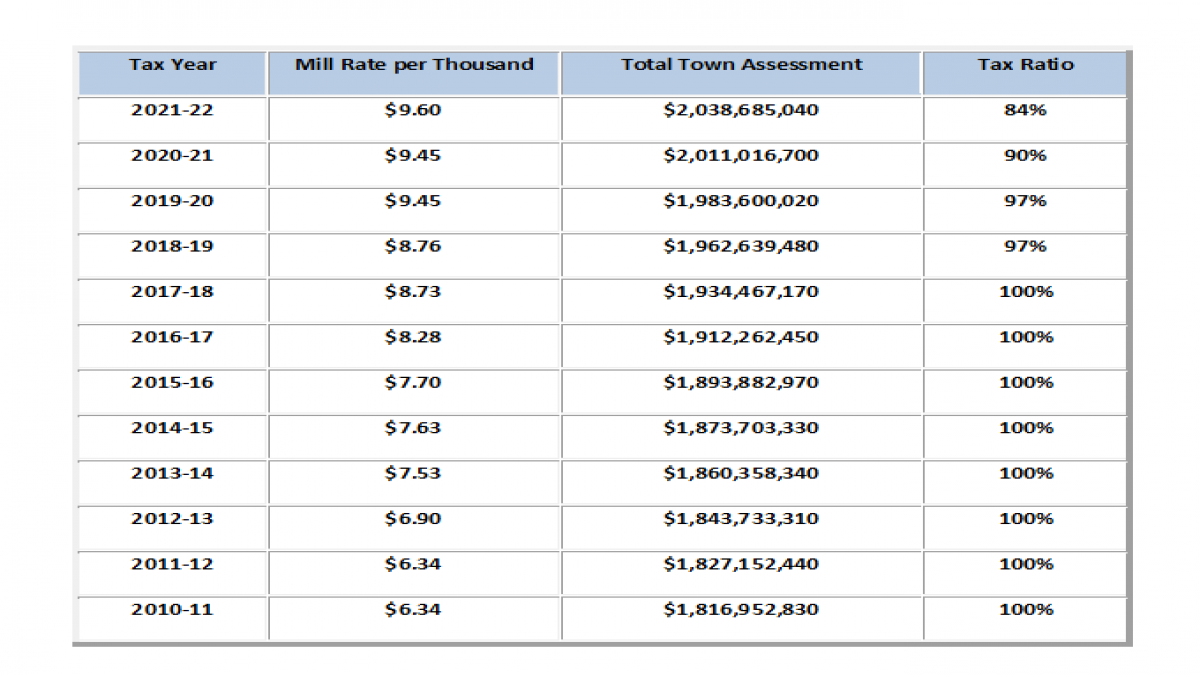

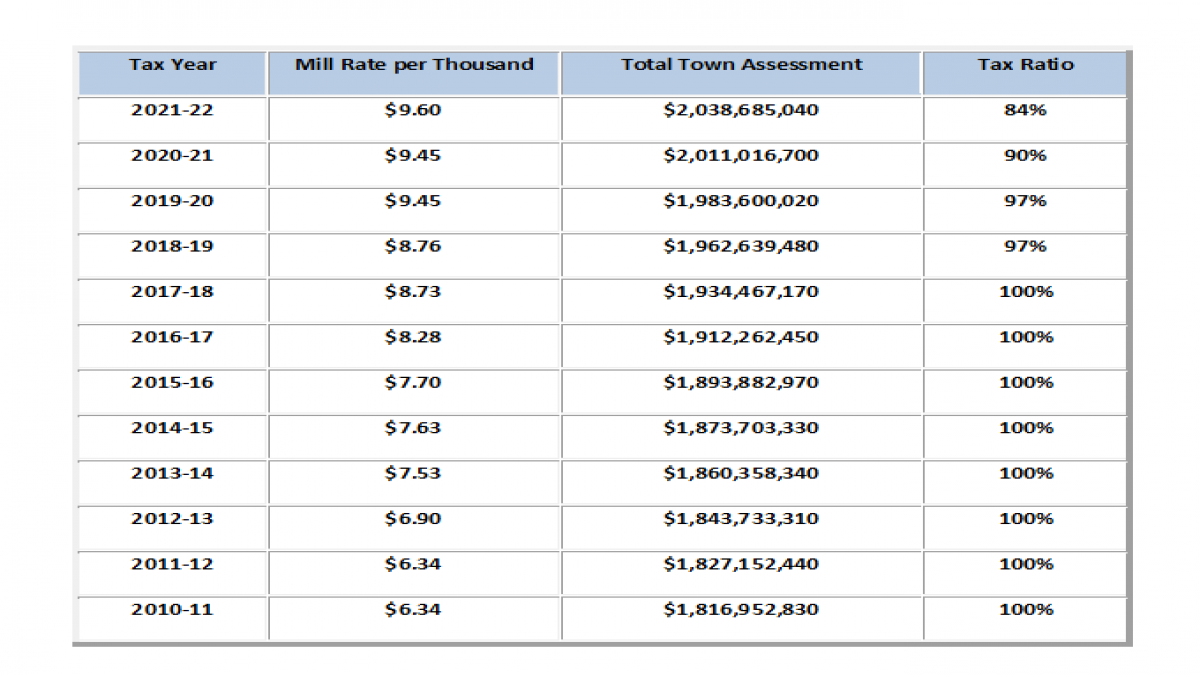

Tax Rates Town Of Kennebunkport Me

We do accept credit card payments in the office and online;

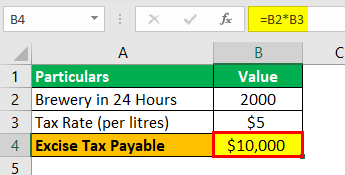

Excise tax calculator kennebunk maine. Payment for the registration fees based upon license plate. The excise tax calculation is based on the original value of the motor vehicle. Excise tax is an annual tax that must be paid prior to registering your vehicle.

The kennebunk sales tax is collected by the merchant on all qualifying sales made within kennebunk The state excise tax on gas in maine is 30 cents per gallon of regular gasoline. The sales tax jurisdiction name is maine, which may refer to a local government division.

All checks should be made out to the “town of kennebunkport.”. If you have general questions, you can call the alfred. For example, passenger vehicle calculations are based on the original sticker price.

Excise tax is defined by maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Excise tax is an annual local town tax paid at the town hall where the owner of the vehicle resides. The typical maine resident will pay $2,597 a year in property taxes.

Cambridge, massachusetts vs kennebunk, maine change places a salary of $50,000 in cambridge, massachusetts could decrease to $30,439 in kennebunk, maine (assumptions include homeowner, no child care, and taxes are not considered. Are you looking to move to a town or city in maine, but also want to get a sense of what the property tax (or mil rate) is?you’ve come to the right place. There is no applicable county tax, city tax or special tax.

Today, property taxes in maine generate approximately $1.8 billion a year to fund local government services. Please call the assessor's office in kennebunk before you send documents or if you need to schedule a meeting. How 2021 sales taxes are calculated for zip code 04043.

Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to the excise tax. Except for a few statutory exemptions, all vehicles registered in the state of maine are subject to excise tax. This is only an estimate.

Departments > treasury > motor vehicles > excise tax calculator. There is no applicable county tax, city tax or special tax. Both real (land and buildings) and personal property (tangible goods) are subject to taxation, unless they are exempted by law or subject to another form of taxation, such as the excise tax for motor vehicles and boats.

You do not pay excise tax on utility trailers so you need to go directly to the bureau of motor vehicles to register them. Town of anson tax collector. However, please note that transactions paid with a card are subject to a vendor fee of 2.75%.

Excise tax is an annual tax that must be paid prior to registering your vehicle. For online vehicle registration renewals only, please click on rapid renewal logo below: The december 2020 total local sales tax rate was 5.000%.

Maine gas tax the state excise tax on gas in maine is 30 cents per gallon of regular gasoline. You can print a 5.5% sales tax table here. The 5.5% sales tax rate in west kennebunk consists of 5.5% maine state sales tax.

The current total local sales tax rate in kennebunk, me is 5.500%. The 5.5% sales tax rate in kennebunk consists of 5.5% maine state sales tax. Online calculators are available, but those wanting to figure their excise tax in maine can do so easily using a manual calculator or paper and pen.

The excise tax rate is $24.00 per thousand dollars of value the first year, $17.50 the second year, $13.50 the third year, $10.00 the fourth year, $6.50 the fifth year and $4.00. Kennebunk collects the maximum legal local sales tax. Property tax rates in maine are well above the u.s.

This is only an estimate. Excise tax must be paid at the registrant's town office prior to completing any registration at a buereau of motor vehicles location. The state’s average effective property tax rate is 1.30%, while the national average is currently around 1.07%.

Excise tax is an annual tax that must be paid prior to registering your vehicle. The excise tax due will be $610.80. Excise tax receipt (provided at the town office).

West kennebunk collects the maximum legal local sales tax. The 04043, kennebunk, maine, general sales tax rate is 5.5%. I created this page after constantly googling the rates.

Payment for the $33 title application fee for vehicles 1995 or newer. While many other states allow counties and other localities to collect a local option sales tax, maine does not permit local sales taxes to be collected. The kennebunk, maine sales tax is 5.50%, the same as the maine state sales tax.

The excise tax due will be $610.80. Remember to have your property's tax id number or parcel number available when you call! Paper trails is a local payroll company with offices in kennebunk and brunswick, and we serve clients across maine and new england.

The sales tax jurisdiction name is maine, which may refer to a local government division. The state of maine publishes this information in a pdf, but wanted to be able to sort by mil rate, county, growth rate, and current mil rate. Maine gas tax the state excise tax on gas in maine is 30 cents per gallon of regular gasoline.

The combined rate used in this calculator (5.5%) is the result of the maine state rate (5.5%). You can print a 5.5% sales tax table here. Taxes are payable at the town hall (6 elm street) during normal office hours, via mail (po box 566) or can be paid online.

This tax is already included in your registration fees.

Excise Tax Information Cumberland Me

Excise Tax Explained – Taxjar

Boe To Consider 75 Cent Gasoline Excise Tax Rate Cut Van Nuys Neighborhood Council

Maine Car Registration A Helpful Illustrative Guide

Vehicle And Trailer Registrations Kennebunk Me – Official Website

Kennebunkport Tax Rate Up 159 Percent – Portland Press Herald

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Gis Tax Mapping Kennebunk Me – Official Website

Mainegov

Biddeford Man Wants To Change Maine Excise Tax With Citizen Initiative On Ballot Wgme

Welcome To Saco Maine

Douglas-magov

What Is An Excise Tax Importing Into The United States

Welcome To The City Of Bangor Maine – Excise Tax Calculator

Online Excise Tax Calculator Makes Exporting Easier

Welcome To The City Of Bangor Maine – Excise Tax Calculator

Excise Tax Rates Maryland And Neighboring States 2009 15 Download Table

I-team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Maine Income Tax Calculator – Smartasset