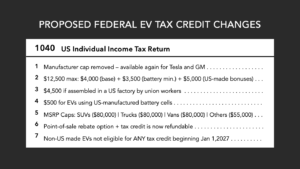

It would limit the ev credit to cars priced at. The bill says individual taxpayers must have an adjusted gross income of no more than $400,000 to get the new ev tax credit.

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

By syndicated content nov 3, 2021 | 5:24 pm.

Ev tax credit bill text. The us senate finance committee has put forth a bill to extend and strongly improve the us federal ev tax credit. Add an additional $4,500 for evs assembled in. Evs and consumers will be able to qualify for another $4,500 in the tax credit if an automaker makes the ev in the us with a union workforce.

Evs with battery pack smaller than 40 kwh are limited to a $4,000 incentive. Briefly, let’s look at a. Joe manchin said thursday that he opposes a provision in the build back better bill that would give an additional $4,500 in.

Add an additional $4,500 for ev assembled at union factories. The bill then will go to the senate. Canada still has ‘runway’ to prevent u.s.

Car buyers that would be worth up to $12,500 on vehicles made on american soil and built with union labour. Many of the members of congress who took part in the meetings said they're still a long way from having decided how they're going to vote, ng said in an interview at the. Now comes the $5,000 boost.

The full ev tax credit will be available to individuals reporting adjusted gross incomes of $250,000 or less, $500,000 for joint filers (decreased from $400,000 for individuals/$800,000 for joint filers currently in place) evs must be made in the us starting in 2027 to qualify for any of the $12,500 credit. Car buyers that would be worth up to $12,500 on vehicles made on american soil and built with union labour. This is for cars placed in service before 2027.

House of representatives worked into the night to pass biden’s $1.75 trillion domestic investment bill that includes the tax credits that canada fears will undercut its own efforts to produce electric cars. Two weeks after trudeau visit, still time to push back on ev tax credit, ng says. It's not clear to me what part of the legislative process this change is part of.

Here’s how you would qualify for the maximum credit: Keep the $7,500 incentive for new electric cars for 5 years. That component, the build back better bill, currently includes a juicy incentive for u.s.

Minister mary ng led a delegation of mps, business leaders and union heads to the u.s. Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022. Ev tax credit, trade minister says by james mccarten the canadian press posted december 3, 2021 6:26 pm

The ev credit language seems largely set in stone from what i can tell and the bigger focus is the salt deduction being increased, paid maternity leave and what. Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for five years; While its possible the ev credit terms being negiated in the bbb plan change before it is ultimately passed, i am not of the opinion that the key sticking points of the bill are related to the current ev credit language.

That component, the build back better bill, currently includes a juicy incentive for u.s. House democrats released a revised bill on wednesday that expands a proposed tax credit of up to $12,500 for electric. The build back better bill includes a $12,500 ev tax credit, up from the current $7,500 available to qualifying cars and buyers.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits – Extremetech

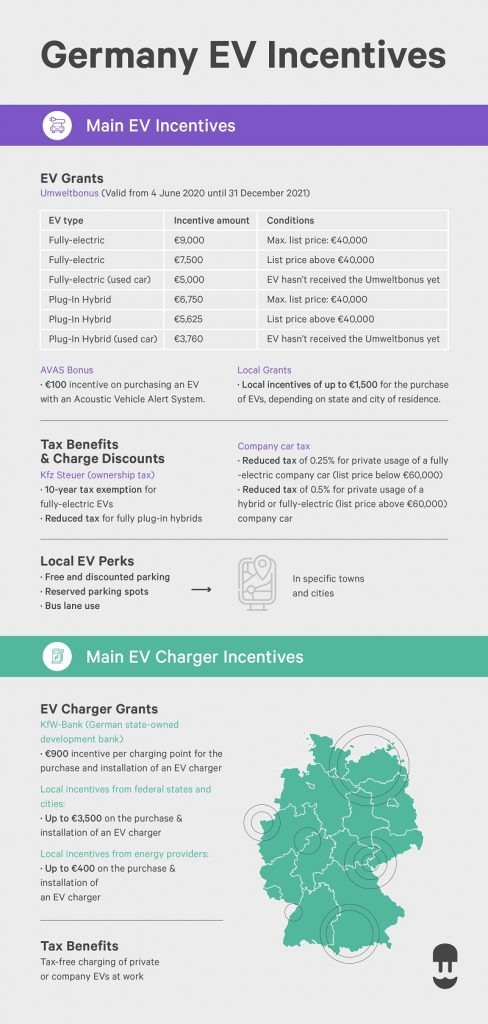

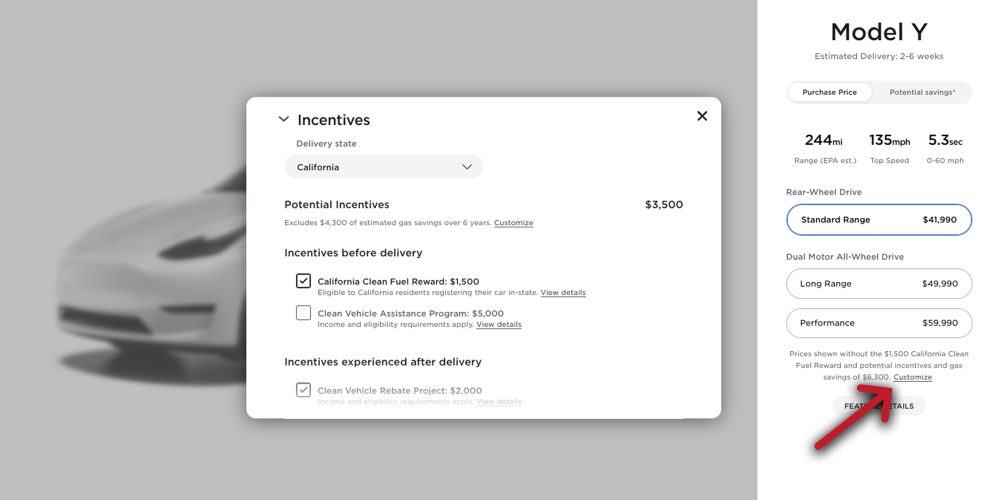

Ev And Ev Charging Incentives In Germany A Complete Guide

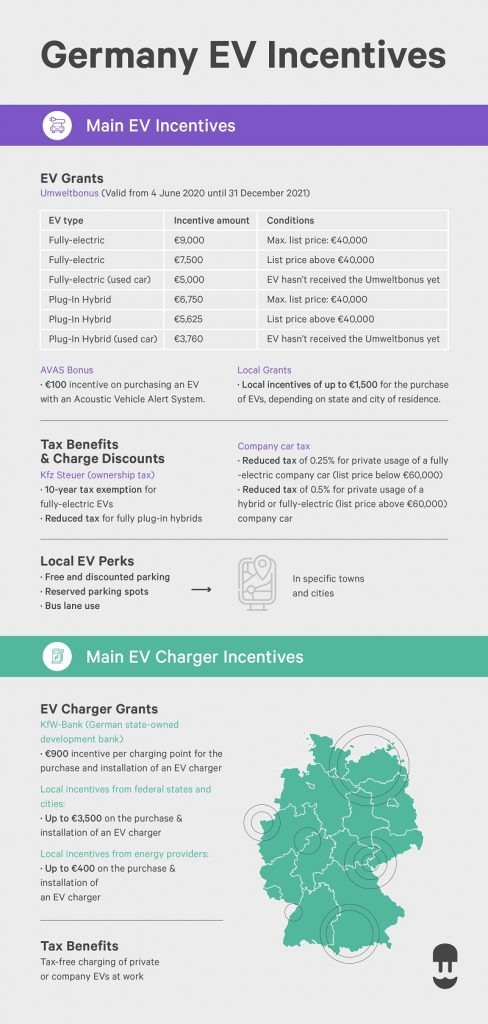

An Assessment Of The Green Act Implications For Emissions And Clean Energy Deployment Rhodium Group

Tesla Toyota Accuse Bidens Ev Tax Credit Of Putting Unions Over The Environment

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

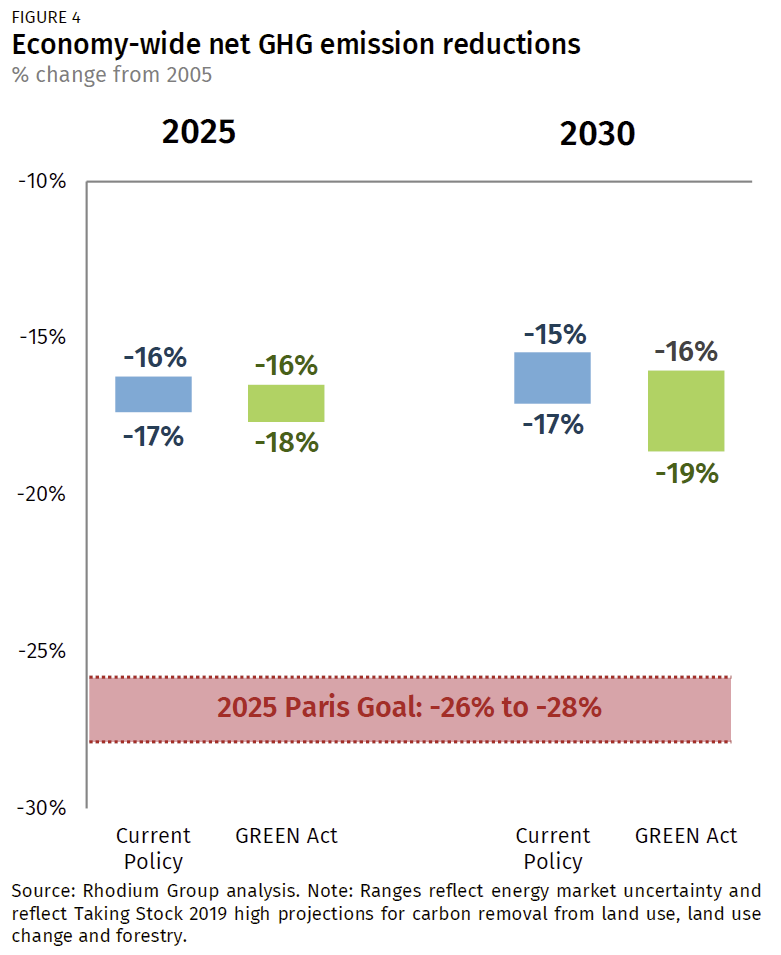

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

A Bipartisan Bill Is Introduced To Retain And Expand The Federal Electric-car Tax Credits

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Aceabe

Southern California Edison Incentives

Electric Vehicle Tax Credits Rebates – Snohomish County Pud

Evadoption

Analysis And Testing Of Electric Car Incentive Scenarios In The Netherlands And Norway – Sciencedirect

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopEVResistanceReasons.png)

Survey 23 Of Americans Would Consider Ev As Next Car – Forbes Wheels

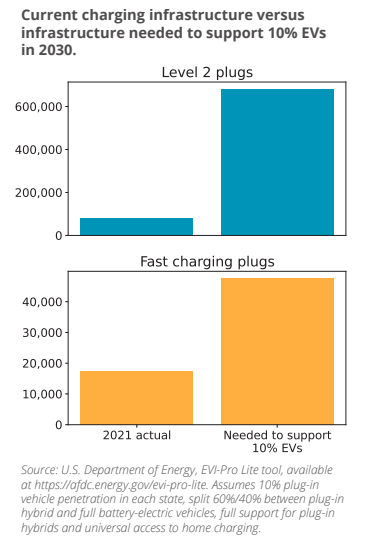

Charged Up For An Electric Vehicle Future Illinois Pirg

The Ev Tax Credit Can Save You Thousands — If Youre Rich Enough Grist