It would limit the ev credit to cars priced at no more than $55,000. And the oem phaseout is retroactive to may 24, 2021 so buyers of tesla and gm evs purchased after may 24, 2021 could apply the credit on their 2021 tax return.

Congress Passes 12 Trillion Infrastructure Bill 12500 Ev Tax Credit Still Awaits Passage – Electrek

Its inclusion comes as the bill sheds multiple other elements to.

Ev tax credit bill retroactive. Refundable electric vehicle tax credit — companies would be able to offer a $4,000 credit to customers who purchase qualified vehicles. The build back better bill includes a $12,500 ev tax credit, up from the current $7,500 available to qualifying cars and buyers. Making a tax credit/refund retroactive for evs doesn’t really make sense from a government perspective.

Based on how the federal ev tax credit currently works, it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your ev. No, it’s not retroactive as it’s currently written. The retroactive extension covers 2017 through 2019.

This has drawn protests from automakers and legislators alike. Therefore, the tax credit isn’t retroactive. With this incentive, the federal government provides a tax credit to cover 30% of installation costs up to $1,000 for private ev charging stations.

One the bill goes into affect, the next 400,000 ev’s tesla sell will be included in the tax credit. The tax incentive would help. The $7,500 base credit could increase $4,500 if an ev is.

For example, someone who purchased an ev in january 2021 and then filed their taxes in april 2022 might not receive their tax refund until june 2022. However, the answer as to whether or not the ev tax credit will be retroactive may not be as straightforward as you think. Hypothetically, if you were to buy an ev in 2021 before a 2022 increase in credit amount, you would.

Here’s how you would qualify for the maximum credit: If the company gets the car on the market before jan. For example, if your charging station installation cost $1,200, you can receive a tax credit of $360.

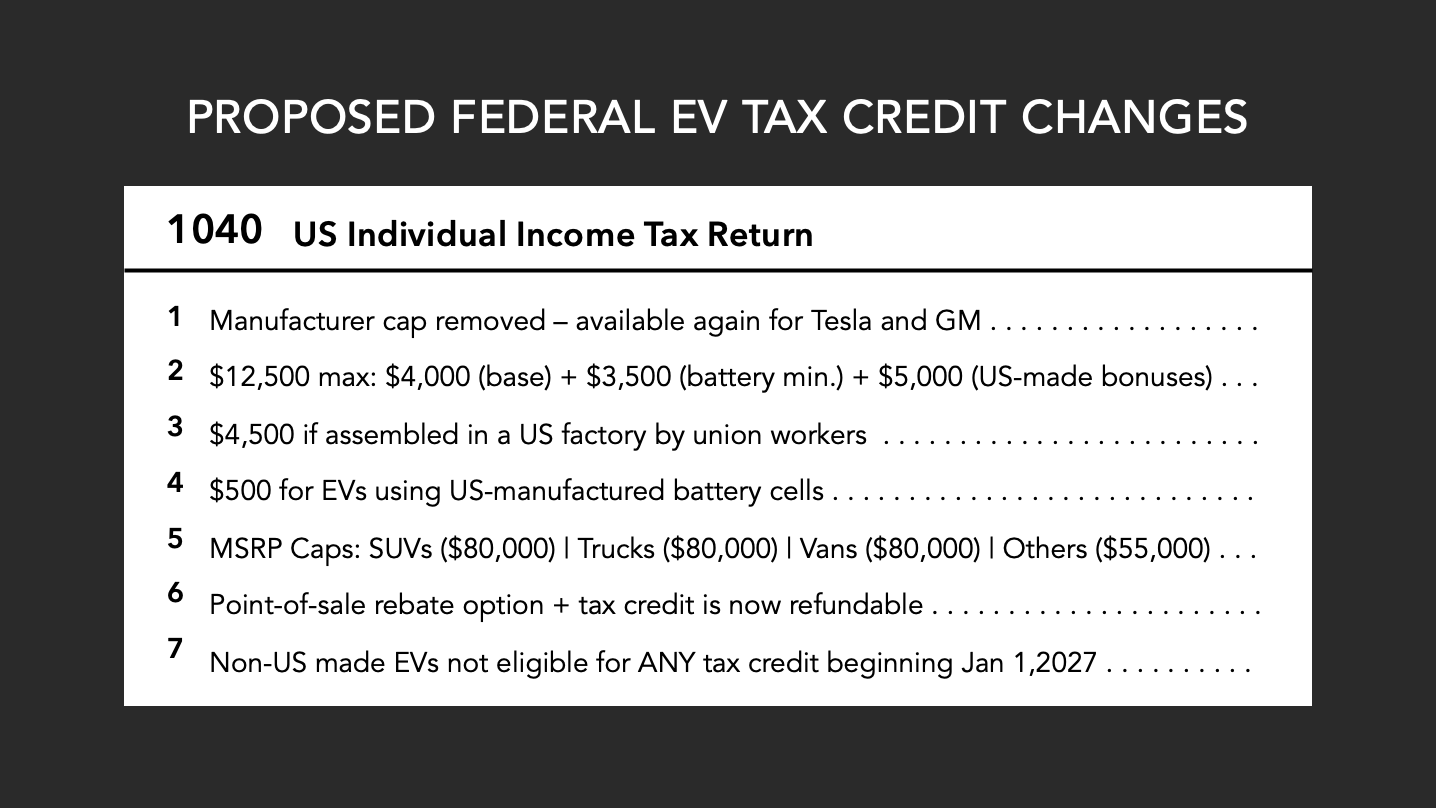

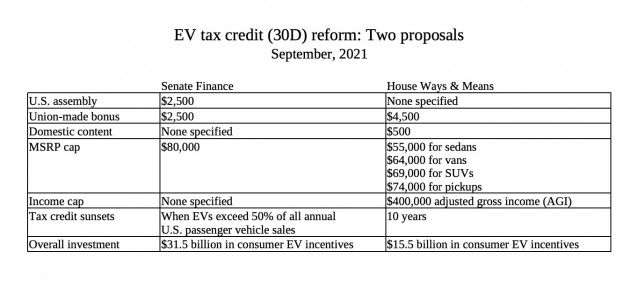

Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022. Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for five years add an additional $4,500 for evs assembled in the us using union labor Current ev tax credits top out at $7,500.

Proposed changes include crediting ev purchasers with up to $12,500 at tax refund time. With the bill in its current state, it is likely to face a lot of opposition in the senate. The base credit amount of $4,000 can be incrementally increased to a maximum of $12,500.

Previously, the credits had been extended through 2017, and have now been extended to 2020. It is unclear how tesla and gm will address this retroactive credit availability for leased evs. The purpose is to encourage ev purchases for people who would go with ice due to generally lower purchase price of equivalent ice vs.

The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles. The current federal ev tax credit of $7,500 could increase to $12,500 under an amendment that was introduced by sen. The initial ev tax credit was passed under the energy improvement and extension act of 2008.

The bill says individual taxpayers must have an adjusted gross income of no more than $400,000 to get the new ev tax credit. The ev credit is also limited. The ev tax credit must be claimed on the tax forms for the year during which the taxpayer purchased a qualifying electric vehicle.

This credit is retroactive, meaning that if you bought and installed a charging station in. At the time, the law stated that the value of the credit was “equal to $2,500 plus, for a vehicle. And for those without that full $7500 tax liability can carryforward the credit over the next 5 years or even apply it at.

Under the current tax credit structure it’s entirely possible that the buyer of an ev might not receive the benefit of the tax credit until nearly 18 months from the time of purchase. The bill has proposed to increase the federal tax credit for electric vehicles to $12,500 from $7,500. A large part of the $12,500 figure comes from $4,500 for evs made at unionized factories.

Under the bill, the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to $250,000 for individuals and $500,000 for joint filers.

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Vubfurm5yoxywm

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

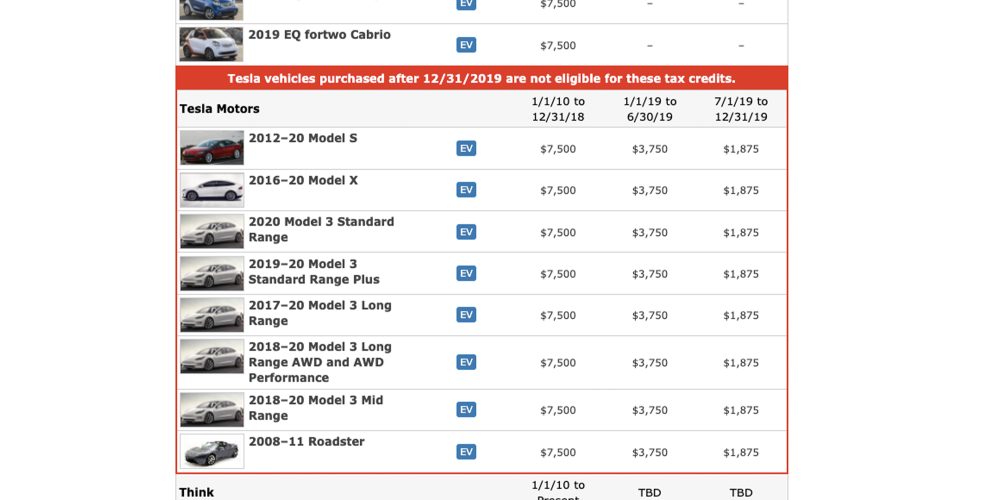

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare

Green Act Us Democrats To Push Ev Sales Cap E-bike Act – Electrivecom

Uber Fails To Pay Some Electric Car Bonuses Citing Glitch – Bloomberg

Vubfurm5yoxywm

12500 Ev Tax Credit Union-built Bonus Included In Plan Biden Claims Can Pass Congress

Tax Credit For Electric Vehicle Chargers Enel X

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Us Retroactively Extends Tax Credits For Charger Installations Electric Motorcycles And Fuel Cell Vehicles Through End Of 2017 Updated – Electrek

Ev Tax Credits In Bidens Build Back Better Act Will Help Sell More Cars Than New Chargers

Electric Vehicle Tax Credits What You Need To Know Edmunds

Tesla To Get Access To 7000 Tax Credit On 400000 More Electric Cars In The Us With New Incentive Reform – Electrek

Electric Vehicle Tax Credits Take Preference Over Biofuels In Democrats Spending Package Agri-pulse Communications Inc