There would also be a new credit for used ev's of up to $2,500. That year, my federal taxes owed is $7,000.

Proposed Changes To Federal Ev Tax Credit Part 2 End Of The Manufacturer Sales Phaseout Evadoption

Based on how the federal ev tax credit currently works, it is not a retroactive incentive and must be claimed on tax forms for the year in which you purchased your ev.

Ev tax credit 2022 retroactive. If you’ve bought and installed ev charging stations since 2017, you’re eligible for this federal tax credit. This credit is retroactive, meaning that if you bought and installed a charging station in either 2018 or 2019, you will be able to claim the credit on your 2019 returns by filling out form 8911. Tesla and gm have reached this threshold, and credits for tesla and gm

On the other hand, i'm a little concerned with not knowing what the federal tax credit might look like in 2022. Receive a federal tax credit of 30% of the cost of purchasing and installing an ev charging station. I wonder if there will be any price adjustments by tesla to the performance to make it qualify.

For example, if your charging station installation cost $1,200, you can receive a tax credit of $360. 19, it looks like the answer is yes. Under the current tax credit structure it’s entirely possible that the buyer of an ev might not receive the benefit of the tax credit until nearly 18 months from the time of purchase.

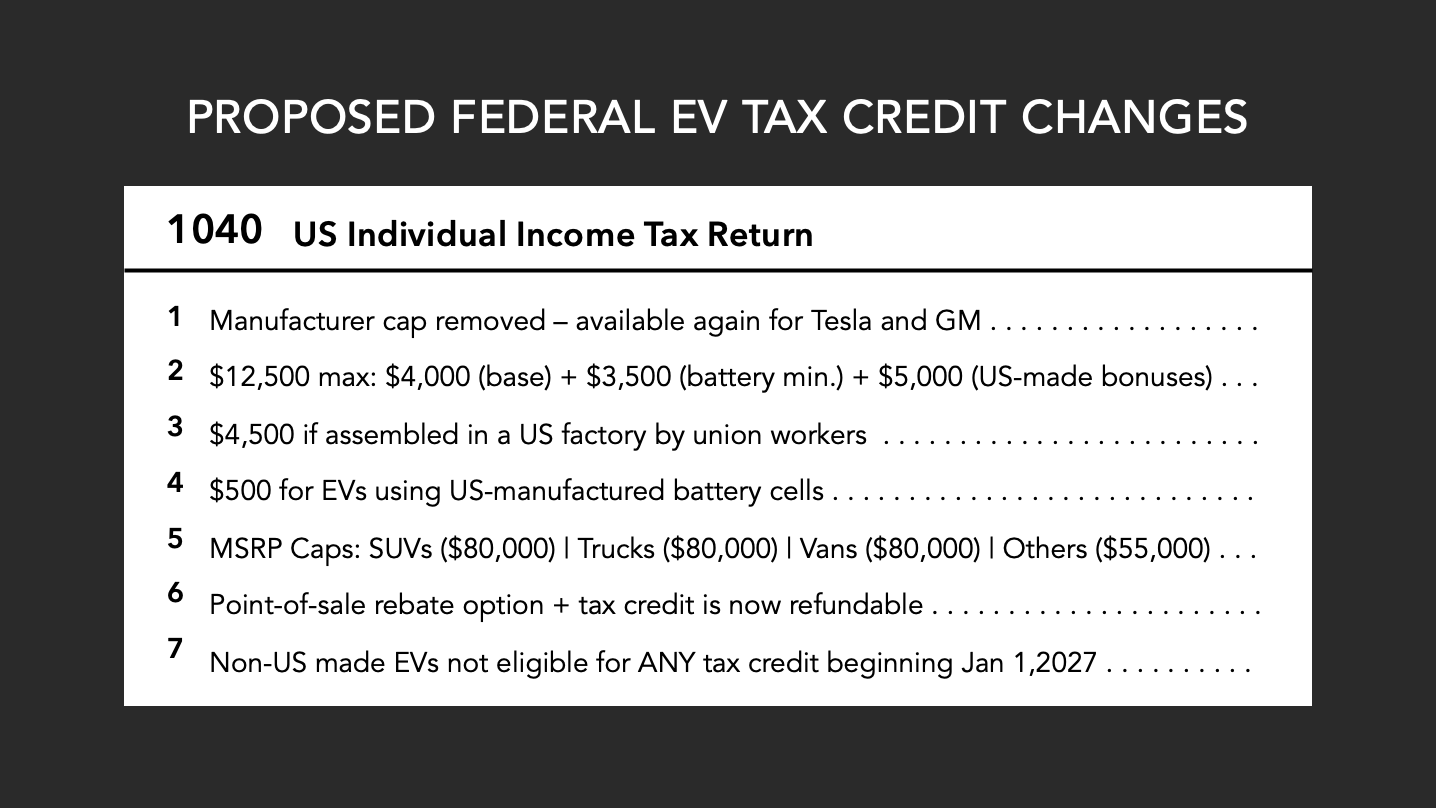

As it stands, the credit provides up to $7,500 in a tax credit when you claim an ev purchase on taxes filed for the year you acquired the vehicle. Add an additional $4,500 for. It looks like this would all take effect in 2022, and replace the existing credits.

Tax credits deduct from the amount of tax you owe, can can not exceed that amount. Federal tax credit for evs jumps from $7,500 to up to $12,500. The initial ev tax credit was passed under the energy improvement and extension act of 2008.

Federal tax credit for evse purchase and installation extended! The ev tax credit proposed by biden and other democrats would be an increase from the current $7,500 credit to a maximum of $12,500. For example, someone who purchased an ev in january 2021 and then filed their taxes in april 2022 might not receive their tax refund until june 2022.

From what i know, these types of tax incentives are typically applicable to an entire tax year, as that’s much simpler than a specific date it’s passed. Keep the $7,500 incentive for new electric cars for 5 years. I buy a chevy bolt euv next year.

The tax credit phases out once a vehicle manufacturer has sold 200,000 qualifying vehicles. The sale price of the used ev would have to be less than $25,000, and would phase out for buyers over $75,000 single/$150,000 mfj. Congress recently passed a retroactive (now includes 2018, 2019, 2020, and through 2021) federal tax credit for those who purchase(d) ev charging infrastructure.

Hypothetically, if you were to buy an ev in 2021 before a 2022 increase in credit amount, you. The build back better bill includes a $12,500 ev tax credit, up from the current $7,500 available to qualifying cars and buyers. $2,500 additional tax credit for qualifying evs with final assembly in the us — effective january 1, 2022:

At the time, the law stated that the value of the credit was “equal to $2,500 plus, for a vehicle. My order was converted to a 2022 and my dealer had a priority code of 10 assigned to it. She told me today ford has since moved the priority up to 1, so it will be one of the first 2022's built.

Would be nice to get one for $45k. The ev charging credit will be available for installations performed through 2020. It is not a check from uncle sam for $12,500.

Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022. However, this credit has a deadline of december 31, 2021, and may decrease in 2022, so it’s recommended that companies looking to install ev charging systems do so before that deadline. With the $55k for sedans limit it looks like the m3lr will be $40k (credit) and the performance will be $58k (no credit).

The $12,500 federal tax credit i receive will lower my taxes owed from $7000 to $0. Here’s how you would qualify for the maximum credit: Federal tax credit for evs jumps from $7,500 to $12,500 keep the $7,500 incentive for new electric cars for five years add an additional $4,500 for evs assembled in the us using union labor

So if it passes in next 3 months(ish), it would most likely apply to 2021 taxes but if it passes at the end of the year it would probably only start in 2022.

Proposed Changes To Federal Ev Tax Credit Part 2 End Of The Manufacturer Sales Phaseout Evadoption

Electric Vehicles Taking Over The Roads Seas And Skies Idtechex Research Article

Get A Tax Break On A New Electric Vehicle – Mize Cpas Inc

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

12500 Ev Tax Credit Union-built Bonus Included In Plan Biden Claims Can Pass Congress

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits – Extremetech

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Tesla To Get Access To 7000 Tax Credit On 400000 More Electric Cars In The Us With New Incentive Reform – Electrek

Vubfurm5yoxywm

Tesla Increases Model Y Prices Again As New Incentives Are Coming – Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

12500 Ev Tax Credit Union-built Bonus Included In Plan Biden Claims Can Pass Congress

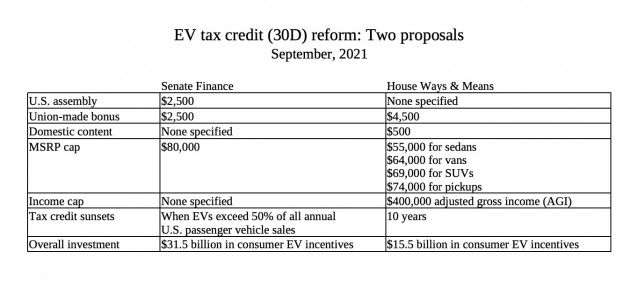

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Electric Vehicle Tax Credits Take Preference Over Biofuels In Democrats Spending Package Agri-pulse Communications Inc

Vubfurm5yoxywm

Ev Tax Credit Boost At Up To 12500 Heres How The Two Versions Compare