The ev tax credit is currently a nonrefundable credit, so the government does not cut you a check for the balance. Wow, is the tax credit really the only determining factor?

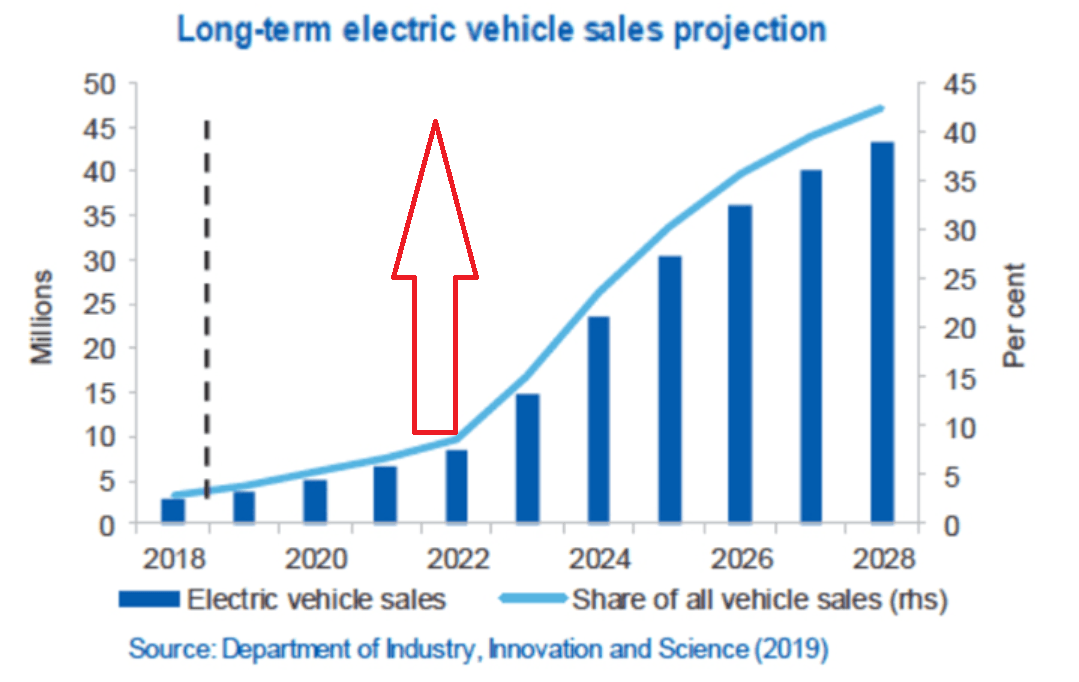

At Least Two Out Of Every Three Cars Sold Worldwide Will Be Electric By 2040we Look At The Evolving Global Ev Landscape – Insider Intelligence Trends Forecasts Statistics

Joe manchin visits toyota and condemns the ev credit, tesla ev caps for sedans and suvs including the mo.

Ev tax credit 2022 reddit. The credit amount will vary based on the capacity of the battery used to power the vehicle. Current ev tax credits top out at $7,500. An expansion of the ev tax credit,.

I’ve spoken with customer service a couple of times, and they seem to be unaware of the upcoming changes to the ev tax credit program in the us. Question about the proposed us ev tax credit slated for 2022. If a vehicle qualifies for the full $12.500 credit.

A refundable tax credit is not a point of purchase rebate. The new proposal limits the full ev tax credit for individual taxpayers reporting adjusted gross incomes of $250,000 or $500,000 for joint filers, down from $400,000 for individual filers and. Your tax liability for the year was $6000, and you had exactly that amount withheld.

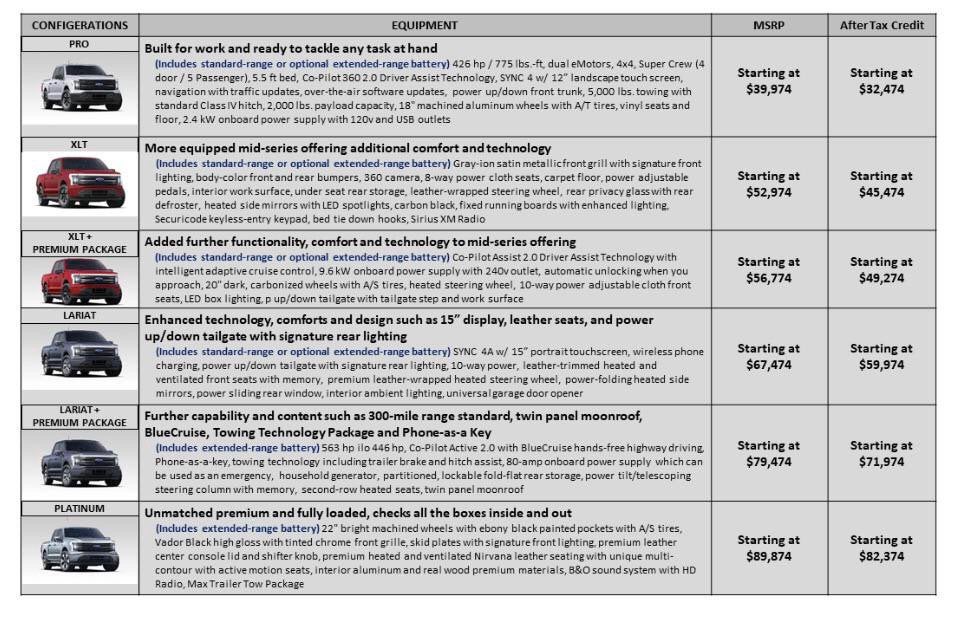

Based on my current cash and credit my truck could be. Lexus teases rz electric suv due in 2022. Evs must be made in the us starting in 2027 to qualify for any of the $12,500 credit.

Sell through all us q4 production. It looks like this would all take effect in 2022, and replace the existing credits. Congress is mulling over passing the build back better act, which would increase the maximum electric vehicle tax credit to $12,500 in 2022.

Let's say you owed the federal government $10,000 in taxes when filing your 2021. W4 only has to do with withholding throughout the year, which has to roughly match the taxes you owe. The federal ev tax credit may go up to $12,500 ev tax credit for new electric vehicles.

I have an order with expected delivery around december 17. Let's say in 2021 you bought an electric car and qualified for the full $7500 tax credit. You must be logged in to vote.

If you want to be eligible for ev tax credits, take the delivery on or after 1/1/2022 and make sure your car price including destination charges before taxes is under 55k. In the us we have a house bill that is decently likely to pass in 2022 that would provide up to a $12,500 point of sale credit for new and used evs. Place an $80,000 price cap on eligible evs.

Your refund will be $6000, not $7500. New ev tax credit changes and updates in this video. The bill says individual taxpayers must have an adjusted gross income of no more than $400,000 to get the new ev tax credit.

The effective date for this is after december 31, 2021. Push a significant amount of deliveries to 2022. It would limit the ev credit to cars priced at.

Create an additional $2500 credit for assembled in the u.s. The second document made further changes: This potential change to the ev tax credit is one of many items included in biden's proposed build back better framework.

I currently have a model 3 scheduled for delivery around the last week of december and i'm looking to push it to the first week of. There would also be a new credit for used ev's of up to $2,500. Eliminates tax credit cap after automakers hit 200,000.

2 days 23 hours left. 2022 us ev tax credit development. Facebook twitter reddit email link.

Perhaps the biggest change is that this will be a refundable credit against taxes owed. There’s a high probability that a tesla delivered in january will come with an ~$8k tax refund and a tesla delivered in. The sale price of the used ev would have to be less than $25,000, and would phase out for buyers over $75,000 single/$150,000 mfj.

My suggestion is to proceed with whatever purchase you wish to make and when you file that year's taxes you will find out if you qualify for a credit (it's not a rebate) and for how much. The proposed tax credit is refundable. It could be nothing (federal) or as low as $3,750 or as high as $12,500 in 2022.

If an ev tax credit gets implemented for 2022, will tesla:

2022 Chevy Bolt Ev And Euv Review Double The Electric Fun Rcars

2022 Models Are Now Going Out Rteslamotors

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Ev Tax Credits At The Forefront Of Change Price Caps On Eligible Trucks And Suvs Raised – Fuentitech

![]()

Looks Like The Infrastructure Bill Passes Not The Bill With Ev Tax Credits Tesla Motors Club

The 2022 Hyundai Santa Fe Plug-in Hybrid Will Be Cheaper Than The Ev Tax Credited Hybrid – Autobala

Norway To Hit 100 Per Cent Electric Vehicle Sales Early Next Year Analysis Shows The Last New Petrol Or Diesel Car Sold In Norway Will Come As Early As April 2022

The Clock Is Ticking On Electric Car Batteries – And How Long They Will Last

Electric Vehicle Tax Credit Favors The Big Three Over Other Companies

A Look At 6 Etfs That Cover The Electric Vehicles Trend Seeking Alpha

2022 Ford F-150 Lightning Pricing Trim Level Details Leaked

Today The 1875 Federal Tax Credit For Gm Is Gone

Which Is Better The 2022 Audi E-tron Or The Tesla Model Y Jioforme

Budget 2021 New Measures To Narrow Cost Difference Between Electric Cars And Conventional Cars Singapore News Top Stories – The Straits Times

2022 Kia Sorento Phev Pricing Confirmed – Slashgear

2022 Kia Sorento Phev Priced At 44990 In The Us

Heres Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit – Electrek

Ev Tax Credit Makes Final Cut7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory Rteslamotors

Rzuh1rig-mphom