The bbba would further extend the ctc through 2025 and make permanent the dctc. Both the bernie sanders proposed legislation, and the september 13 th house of representatives ways and means committee bills, would have drastically reduced the $11,700,000 per person estate and.

2021 Guide To Potential Tax Law Changes

The new proposal allows single and married filing joint taxpayers to deduct up to $72,500 per year in state and local income and real estate taxes.

Estate tax change proposals 2021. Under the proposal, the current exemption of $11,700,000 will be reduced on january 1, 2022 to an. No expected change in the estate tax exemption for 2022 under the “build back better” legislation! The proposed reduction in the estate tax exemption would.

Read about the potential changes here. Increasing tax rates for individuals. 2021 federal estate and transfer tax law proposals.

• taxpayers with assets over $3.5 million tax proposals under current rules for 2021, you can transfer up to $11.7 million during your lifetime or at death without paying gift or estate tax. For the last 20 years, the battle over estate taxes has centered around the elimination of the estate tax (and the accompanying step up in basis) and the amount of the. In september, we posted on the sweeping tax changes proposed by the ways and means committee of the house of representatives.

The american rescue plan act (arpa), enacted in early 2021, temporarily expanded both the child tax credit (ctc) and the dependent care tax credit (dctc). This year has brought many proposals to congress that would dramatically change the tax implications for many farm businesses. Estate and gift tax exemption:

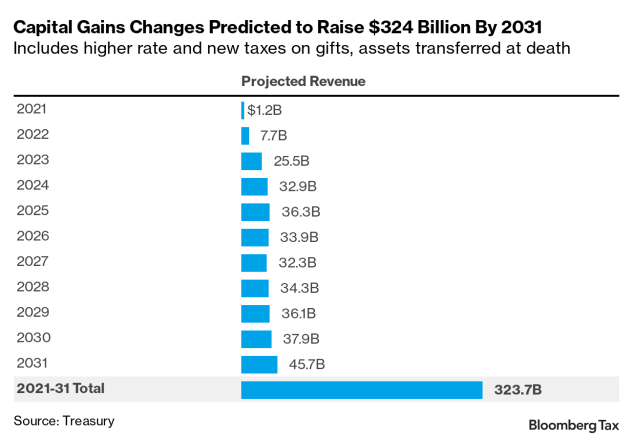

The proposed bill would increase the top marginal individual income tax rate to. There’s still a chance to reduce taxable estate as part of overall estate planning and. Unrealized gains would be taxed when assets transfer at death or by gift as if they were sold.

If passed, both the federal and new york estate tax exemptions for 2022 would be about $6 million. Estate tax proposals increase the federal estate tax who may be affected? The proposals will inevitably undergo further revisions before being passed by the house and taken up by.

The new exemption amount would be $5 million, indexed for inflation dating back to 2010. In addition, the proposed bill provides that estates or trusts with income over $100,000 would be subject to an additional 3% tax on their modified adjusted gross income. We are constantly monitoring the situation in d.c.

This would be in effect for tax years 2021 through 2031, after which the cap would be reduced to the current level of $10,000. Net investment income tax would be broadened to cover more income if your total income was greater than $400,000. The proposed impact will effectively increase estate and gift tax liability significantly.

And will continue to provide updates on policies that are relevant to our clients. As a result of the proposed tax law changes, families, small business owners and others may want to take advantage of the current $11.7 million gift tax exemption before the end of 2021. As of november, 2021, the proposed “build back better” legislation does not contain any changes to the federal estate tax exemption provisions.

These proposed modifications to the tax laws could impact the effectiveness of your current estate plan. Capital gains tax would be increased from 20% to 39.6% for all income over $1,000,000. In late october, the house rules committee released a revised version of the proposed build back better act reconciliation bill.most of the major proposals that would create substantial changes in.

The proposal in congress would cut the federal exemption in half. You can also transfer up to that same amount to Gift/estate and gst lifetime exemptions.

By dobbslg | nov 15, 2021. This change would be effective for tax years after 2021. The biden administration has proposed sweeping estate tax impacts to the estate and gift structure.

The biden campaign is proposing to reduce the estate tax exemption to $3,500,000 per person. By jeffrey cohen, esq., c.p.a. Then, the gift and estate tax exemption is lowered from $11.7 million to $6 million with the gift and estate tax rate increased from 40% to 45%, all effective january 1, 2022.

Revised build back better bill excludes major estate tax proposals. The proposed law would reduce the federal gift and estate tax exemption from the current $10 million exemption (indexed for inflation to $11.7 million for 2021) to $5 million (indexed for inflation to roughly $6.2 million) as of january 1, 2022. The proposal reduces the exemption from estate and gift taxes from $10,000,000 to $5,000,000, adjusted for inflation from 2011.

Although we stress that these are indeed proposals at this point, we wanted you to be aware. This is currently $11,700,000 per person and was scheduled to be reduced january 1, 2026. Following weeks of negotiations between president joe biden and congressional democrats, the white house released a retooled framework for the build back better act on october 28.

On sunday, september 12, 2021, the house ways and means committee released a first draft of proposed tax legislation, including several provisions that could significantly impact the estate planning environment. Proposals to decrease lifetime gifting allowance to as low as $1,000,000. Moore, attorney in the estate planning & probate practice group.

Thankfully under the current proposal the estate tax remains at a flat rate of 40%. This last week, house democrats released details of a new tax proposal to support the $3.5 trillion spending plan. The federal estate tax exemption is currently $11.7 million and the new york estate tax exemption is currently approximately $5.9 million (adjusted for inflation).

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Pass-through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

2021 Guide To Potential Tax Law Changes

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Biden Tax Plan And 2020 Year-end Planning Opportunities

2021 Guide To Potential Tax Law Changes

House Democrats Tax On Corporate Income Third-highest In Oecd

Tax Pros Perplexed By Scope Of Bidens Capital Gains Overhaul

One More Scary Estate Tax Change And New Action Items For Many Affluent Taxpayers

2021 Guide To Potential Tax Law Changes

Green Book Details Presidents Tax Reform Proposals Center For Agricultural Law And Taxation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Guide To Potential Tax Law Changes

A Closer Look At 2021 Proposed Tax Changes – Charlotte Business Journal

2021 Guide To Potential Tax Law Changes

2021 Guide To Potential Tax Law Changes

The New Death Tax In The Biden Tax Proposal Major Tax Change

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

House Estate Tax Proposal Requires Immediate Action