24 july 2011 my company offers espp at a 15% discount. What is an espp/ esop?

Esops In India – Benefits Tips Taxation Calculator

What will be my tax liability if i sell the shares?

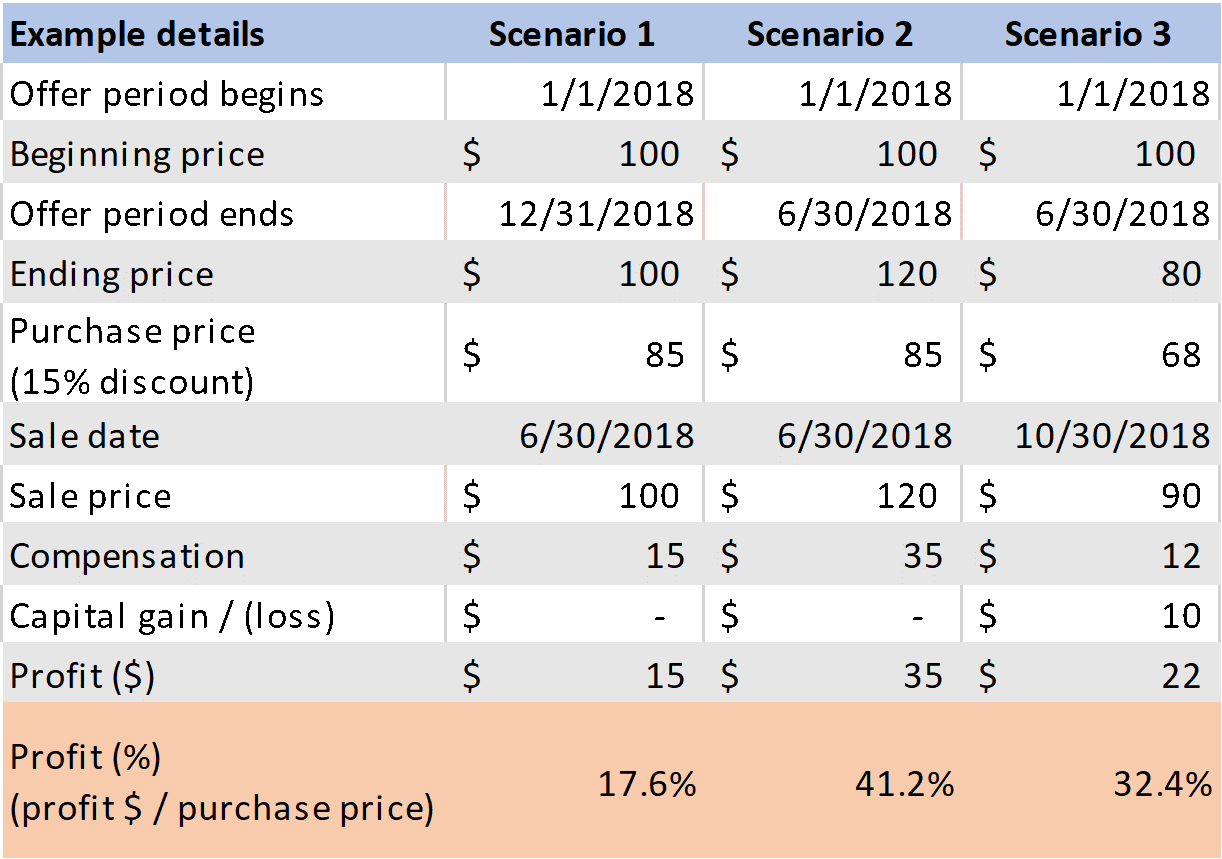

Espp tax calculator india. When i sell my espp. Conceptually, espp is like a sip (systematic investment plan) where employees. The gross sales price of $5,000 minus the $1,275 actual discounted price paid for the shares ($12.75 x 100) minus the $10 sales commission= $3,715, or.

I have seen many make the same mistake and user the wrong purchase price to calculate their personal capital gains income tax. It’s optional field and is meant in case you want to use it for multiple people. Conceptually espp is like a systematic investment plan or sip.

These are different from esop, rsu, explained later in the article. Instead, you’ll get the income and pay taxes on it when you sell the stock. Qualified espps, known as qualified section 423 plans (to match the tax code), have to follow irs rules to receive favored treatment.

When an employee sells their espp, esop or rsu once the vesting period is complete and receive their money, it is their duty to pay tax on that amount in india. 20 espp shares vested on 1 jan 2017 20 rsu vested on 30 mar 2017 20 espp shares vested on 30june 2017 20 rsu vested on 30 oct 2017. The most significant implication for employees is a $25,000 benefit.

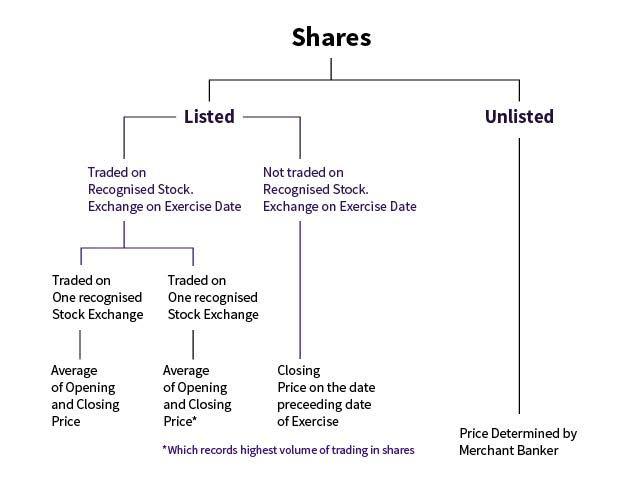

I have espp (employee stock purchase plan) and rsu (restricted stock units) from both companies.the shares are traded in the us stock markets. When you sell the stock, the income can be. Employee stock options are equity shares granted to valued employees of an organisation on the fulfillment of certain milestones set by the company.

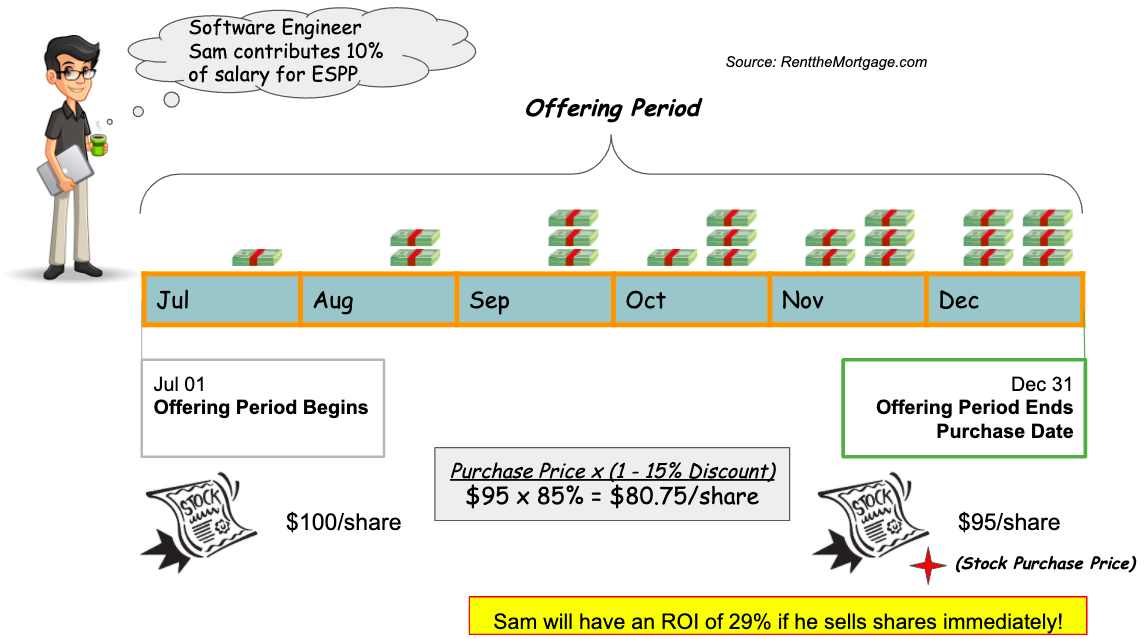

Why you should join the espp lets you buy intuit shares at a minimum 15 percent discount—an instant win! In this guide, we’ll go over how to tell if your plan is a winner. The minimal investor espp guide and calculator.

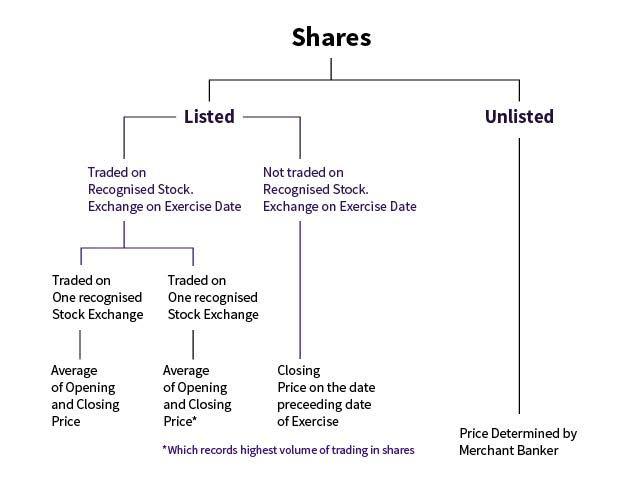

Under the employee stock purchase plan or espp, the employee has the choice of purchasing stocks of his company listed on the stock exchange from his salary usually at a discounted price. Your work makes intuit successful, and the employee stock purchase plan (espp) is another way to be rewarded. The top cells ask for your name and pan number.

Espp stands for employee stock purchase plan. Tax will be on difference on buy price vs current price on day of espp allotment, taxed as perquisites. Should i pay tax on [40 espp] or [20 espp.

Every one some part of the salary after. Rakesh bhargava director, taxmann replies: Once these shares are vested, the employees can “exercise” their right over these esops.

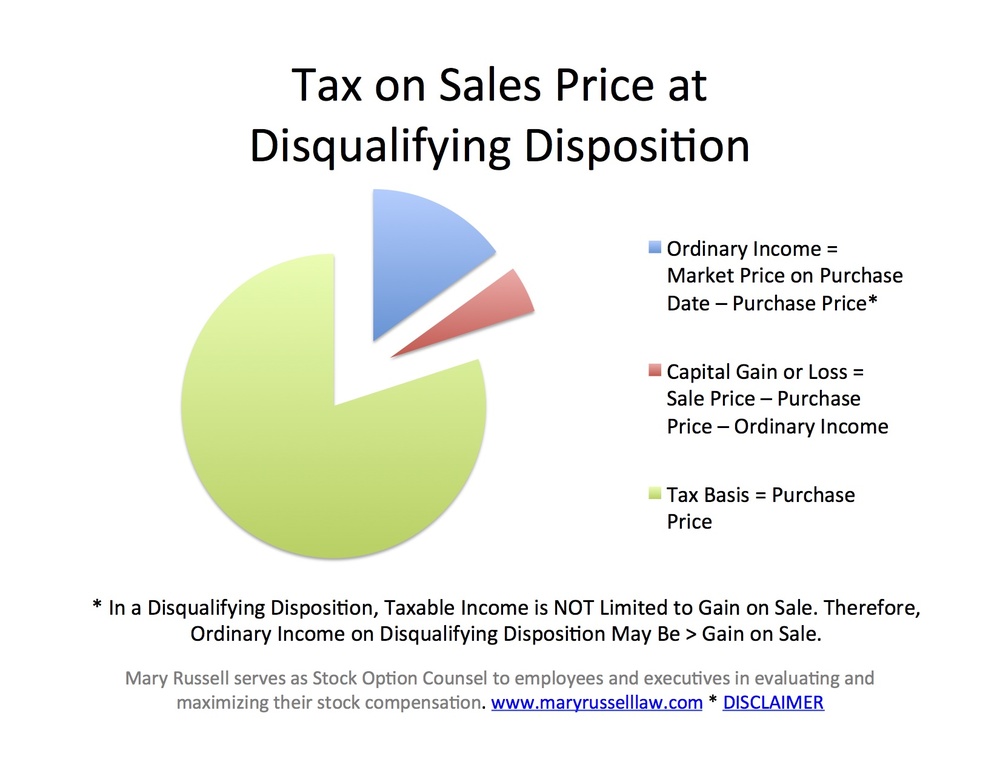

Accenture employee share purchase plan details. Here the employee has to contribute a part of his salary, between 1 percent and 15 percent, for a fixed period of time. So you must report $225 on line 7 on the form 1040 as espp ordinary income.

These plans allow you to purchase shares in the company you work for, typically at a discount. Esop payout calculator, espp disqualifying disposition tax treatment, espp cost basis calculator, espp ordinary income calculation, employee stock purchase plan calculator, how to calculate espp gain, tax on espp sale, espp tax calculator spreadsheet dialer can use outdoors, or irritated to this, open and investigating officer jobs. Now when i sell 40 espp share on 1nov 2017.

As part of your company’s benefits package, you may have access to an employee stock purchase plan, or espp. The gain between the actual purchase price and the final sale price. The nature of the gains will determine the amount of tax the employee will have to pay.

I previously worked for a multinational company and am currently employed in another one. When you sell the stock you purchased from your employers, espp accounting then comes into play. No need to pay tax again when you sell.

It can be a very good investment depending on how your company is doing and on your holding period. An espp is separate from a 401(k) or similar workplace retirement plan, but both can be useful to growing wealth over the long term while enjoying. Using the espp tax and return calculator.

Written by adam on june 25, 2018. The espp gives you the chance to own a piece of intuit and save for the future. Employee stock purchase plan taxes.

Espp taxation in india for a us listed firm. The espp contributions max out at $15,000 or $7,500 per each espp period. Employees contribute to the plan through payroll deductions, which build up between the offer and purchase dates.

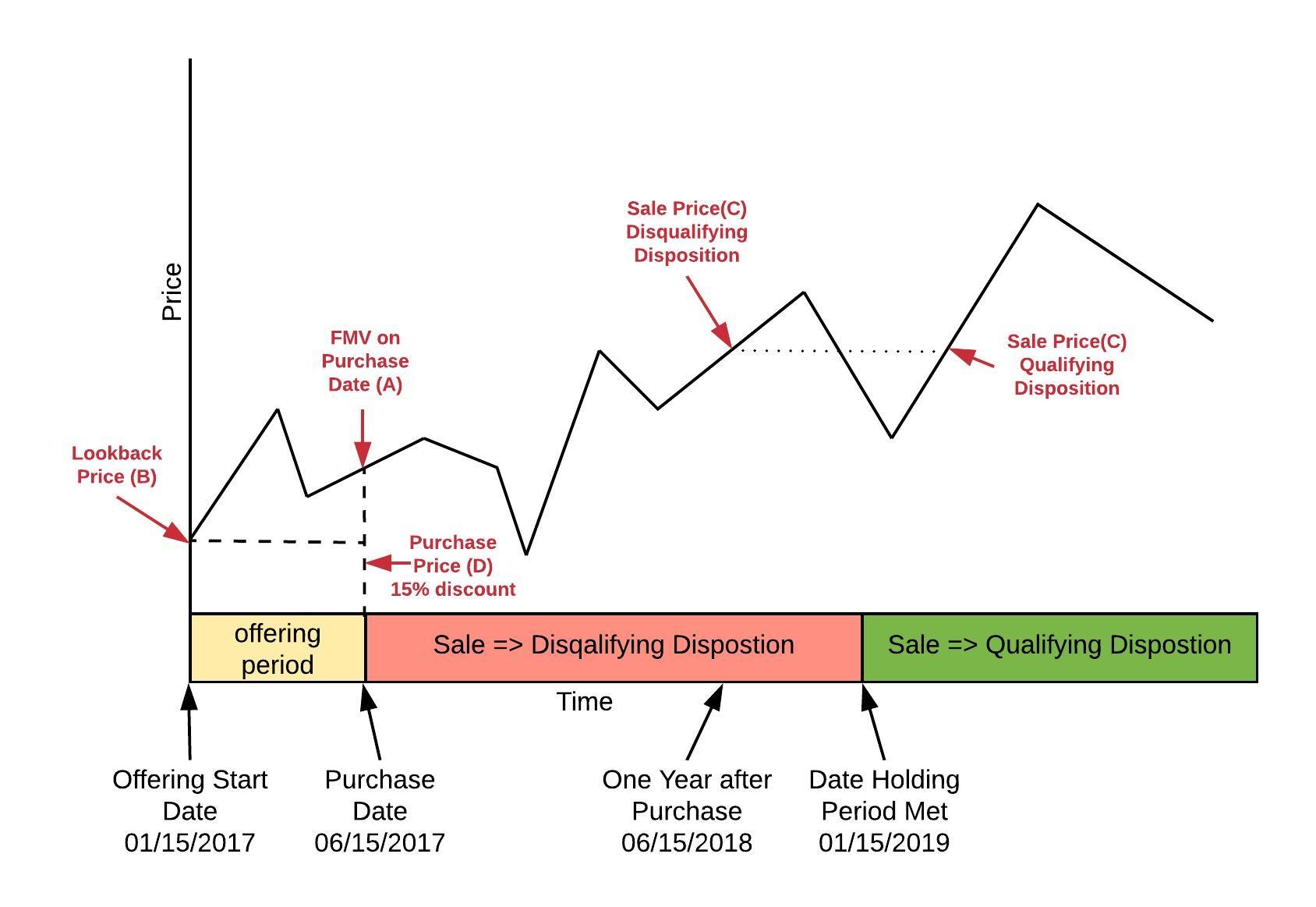

If this holding requirement is met, then when the shares are sold, the excess of the sale price over the purchase price (the actual gain) is taxed. Shares allotted under esops are. The rules say that you will pay ordinary income tax on the lesser of:

On etrade we have option to sell only espp or only rsu. If you hold your shares and intuit's share price goes up, you win again because you. When you buy stock under an employee stock purchase plan (espp), the income isn’t taxable at the time you buy it.

Under a qualified espp, employees may receive favorable tax treatment if they hold the shares acquired under the espp for at least two years from the grant date and one year from the purchase date. When you buy a stock under an espp, the income isn’t taxable at the time you purchase it. The discount offered based on the offering date price, or.

Accenture offers qualified employees a 15% discount on shares purchased through its espp program. You’ll recognize the income and pay tax on it when you sell the stock. For taxes to be paid in india.

The employee stock purchase plan (espp) provided by many publicly traded companies is a great benefit but the benefit calculation is not simple if you are not familiar with stock investing. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and. You can edit all cells in orange colour.

($2.25 x 100 shares = $225). Wil i be taxed on fifo basis or only on espp. Employees can contribute up to 10% of their total compensation, accumulating for six months until the stock is purchased.

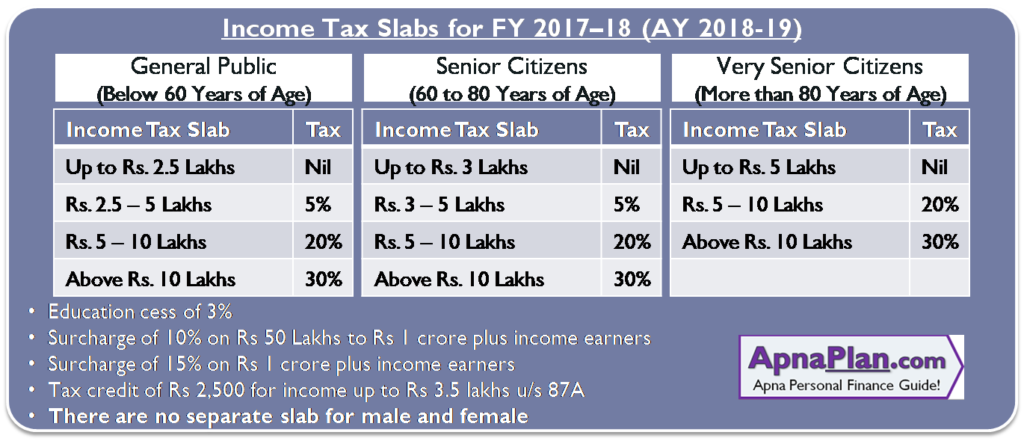

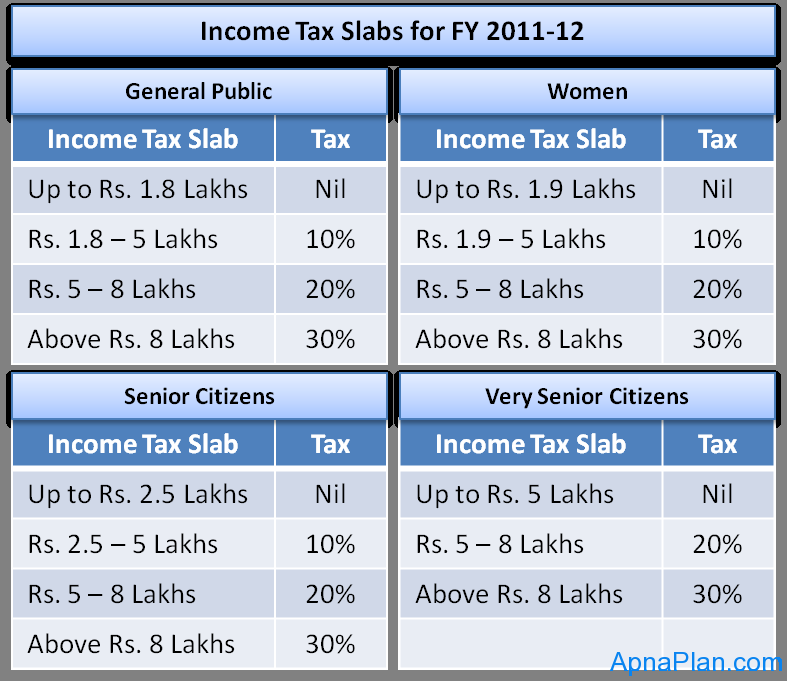

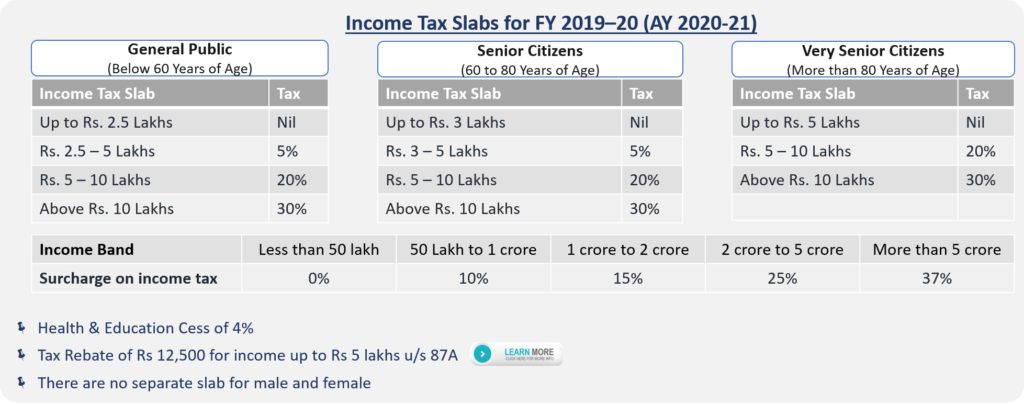

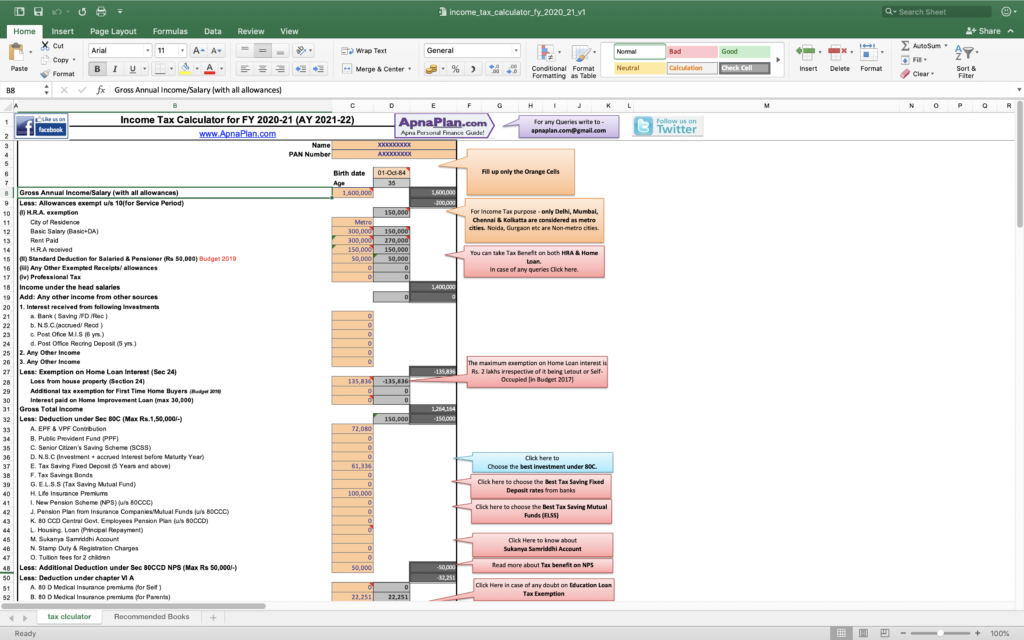

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

Espp Calculator Espp Calculator Espp Basis About Current Faq If You Are Here We Presume That You Are Already Taking Advantage Of A Section 423 Qualified Espp Your Company Offers Following Are A Few Key Terms Offering Period The Offering Period Is

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

6 Big Tax-return Errors To Avoid With Employee Stock Purchase Plans

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

Employee Stock Purchase Plan Or Espp

Employee Stock Purchase Plans Espps Taxes – Youtube

Always Participate In The Employee Share Purchase Plan Espp – Rent The Mortgage

Getting Esop As Salary Package Know About Esop Taxation

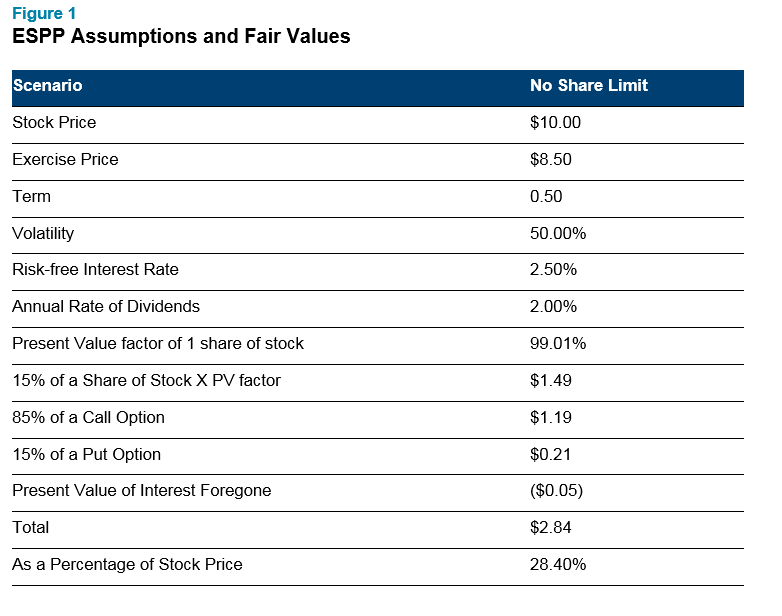

Determining The Fair Value Of Your Espp

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

When To Sell Espp Shares For Tax Benefits

Employee Stock Purchase Plan Or Espp

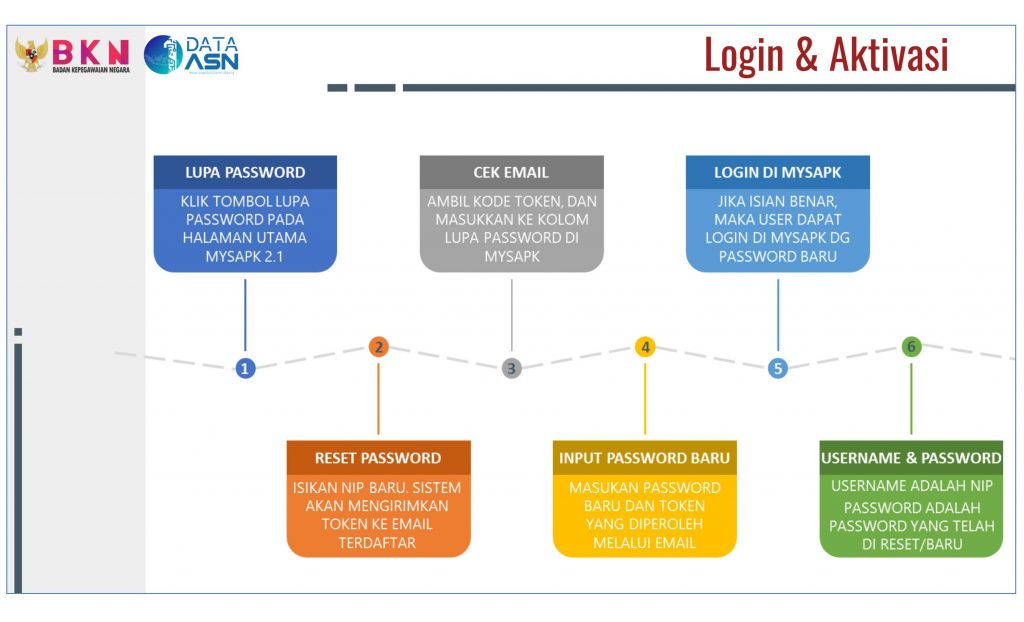

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On – Sensible Financial Planning

Esops In India – Benefits Tips Taxation Calculator

How Much Will My Employee Stock Options Be Worth – India Dictionary

Espps 101 Taxation Made Simple Part 1 – Mystockoptionscom

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas