This is the total of state, county and city sales tax rates. July 24, 2019 page 1 of 3.

Tourism Taxes

The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included.

Duluth mn sales tax rate. Let more people find you online. [ 2 ] state sales tax is 6.88%. Depending on the zipcode, the sales tax rate of duluth may vary from 7.88% to 8.38%.

Every 2015 combined rates mentioned above are the results of minnesota state rate (6.88%), the duluth tax rate (0.5% to 1%), and in some case, special rate (0% to 0.5%). The duluth sales tax is collected by the merchant on all qualifying sales made within duluth The duluth, minnesota, general sales tax rate is 6.88%.

218‐730‐5917 • www.duluthmn.gov an equal opportunity employer minnesota state sales/use tax* minnesota state liquor tax* st. Minnesota department of revenue will administer this tax. 31 rows minnesota (mn) sales tax rates by city the state sales tax rate in.

Start yours with a template!. Start yours with a template!. A sample of the 975 minnesota state sales tax rates in our database is provided below.

101 rows how 2021 sales taxes are calculated for zip code 55804. The duluth, minnesota sales tax is 8.38%, consisting of 6.88% minnesota state sales tax and 1.50% duluth local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). The duluth sales tax rate is %.

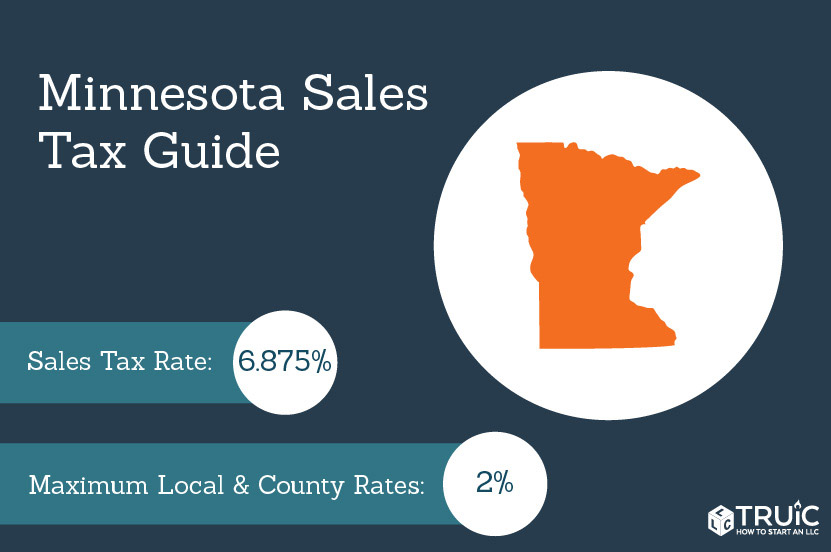

Sales tax and use tax rate of zip code 55810 is located in duluth city, carlton county, minnesota state. Let more people find you online. 823 rows minnesota has state sales tax of 6.875%, and allows local governments to collect a.

How does the duluth sales tax compare to the rest of mn? Our dataset includes all local sales tax jurisdictions in minnesota at state, county, city, and district levels. Every 2017 q3 combined rates mentioned above are the results of minnesota state rate (6.88%), the minnesota cities rate (1%), and in some case, special rate (0.5%).

Ad earn more money by creating a professional ecommerce website. Estimated combined tax rate 8.38%, estimated county tax rate 0.00%, estimated city tax rate 1.00%, estimated special tax rate 0.50% and vendor discount none. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates.

The 8.875% sales tax rate in duluth consists of 6.875% minnesota state sales tax, 1.5% duluth tax and 0.5% special tax. [ 3 ] state sales tax is 6.88%. Sales tax and use tax rate of zip code 55811 is located in duluth city, st.

411 west first street • room 120 • duluth, minnesota • 55802‐1190 telephone: Every 2021 combined rates mentioned above are the results of minnesota state rate (6.875%), the duluth tax rate (1% to 1.5%), and in some case, special rate (0.5%). Sales tax and use tax rate of zip code 55807 is located in duluth city, st.

(the previous sales and use tax rate was 1.0 percent). $9.21 [the property tax rate shown here is the rate per $1,000 of home value. Estimated combined tax rate 8.88%, estimated county tax rate 0.00%, estimated city tax rate 1.50%, estimated special tax rate 0.50% and vendor discount none.

Minnesota has a 6.875% sales tax and st louis county collects an additional n/a, so the minimum sales tax rate in st louis county is 6.875% (not including any city or special district taxes).this table shows the total sales tax rates for all cities and towns in st. The duluth, minnesota, general sales tax rate is 6.875%. This amount is in addition to the minnesota sales tax (6.875%), st.

The duluth, minnesota, general sales tax rate is 6.88%. 7.85% [the total of all income taxes for an area, including state, county and local taxes.federal income taxes are not included.] property tax rate: Louis county transit sales use tax and duluth general sales tax are paid to the state of minnesota via the minnesota department of revenue website.

For earlier tax rate information please contact the treasurer's office by e. The minnesota sales tax rate is currently %. There is no county sale tax for.

Higher sales tax than any other minnesota locality. The sales tax rate is always 8.38%. Tax combinations in the city of duluth.

Use leading seo & marketing tools to promote your store. Depending on the zipcode, the sales tax rate of duluth may vary from 8.375% to 8.875%. 7.50% [the total of all sales taxes for an area, including state, county and local taxes.income taxes:

Estimated combined tax rate 8.38%, estimated county tax rate 0.00%, estimated city tax rate 1.00%, estimated special tax rate 0.50% and vendor discount none. The minimum combined 2021 sales tax rate for duluth, minnesota is. Duluth sales and use tax rate increase to 1.5 percent.

Starting october 1, 2019, the duluth sales and use tax rate is increasing to 1.5 percent. Use leading seo & marketing tools to promote your store. There is no applicable county tax.

The current total local sales tax rate in duluth, mn is 8.875%. Tax rates for duluth, mn. [ 2 ] state sales tax is 6.88%.

Louis county transit sales/use tax* duluth city sales/use tax* duluth tourism Sales tax and use tax rate of zip code 55810 is located in duluth city, st. There is no county sale tax for duluth, minnesota.

Louis county transit sales/use tax (0.5%) and duluth general sales tax (1.5%). [ 3 ] state sales tax is 6.88%. The december 2020 total local sales tax rate was also 8.875%.

Ad earn more money by creating a professional ecommerce website. The county sales tax rate is %.

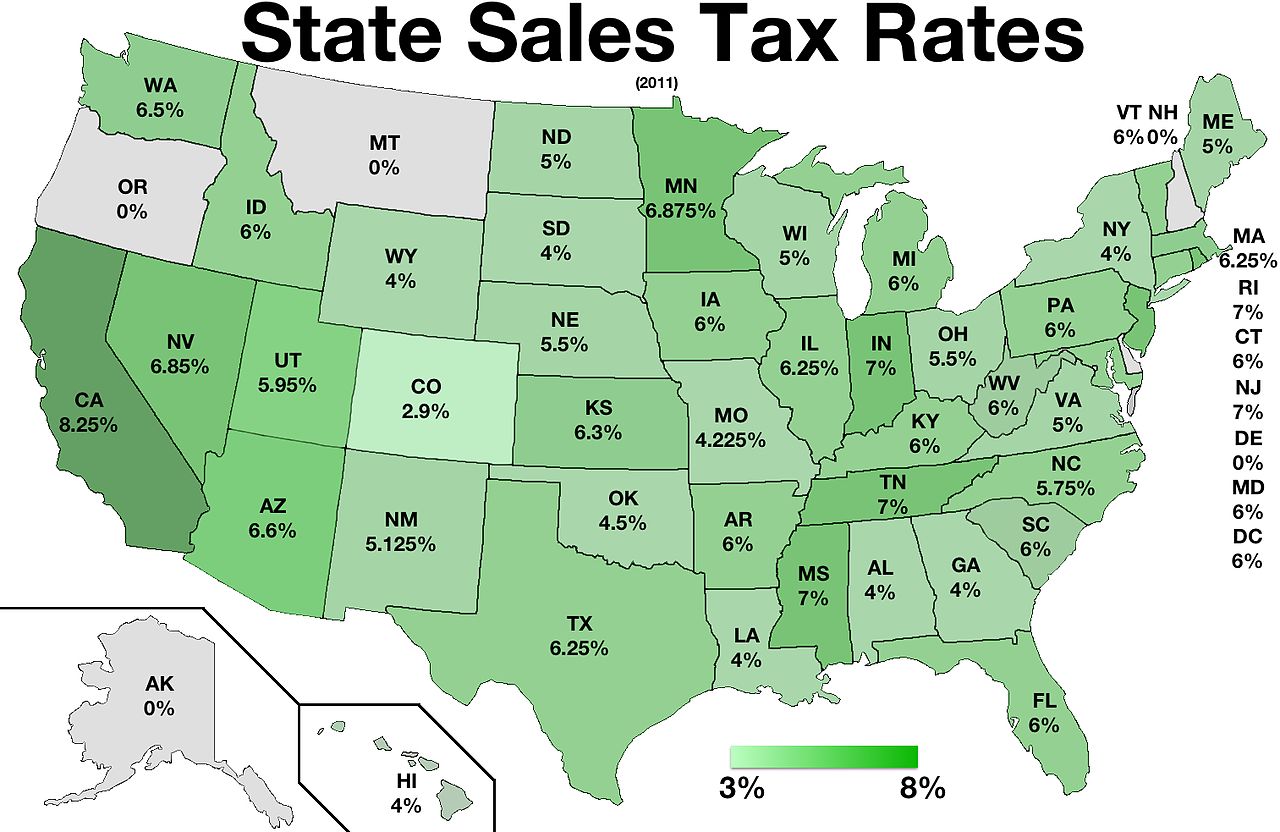

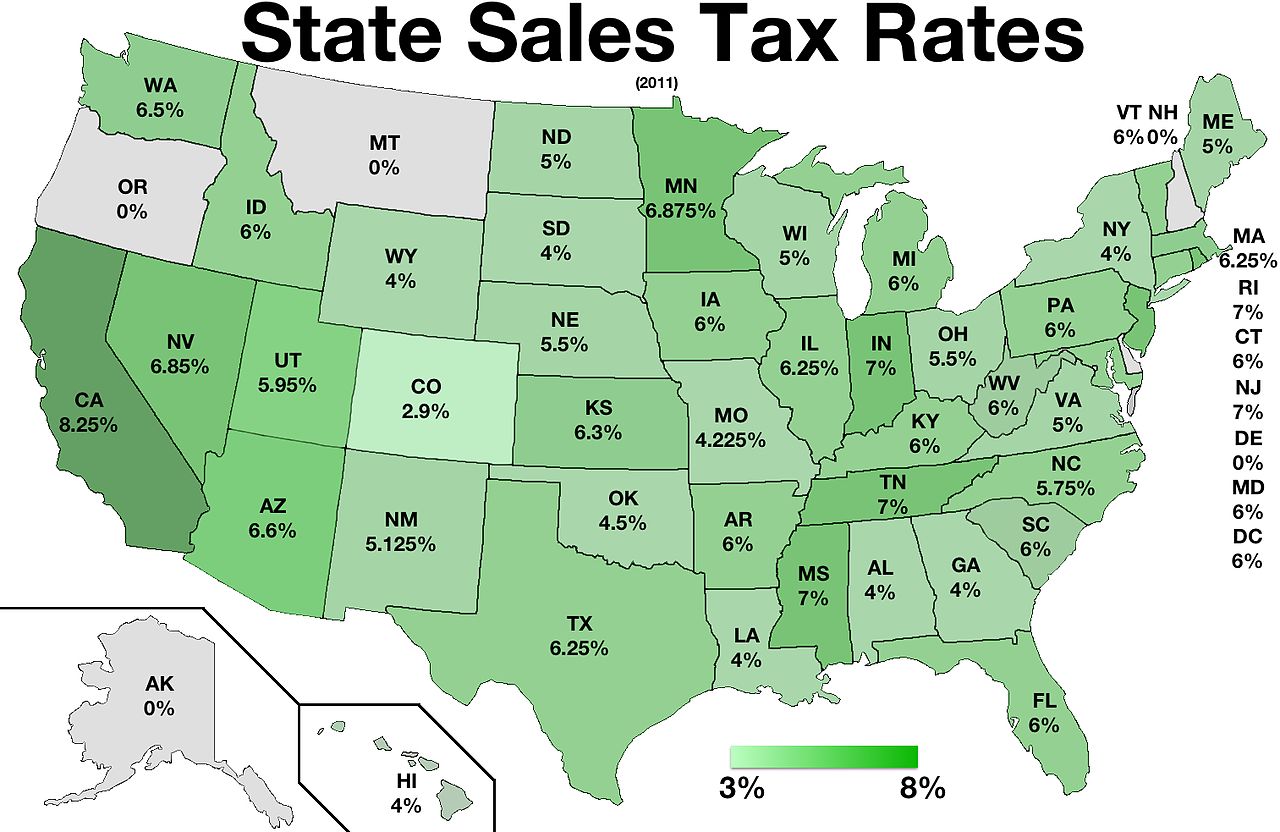

Sales Taxes In The United States – Wikiwand

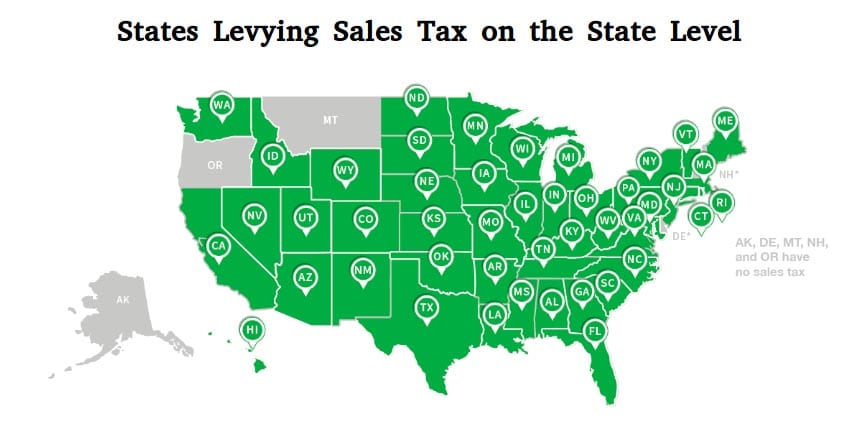

Minnesota Sales Tax Information Sales Tax Rates And Deadlines

Agriculture Accounting Services – Financepal

2

Us Supreme Court Reversed Decision On Online Sales Tax Collection

Sales Taxes In The United States – Wikiwand

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Minnesota Sales Tax – Small Business Guide Truic

Sales Taxes In The United States – Wikiwand

Minnesota Eyes Long-ignored Sales Tax On Services Duluth News Tribune

Property Tax Reports

Minnesota State Income Tax Mn Tax Calculator Community Tax

2

Sales Taxes In The United States – Wikiwand

Minnesota Clothing Sales Tax Exemption Appreciation – Perfect Duluth Day

Minnesota Sales Tax Rates By City County 2021

2

Minnesota Eyes Long-ignored Sales Tax On Services Duluth News Tribune

Treasury