The sales tax will be collected at the county clerks office when you go to get plates. Check out vehicle sales tax on ebay.

Top 10 States With The Lowest Taxes Wyoming Wyoming Tourism Spearfish

Sales tax applies where the purchase of the vehicle occurred in wyoming.

Does wyoming have sales tax on cars. Fortunately, there are several states with low car sales tax rates, at or below 4%: Use tax applies there the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming. It just can't be done.

Are services subject to sales tax in wyoming? The tax fee is based on your county's tax rate. Currently, combined sales tax rates in wyoming range from 4% to 6%, depending on the location of the sale.

We have almost everything on ebay. Ad looking for vehicle sales tax? A first party claim is a claim filed against your own carrier, regardless of fault.

If you have lost your title or it has been mutilated, you will need to apply for a duplicate before you sell the vehicle. For industrial lands, this percentage goes up to 11.5 percent. But did you check ebay?

On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0% and 2%. We have almost everything on ebay. Sales tax applies where the purchase of the vehicle occurred in wyoming.

Sales tax applies where the purchase of the vehicle occurred in wyoming. What states have the highest sales tax on new cars? Montana, alaska, delaware, oregon, and new hampshire.

Factory cost (not blue book) of the vehicle purchased (msrp), whether you traded. When buying a vehicle, you'll generally need to factor in the following costs/fees in addition to the purchase price and tax: Wyoming does not use a formal bill of sale, and some counties provide one while others rely on the transaction parties to provide one.

Wyoming law requires that a bill of sale must be presented to pay sales tax when a vehicle is purchased from a dealer. Prescription drugs and groceries are exempt from sales tax. However, some areas can have a higher rate, depending on the local county tax of the area the vehicle is purchased in.

The minimum sales tax varies from state to state. In addition, local and optional taxes can be assessed if approved by a vote of the citizens. The amount of sales tax you’ll pay will be determined by 3 factors;

Tangible, personal property and goods that you sell like furniture, cars, electronics, appliances, books, raw materials, etc. The wyoming (wy) state sales tax rate is currently 4%. States with high tax rates tend to be above 10% of the price of the vehicle.

Check out vehicle sales tax on ebay. The amount of sales tax due depends on: An example of taxed services would be one which sells, repairs, alters, or improves tangible physical property.

The wy sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. This means that a carpenter repairing a roof would be required to collect sales tax, while an accountant would not. Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming.

Wyoming collects a 4% state sales tax rate on the purchase of all vehicles. Sales and use tax the county treasurer collects a sales or use tax on all vehicle purchases. Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming.

Wyoming's sales tax rates for commonly exempted items are. A sales or use tax is due prior to first registration of a vehicle. Below is a list that shows which states require insurance companies to pay sales tax above and beyond the vehicle's actual cash value.

A third party claim is a claim filed against another carrier (at fault carrier). State wide sales tax is 4%. States with some of the highest sales tax on cars include oklahoma (11.5%), louisiana (11.45%), and arkansas (11.25%).

The county treasurer collects a sales or use tax on all vehicle purchases. In addition to taxes, car purchases in wyoming may be. But did you check ebay?

For residential and commercial property, the tax collected is 9.5 percent of the value of the property. See the publications section for more information. This is the state requirement, but a local mill levy rate (mlr) is added based on each area's rates for residential and commercial property.

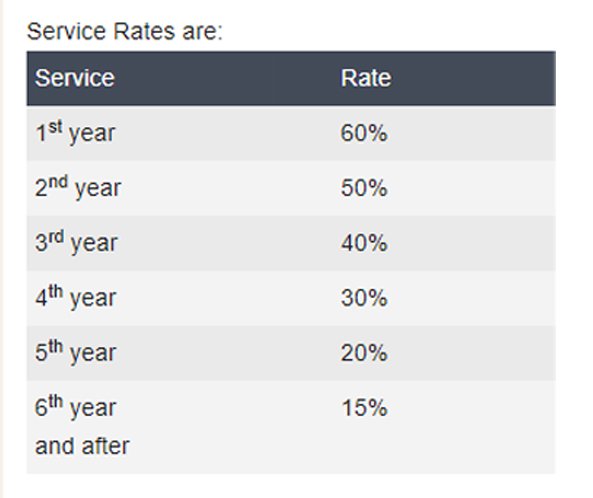

Certain services your business may provide The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. The county treasurer collects a sales or use tax on all vehicle purchases.

Use tax applies where the purchase occurred outside of wyoming and is for the use, storage or consumption of the vehicle within wyoming. Does the sales tax amount differ from state to state? When a vehicle is purchased from an individual, no bill of sale is required.

The states with the highest car sales tax rates are: The states with the lowest combined state and local sales tax rates are hawaii , wyoming , wisconsin , and maine. Only five states do not have statewide sales taxes:

The use tax is the same rate as the tax rate of the county where the purchaser resides. States requiring sales tax be paid for total loss settlements. Sales tax is due in 65 days.

Ad looking for vehicle sales tax? What is wyoming's sales and use tax? You’ll typically need to collect wyoming sales tax on:

The state of wyoming does not usually collect sales taxes on the vast majority of services performed. Depending on local municipalities, the total tax rate can be as high as 6%. Sales tax applies where the purchase of the vehicle occurred in wyoming.

Shipping From Arkansas To California California Arkansas Vehicle Shipping

Wyoming Affidavit Of Distribution For Motor Vehicle Form Resume Download Resume Computerized Accounting

With The New Month Comes A New Season And New Specials Httpwwwvwofoaklandcomspecials Lease Deals Volkswagen New Month

Wyoming Sales Tax – Taxjar

Trickrides Ratrods Trickit Carlifestyle Rat Rod Cartoon Antiques

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Sales Tax On Cars And Vehicles In Wyoming

Vehicle Buying Do You Pay Sales Tax For The State You Buy From Or Live In

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Updated 17 States Now Charge Fees For Electric Vehicles Gas Tax Electricity States

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Pin On 2012-06 Sanfords Pub Grub Casper Wyoming

Pin On Hot Deals

How To Write A Bill Check More At Httpsnationalgriefawarenessdaycom4317how-to-write-a-bill

Pin By Lemoncheckscom On Lemoncheckscom Mazda 2 Mazda Hatchback

96 Chevy Lumina Ls – 2000 Collegeville Cars For Sale Family Car Chevy

Auktionsrueckblick 2011 – Die Teuersten Oldtimer Des Jahres Ferrari Old Sports Cars Ferrari Car

Vintage Mcdonald Collectible Cars 2 Hamburglar 1 Big Mac Etsy Big Mac Car Collection Mcdonald