Fill in your address only if you are filing this form by itself and not with your tax return It's expected around 2/18 and i imagine turbotax will update online/software when available.

How Do I Include Form 5329 When I E-file With Turb

Usually i just do online because i dont think the download version is as well managed.

Does turbotax have form 8915-e. As long as you fall into the affected guidelines which literally applies to anyone from what i read, then yes. Turbotax will update this section shortly after the irs releases. Says 2/26/21 as go live eta but since they keep pushing it back i’ll believe it when i see it.

About form 8915, qualified disaster retirement plan distributions and repayments. Terms and conditions may vary and are subject to change without notice. Is there a number i can call for help?

Ad turbotax® tax experts are on demand to help when you need it. If you really want to know, and want to be of help, the turbotax community is not this place. No date has been given by the irs.

What happens here has nothing to do with turbotax, or with h&r block or with aarp tax prep. Question i use turbotax home & business. Login to your turbotax account

I cannot find it anywhere. But i didn’t actually manually fill in the 8915 form. The form needed has not been released yet by the irs.

No tax prep person or software has it yet. Since your browser does not support javascript, you must press the resume button once to proceed. When i did that, my tax return went up by almost $1000.

Get your taxes done right. Click retirement plan income in the federal quick q&a. Does the software include this form?

I thought turbotax did for you. For form 8915 click on + add form. You are in the wrong community.

It covers everything you have for your federal return and state tax returns are $12.95 right now. Ad turbotax® tax experts are on demand to help when you need it. From within your taxact return ( online or desktop), click federal.

Asked 7 months ago by john. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Get your taxes done right.

I saw it came out and i saw that someone said to just edit your 1099 and turbotax would fill in the 8915 for you.

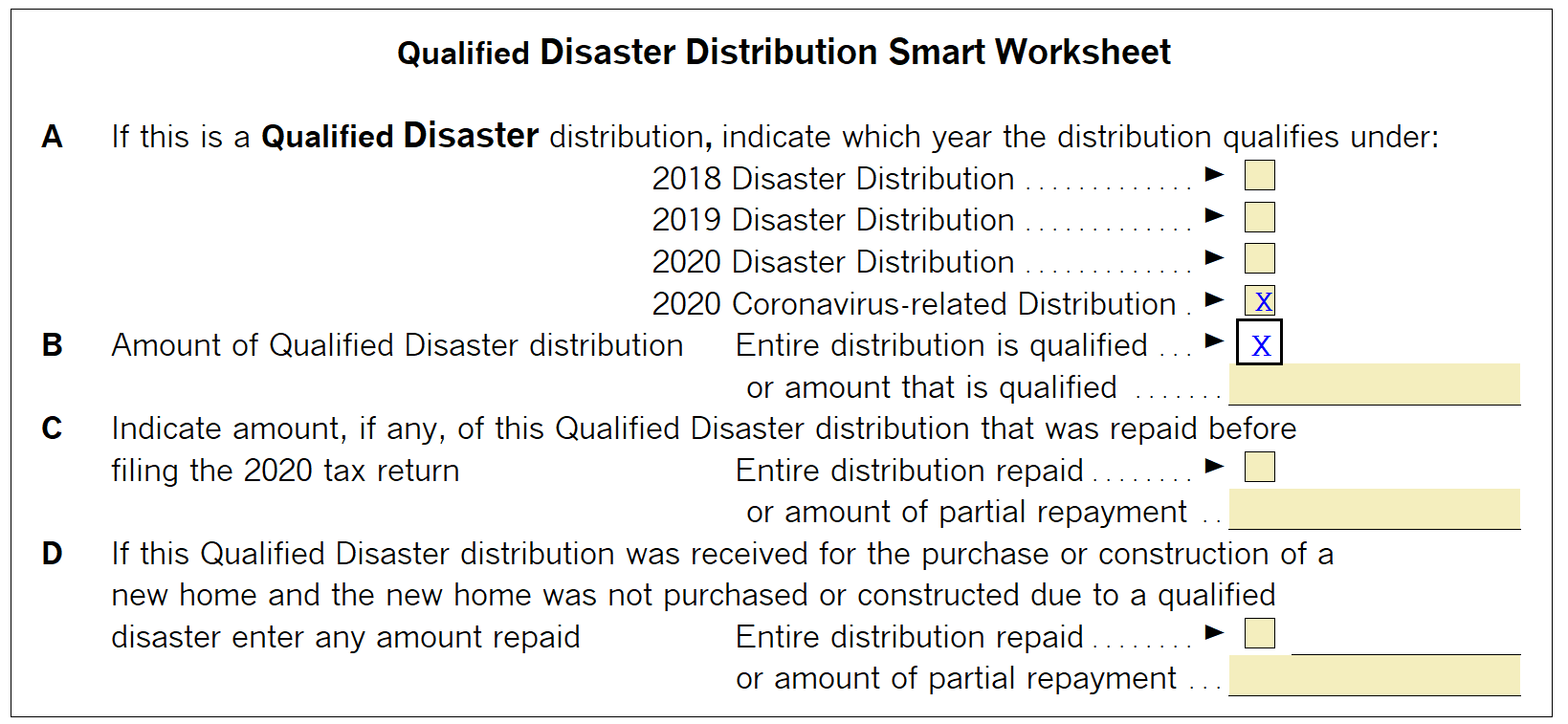

Cannot Check Box For Covid On Form 8915e S Or T

Solved Irs Form 8915 E – Page 2 – Intuit Accountants Community

Amazoncom 2009 Turbotax Home Business Estado Federal 5 Efiles Intuit Turbo Impuestos Todo Lo Demas

Form 8915-e For Retirement Plans Hr Block

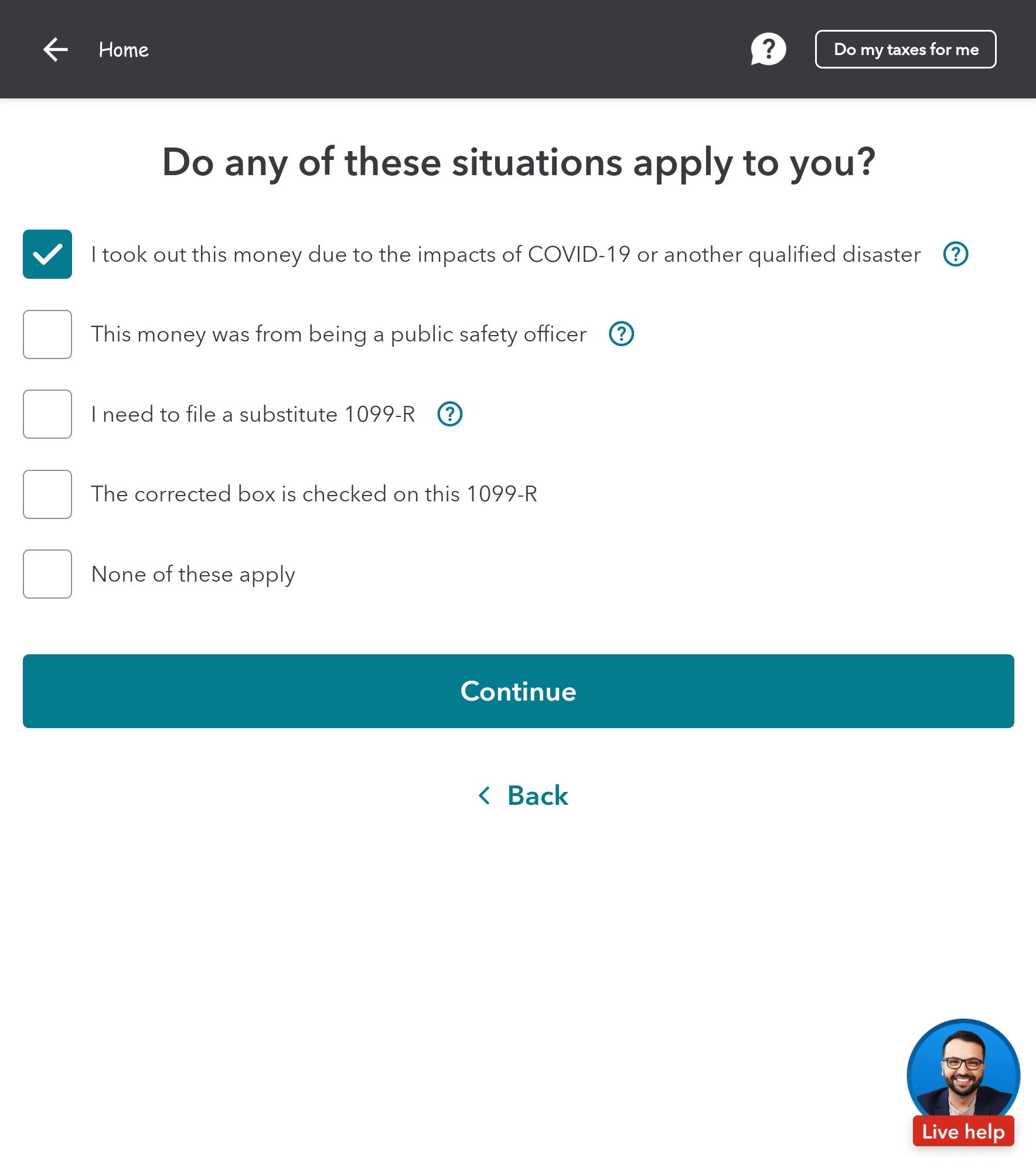

Covid Retirement Account Withdrawal In Turbotax And Hr Block

Solved Re Form 8915-e Is Available Today From Irs When – Page 2

Re Took 39000 From 401 Under Cares Act I Had 30

Questions And Answers Intuit Turbotax Home Business Federal Efile State 2020 1-user Mac Windows Int940800f104 – Best Buy

Anyone Know When Turbo Tax Plans To Update Their E

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

Solved Re I Received An Early Withdrawal Of My Retiremen

Re When Will Form 8915-e 2020 Be Available In Tur – Page 20

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915-e Explained – Youtube

Generating Form 8915-e In Proseries – Intuit Accountants Community

Re When Will Form 8915-e 2020 Be Available In Tur – Page 23

Solved Re Form 8915-e Is Available Today From Irs When – Page 2

It Looks Like The Irs Has Released Form 8915-e For

Re When Will Form 8915-e 2020 Be Available In Tur – Page 19

Re When Will Form 8915-e 2020 Be Available In Tur – Page 19