First, here are some tesla vehicles that will qualify for the tax credit. What you need to know about the federal ev tax credit phase out.

The Looming Issue With Teslas Model 3 Production Delay Greentech Media

Most tesla cars purchased after december 31, 2019, do not qualify for the credit.

Does tesla model y qualify for federal tax credit. It phased out in 2019, first reducing to $3750 and then to $1875. The proposed language in the build back better act would reset this for tesla and gm (who have currently passed this threshold) would be eligible again. Currently, state of california is offering $2500 credit.

That should be fair sales for us buyers and from all auto manufactures sold in the us. Year in gifts tech life social good entertainment deals The tesla team august 10, 2018.

Then require only new zero emission autos sold after 2050. Can both new and used vehicles qualify for section 179? Similarly, some vehicles from cadillac and chevrolet do not qualify due to the production numbers.

Model y is more than 40k so i don’t think it will work, unless you live somewhere else with other tax credit. Tesla motors makes electric vehicles and, in the us, people had a federal tax credit of $7,500 for tesla. The credit would only apply to whoever purchased the car new.

Let’s hope they approve an extended federal tax credit of $7500 for all until a date such as 2024. I did a little more digging on certain tax forms about bonus depreciation under 179 if the vehicle weighs less then 6,000 lbs. Ev tax credit for used electric vehicles and motorcycles

Current law for the federal tax credits phases them out after a manufacturer sells over 200,000 qualifying vehicles. Tesla and gm are set to regain access to tax credit worth $7,000 on 400,000 more electric cars in the us with new proposed reform of the. I just put the deposit for tesla model y but holding to get delivery until $7000 federal credit.

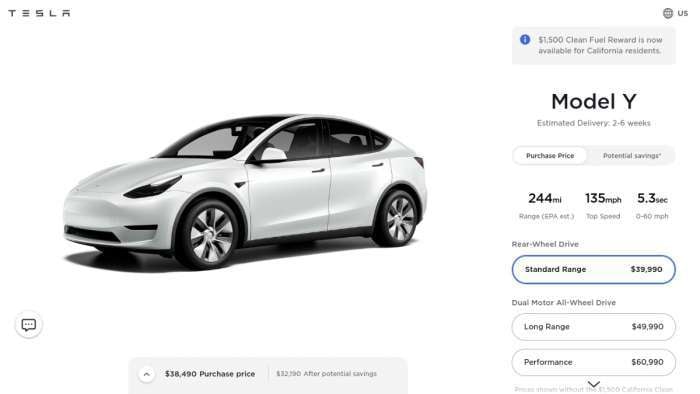

Entry level model s (starts at $79,690) model 3 (starts at $39,690) model y (starts at $51,990) So nobody knows what exactly will pass, but i'd like a $7500 tax credit if possible. Tesla's model 3 simplifies the ev.

Up to $5,000 rebate for individuals purchasing vehicles with a base msrp * under $45,000 before including delivery centre fees. For tesla’s bought on or after january 1, 2020, there has been no federal tax credit. Once the process has begun, purchasers of electric vehicles are eligible to claim 50% of the credit if the vehicle was acquired in the first.

Assuming the house msrp plan passes, does anyone know if the model y's msrp is calculated before or after fsd add on? (i believe) anyway, the new tesla model y came out for the consumer and it is below 6,000lbs, which is the threshold for qualifying. Today (january 1, 2020), with the beginning of a new quarter, there is no federal tax credit available for new tesla cars sold in the u.s.

I don’t think you would get tax credit since if you are in us it only applies to people who earn less than 100k a year and also only applies to cars under $40k. Tesla reached this mark in july of 2018, so the 50% credit phase out began in january 2019 and ran through the end of june 2019. In addition, the tax credit was not eligible for used cars.

Qualifying for a deduction will depend on stated use, vehicle gvw (which varies with trim packages and options), and more. Since 2010, anyone purchasing a qualified electric vehicle, including any new tesla model, has been eligible to receive a $7,500 federal tax credit. It varies based on the size of the battery but because tesla uses big batteries they qualify for.

All of this comes as tesla soldiers into 2020 without any federal tax credits. This happened in 2018 and all new tesla’s bought through the end of 2018 qualified for the $7500 tax credit. If you’re wondering why no teslas or the recently announced gmc hummer ev are included, it’s because gm and tesla vehicles are no longer eligible for.

Trims of the same model qualify up to msrp * $55,000 before delivery centre fees. Tesla model x toyota 4runner, landcruiser, sequoia, tundra * note: As of october, 2021, the only two companies to begin phasing out are tesla and general motors.

Apparently, you can deduct up to $18,100 the first year. Why does tesla no longer qualify? Please consult with your accountant regarding the eligibility of any particular vehicle.

The federal ev tax credit is the first to run out for electric carmaker tesla on dec. The senate's plan eliminates the 200k ev tax credit cap for tesla and gm vehicles bought after 5/24/21 for a $7500 tax credit for 2021 returns. By 2020 the subsidy will be zero dollars for tesla.

View transport canada’s website for eligible trims.

2021 Ford Mustang Mach-e Vs Tesla Model Y The Next Normal

2021 Tesla Model Y Performance Awd – Pge Ev Savings Calculator

Tesla Model Y Price Jumps Another 1000 After 2000 Increase Last Week Fox News

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers – Forbes Wheels

Teslas 7500 Tax Credit Goes Poof But Buyers May Benefit Wired

Is House Ev Tax Credit Proposal Targeting Tesla Huge Increase For Unions

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Elon Musk Made A Risky Tesla Model Y Prediction – Slashgear

Is The Tesla Model Y Really Worth 60000 Will Orders Slow Down

Is The Tesla Model Y Really Worth 60000 Will Orders Slow Down

Tesla Hikes Price Of Model 3 Model Y By 2000

2021 Tesla Model Y Performance Awd – Pge Ev Savings Calculator

High-performance Mustang Mach-e Due In 2021 Takes Aim At Model Y

1 Trillion Us Infrastructure Bill 3 Ways It Impacts Drivers News Carscom

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Ev Tax Credits 12500 On The Line As Bidens Bill Heads To Senate – Roadshow

Tesla Model Y Features Prices Specs And More – Electrek

Latest On Tesla Ev Tax Credit December 2021 – Current And Upcoming In 2022

Edmunds 2021 Ford Mustang Mach-e Vs 2020 Tesla Model Y Ap News