Delaware repealed its estate tax at the beginning of 2018. While federal estate tax is assessed on a decedent’s total combined asset value, indiana inheritance tax is a transfer tax assessed on each separate transfer.

Ingov

No estate tax or inheritance tax

Does indiana have estate or inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness. Oklahoma and kansas have also repealed their estate taxes. Although some indiana residents will have to pay federal estate taxes, indiana does not have its own inheritance or estate taxes.

Indiana’s inheritance tax still applies. Indiana's inheritance tax is imposed on certain people who inherit money from someone who was an indiana resident or owned property (real estate or other tangible property) in the state. As of 2020, 12 states plus the district of columbia impose an estate tax;

Indiana inheritance and gift tax. However, the state of indiana is not one of them. Estate tax of 3.06 percent to 16 percent for estates above $5.9 million;

Indiana inheritance tax was eliminated as of january 1, 2013. Federal estate tax can be complicated and requires a cpa or tax attorney to navigate the issue. An inheritance tax is a state tax that you’re required to pay if you receive items like property or money from a deceased person.

Twelve states and the district of columbia collect an estate tax at the state level as of 2019. Whereas the estate of the deceased is liable for the estate tax, beneficiaries pay the inheritance tax. This is great news if you live in the hoosier state.

People often use the terms “estate tax” and “inheritance tax” interchangeably when, in fact, they are distinct types of taxation. 3 hours ago does indiana have an inheritance tax or estate tax? Ad an inheritance tax expert will answer you now!

Below we detail how the estate of indiana will handle your estate. For individuals dying before january 1, 2013. Eight states and the district of columbia are next with a top rate of 16 percent.

How much is inheritance tax. Estate tax of 10 percent to 16 percent on estates above $1 million; However, be sure you remember to file the following:

There's a federal estate tax, although it only applies to estates worth over $11.7 million. Inheritance tax of up to 15 percent In general, estates or beneficiaries of.

The top inheritance tax rate is 15 percent (no exemption threshold) kansas: Inheritance tax applies to assets after they are passed on to a person’s heirs. Ad an inheritance tax expert will answer you now!

However, other states’ inheritance laws may apply to you if. Inheritance tax of up to 16 percent; There is no inheritance tax in indiana either.

Indiana is one of 38 states in the united states that does not have an estate tax. On the federal level, there is no inheritance tax. Here in indiana we did have an inheritance tax, and this is why some people assume that we are one of these states.

As a result, indiana residents will not owe any indiana state tax after this date with respect to transfers of property and assets at death. Although some indiana residents will have to pay federal estate taxes, indiana does not have its own inheritance or estate taxes. There is also a tax called the inheritance tax.

The top estate tax rate is 16 percent (exemption threshold: Indiana, ohio, and north carolina had estate taxes, but they were repealed in 2013. Indiana repealed the inheritance tax in 2013.

No estate tax or inheritance tax. That tax has now been completely eliminated and in fact, the inheritance tax division of the indiana department of revenue remains open only to enforce collection of tax owed from prior years. Do you have to pay taxes on inheritance in indiana?

Several states have their own estate taxes with lower thresholds, while five have inheritance taxes. Tennessee followed suit in 2016, and new jersey and delaware eliminated their estate taxes as of 2018. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes.

Of course, indiana cannot change federal law and there does remain in existence a federal estate tax. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Indiana inheritance tax is imposed on the transfer of property from an indiana decedent to a beneficiary.

New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax. No estate tax or inheritance tax. To the extent that there is any good news about a.

The tax rate is based on the relationship of the inheritor to the deceased person. Maryland is the only state to impose both. Inheritance tax of up to 18 percent;

In fact, the indiana inheritance tax was retroactively repealed as of january 1st of 2013. Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. You do not need to pay inheritance tax if you received items from an indiana resident who died after december 31, 2012.

Below we detail how the estate of indiana will handle your estate if there’s a valid will as well as who is entitled to your property if you have an invalid will or none at all. What is an inheritance tax and does indiana impose one? But even though indiana may not have an estate tax, you could have an issue at the federal level.

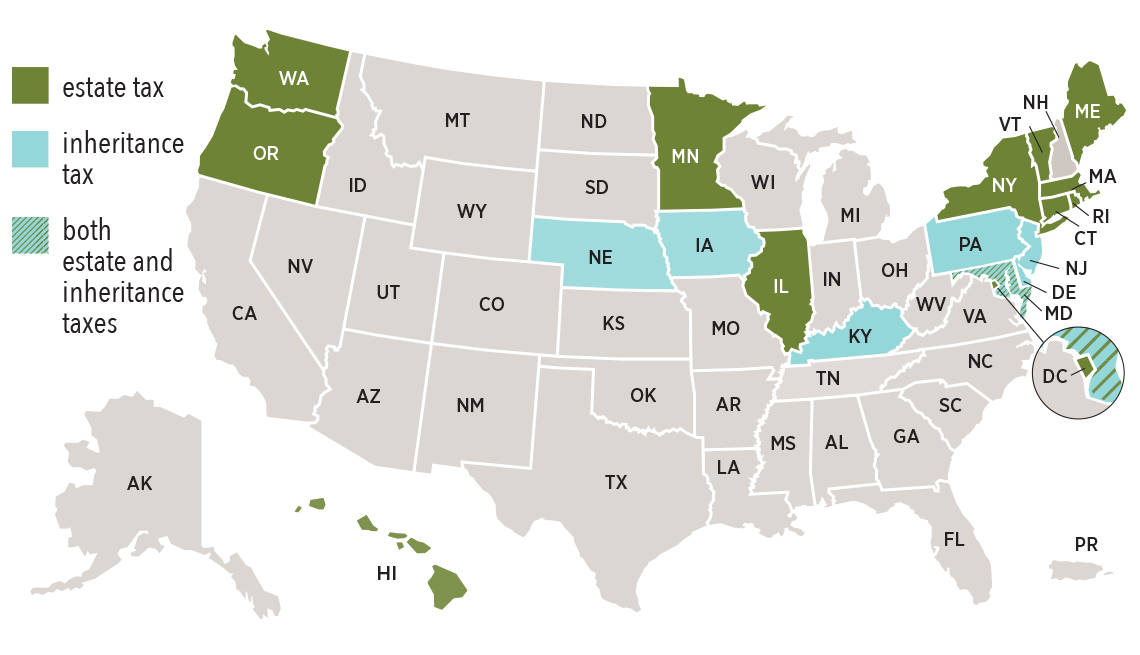

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

Three Taxes Can Affect Your Inheritance

State Estate And Inheritance Taxes

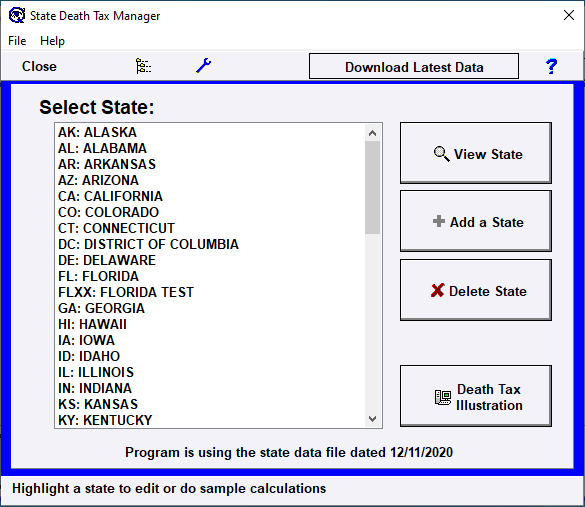

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

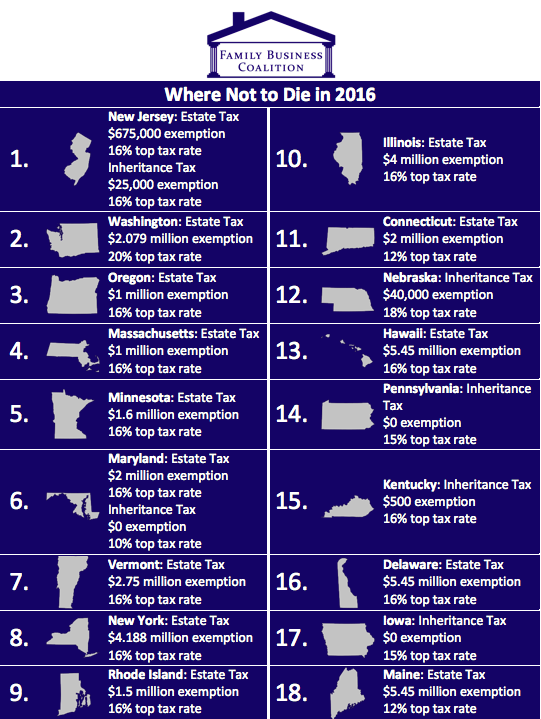

17 States With Estate Taxes Or Inheritance Taxes

How Do State Estate And Inheritance Taxes Work Tax Policy Center

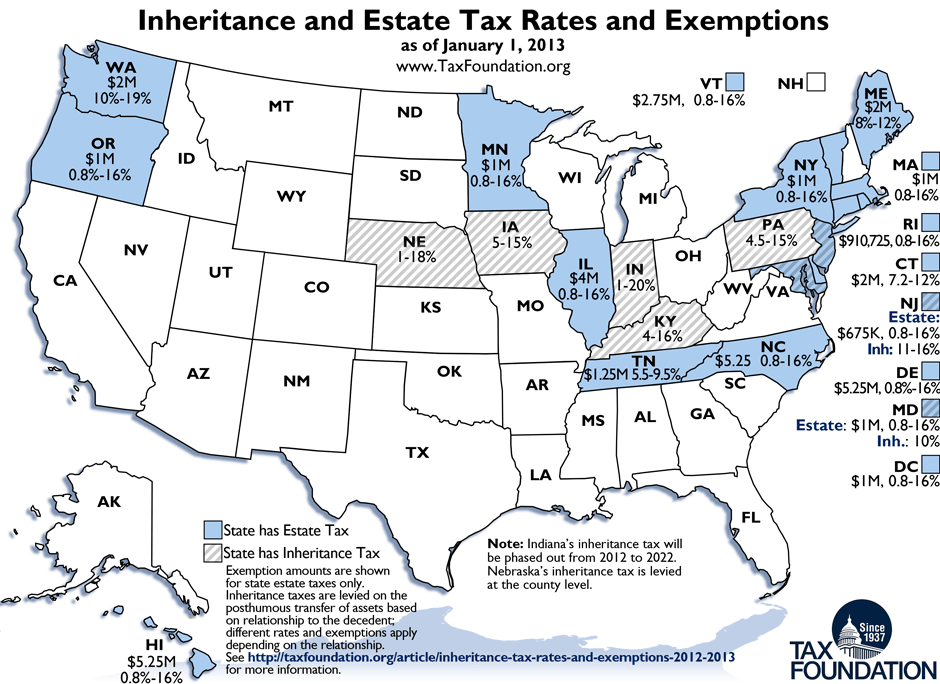

State Estate And Inheritance Taxes In 2014 Tax Foundation

State-by-state Estate And Inheritance Tax Rates Everplans

In States The Estate Tax Nears Extinction Huffpost Latest News

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Does Your State Have An Estate Or Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Indiana Does Not Have An Inheritance Tax Anymore Indianapolis Estate Planning Attorneys

Alternative To Inheritance Tax Cuts Seventh State

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

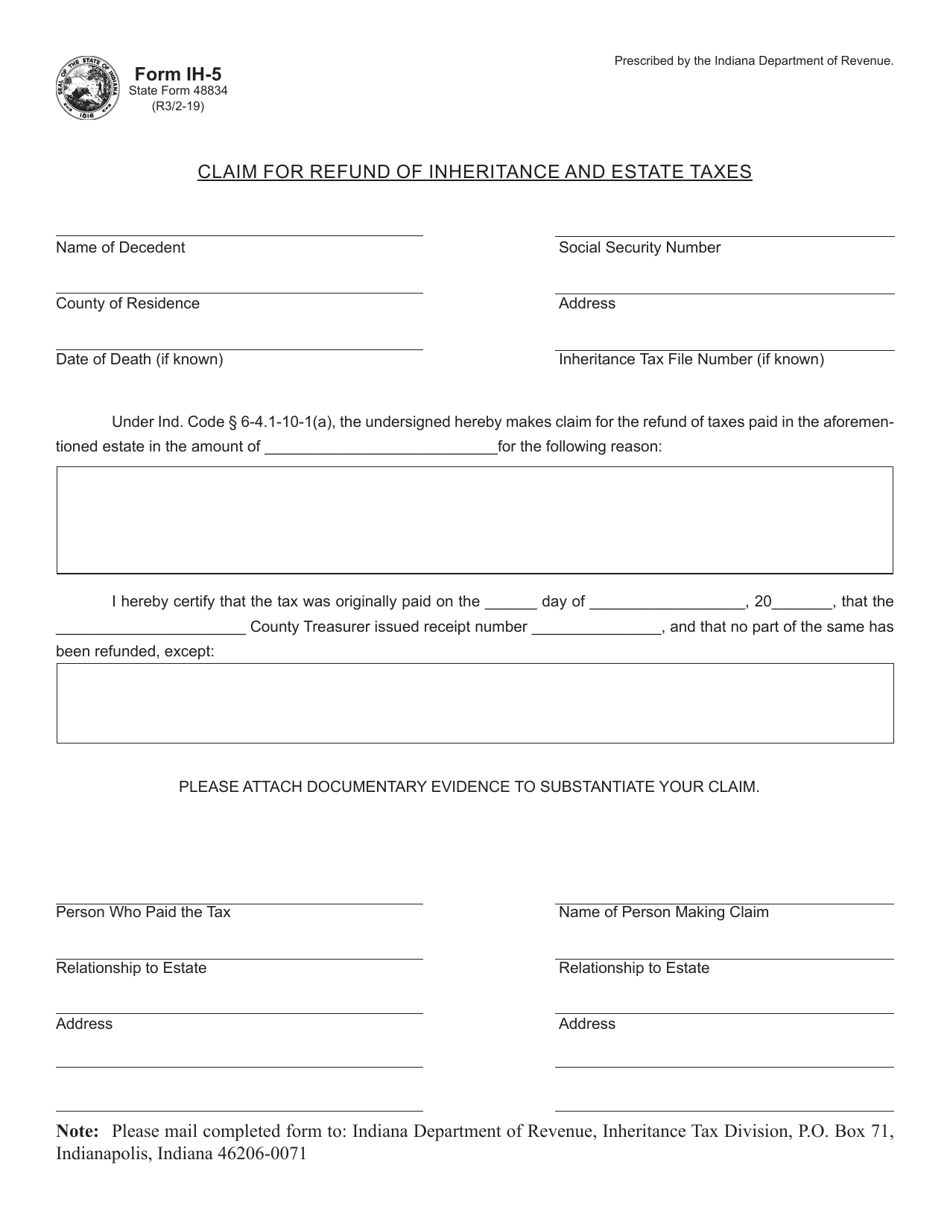

Form Ih-5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die