The first thing to realize is that any winnings are taxable and bettors should include it on a tax return. However, if you do itemize, you can deduct the $1,300 as a gambling loss which will offset $1,300 of your gambling winnings.

Draftkings Log In Bonus Mobile App Download Register For Tips And Predict

Here are two of the basic irs forms used to report winnings from gambling, including the standard personal income tax form.

Does draftkings send tax forms. Draftkings seems to think that since they have the option to file for an extension, they should do that most years because they can’t do things in a timely fashion. Draftkings will send you a 1099 tax form in the mail, but only if you win more than $600 over the course of the year with dfs. This is standard operating procedure for daily and traditional sports betting sites, and is one of the requirements for draftkings, and sites like it, to stay in business.

The amount of winnings should appear in box 3, “other. Draftkings is just protecting themselves from people giving fake information to avoid possible future taxes. If you win any prize worth more than $600, the sweepstakes' sponsor is required to send you a 1099 form for it.

Completing a w9 or w8 does not indicate whether or not you will be receiving a 1099 for. We will withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the wager. However, the income will still be subjected to federal income tax and you will be required to report it on your tax form.

If you reported your $5,661 of income as 'hobby income', you would still need to itemize to deduct the $1,300 to offset any income. It’s the same form required by any businesses when you could earn income. Draftkings w9 email to players.

It can be found in the wages & income section, and i have attached a screenshot. Providing an incorrect ssn on this form is not a good idea. If you take the standard deduction, you cannot offset any of your winnings.

This year, players have until april 15th to submit their tax returns for 2020. First of all, a w9 is just a standard form used to identify tax payers. Fanduel sent me a tax form just the other day, don’t use draftkings so i’m not sure how they go about it

I will advise you to report net earnings of $1, but anything over $600 is what will be reported to the irs. If it turns out to be your […] and if you really bring home the bacon, earning at least $5,000 for sports betting, this definitely goes on your tax record. We’re guessing that players should be receiving their 1099s forms very soon, so players should hang tight and complete as much of their tax form as they can in the meantime as the filing deadline is april 18th.

Will fanduel send me tax forms? A majority of companies issue tax forms by january 31st every year as required by law. Remember, even if you showed a small profit for the year (under $600) on draftkings, you still need to report your income on your 1040 federal income tax return.

The fanduel w9 form requires you fill out a few basic personal details in the event that you earn more than the yearly threshold for daily fantasy. On the next screen, click 'this was prize winnings'. For sports bettors, the irs form 1099 will be the most common tax form.

Maintaining good records of your gambling activity will allow you to itemize your losses and deduct them from your final tax bill. The best place to put this 1099 is under ''other common income''. “taxpayers still have a responsibility to report their prize on their tax return as ‘other income.’”

You may contact draftkings at support@draftkings.com if you cannot access your electronic tax information or to request a paper copy of your tax information. If you’re anxious, you can always contact support@draftkings.com to find out the latest information for your account. The answer is yes, your cumulative net profit is taxed, and draftkings is contractually required to send a 1099 tax form to any player that nets of $600 in profit in a calendar year.

This is because income below $600 made from side jobs is not reportable to the irs, and because of how draftkings is classified in terms of taxes. Draftkings also requires that certain players submit the form as well. Can i write off draftkings losses?

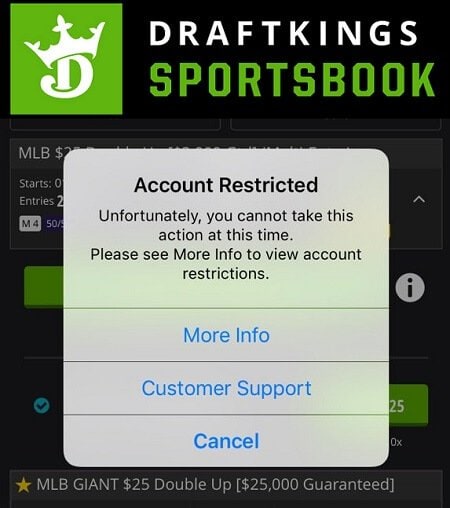

Yes, they will, again in limited circumstances. If draftkings requests that an entrant completes and executes such an affidavit and the entrant fails to do so within seven (7) days, or draftkings otherwise determines that the entrant does not meet the eligibility requirements or is not in compliance with these terms, draftkings reserves the right to terminate the entrant's account and. The information provided on these forms (name, social security number, and address) will be used by draftkings to populate irs form 1099.

Does draftkings send tax forms. In respect to this, do you get taxed on draftkings? Here is the full email that some draftkings players are sending players:

Draftkings Michigan Sportsbook 1050 Bonus December 2021

Fanduel Vs Draftkings Which Is The Best Daily Fantasy And Sportsbook Service Techradar

Draftkings Shares Plunge As Short-seller Hindenburg Claims Crime Links Sporticocom

Draftkings Sportsbook Promo Code 1000 Risk Free Bet

Red Sox Name Boston-based Draftkings As Exclusive Daily Fantasy Sports Partner

Draftkings Tom Brady Team Up For Nft Marketplace On Draftkings App Sporticocom

Draftkings To Hire 30 Software Engineers As It Opens Dublin Operation

Draftkings Pennsylvania Sportsbook 1 Mobile Pa App – 1050 In Bonuses

How To Bet On Golf At Draftkings Sportsbook

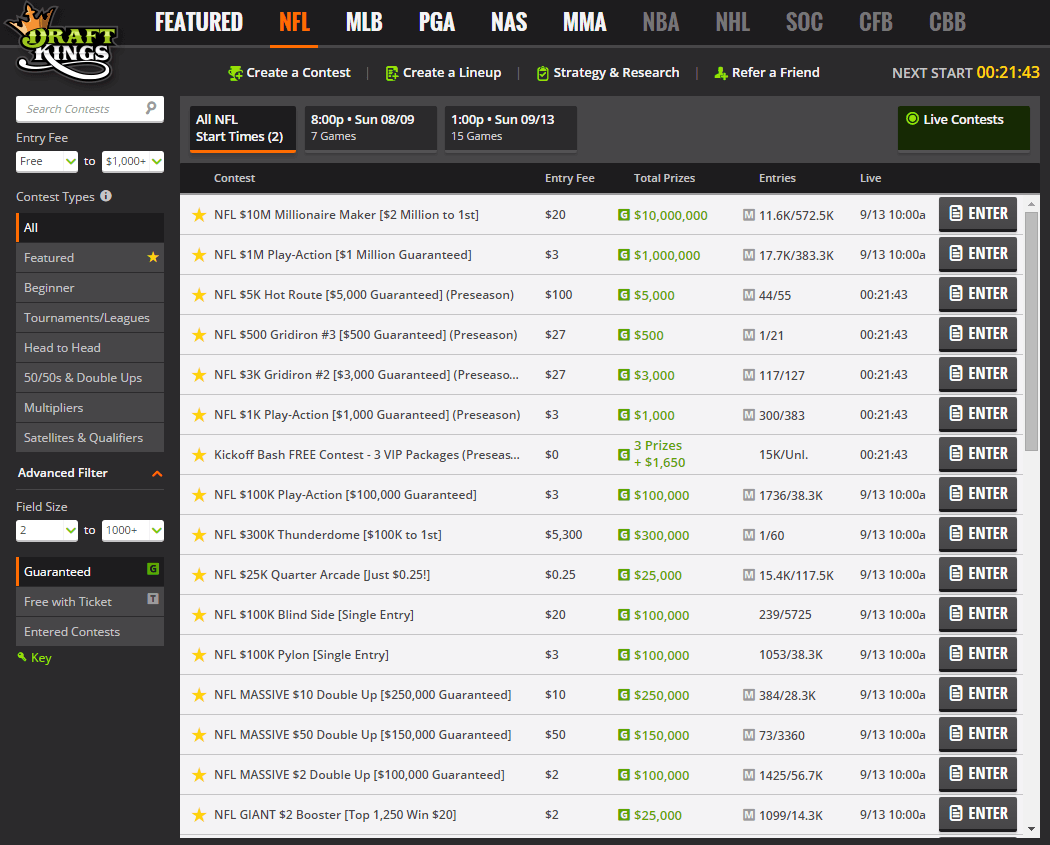

Draftkings Daily Fantasy Sports – 500 Bonus On Dfs – Basketball Insiders Nba Rumors And Basketball News

Draftkings Review

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Sportsbook Casino Review Up To 1050 Bonus For Sports

Draftkings Ct Promo Code 2021 For 1050 Bonus

Terms Of Use Draftkings Sportsbook

/cdn.vox-cdn.com/uploads/chorus_asset/file/22778751/DK_Nation_1800x1200_6.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace – Draftkings Nation

Draftkings Raises A Stink About Massachusetts Online Gaming Proposal – Boston Business Journal

Restore Restricted Or Locked Draftkings Sportsbook Account