Such ministers wrongly assume that because certain of their income may be exempt from withholding of taxes, this also means they're exempt from paying taxes. Because the gifts were his main source of income instead of a stated salary, the court ruled that it essentially was his salary.

2

Every other employer is required by law to withhold income taxes for their employees, but pastors are exempt from that.

Do pastors pay taxes in canada. The average salary for a pastor in canada is c$51,384. Each of these deductions have their own Many pastors do pay taxes, and opting out of taxes is now more often the exception.

If you are a member of the clergy, you must include in your income offerings and fees you receive for marriages, baptisms, funerals, masses, etc., in addition to your salary. If your employee is a member of the clergy, they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. (attached as exhibit a) d.

As per income tax act 1961 organisation registered u/s. Anything other than the cash payment (before taxes) the pastor receives should be reported in a totally separate category. Let me describe how this works.

So, churches don’t have to. An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the clergy residence deduction if the employee is in one of the following situations: 3) one commenter noted we should simply pay a pastor a total wage and let him/her be responsible for filing the taxes.

If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a taxable benefit and included in his t4 return. Exemptions from property taxes represent an even larger benefit to churches — the total value of all property owned by all religious groups in the united states easily runs into the tens of billions of dollars.this creates a problem, according to some, because the tax exemptions amount to a substantial gift of money to churches at the expense of taxpayers. Third, unlike seca taxes, churches have the option to withhold income taxes for pastors.

Churches are obligated to withhold certain amounts at source, including: The pastor will be able to claim the clergy housing deduction as outlined in item 5 below.) e. In charge of, or ministers to, a diocese, parish, or congregation.

If you take a pastoral job offer, you should not assume that your. I like this approach but living in the greater vancouver area i suspect we would have trouble determinening what this wage should be if no house is being provided. Even as per service tax temples/church/mosque giving shops on rent and place to any religious function in his area are also not liable to charge service tax on them.

You are eligible to claim the clergy residence deduction on line 23100 of your return if you were a member of the clergy or a religious order or a regular minister of a religious denomination, who was in one of the following: If you make arrangements with your church, you can elect voluntary withholding. Employment insurance, canada pension, income tax, and registered pension plan contributions.

There are many resources to find out what the. No worker in a secular company adds their benefits and expenses and calls it their pay. Visit payscale to research pastor salaries by city, experience, skill, employer and more.

The donations far exceeded the pastor’s salary. Can't speak for canada, but u.s. Instead, clergy can pay income taxes in quarterly installments throughout the year.

Maybe we should add that as a seperate discussion. 12aa, exempted to pay tax to charitable organization, societies and religious places to pay tax from fund get by donations. If the offering is made to the religious institution, it is not taxable to you.

He can pay this self employed tax by making quarterly estimated tax payments, or by requesting the church to hold out extra income tax. When a minister works for a church, the church can withhold income tax. Our team of certified compensation professionals has analyzed survey data collected from thousands of hr departments at companies of all sizes and industries to present this range of annual salaries for.

Ministers who choose to do so are no longer responsible for paying social security tax, which, as of 2011, equaled 12.4 percent of a taxpayer's income. In charge of a diocese, parish, or congregation; An employee who is a member of the clergy, a regular minister, or a member of a religious order can claim the clergy residence deduction if they are in one of the following situations:

In addition to the blue envelope gifts, the pastor took a housing allowance of $6,500 a month. Pastors most certainly pay taxes on their income. If requested by canada revenue agency (cra).

Ministers who choose to opt out are not able to collect social security payments in the future, and the irs generally does not allow a minister to revoke this decision once it has been made. If that is the case, the church should withhold income taxes only (not social security taxes, which you.

2

2

Pastors – Parsonage Or Own Home – Church Investors Fund

Extra Income Archives – The Pastors Wallet

2

Church Stewardship Church Ownership The Church Is Not Ours The Vision Of The Church Is Not Ours It Is Gods As Leaders You Must Articulate The Vision – Ppt Download

2

Clergy Housing Tax Free – Canada The Network

Church Stewardship Church Ownership The Church Is Not Ours The Vision Of The Church Is Not Ours It Is Gods As Leaders You Must Articulate The Vision – Ppt Download

2

2

2

Called To Canada Non-canadian Pastors Serving Canadian Churches The Network

2

Why Does A Marriage Usually Include A Pastor – Quora

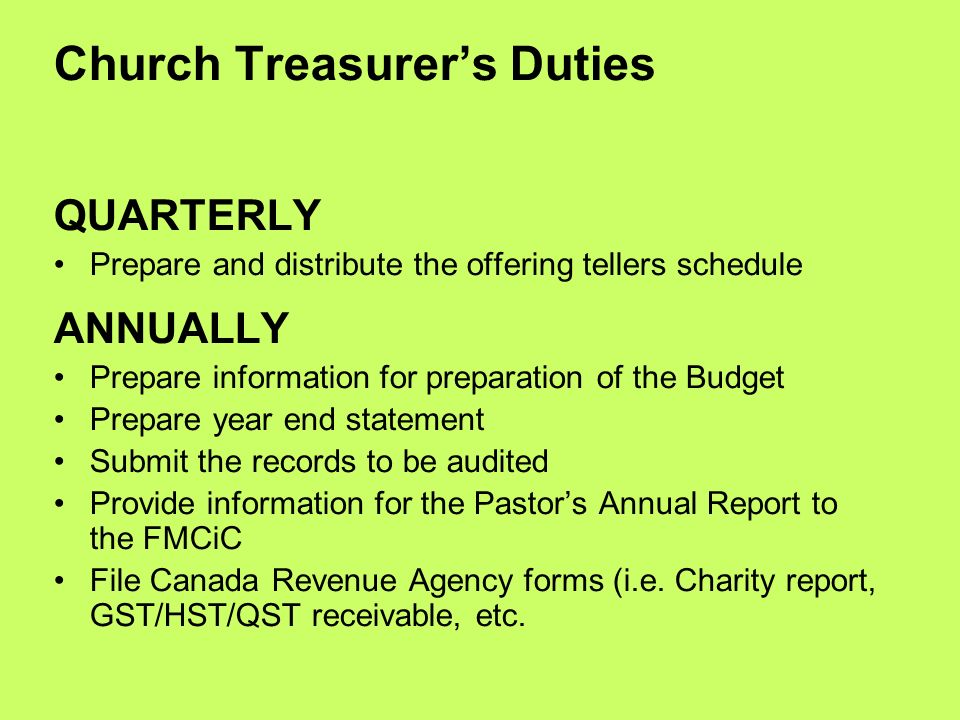

The Free Methodist Church In Canada Housing Allowance

What Is The Deadline For Pastors To Opt Out Of Social Security With Form 4361 – The Pastors Wallet

Planned Giving – Canada – Charitable Bequests Rrsps Rifs

Church Stewardship Church Ownership The Church Is Not Ours The Vision Of The Church Is Not Ours It Is Gods As Leaders You Must Articulate The Vision – Ppt Download