At the time you receive the benefits, you’ll have to pay any taxes that are payable. The amount of annuity taxation depends on how the particular payout for the annuity is set up.

How To Avoid Paying Taxes On An Inherited Annuity

In a recent article from nj.com, “who pays inheritance tax on.

Do i pay taxes on an inherited annuity. You can transfer it to another annuity. Obviously, you could receive a lump sum and you're going to pay taxes on that lump. Once the annuity enters the annuitization phase, they must begin paying taxes on earnings, as well as any other untaxed portions.

Do i have to pay taxes on an inherited annuity? The simplest option is to take the entire amount as a lump sum. The inherited annuity’s remaining funds can be withdrawn in a single payment, if desired.

If you have inherited your spouse’s annuity, you can choose to transfer the annuity contract into your name. Principal that was not taxed and earnings will be subject to taxation as income. So you're going to have to pay taxes on an inherited annuity.

A person who inherits an annuity has to pay income tax based on the difference between the premium paid into the annuity and the amount still in it when the annuitant died. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Only a spouse can inherit an annuity and benefit from the options the late spouse enjoyed.

The amount depends upon your relationship to the deceased and the value of the annuity. The part of the annuity payment representing return of capital is not taxable, but the earnings are. When inheriting an annuity from a parent, you will have to pay taxes on payments as ordinary income.

Paying taxes on inherited annuity i understand we pay taxes on the taxable amount listed in box 2a of the 1099. In turn, taxation of annuity distributions depends on whether. You can take the entire value of the annuity as a lump sum, or set up an inherited ira to receive the money.

Yes, there are taxes due on inherited annuities. Now, the good news is, most carriers, most annuity companies will give a surviving spouse or beneficiary payout options. If you're not the spouse of the deceased, you basically have two options for taking distributions.

If it seems like everything is subject to an inheritance tax, well, that is often true. Distribution options beneficiaries inheriting an annuity have a few different options in receiving the. If a surviving spouse recently inherited an annuity, they can either pay taxes on all of the funds now, spread the tax payment over time, or exercise the spousal continuation provision.

The amount depends upon your relationship to the deceased and the value of the annuity. The taxation on the distribution depends on how you choose to. You’ve just inherited a retirement account.

However, how the taxes add up depends on the beneficiary and how the annuity has been structured. Any taxes due on the benefits must be paid at the time they are received. Do i have to pay taxes on an inherited annuity?

Do i treat this as income adding it to myearned income and possibly raising my tax bracket, or do i pay taxes based on the earned income bracket? In this situation, the person inheriting the annuity must pay the estate tax on the annuity. If it seems like everything is subject to an inheritance tax, well, that is often true.

The only caveat is that the entire annuity. You could opt to take any money remaining in an inherited annuity in one lump sum. You will also be able to receive remaining funds as a stream of payments instead of a lump sum.

You’d have to pay any taxes due on the benefits at the time you receive them. Spousal continuation is the tax strategy to avoid paying taxes now. If a beneficiary inherits this type of annuity, they will be required to pay taxes on the growth.

Yes, there are taxes due on inherited annuities. Irs publication 575 says that, in general, those inheriting annuities pay taxes the same way that the original annuity owner would. Learn more about taxes at bankrate.com.

Can i rollover an inherited annuity? Under most scenarios, the only taxes due on a tax deferred annuity you have inherited would be ordinary income tax on the untaxed growth. How do you avoid taxes on an inherited annuity?

You have the option of taking any remaining money from an inherited annuity in one big sum.

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Fixed Annuity Rates March 2019 Annuity Saving For Retirement Insurance Marketing

Inherited Annuity Tax Guide For Beneficiaries

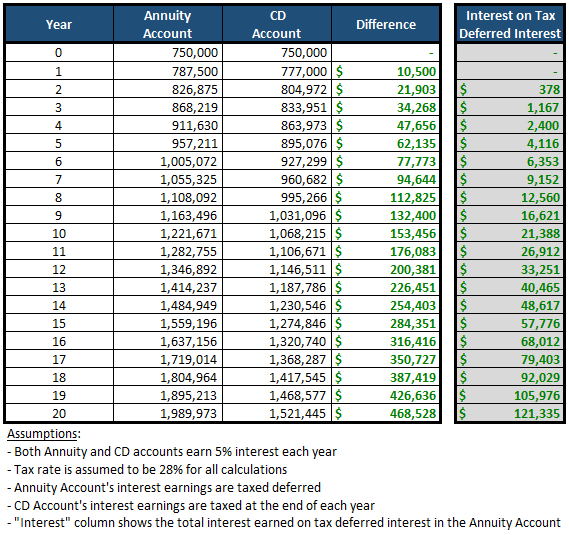

Annuity Taxation How Are Annuities Taxed

Council Post Why Non-recourse Loans Arent Always Non-recourse Second Mortgage Loan Company Credit Companies

Inherited Non-qualified Annuities For Spouses Non-spouses And Trusts

Annuity Beneficiaries Inheriting An Annuity After Death

Home – Njmoneyhelpcom Tax Refund Inherited Ira Paying Taxes

Annuity Beneficiaries Inherited Annuities Death

Taxation Of Annuities Explained Annuity 123

Understanding Annuities And Taxes Mistakes People Make – Due

Httpsnewsoftoday Telling The Untold News Re-evaluating Your Life Insurance Coverage As Retirement App Take Money Permanent Life Insurance Retirement

Annuity Beneficiaries Inheriting An Annuity After Death

Stretch Iras Are Now A Thing Of The Past Due To A New 10-year Rule That Affects Non-spousal Beneficiaries Of An Inherit Inherited Ira Financial Education Ira

Whoa A Week In A Maldives Overwater Villa For 2000 Refundable – Pizza In Motion Maldives Underwater Restaurant Villa

2021 Investment Outlook Investing Financial Coach Economic Trends

Taxation Of Annuities Ameriprise Financial

Sick Employees Not Taking Time Off To Recover Hr Paid Sick Leave Sick Pay Sick Leave

Annuity Taxation How Various Annuities Are Taxed