Families signing up now will normally receive half of their total child tax credit on december 15. Children who are adopted can also qualify if they're us citizens.

Child Tax Credit Updates Why Will December Payments Be Bigger Than The Others Marca

Here’s who will get a bigger december payment#ctc #childtaxcredit #decemberpaymentthe child tax credits are worth $3,600 per chi.

December child tax credit increase. Cash boost child tax credit: For purposes of the child tax credit and advance child tax credit payments, your modified agi is your adjusted gross income (from the 2020 irs form 1040, line 11, or the 2019 irs form 1040, line 8b), plus the following amounts that may apply to you. The deadline is monday for payment on december 15th

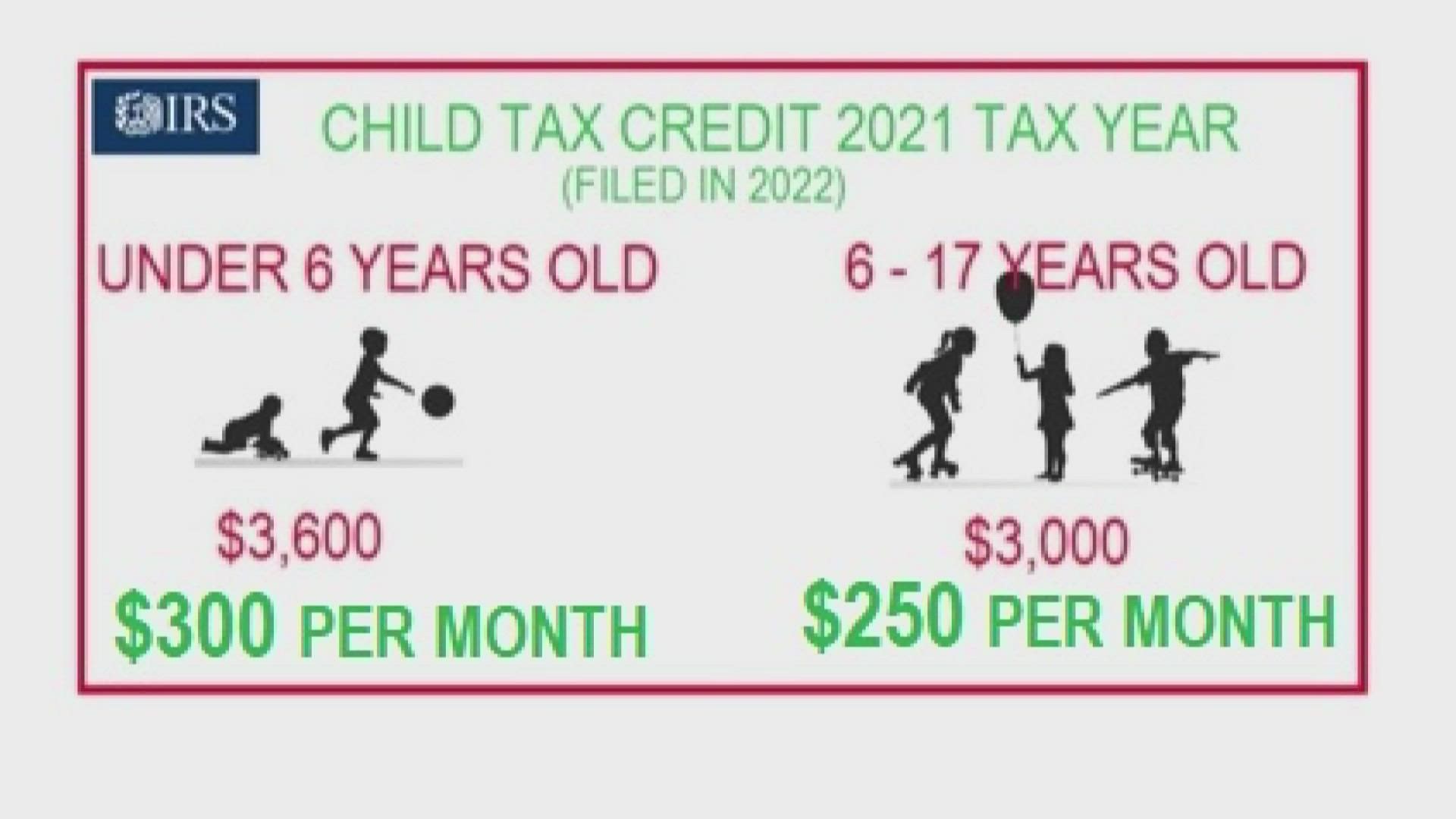

Child tax credit deadline coming up that could give up to $1,800 per child on dec. This year, the american rescue plan (arp) increased the ctc from $2,000 per child to as much as $3,000 or $3,600, depending on the age of the child, for many families. Some families will get $1,800 child tax credit in december.

The amount grew from $2,000 to as much as $3,600; Tens of thousands of u.s. Increased to $7,200 from $4,000 thanks to the american rescue plan ($3,600 for each child under age 6).

Recipients could sign up to obtain the money. If the monthly prepayment is not extended, the child tax credit will revert to a $ 2,000 lump sum in 2022 and can be collected at the time of taxation in 2023. The maximum credit is available to those individual taxpayers with a modified adjusted gross income (agi) of $75,000 or less.

The 'stimulus check', part of president joe biden's child tax credit plan, will see those who meet the final november 15 deadline potentially receive up to $1,800 per child come december. The child tax credit monthly payments began in july 2021 and will continue through december. If you have a baby anytime in 2021, your newborn will count toward the child tax credit payment of $3,600.

Any amount on line 45 or line 50 of the 2020 or 2019 irs form 2555, foreign earned income. The child tax credits are worth $3,600 per child under six in 2021, $3,000 per child between six and 17 and $500 for college students aged up to 24. This means a payment of up to $1,800 for each child under 6, and up to $1,500 for each child age 6 to 17.

But more than a third of children don’t receive it because their parents earn too little. The child tax credit for 2021 is bigger and better than ever. Part of the american rescue plan passed in march, the existing tax credit, an advance payment program of the 2021 tax return for people who are eligible, increased from $2,000 per child to $3,600.

The child tax credit was changed in three essential ways this year by the american rescue plan: The first payment arrived in july and installments include up to $300 a month for each child aged 5 and younger or up to $250 each month for children between ages 6 to 17. Two more child tax credit checks are on the schedule for this.

Families who signed up late to child tax credits with the irs tool will receive up to $900 per child on november 15 and december 15. Enhancements made by the american rescue plan act back in march increased the overall credit amount, allowed older children to qualify. The child tax credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17.

Monthly payments continue through december and a payout comes during tax season next year.

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs – Fingerlakes1com

Child Tax Credit 2021 Payments How Much Dates And Opting Out – Cbs News

Pin On News Updates

Documentation Beats Conversation Every Time If You Have Irs Tax Debts Contact Me I Service The Entire Us Business Tax Irs Taxes Tax Debt

How The 48-hour Rule Can Help You Avoid Debt Tax Write Offs Tax Deductions Debt

Decembers Payment Could Be The Final Child Tax Credit Check What To Know – Cnet

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tvcom

Child Tax Credit Who Will Get A Big December Check Wgn-tv

New Child Tax Credit Brings A Drop In Households Reporting Hunger Npr

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Vjj0r3z3xyhwqm

Pin On Career Items

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

December Child Tax Credit Payment Deadline Is Nov 15 Forbes Advisor

Will The Enhanced Child Tax Credit Continue In 2022 Heres Everything We Know – Cnet

Why Might The December Child Tax Credit Payment Be Bigger Than The Others – Ascom

Pin On Saving Money Tips

What To Know About The First Advance Child Tax Credit Payment

Todays The Last Day To Opt Out Of The December Child Tax Credit Check What To Know – Cnet