All taxes due + 15% penalty. Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%.

How To File And Pay Sales Tax In Texas Taxvalet

The current total local sales tax rate in dallas, tx is 8.250%.

Dallas texas local sales tax rate. The state sales tax rate is 6.25 percent of the sales price of taxable goods and services, and this rate is uniformly applied to The december 2020 total local sales tax rate was also 8.250%. The texas sales tax rate is currently %.

Ad earn more money by creating a professional ecommerce website. Name local code local rate totalrate name local code local rate totalrate. What is the sales tax rate in dallas, texas?

Start yours with a template!. Local code local rate total rate; The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date and end date of each tax.

Discount 1% from taxes due. The state sales tax rate in texas (tx) is currently 6.25%. Texas state sales tax equals 6.25%.

Services consists of a state sales and use tax and a local sales and use tax. It’s a fixed rate statewide; Let more people find you online.

Rate histories for cities who have elected to impose an additional tax for property tax relief, economic and industrial development section 4a/4b, sports and community venue, municipal development, and street maintenance and repair also. The county sales tax rate is %. , tx sales tax rate.

This is the total of state, county and city sales tax rates. Ad earn more money by creating a professional ecommerce website. The following table shows the amount due based on the date the city receives your report and payment:

The base state sales tax rate in texas is 6.25%. The local sales tax rate in dallas county is 0%, and the maximum rate (including texas and city sales taxes) is 8.25% as of november 2021. If you need access to a database of all texas local sales tax rates, visit the sales tax data page.

However, with the addition of local sales takes it can reach the maximum of 8.25%. Use leading seo & marketing tools to promote your store. Depending on local municipalities, the total tax rate can be as high as 8.25%.

The dallas sales tax rate is %. Use leading seo & marketing tools to promote your store. All taxes due (no discount) 11 to 30 days late:

Click any locality for a full breakdown of local property taxes, or visit our texas sales tax calculatorto lookup local rates by zip code. The minimum combined 2021 sales tax rate for dallas, texas is. Dallas collects the maximum legal local sales tax the 8.25% sales tax rate in dallas consists of 6.25% texas state sales tax , 1% dallas tax and 1% special tax.

There is no applicable county tax. Winnie(chambers co).081250 wylie(collin co) 2043116.020000.082500 chambersco health serv 5036507.005000 wylie(dallas co) 2043116.020000.082500 winnie‐stowellhosp dist 5036525.007500 wylie(rockwall co) 2043116.020000. Localities can add their own sales taxes on top of this, however, which can bring the rate up to as much as 8.25% in some areas.

104 rows total tax rate: Counties and cities in texas (as well as other jurisdictions such as transit authorities) are allowed to charge an additional local sales tax on top of the texas state sales tax. The texas state sales tax rate is 6.25%, and the average tx sales tax after local surtaxes is 8.05%.

Postmarked by the due date (15th): Let more people find you online. Start yours with a template!.

The North Texas Water District Will Build And Operate The Bois Darc Lake With Close Coordination With Local State And Federal Au Texas Parks Lake Texas Water

States With Highest And Lowest Sales Tax Rates

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Are There Any States With No Property Tax In 2021 Free Investor Guide

How To Charge Your Customers The Correct Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Texas Sales Tax Rates By City County 2021

How To Charge Your Customers The Correct Sales Tax Rates

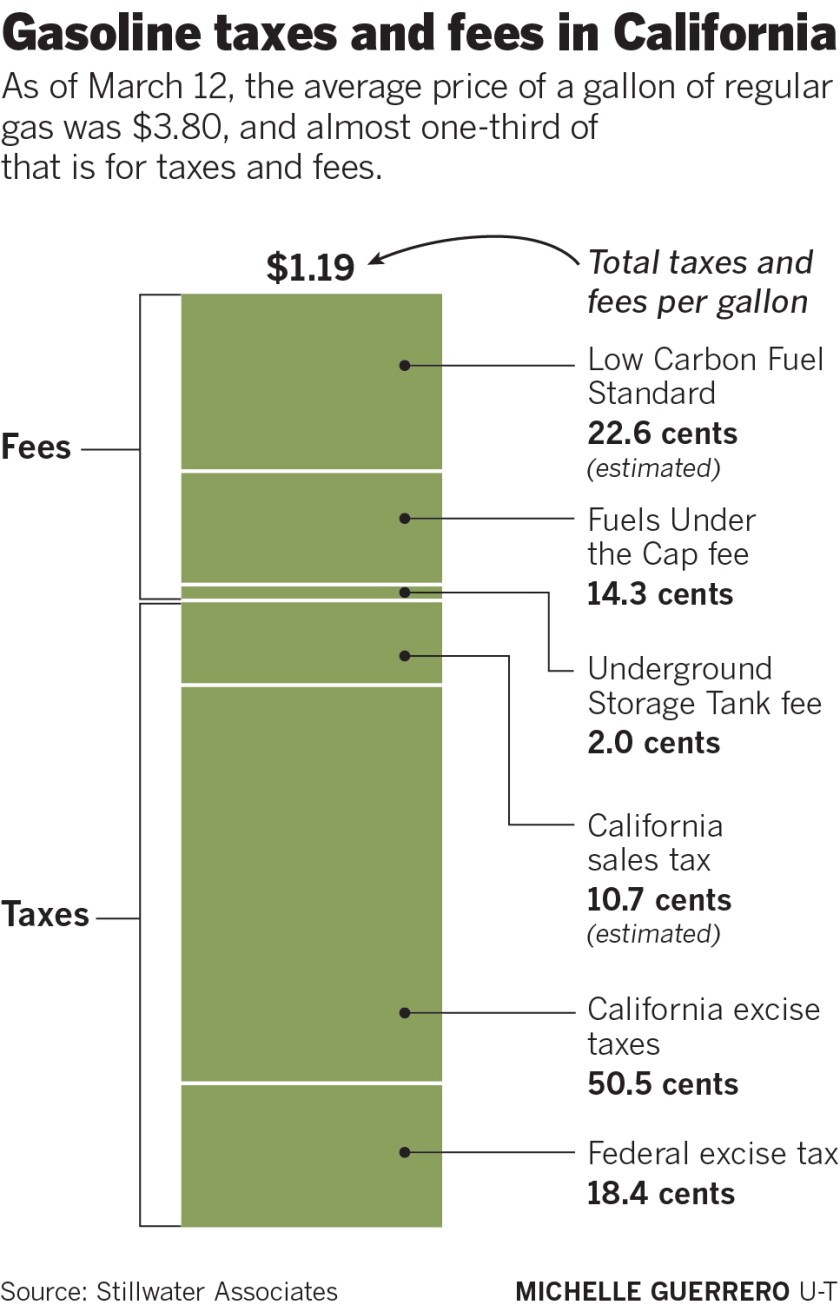

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

What Is The San Antonio Sales Tax Rate – The Base Rate In Texas Is 625

Downtown Houston Downtown Houston Houston Skyline Houston Texas

Arlington Voters Approved A Sales Tax Increase Heres How The City Will Spend That Money

Sales Tax On Grocery Items – Taxjar

Texas Sales Tax – Taxjar

How To Calculate Sales Tax – Video Lesson Transcript Studycom

Pin On Stickers

Worksheet For Completing The Sales And Use Tax Return Form 01-117

Pin On Dallas Real Estate Market

Business Intelligence Consultancy Services – How And Why Corporate Training Sales Coaching Marketing Consultant