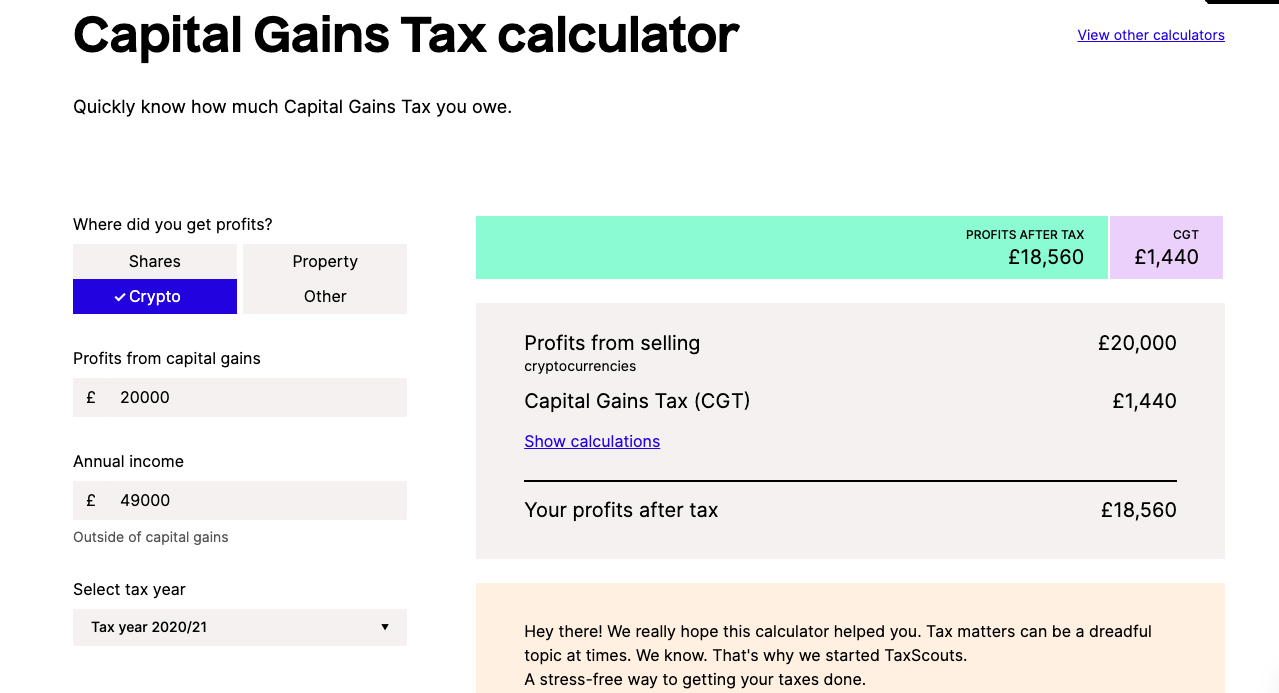

Taxscouts is a team of accountants who can help you file your tax form for just £119. For uk residents, the capital gains tax on cryptocurrency transactions is taxed at 10% for the basic rate (up to £37500), up to a maximum of 20%.

Uk Crypto Tax Guide 2021 Cryptotradertax

Accordingly, the eu taxation may range widely.

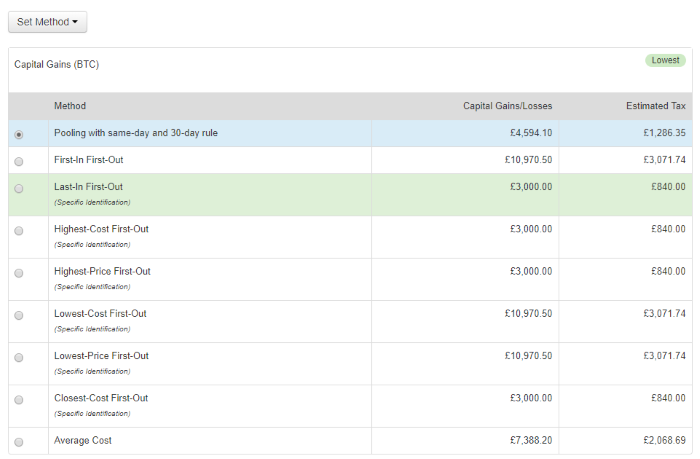

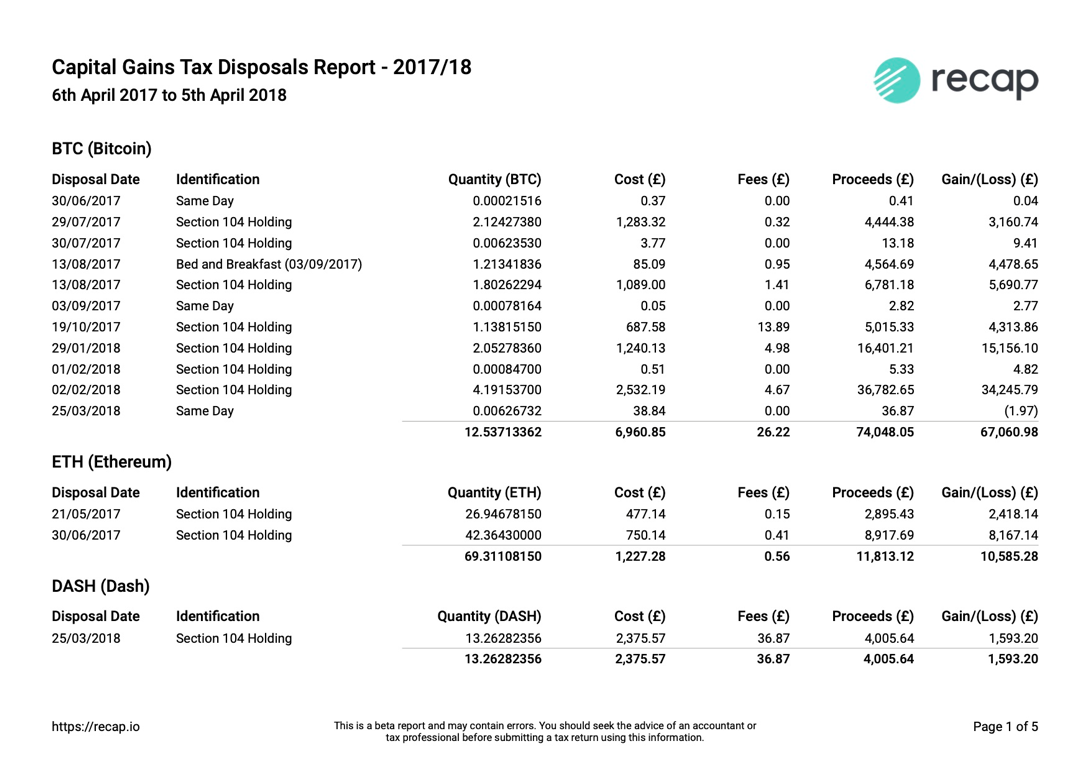

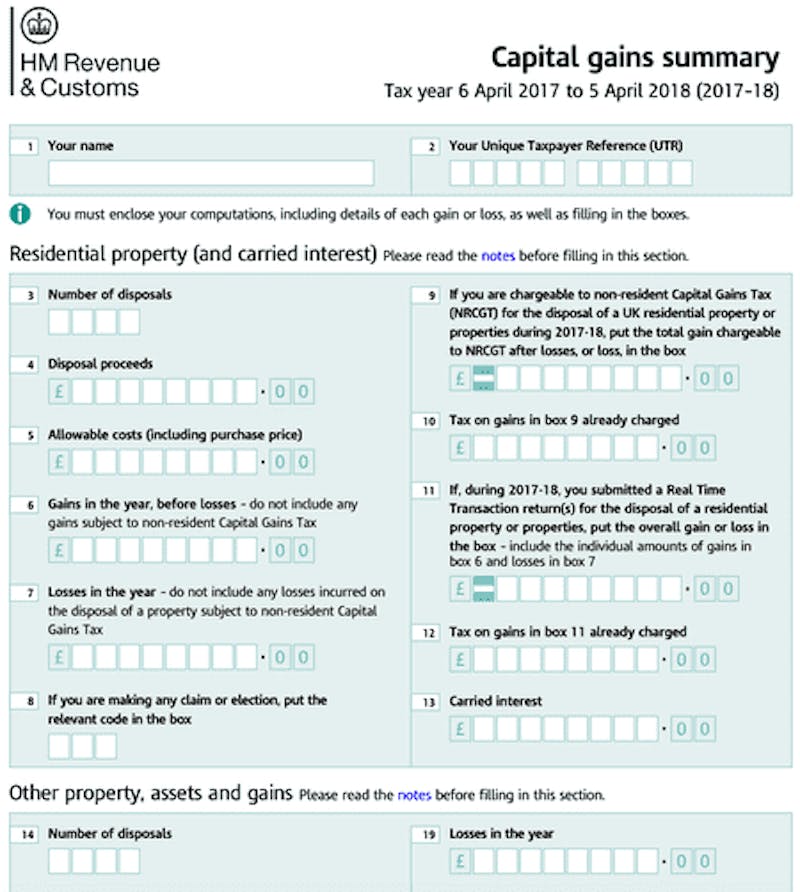

Cryptocurrency tax calculator uk. So, is there a crypto tax in the uk? 2020 capital gains tax changes if you sell a residential property, you now need to declare your profits within 30 days and pay any tax you owe. Calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc.

20 are subject to tax. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. “disposal” is a broad term that essentially means whenever you get rid of a cryptocurrency.

How do cryptocurrency taxes work? When to file uk crypto taxes. As the cryptosphere gained more traction, revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax.

Ideally, you’ll want to submit your tax return before this point as you also need to pay any taxes due by midnight on the 31st january 2022. Crypto is taxed in the same way as gold and real estate. Be aware that this includes both uk residents and those who own uk property but live abroad.

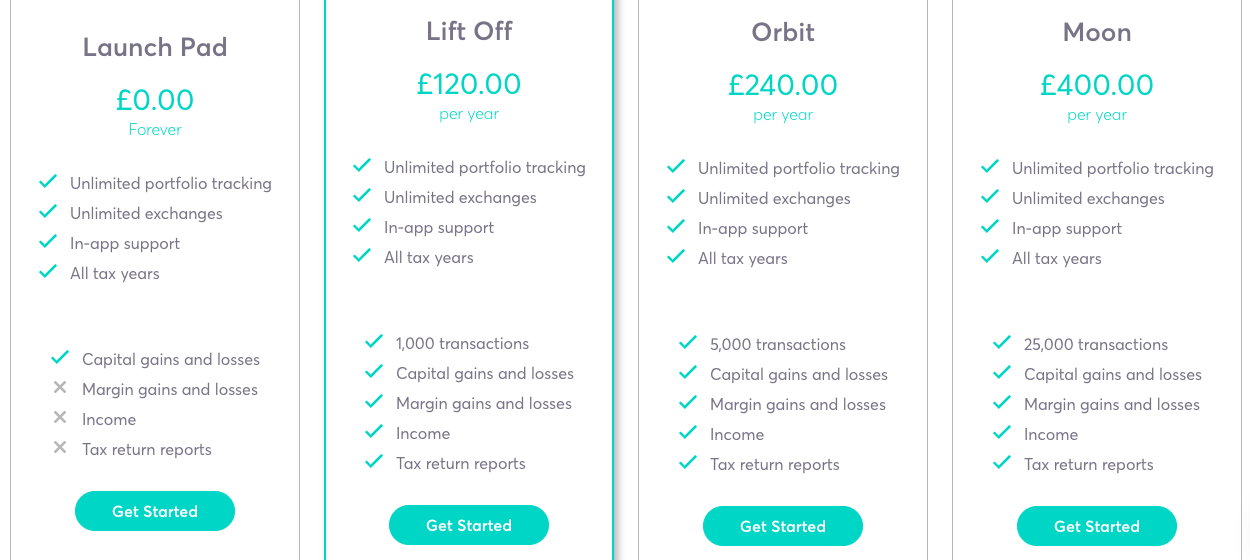

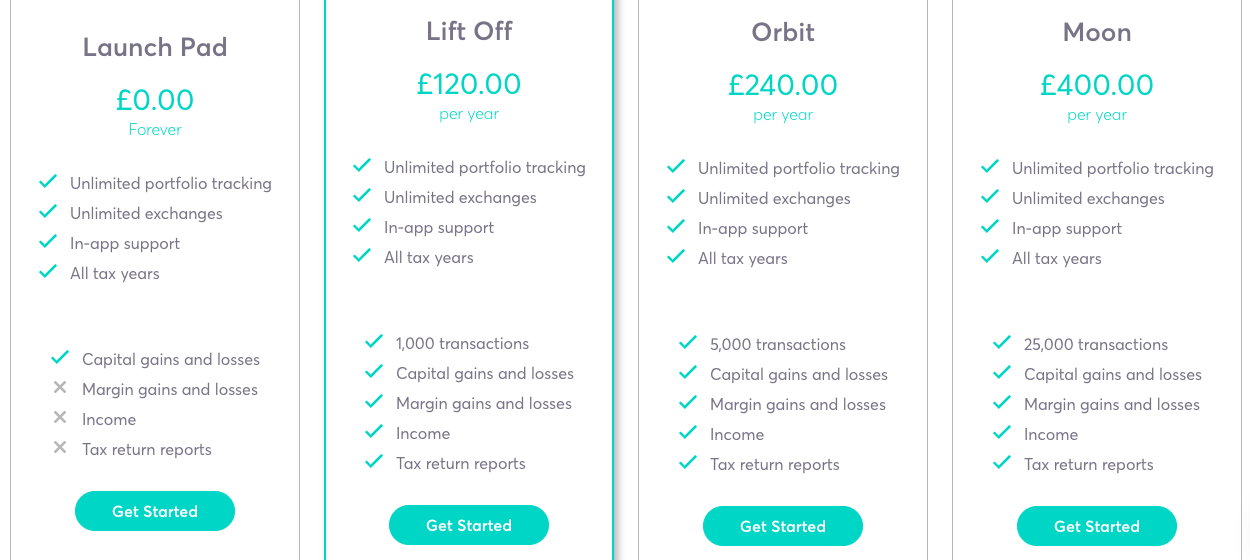

Bitcoin.tax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Accounting and cryptocurrency tax in the uk. Best crypto tax calculators to use in the uk taxscouts.

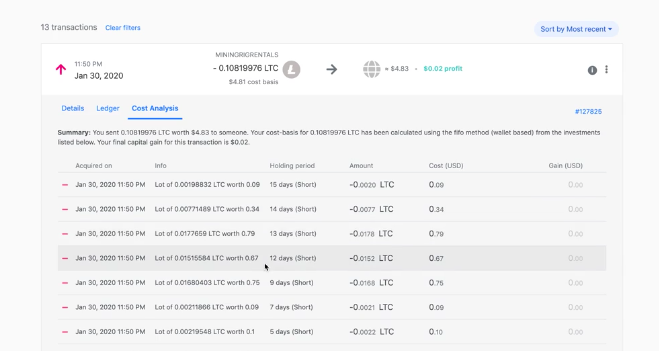

Simply upload or add the transaction from the exchanges and wallets you have used, along with any crypto you might already own, and we'll calculate your capital gains. The rate you pay on crypto taxes depends on your income level and how long you have held the crypto. Since then, its developers have been creating native apps for mobile devices and other upgrades.

So if the profit from selling your cryptocurrency, in addition to any other. As with mining, income tax takes precedence over cgt when the change of value is calculated. Crypto tax calculator help center.

This means that capital gains and losses rules apply when you dispose of your cryptocurrency. You need to report any income from crypto or capital gains from crypto in your self assessment tax return by this date. To check if you need to pay capital gains tax, you need to work out your gain for each transaction you make.

Hmrc doesn’t consider cryptoassets to be a form of money, whether exchange tokens, utility tokens or security tokens. Now, in the uk, the tax of digital value, the investment or transactions price, or secured income has to be turned into fiat at the exchange rate of a cryptocurrency (market price) working on the date of acceptance of the interest or profits. Investors, traders, miners, and thieves.

The way you work out your gain is different if you sell tokens within 30. Hmrc also suggests what cost you can deduct from disposal proceeds to calculate capital gain. How are bitcoin and other cryptocurrencies taxed in the uk and usa?

With the government specifically targeting crypto, it’s essential that you understand the tax consequences of owning crypto. You should still keep records of these transactions so that you can. Cryptocurrency tax in the uk is still an emerging area.

Accointing.com is the only cryptocurrency tax calculator partnered with myna and is fully compliant with the hmrc’s crypto tax guidance. Automatically classify and calculate your crypto taxes. This is a local company that knows all ins and outs in order to stick to all the regulations we have in our kingdom.

Whilst cryptocurrency is a relatively new asset, the regulations surrounding it are still being formed. The original software debuted in 2014. With over 300,000 users, cointracking.info is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

The european union is still not unified enough to view it as a monolithic body. Hmrc has published guidance for people who hold cryptoassets (or cryptocurrency as they are also known), explaining what taxes they may need to pay, and what records they need to keep. How accointing.com simplifies your crypto tax filing.

The uk tax deadline is the 31st of january 2022. These profits are taxed at different rates. See the full hmrc guidance here.

When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for (minus any exchange fees). This rule has been in place since 6th april 2020. This is known as a capital gains tax and has to be paid in most countries such as the usa, uk, canada etc.

To add clarity, the hmrc (uk tax agency) recently explicitly stated that you cannot claim all fees, all the time, straight up, and that you need to have a methodology for assigning fees equitably when swapping currency. We expect other tax agencies to follow suit. If you don’t do this, you could face a fine from hmrc.

Uk cryptocurrency tax law compared to the eu. The guidance provided by regulators is only at an initial stage, and will no doubt evolve over time. However, when it comes to taxing them, it depends on how the tokens are used.

Bitcoin And Crypto Tax In The Uk With New Hmrc Policy

How To Calculate Your Crypto Taxes For Your Self-assessement Tax Return Recap Blog

Uk Cryptocurrency Tax Guide Cointracker

Best Bitcoin Tax Calculator In The Uk 2021

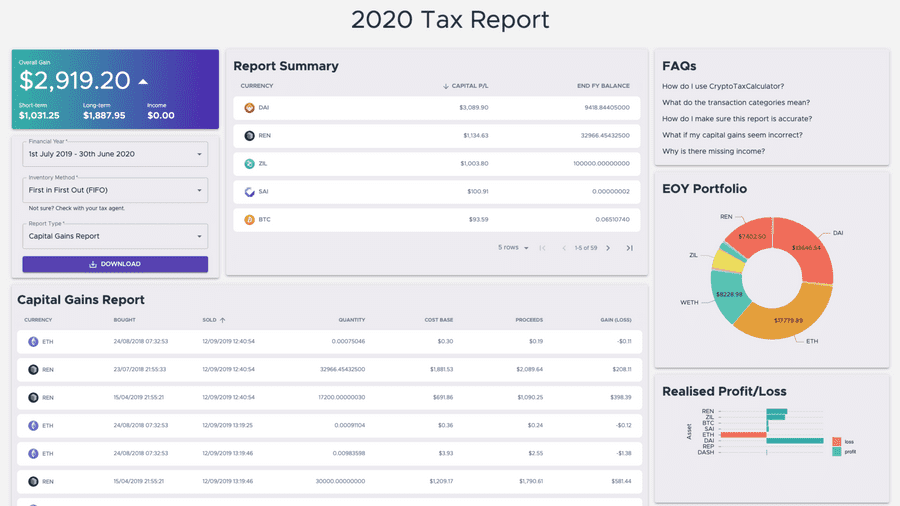

Crypto Tax Calculator

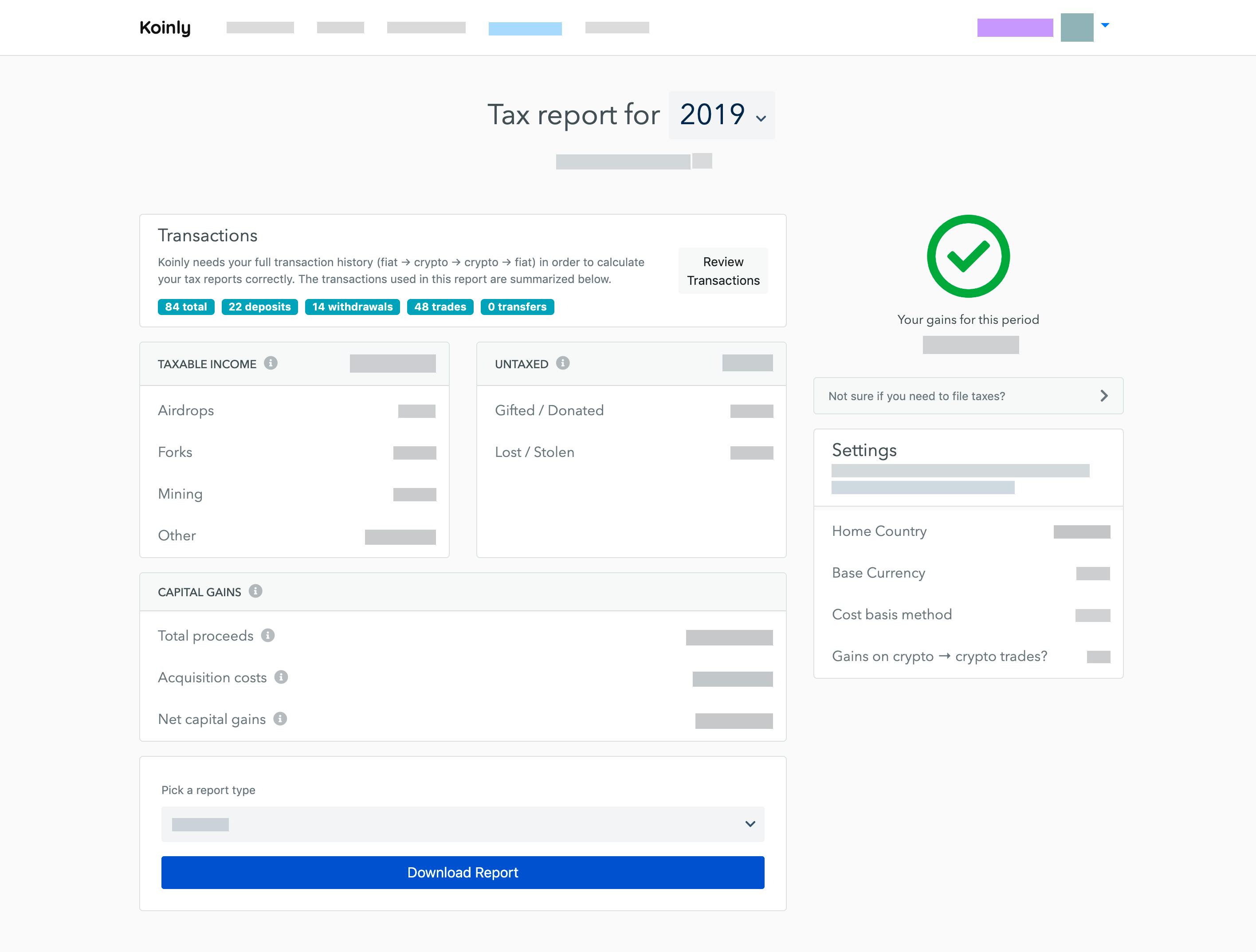

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

![]()

Cointracking – Crypto Tax Calculator

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

Wades Cryptocurrency Trading Journal Tax Calculator Spreadsheet Amazoncouk Software

Uk Cryptocurrency Tax Guide Cointracker

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Cointracking – Crypto Tax Calculator