Bitcoin & cryptocurrency tax software. $7,000 x 5 percent = $350 state taxes owed $1,050 + $350 = $1,400 total tax liability for transaction #2.

Tax On Cryptocurrency In Ireland – Money Guide Ireland

Crypto tax calculator australia is a new crypto tax calculator service for australians wanting to know how much capital gains tax or income tax they need to pay on their cryptocurrency transactions.

Cryptocurrency tax calculator ireland. There are other rates for specific types of gains. Capital gains tax (cgt) form if you are an irish citizen you will need to file your capital gains from crypto trading on a capital gains tax form for both the initial and later periods. The software always supports bitcoin, ethereum, litecoin, defi and nearly any other coin.

Full support for us, uk, canada, and australia and partial support for others. At this point the value of the tokens is 0. You pay £127 at 10 % tax rate for the next £1,270 of your capital gains.

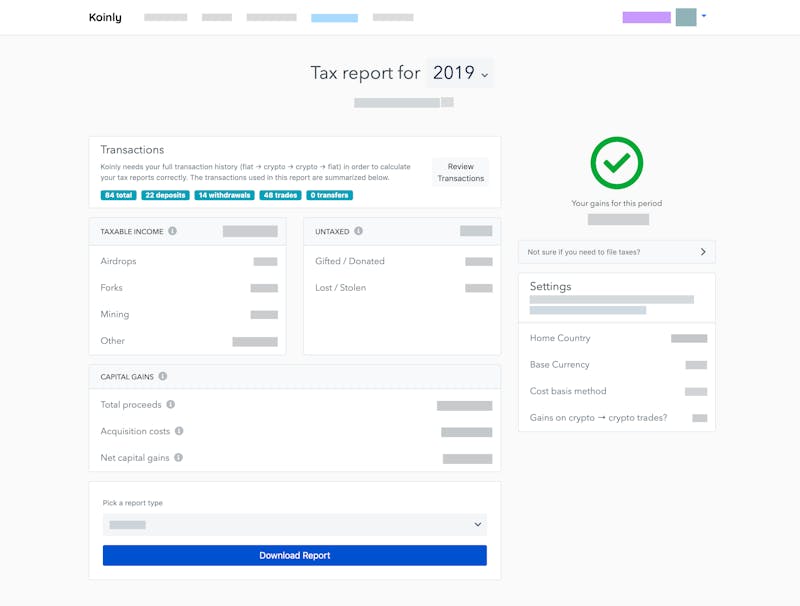

Download your tax reports in minutes and file with turbotax or your own accountant. Cryptocurrency tax software is very simple instead of calculating all the taxes you have to pay for all your trades or crypto income, you can enter your data into the crypto tax software and it will generate what you have to pay. Koinly helps you calculate your capital gains for both periods in accordance with revenue commissioners's guidelines i.e.

Therefore, individuals that are trading in cryptocurrency are required to file an income tax return (form 11 or form 12) each year and declare profits made on trading. 12.5% for gains from venture capital funds for companies. This business is now offering this exclusive service to australian consumers who trade cryptocurrencies and also accountants who may be seeing crypto.

the basics of crypto taxes. This manual sets out hmrc’s view of the appropriate tax treatment of cryptoassets, based on the law as it stands on the date of publication. Think moons, but on a much smaller scale.

Therefore, accounts for tax purposes cannot be maintained in crypto. 40% for gains from foreign life policies and foreign investment products. We can see the gain/loss on each transaction clearly.

Navigating to the tax reports page also shows us the total capital gains. After entering the 3 transactions into koinly manually, this is the output: In the u.s., cryptocurrencies like bitcoin are treated as property for tax purposes.

Using beartax to calculate cryptocurrency gain/loss means never worry about using spreadsheets or manual calculations. Cointracker is the most trusted bitcoin tax software and crypto portfolio manager. Online crypto tax calculator with support for over 400 integrations.

Returns to revenue must be shown in euro amounts and remittances made appropriately. Hmrc has published guidance for people who. Use deloitte’s irish tax calculator to estimate your net income based on the provisions in the latest budget

The profits will be subject to normal income tax rules i.e. Cointracker helps you become fully compliant with cryptocurrency tax rules. 4 valuation of cryptocurrencies many cryptocurrencies, such as bitcoin, are traded on a number of exchanges.

Emoluments for the purposes of calculating payroll taxes is the euro amount attaching to the cryptocurrency at the time the payment is made to the employee. Using fifo and the 4 weeks rule. Prsi, paye and usc will apply at the relevant rates (up to 52% tax).

I am working with a small online community to make an asa token to help reward good community behavior. Crypto tax software always supports bitcoin, ethereum litecoin, and more. You pay no cgt on the first £12,300 that you make.

The amount you have to pay in taxes will depend on the duration you hold your crypto. However at any point in the future one of the users could create a liquidity pool and set a value for the token. That is, the profits from trading will be taxable under income tax rules.

$49 for all financial years. 15% for gains from venture capital funds for individuals and partnerships. They saw a gap in the market and that's how they came up with crypto tax calculator australia, an application to help crypto holders organise their crypto transactions into different categories including capital gains or loss of coins, fees and other documentation.

Instead, euro or other fiat currency should be used. Capital gains tax (cgt) breakdown. The crypto tax calculator was created by crypto traders who have been through the crypto taxation system.

The rate of cgt is 33% for most gains. To calculate crypto taxes for michael we are going to use koinly which is a free online crypto tax calculator. Automatically connect coinbase, binance, and all other exchanges & wallets.

File your crypto taxes in ireland learn how to calculate and file your taxes if you live in ireland. You pay £1,286 at 20 % tax rate on the remaining £6,430 of your capital gains.

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Today Marks The 2nd Anniversary Of Chinas Bitcoin Ban What Has Changed Bitcoin Cryptocurrency Capital Gains Tax

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Blog – Kryptowaehrung-steuern News Strategien Tipps

Business Background With Finance Graphs Pen Calculator And Pda Sponsored Background Finance In 2021 Stock Photography Business Photography Business Business

Ireland Cryptocurrency Tax Guide 2021 Koinly

Understanding Crypto Taxes Coinbase

Koinly Blog – Kryptowaehrung-steuern News Strategien Tipps

Income Protection Insurance Compare Quotes Ireland Income Protection Insurance Ireland Income Protection Insurance Income Protection Compare Quotes

Crypto Tax Profit And Loss Explained Koinly

Pin On Rb Inspirationui

Tax On Cryptocurrency In Ireland – Money Guide Ireland

Bitcoin Gif – Bitcoin – Discover Share Gifs In 2021 Bitcoin Mining Bitcoin Giphy

Nvidia Aims To Build Better Robots With The Isaac Initiative Nvidia Graphic Card Data Center

How To Calculate Costs Basis In Crypto Bitcoin Koinly

.png)

Fifo Lifo And Hifo – Whats The Best Method For Crypto Cryptotradertax

Hire Amela Accounting For Accounting And Tax Services In 2021 Tax Services Tax Holiday Bookkeeping