This change is the result in a state law passed this year that. Initially, the tax was intended for parking lot operators and valet services.

The Cook County Property Tax System Cook County Assessors Office

Tax year 2020 second installment due date:

Cook county parking tax portal. When each township reassessment is completed by the assessor, property owners may appeal the assessment set by the assessor at the board. Billed amounts & tax history. Parking lot and garage operations.

The pin is used for assessments, tax rate calculations and tax collections. Payments check your payment status or make an online payment. The cook county treasurer's office website was designed to meet the illinois information technology accessibility act and the americans with disabilities act.

Parking, red light, or speed ticket (s) surplus, vehicles, auctions. California avenue, chicago, il 60608. Parking lot & garage operation tax.

118 n clark street room 1160. The jury assembly room is located on the 3rd floor in room 3a00. The cook county board today approved an amendment that would lower the tax rate for many individuals who park in garages and lots.

1) amusement tax, 2) alcoholic beverage tax, 3) gasoline and diesel fuel tax, 4) hotel accommodations tax, and 5) parking lot and garage operations tax. All other cook county home rule taxes will continue to be administered outside the portal. Yarbrough, cook county clerk 118 n.

Jurors park for free only in the cook county parking structure located across from the courthouse on california boulevard. Once you search by pin, you can pay your current bill online or learn additional ways to pay by clicking more tax bill information on the next page. You can use the filter option to search for a property's pin or address.

Commissioners approved a 6 percent tax rate for daily parking and a 9 percent rate for weekly and monthly parking. You must show your summons to the parking attendant upon entering. (sp) citations consist of two different violation types:

Calculate the cost of a building permit. Extension of orders expiring or set for status july 6, 2020 through and including july 17, 2020 at the maywood. The riverside township assessor’s office acts as a taxpayer advocate for local residents in the cook county property tax system.

Both notices are h… read more. 22% for daily parking during the week as well as all weekly and monthly parking. Billed amounts & tax history.

Parking lot and garage operations; With almost 1.8 million parcels in cook county, assessments are determined triennially through a mass appraisal system by the cook county assessor. The cook county treasurer’s office provides payment status for current tax years and the ability to pay online.

Find the zoning of any property in cook county with this cook county zoning map and zoning code. In recent months, the cook county department of revenue has been auditing private parking operators, related to a tax imposed on all parking lots and garage operations. Find other city and county zoning maps here at zoningpoint.

Riverside township contains about 6,457 of those parcels. Once you search by pin, you can pay your current bill online or learn additional ways to pay by clicking more tax bill information on the next page. Clark street, room 230 chicago, il 60602

The new structure imposes a rate of 6% of the charge or fee paid for. Once you search by pin, you can pay your current bill online or learn additional ways to pay by clicking more tax bill information on the next page. The cook county assessor sets the taxable value on all of the more than 1.8 million parcels of real estate located in cook county.

Cook county property tax portal. Calculate the cost of a building permit. The cook county property tax portal is the result of collaboration among the elected officials who take part in the property tax system;

The cook county treasurer’s office provides payment status for current tax years and the ability to pay online. Effective september 1, 2013, the cook county board of commissioners approved a change to the structure of the parking tax imposed upon the use and privilege of parking a motor vehicle in or upon any parking lot or garage in the county; If your business is subject to any of the following taxes, you must use the portal:

Cook county property tax portal. Effective september 1, 2013, the cook county board of commissioners approved a change to the structure of the parking tax imposed upon the use and privilege of parking a motor vehicle in or upon any parking lot or garage in the county.

Taxpayer Portal

Covid-19 – Northfield Township Office

Covid-19 – Northfield Township Office

Your Property Tax Bill Village Of Brookfield

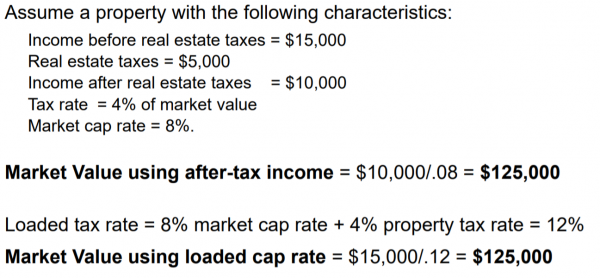

How Commercial Properties Are Valued Cook County Assessors Office

Covid-19 – Northfield Township Office

Coronavirus Covid-19 Updates Last Updated 1030am On Friday April 2nd Chicagos 46th Ward Alderman James Cappleman

Employee Benefits

The Cook County Property Tax System Cook County Assessors Office

Buffalo Grove Il

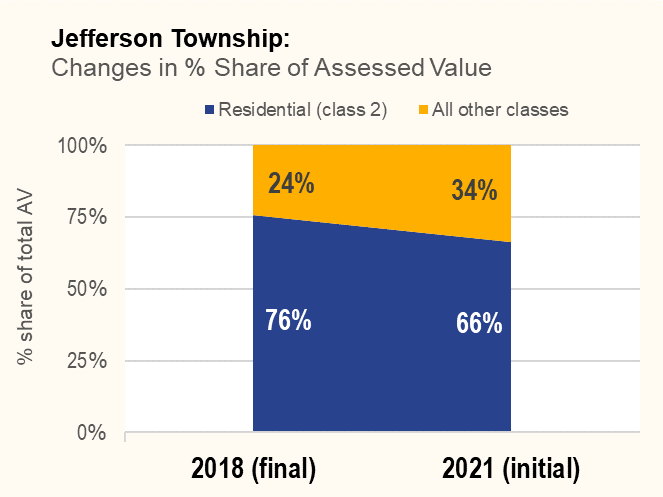

Jefferson Township Valuation Reports 2021 Cook County Assessors Office

Rogers Park 2021 Valuation Reports Cook County Assessors Office

Cook County Property Tax Bill And Property Exemptions Village Of Crestwood

Property Taxes City Of Evanston

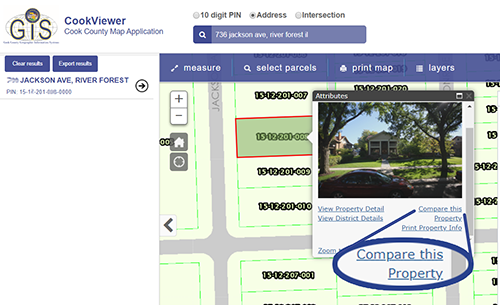

What Are Comparable Properties Cook County Assessors Office

Buffalo Grove Il

2

Covid-19 – Northfield Township Office

Covid-19 – Northfield Township Office