Of that amount, the state receives 6.25%, while the contra costa transportation authority (ccta) and bart each receive 0.5%. The 8.125% sales tax rate in concord consists of 6.5% arkansas state sales tax and 1.625% cleburne county sales tax.

Georgia Sales Tax Rates By City County 2021

You can print a 9.75% sales tax table here.

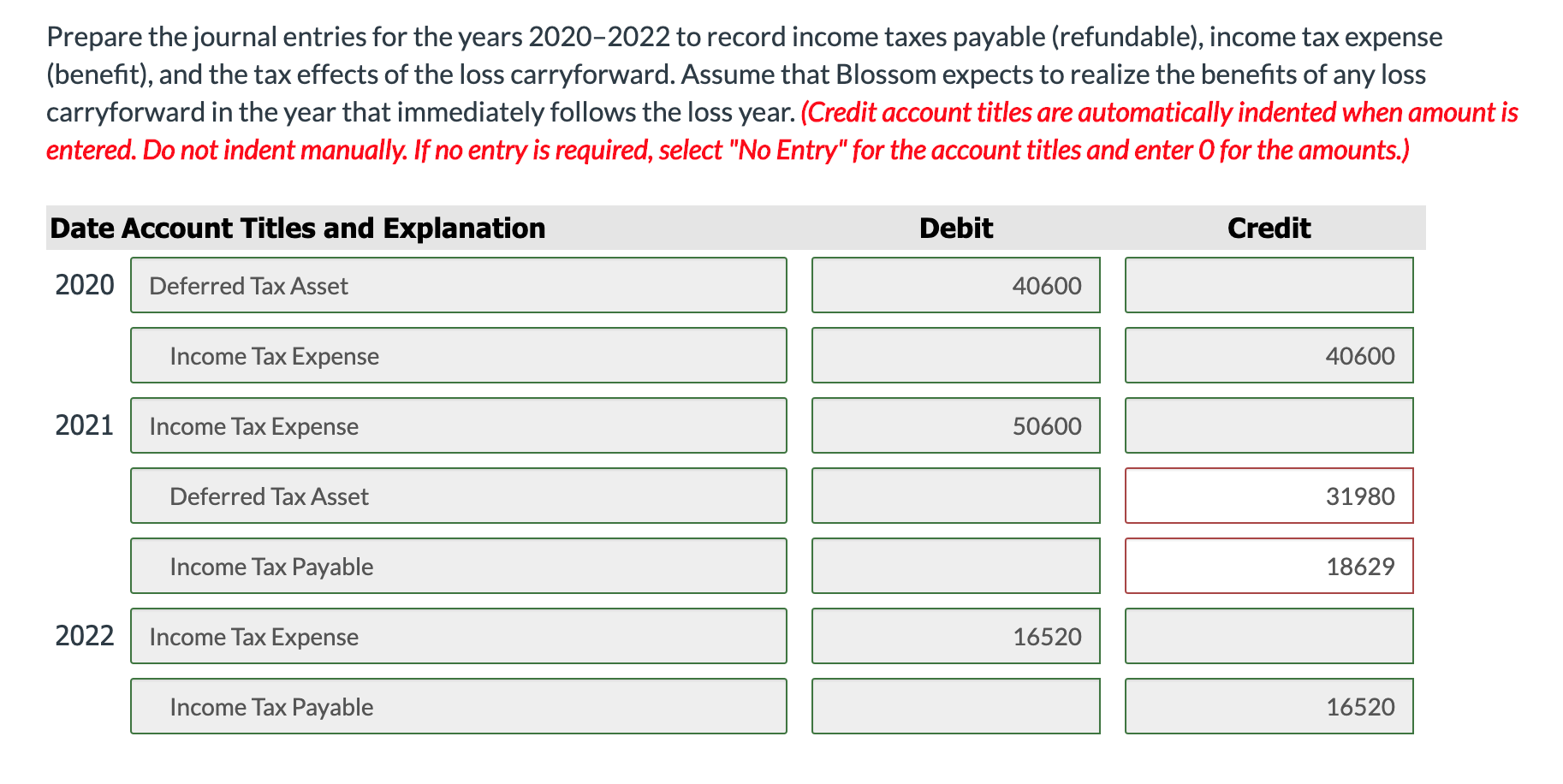

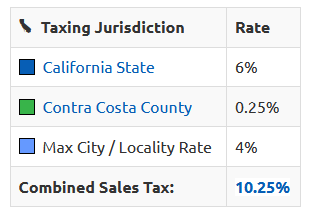

Concord ca sales tax rate 2020. The 94546, castro valley, california, general sales tax rate is 9.25%. The california state sales tax rate is 7.5%, and the average ca sales tax after local surtaxes is 8.44%. The 9.75% sales tax rate in concord consists of 6% california state sales tax, 0.25% contra costa county sales tax, 1% concord tax and 2.5% special tax.

Hdl companies $13.1m q1 2021 31.6% from q1 2020 $325k q3 2021 9% from q3 2020 current vacancy & lease rates (as of quarter 3, 2021 |. 1788 rows california city* 7.250%: Create your own online store and start selling today.

Create your own online store and start selling today. There is no applicable city tax or special tax. City of pleasant hill 9.25%.

Select board member shannon chapman was appointed to attend the sale to. The raise was approved by california voters in the nov. The combined rate used in this calculator (9.25%) is the result of the california state rate (6%), the 94546's county rate (0.25%), and in some case, special rate (3%).

Concord voters will consider measure v, which also would continue and increase an existing sales tax from 0.5% to 1%. For tax rates in other cities, see arkansas sales taxes by city and county. Please ensure the address information you input is the address you intended.

The concord, california sales tax is 8.75% , consisting of 6.00% california state sales tax and 2.75% concord local sales taxes.the local sales tax consists of a 0.25% county sales tax, a 0.50% city sales tax and a 2.00% special district sales tax (used to fund transportation districts, local attractions, etc). You can print a 8.125% sales tax table here. 101 rows the 94520, concord, california, general sales tax rate is 8.75%.

City of concord community development department source: Type an address above and click search to find the sales and use tax rate for that location. This is the total of state, county and city sales tax rates.

The california sales tax rate is currently %. Try it now & grow your business! The concord sales tax rate is %.

5 digit zip code is required. City of capitola is 9.00%. City of santa cruz is 9.25%.

For tax rates in other cities, see california sales taxes by city and county. 41 rows concord, california, measure v, sales tax (november 2020) concord. Concord's current sales tax rate is 8.75%.

The minimum combined 2021 sales tax rate for concord, california is. Concord officials recently conducted a tax sale for five properties with delinquent taxes going back to 2018. Rate variation the 94546's tax rate may change depending of the type of purchase.

Counties and cities can charge an additional local sales tax of up to 2.5%, for a maximum possible combined sales tax of 10%; California has 2558 special sales tax jurisdictions with local sales taxes in. The tax rate given here will reflect the current rate of tax for the address that you enter.

City of san pablo 9.25%. Groceries and prescription drugs are exempt from the california sales tax; Try it now & grow your business!

Del norte (unincorporated area) 2 8.50% el dorado San francisco (kron) — several bay area cities saw a sales & use tax hike go into effect on april 1. It’s projected to raise $27 million annually.

City of el cerrito 10.25%. Measure q/v) transient occupancy tax revenue q3 2021 1,263 source: The county sales tax rate is %.

City of concord finance department source: City of crescent city 8.50%.

Texas Sales Tax Rates By City County 2021

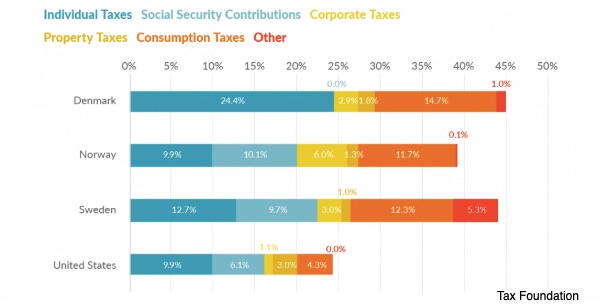

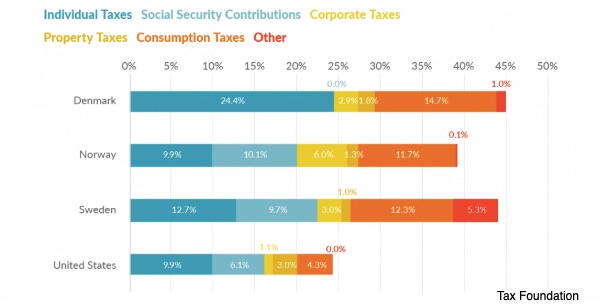

The Scandinavian Taxes That Pay For Their Social Programs

Virginia Sales Tax Rates By City County 2021

Nebraska Sales Tax Rates By City County 2021

California Sales Tax Rates By City County 2021

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap – Clevelandcom

2

Taxes Contra Costa Herald

The Scandinavian Taxes That Pay For Their Social Programs

These Cuyahoga County Places Have Ohios 6 Highest Property Tax Rates Thats Rich Recap – Clevelandcom

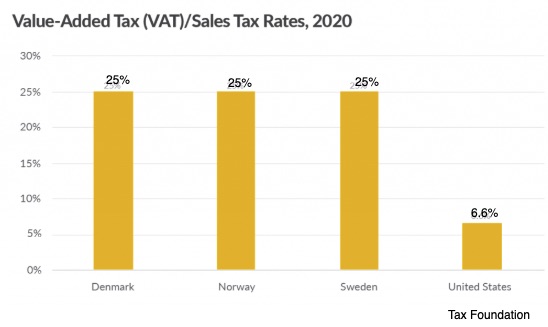

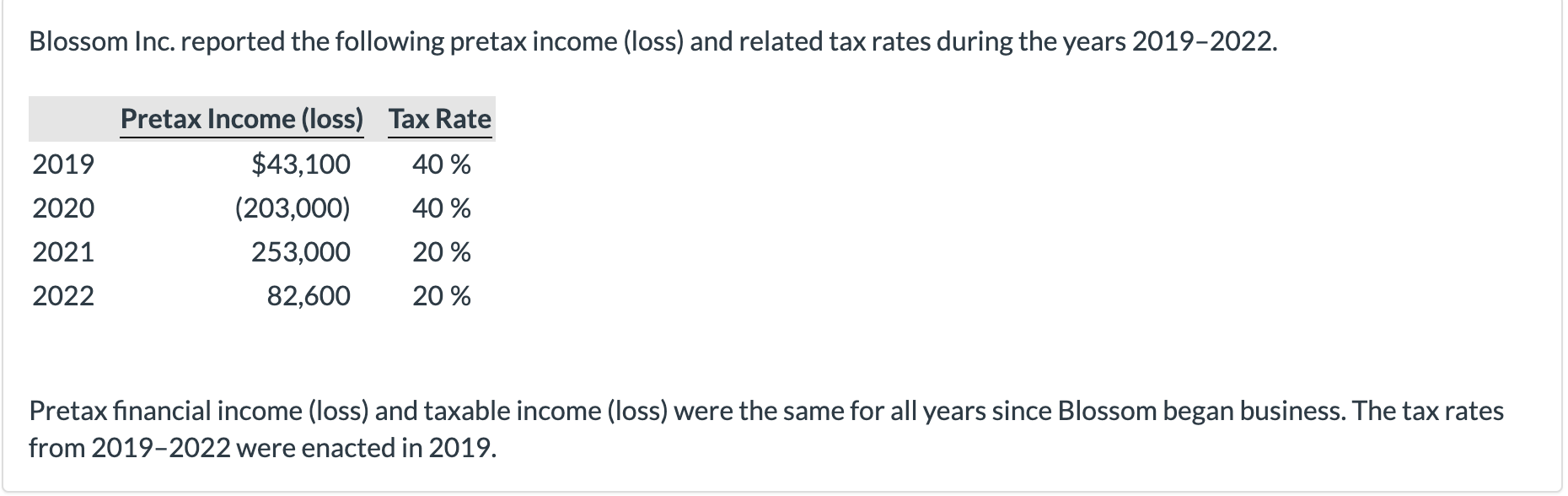

Solved Blossom Inc Reported The Following Pretax Income Cheggcom

Solved Blossom Inc Reported The Following Pretax Income Cheggcom

Budget 101

Taxes Contra Costa Herald

Yijsmc4l5utf3m

Massachusetts Sales Tax Rates By City County 2021

Ohio Sales Tax Rates By City County 2021

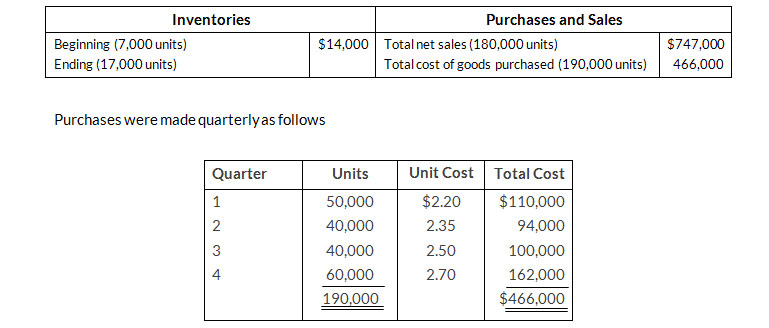

Inventories

North Carolina Nc Car Sales Tax Everything You Need To Know