Property taxes in colorado are among the lowest in the country, with an average effective rate of just 0.57%. 2440 w hillside ave, denver, co 80219.

Property Tax Definition Learn About Property Taxes Taxedu

Property search and pay property taxes.

Colorado real estate taxes. All personal property and real estate taxes must be paid or postmarked by dec. At an average of 0.55 percent of a home's vallue. Choose from many topics, skill levels, and languages.

Real estate transfer taxes are an especially tricky issue in colorado, as the state passed a constitutional amendment in 1992 freezing all real estate transfer taxes and prohibiting any new transfer taxes being imposed. 1.45%, or 1.1% for values up to $400,000; There may be capital gains taxes on the inherited property if you sell.

Additionally, residents don’t have to wait to receive their bill to pay their taxes. Use the dr 1079 to remit colorado tax withheld on transfers of real property interests. Colorado real estate transfer tax laws vary throughout the state, so buyers should consult a local real estate professional for specific information.

1.45% or 1.1% for values up to $400,000. The determination of the amount to be withheld, if any, will be made on the dr 1083. Property taxes due are calculated by multiplying the actual value of the property by the assessment rate by the mill levy.

Ad find the right instructor for you. Colorado does not have inheritance taxes, but there are federal estate taxes. Here in colorado, we are blessed with very low property taxes compared to many other states.

The colorado estate tax is calculated as the share of the estate that includes colorado property multiplied by the state death tax credit. The statewide sales tax in colorado is just 2.9%, but with local sales taxes the total rate can get up to 7.9%. However, the federal “unified credit,” reduces the federal estate tax liability and therefore can affect the state tax liability.

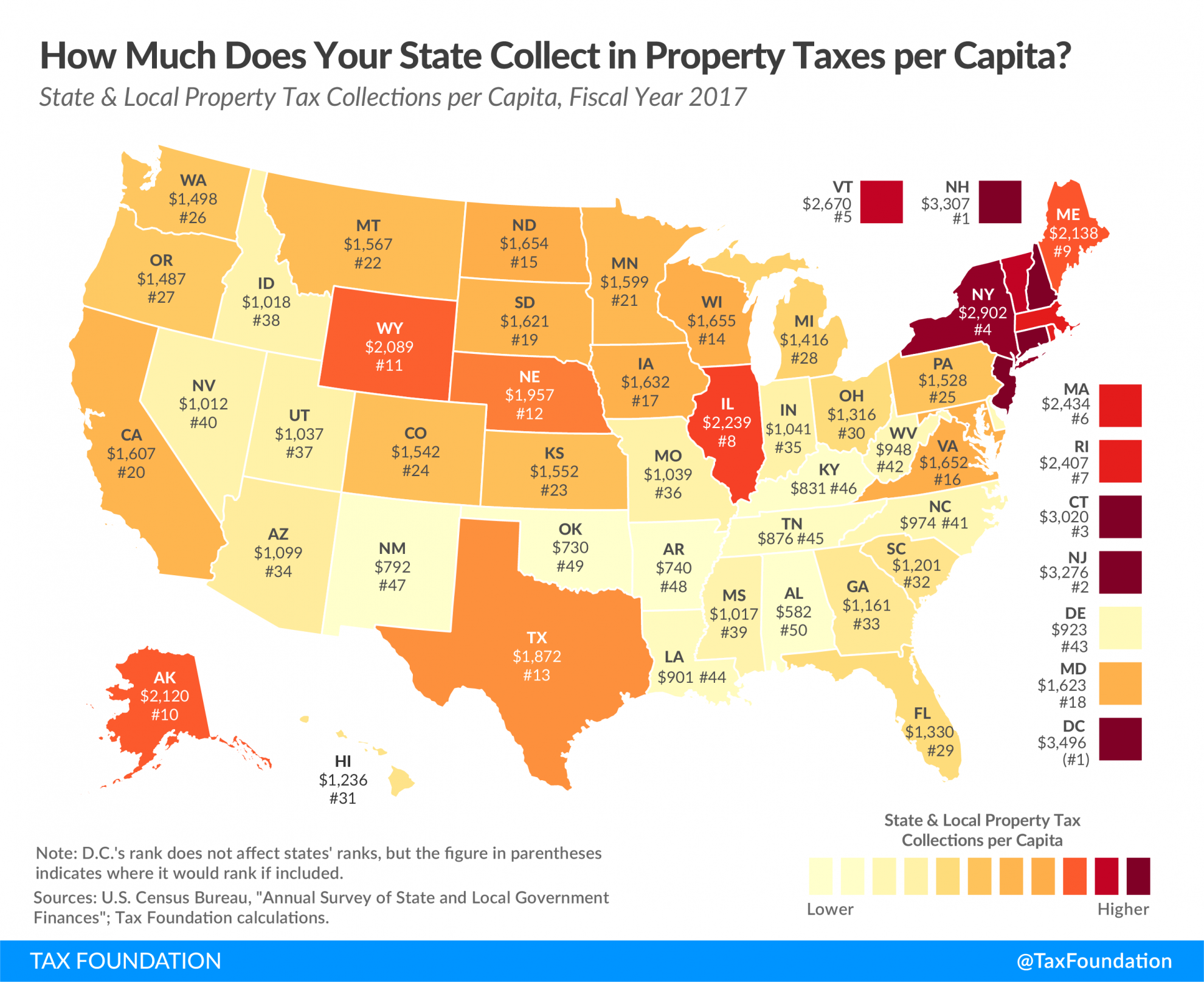

Out of the 50 states and the district of columbia, colorado ranked behind only hawaii, alabama and louisiana, wallethub notes. Property taxes in the centennial state are currently at 7.96 percent, whereas the rate for nonresidential properties is at 29 percent. According to usa today, colorado has the 7th lowest property tax rates in the country, although that is a statewide average.

In colorado, we have a real estate transfer tax fee. Colorado has some of the lowest residential property taxes in the country, with an average effective rate of just 0.49%. In a state of colorado the fee is no more than 2% of the purchase price.

And trusts are subject to colorado income tax withholding on the sales of colorado real estate in excess of $100,000. Under a 7.15% residential property tax assessment rate, a home with the median market value of about $470,000 would be assessed for taxes at $33,605, which means a 1 mill tax would be $33.6. The amount of the withholding tax remitted will be credited to the colorado income tax account of the transferor, similar to wage withholding.

The withholding tax, if required, will be the smaller of • two percent (2%) of the sales price, rounded to the nearest dollar, or Payments made after 2021 will be charged a 9% penalty plus 2% interest per month. Search arapahoe county personal or real property tax and assessment records by pin, ain or address, or pay property taxes online.

Marijuana is legal in colorado, and the tax on marijuana purchases is 30%. How much is the transfer tax? No state exemptions are allowed.

They are not based on a calendar year. The withholding tax when imposed is the lesser of two percent of the sales price, rounded to the nearest dollar, or, the net proceeds from the sale. Luckily, the basic exemption for federal taxes is high so that most estates won’t have to pay an estate tax.

Residents can pay their personal property and real estates taxes through our online tax payment portal. It's also well below the national average of 1.07%. A bill issued in july 2021 would cover the period of july 1, 2021, through june 30, 2022.) property taxes not paid in full by january 5 following billing are assessed an interest charge of 2% for the month of january and an additional 3/4 of 1% each month thereafter.

How real estate is taxed varies greatly from state to state. Join millions of learners from around the world already learning on udemy. School infrastructure authorizing the district to increase its debt by up to $795 million in bonds with a maximum repayment cost of $1.5 billion and to continue the.

5334 south prince st., littleton, co 80120. 3% tax on value of property unless there is also a local transfer tax; Mls id #5254144, banyan real estate llc.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Colorado Property Tax Calculator – Smartasset

Colorado Property Tax Calculator – Smartasset

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Dont Get Overtaxed A Guide To Colorado Property Taxes And Appeals Faegre Drinker Biddle Reath Llp – Jdsupra

Adding Someone To Your Real Estate Deed Know The Risks – Deedscom

Property Tax Definition Learn About Property Taxes Taxedu

Property Taxes How Much Are They In Different States Across The Us

Tax Department Wilson County

Are There Any States With No Property Tax In 2021 Free Investor Guide

Assessor – Douglas County Government

Property Taxes By State Highest To Lowest Rocket Mortgage

Mcgm Bmc Property Tax Mumbai Step-wise Payment Procedure

Disabled Veterans Property Tax Exemptions By State

Real Estate Lead Tracking Spreadsheet

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Assessor – Douglas County Government