All retail sales are considered for the purpose of the $100,000 threshold, regardless of whether those sales would be subject to colorado tax. The exemption for that tax is $11.18 million in 2018.

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

At least state estate tax rates are lower than federal estate tax rates.

Colorado estate tax threshold. Tax is tied to federal state death tax credit. Even though there is no estate tax in colorado, you may still owe the federal estate tax. Sep 02, 2020 · hawaii and washington state have the highest estate tax top rates in the nation at 20 percent.

The tax is imposed at a rate of 4.55%, the same rate as the flat rate on individual taxpayers. With our definite plans to relocate to hawaii and live out our remaining years, having to potentially pay both a federal estate tax and a state estate tax is a real downer. For 2021, this amount is $11.7 million (or $23.4 million for married couples).

Note, however, that the estate tax is only applied when assets exceed a given threshold. A checking account with $10,000; A state inheritance tax was enacted in colorado in 1927.

Estate tax estate tax is a tax on assets typically valued at the date of death. For this, the first $225,000 of the decedent’s estate goes to the spouse, as well as half of the balance. Unlike the federal income tax, colorado's state income tax does not provide couples filing jointly with expanded income tax brackets.

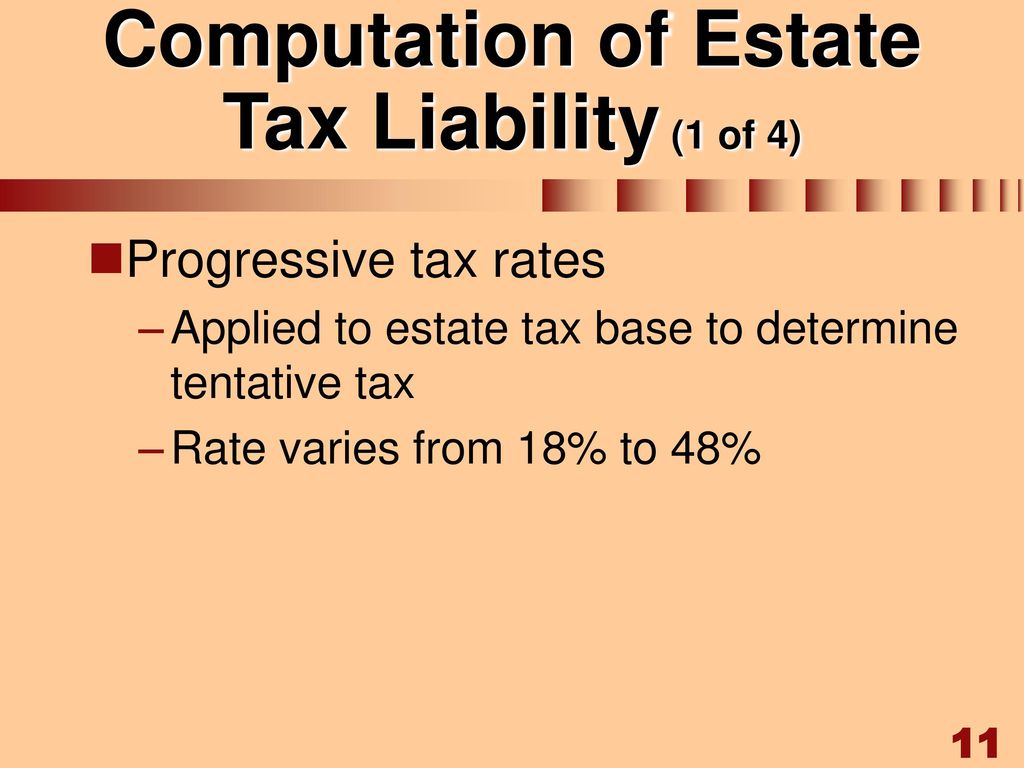

You first calculate your taxable estate value, apply the graduated estate tax rates to arrive at a tentative u.s. If the asset value exceeds the exemption amount, there can be a significant estate tax at rates between 35% and 55%. Retail sales for rules for determining the location of a sale.

The top estate tax rate is 16 percent (exemption threshold: 1 the 2021 limit, after adjusting for inflation, is $11.7 million, up from $11.58 million in 2020. Marsha dies in colorado owning the following assets:

Unlike the federal income tax, colorado's state income tax does not provide couples filing jointly with expanded income tax brackets. The federal credit for state death taxes table has a tax rate of 0% for the first $40,000. To qualify for a small estate probate in colorado, the estate must not contain any real property (i.e.

This tax is portable for married couples. A savings account with $15,000 That means that if the right legal steps are taken, a married couple can protect up to $22.36 million when both spouses die.

For 2020, the basic exclusion amount will go up $180,000 from 2019 levels to. Estate tax of 16 percent on estates above $5 million; The total value of the probate estate is $34,000, well below the small estate limit, and it does not include any real estate.

No estate tax or inheritance tax. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: A federal estate tax return can be.

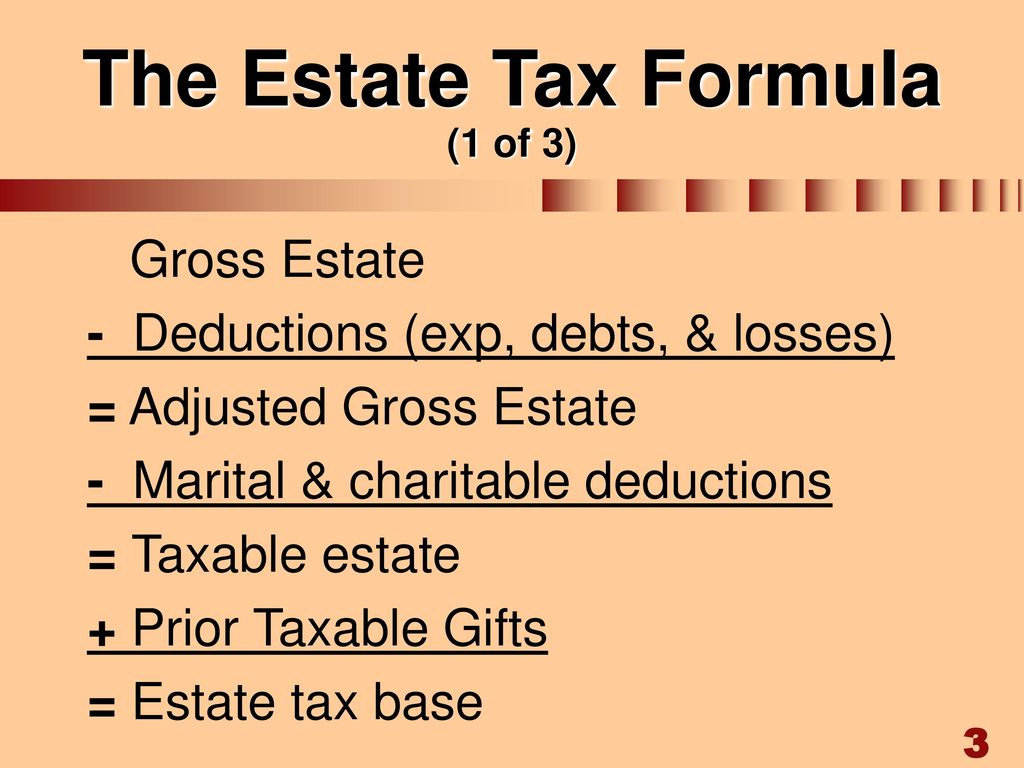

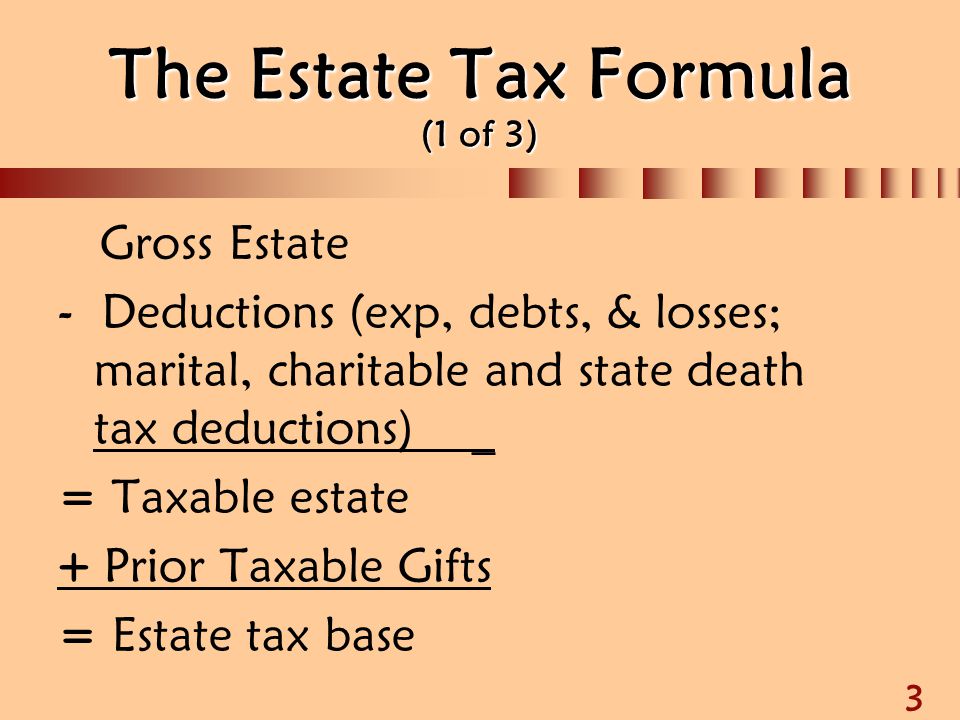

For 2020, a filing is required for estates with combined gross assets and prior taxable gifts exceeding $11.58 million. Estate tax can be applied at both the federal and state level. That number is used to calculate the size of the credit against estate tax.

Most simple estates, such as cash or a small amount of easily valued assets, do not require the filing of an estate tax return. Please submit completed declaration schedules to the colorado county assessor's office in which the property is located as of the january 1 assessment date. However, not many states have an estate tax.

If the asset value exceeds the exemption amount, there can be a significant estate tax at rates between 35% and 55%. Under scenario #1, marsha’s estate can be administered using a small estate affidavit. Land, homes, buildings, etc.) and the decedent's personal property must be less than $66,000.

As of january 1, 2012, the exclusion equaled the federal estate tax applicable exclusion amount, so long as the fet exclusion was not less than $2,000,000 and not more than $3,500,000. Until 2005, a tax credit was allowed for federal estate taxes, called the “state death tax credit.” 2 the colorado estate tax is equal to this credit. The good news is that since 1980 in colorado there is no inheritance tax, and there is no us inheritance tax, but there are other taxes that can reduce inheritance.

Across the states, flat tax rates range between 3.07 percent (pennsylvania) and 5.25 percent (north carolina), while marginal tax rates among states with graduated rates range from zero for the lowest income brackets to between 2.9 percent (north dakota) and 13.3 percent (california) for the highest income brackets. Estate tax liability to help you assess your exposure, the following sections explain how to calculate an estimate of your estate tax liability if you were to pass away. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.)

Payroll counting toward the $50,000 threshold for establishing substantial nexus is the total amount paid by the taxpayer for compensation in colorado during the tax year. Estate tax, claim a prorated unified credit and the marital credit (where. It taxes the entire amount of the estate on estates over that $1 million threshold.

20% is the highest state estate tax rate for all states who do impose estate taxes. The top inheritance tax rate is 15 percent (no exemption threshold) rhode island: Net annual rental rate is the annual rental rate paid by the taxpayer less any annual rental rate received by the taxpayer from subrentals.

Social security, retirement accounts and pensions are all partially taxed. In 2010, vermont increased the estate tax exemption threshold from $2,000,000 to $2,750,000 for decedents dying on or after january 1, 2011. 1 the 2021 limit, after adjusting for inflation, is $11.7 million, up from $11.58 million in 2020.

Three cities in colorado also have a local income tax. But if it’s the decedent who has children from a past relationship, the spouse’s share drops to the estate’s first $150,000 and half the balance, according to.

A New Era In Death And Estate Taxes

Homestead Exemption In Colorado – Homesteading Colorado Estate Tax

Colorado Estate Tax Do I Need To Worry – Brestel Bucar

Chapter 13 The Estate Tax – Ppt Download

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

Pin Oleh Aspek Finansial Di Awesome Lebaran Uang Blog

Chapter 13 The Estate Tax – Ppt Download

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Recent Changes To Estate Tax Law Whats New For 2019

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Do I Need To Worry – Brestel Bucar

Chapter 13 The Estate Tax – Ppt Video Online Download

Why Billions Of Dollars In Estate Taxes Go Uncollected Estate Tax Tax Attorney Estate Planning

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Wyoming Tax Benefits – Jackson Hole Real Estate – Ken Gangwer

Pin On Lugares Que Visitar