The united states' white house and treasury department have worked together with code for america to. Uninsured children who do not show up on any filer’s 2019 or 2020 tax return.

14m In Advance Child Tax Credit Payments Processed News Guampdncom

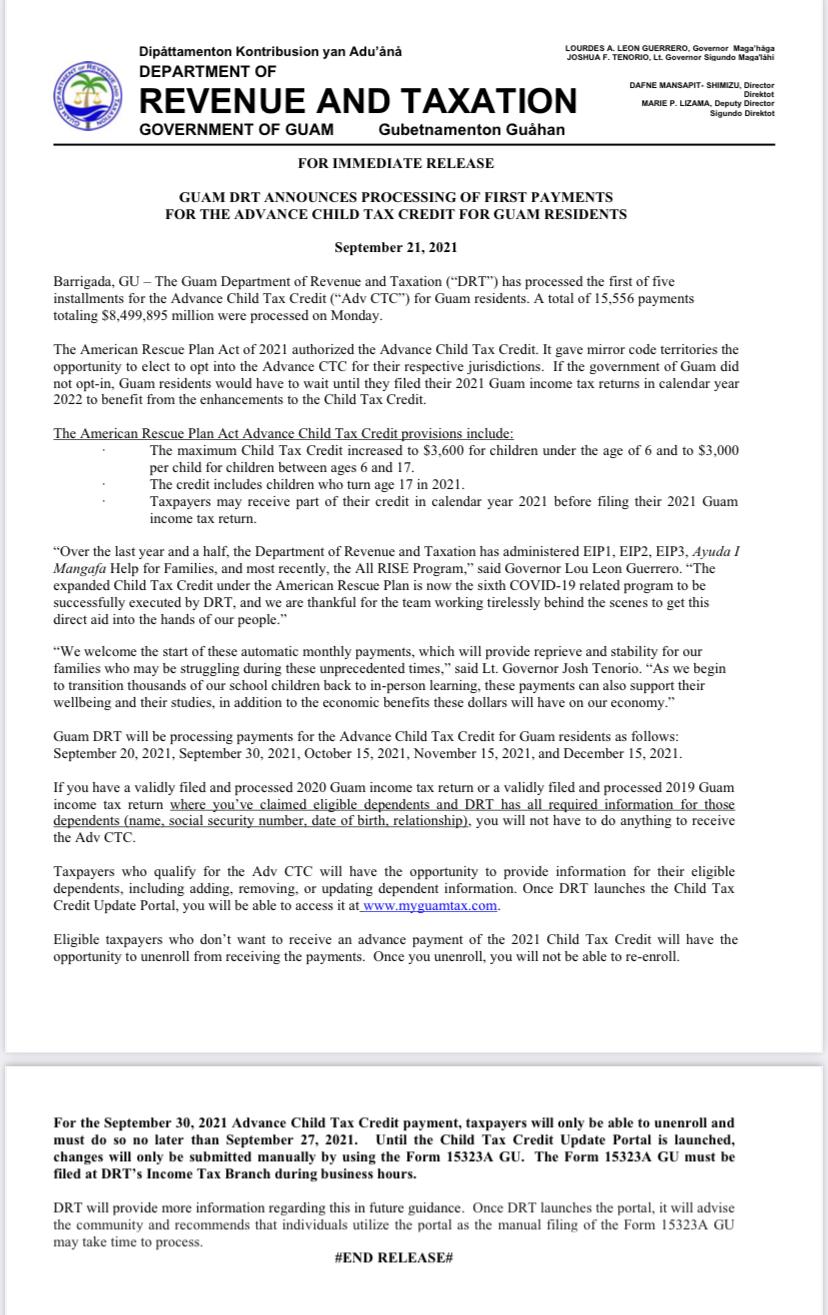

The other four installments of the advance child tax credit will be.

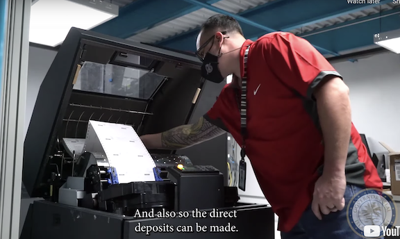

Child tax portal guam. Advance child tax credit & portal opening the american rescue plan (arp) has increased the child tax credit (ctc) on a temporary basis for 2021. Advance child tax credit payments are early payments processed by guam drt of 50 percent of the Once drt launches the portal, it will advise the community and recommends that individuals utilize the portal as the manual filing of the form 15323a gu may take time to process.

The guam child tax credit portal at www.myguamtax.com. What are advance child tax credit payments? Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Guam residents may either file manually or online by. Child tax credit update portal. Treasury approved a total of $93,537,000 in initial funding for the advance ctc.

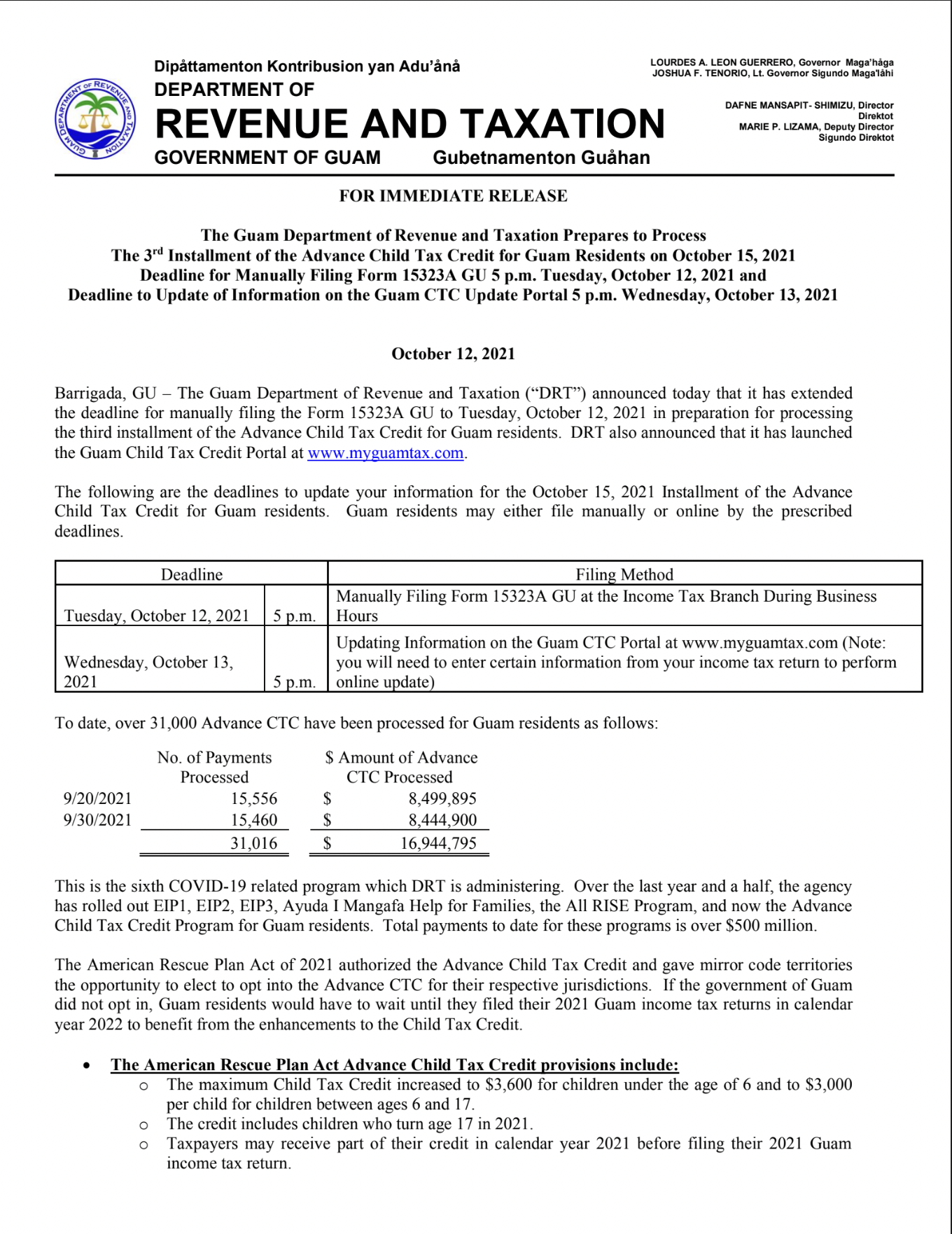

How the irs child tax credit portals can help parents with payments. Two more child tax credit checks are on the schedule for this year, with the second half of the payments arriving during tax season in 2022. The following are the deadlines to update your information for the october 15, 2021 installment of the advance child tax credit for guam residents.

For purposes of the child tax credit and advance child tax credit payments, your modified agi is your adjusted gross income (from the 2020 guam form 1040, line 11, or the 2019 guam form 1040, line 8b), plus the following amounts that may apply to you. Those with children 5 or younger will receive $3,600 per child. You may claim this increased credit even if you don’t have earnings or pay u.s.

Until the child tax credit update portal is launched, changes will only be able to be submitted manually by using the form 15323a gu. A family who has a newborn and filed a 2019 or 2020 tax return will only need to update the child tax credit update portal with their child’s information. A portal to update bank details and facilitate payments.

6:30 pm pst november 25, 2021 Every family qualified for child tax credits and with a child between the ages of 6 and 17 will receive $3,000 of this tax credit. Enter payment info here tool in 2020, to qualify for advance payments of the child tax credit.

Any changes made by august 2 will. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. The guam department of revenue & taxation (drt) reminds taxpayers that the 2021 income tax filing season is scheduled to begin on friday, february 12, 2021.

This is the first of five installments for the advance child tax credit for guam residents, according to a press release. If you are receiving monthly advance payments of the child tax credit, you can make certain changes in the child tax credit update portal by 11:59 p.m. Take certain corrective actions by october 4, to affect future advance child tax credit payments.

By the end of this year, families will have received. Eastern time on october 4 to affect the next scheduled payment on october 15, 2021. Instead of calling, it may be faster to check the.

A new website from the irs aims to help millions of eligible families sign up for the monthly advance child tax credit (ctc. The use of this site constitutes your agreement to the cnmi department of finance advance child care tax credit portal terms of use and privacy policies.terms of use. The new bank account feature was added to the child tax credit update portal which is available on the irs website.

This summer, the irs opened its child tax credit online portals.the first portal is for people not normally required to file an. Any amount on line 45 or line 50 of the 2020 or 2019 form 2555, foreign earned income. The form 15323a gu must be filed at drt’s income tax branch.

A total of 15,556 payments totaling $8,499,895 million were processed on monday. This is the date that drt will begin accepting 2020 tax year returns and The child tax credit portal has been updated just before the final deadline to make changes for the dec.

The child tax credit update portal lets you opt out of receiving this year's monthly child tax credit payments. Taxpayers will be able to make adjustments to their information for purposes of the advance child tax credit in phases. Payment of the advance child tax credit and the reimbursement to the government of guam for the child tax credit were authorized by the american rescue plan act of 2021, which was signed into law by president biden on march 11, 2021.

The maximum child tax credit amount for 2021 has increased from $2,000 to $3,000 for children who are ages 6 through 17 ($3,600 for children ages 5 and under) at the end of 2021.

Guamtaxcom

85m In Advance Child Tax Credit To Be Mailed Guam News Postguamcom

Govguam Makes Plan For Increased Child Tax Credit Guam News Postguamcom

Guamtaxcom

Child Tax Credit Checks Out By August Maybe Guam News Postguamcom

Guamtaxcom

Coming Friday 3rd Actc Payment Get Info Here – Kandit News Group

Guamtaxcom

First Batch Of Advance Child Tax Credit Payments Processed – Kuamcom-kuam News On Air Online On Demand

Advance Child Tax Credit Deadline Today Last Day Wednesday To U – Kuamcom-kuam News On Air Online On Demand

First Batch Of Child Tax Credit Payments Processed – Kandit News Group

Expanded Child Tax Credit Plan Approved Rev And Tax Working On Pay Out Money Guampdncom

144m In Advance Child Tax Credit For Guam Processed Guam News Postguamcom

Drt Working Simultaneously On All Rise Child Tax Credit And Oth – Kuamcom-kuam News On Air Online On Demand

Guamtaxcom

Child Tax Credit Second Installment Processed News Guampdncom

Should You Opt Out Of Advance Child Tax Credit Guam News Postguamcom

Drt Will Start Paying Advance Child Tax Credit Update Portal Out Soon – Pnc News First

Coming Friday 3rd Actc Payment Get Info Here – Kandit News Group