15 by direct deposit and through the mail. 15 was the official payment date, he said that the date that the funds are available can be different.

Child Tax Credit 2021 How To Track September Next Payment Marca

The next and last payment goes out on dec.

Child tax credit september date. 15 or be mailed as a paper check. As soon as the second payment arrives at your bank account, you’ll receive the next advanced payments on the following dates. We'll tell you when the next advance check will come, the number of payments left, how to unenroll and how to use the portals to update your info.

Age is determined on december 31, 2021. In those cases, the credit will be sent on the next closest business day. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

(ap photo/lm otero, file) ap the second payment was sent out to families on august 13. Payment dates for the child tax credit payment. Goods and services tax / harmonized sales tax (gst/hst) credit

15 (opt out by nov. Child tax credit september 2021 payment date. December 13, 2021 * haven't received your payment?

September advance child tax credit payments. 15 (opt out by oct. The irs has announced the september child tax credits are on their way and future payment dates.

Below's the full list of child tax credit payment dates for 2021. The irs bases your child's eligibility on their age on dec. September child tax credit deposit date.

15 (opt out by aug. Two more child tax credit checks are on the schedule for this. Important points regarding september child tax credit date 2021:

What should i do if i haven't gotten any child tax credit payments? The 2021 advance monthly child tax credit payments started automatically in july. 15 (opt out by nov.

Third monthly payment on september 15 usa. The irs issued a formal statement on september 24, which anyone missing their september payment should read. Monthly payments continue through december and a payout comes during tax season next year.

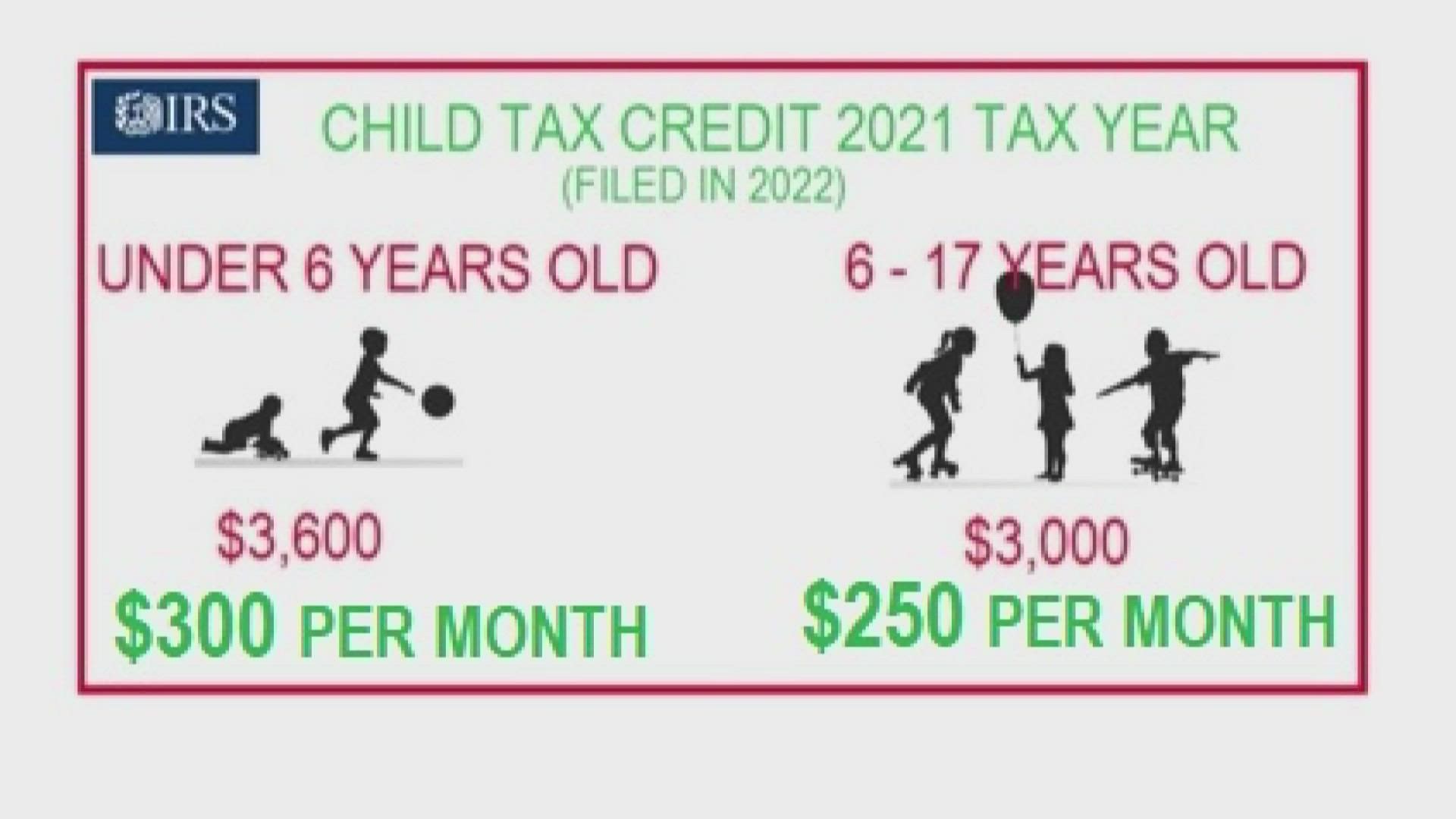

The 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows: Here are the remaining dates that families can expect checks in the mail or direct deposits: For 2021 only, the child tax credit amount is increased from $2,000 for each child age 16 or younger to $3,600 per child for kids who are 5 years old or younger and $3,000 per child for kids 6 to.

Just be aware that this is when direct deposits are typically sent out. For 2021 only, the child tax credit amount is increased from $2,000 for each child. Some frustrated parents left waiting for september child tax credit payments.

15 (opt out by oct. For more scheduled future dates of monthly. September child tax credit date 2021 shows that those who have complicated tax situations might opt out of the monthly checks and might be able to get a larger payout.

13 (opt out by aug. 15, millions of families received the third advance child tax credit payment automatically from the irs. The deadline is already around, but the users can contact the irs update portal and make changes to the banking details or the mailing address.

29) what happens with the child tax credit payments after december? Meanwhile, those who get it by paper check may have to wait longer depending on if there are mailing delays. Tax benefits of the child tax credit (september 2021) individual taxes:

Child tax credit payments will be deposited sept. The second payment was sent out to families on august 13. After the funds are deposited, it should appear in your bank account within hours as the government payments have sped up significantly.

The couple would then receive the $3,300 balance — $1,800 ($300 x 6) for the younger child and $1,500 ($250 x 6) for the older child — as part of their 2021 tax refund. The treasury will deposit the third advanced child tax credit payments on september 15. The third payment date is wednesday, september 15, with the irs sending most of the checks via direct deposit.

Wait 5 working days from the payment date to contact us. (the deadline for the september payment has passed.) you can use the irs child tax credit update portal online anytime. The irs said wednesday that september’s payments,.

15 (opt out by nov. For both age groups, the rest of the payment. When does the child tax credit arrive in september?

But others who got their july and. A portal to update bank details and facilitate payments the money will go out on september 15, say. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

United Kingdom Hm Revenue Customs Tax Credits Award Statement Template In Word And Pdf Format Doc And Pdf Statement Template Tax Credits Templates

Cbic Blocks Input Tax Credit Due To Mismatch Of Returns Tax Credits Indirect Tax Tax

Gstr-6 Legal Services Internal Audit Tax Credits

Pin On Tech

Child Tax Credit Missing A Payment Heres How To Track It – Cnet

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tvcom

September Child Tax Credit Payments Are Here What Happens If Irs Misses You – Fingerlakes1com

Gst India Tax Taxation Vat Excise Servicetax Indirecttax Economy Business Finance Law Corporate Marke Indirect Tax Goods And Services Tax Credits

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Tax Credit Tax Credits Tax Help Tax Time

Reminder For Filing Tax Audit Report Of Your Business For Fy 2017-18 Filing Taxes Chartered Accountant Financial Services

November Child Tax Credit Deadline To Opt Out Near Irs Reveals Updated Payment Dates – Fingerlakes1com

Schedule Date Of Gst Return Filling For Regular Business Accounting And Finance Accounting Course Filing Taxes

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs – Fingerlakes1com

Child Tax Credit 2021 Payments How Much Dates And Opting Out – Cbs News

Build Back Betters Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities