Eastern time on november 29, 2021. The maximum credit in 2021 is $3,600 for children under 6 and $3,000 for children between 6 and 17.

I Got My Refund – Posts Facebook

2.6k members in the childtaxcredit community.

Child tax credit september 2021 reddit. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. Here we are and that is not an available option. Thousands of parents who received their july and august child tax credit payment checks say the september payment has not shown up.

This third batch of advance monthly payments, totaling about $15 billion, is reaching about 35. The $500 nonrefundable credit for other dependents amount has not changed. In january 2022, the irs will send families that received child tax credit payments a letter with the total amount of money they got in 2021.

Also, it seems to be people who received ggs 1, and they’re receiving the additional payment for their dependent which is an extra $500. Previously, the maximum tax credit was $2,000 per child under 17. “as i’ve said again and again:

September child tax credit not issued reddit. Part 2 of ggs 2 : Advance child tax credit payments in 2021.

As provided in this topic e, if the irs has not processed your 2020 tax return as of the payment determination date for a monthly advance child tax credit payment, we will determine the amount of that advance child tax credit payment based on. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. $3,600 for children ages 5 and under at the end of 2021;

But should have qualified for adjusted amounts in august and september. Children born in 2021 make you eligible for the 2021 tax credit of $3,600 per child. Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money.

Half the total credit amount is being paid in advance. The arp increased the 2021 child tax credit from a maximum of $2,000 per child up to $3,600. Payment will be going out next friday 9/16 or maybe 9/14 or 9/15.

I have not received the september ctc payment, one person noted on. You’re not required to file an amended return to receive advance child tax credit payments. (that's up to $7,200 for twins.) this is on top of payments for.

Eastern time on november 29, 2021. Many worried about why september child tax credit didn't show up yet. A community to discuss the upcoming advanced child tax credit.

So after calling the irs and ctc hotline trying to get the best answers and having them all coming out different, i am sad to report that my status is still pending and the only advice i keep getting is to keep checking the portal for a status update.basically that i have to file for the ctc credit on the tax return for 2021 of it doesn't. Many families could be looking. Meanwhile, some people did post that they had started receiving checks in the mail on friday — or two days since september payments were set to be issued sept.

Permanent on september 14, 2021 in. The fourth round of the stimulus checks was pleaded desperately and washington has chosen to allow another direct payment. Families can receive 50% of their child tax.

The 2021 advance monthly child tax credit payments started automatically in july. Credit unions and chime get posted earlier than most. November 17, 2021 @ 4:27 am.

The 2021 child tax credit was temporarily expanded from $2,000 per child 16 years old and younger to $3,600 for children age 5 and younger and to $3,000 for children age 17 and younger. Problems with your child tax credit payment? The current changes to the 2021 child tax credit made the credit $3,600.

That’s why my build back agenda will extend the expanded child tax credit we passed under my american rescue plan.” the second half of the infusion worth up to $1,800 will then land in bank accounts, or as paper checks, once a 2021 tax return. For tax year 2021, the child tax credit is increased from $2,000 per qualifying child to: Washington — the internal revenue service and the treasury department announced today that millions of american families are now receiving their advance child tax credit (ctc) payment for the month of september.

Important changes to the child tax credit are helping many families get advance payments of the credit: Each child from the age of 6 to 17 qualifies for $3,000 annually, or $250 per. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m.

It will also let parents take advantage of any increased payments they. Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021. $3,000 for children ages 6 through 17 at the end of 2021.

Eligible families could claim a tax credit of up to $2,000 per child under age 17 who is a citizen of the u.s. A stimulus check issued by the irs is shown on april 23, 2020. The people who really need a tax break in this country are working families.

News > business child tax credit payments for september are missing for some.

971 Notice Issued Anyone Know What I Should Do At This Point Just Keep Waiting Rirs

New Details On Ev Credits In Reconciliation Bill Relectricvehicles

I Got My Refund – Posts Facebook

September Child Tax Credit Payment How Much Should Your Family Get – Cnet

Sony Music Labels Inc Mika Nakashima Released On 1027 Both A-side Singles Symphonia What You Want To Know What You Dont Want To Know 2nd New Visual And Recording Details Lifted

Sypherpk Claps Rear At Haters Crying His Fortnite Streams A Saline Mess – Game News 24

September Child Tax Credit Payment How Much Should Your Family Get – Cnet

Laughs Nervously What The Fuck Raboringdystopia

Letter From Internal Revenue Service Austin Tx 73301-0003 Rirs

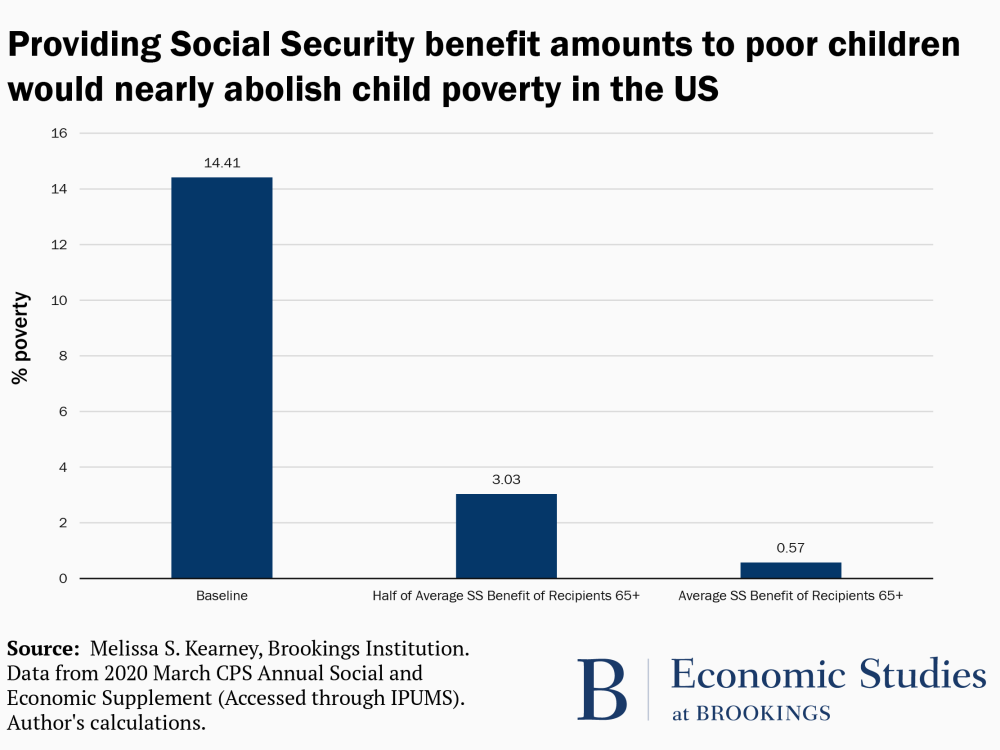

We Could Abolish Child Poverty In The Us With Social Security Benefits For Poor Kids

Amended Tax Return Updated Rirs

3zuciy4z35evnm

I Got My Refund – Posts Facebook

September Child Tax Credit Payment How Much Should Your Family Get – Cnet

New Details On Ev Credits In Reconciliation Bill Relectricvehicles

I Got My Refund – Posts Facebook

I Got My Refund – Posts Facebook

Letter From Internal Revenue Service Austin Tx 73301-0003 Rirs

Bbffbjuevhmxjm