$300 monthly per eligible child under age 6. Even if you don’t pay any taxes, you may qualify for a refund of the ctc.

Abc7 – Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If Youre One Of Those Families

If you have a baby anytime in 2021, your newborn will count toward the child tax credit payment of $3,600.

Child tax credit payment schedule and amount. The $500 nonrefundable credit for other dependents amount has not changed. (that's up to $7,200 for twins.) this is on top of payments for any other qualified child dependents you claim. For parents of eligible children up to age 5, the irs will pay up to $3,600 for each kid, half as six advance monthly payments and half as a 2021 tax credit.

Families signing up now will normally receive half of their total child tax credit on december 15. 29) what happens with the child tax credit payments after december? Two more child tax credit checks are on the schedule for this.

November's child tax credit cash will be sent out to parents in need across the country next week. 15 (opt out by nov. This means a payment of up to $1,800 for each child under 6, and up to $1,500 for each child age 6 to 17.

$3,600 for children ages 5 and under at the end of 2021; Child tax credit update portal. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

$3,000 for children ages 6 through 17 at the end of 2021. The credit amount jumped from $2,000 to $3,000 for children. The expanded tax credit delivers monthly payments of $300 for each eligible child under 6, and $250 for each child between 6 to 17 years old.

See the payment date schedule. The ' stimulus check ', part of president joe biden 's child tax credit plan, will see those who meet the final november 15 deadline potentially receive up to $1,800 per child come december. 13 (opt out by aug.

Advance payments are sent automatically to eligible people. Normally, anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they unenroll. To get the full enhanced ctc — which amounts to $3,600 for children under 6 years old and $3,000 for kids ages 6 to 17 years old — single.

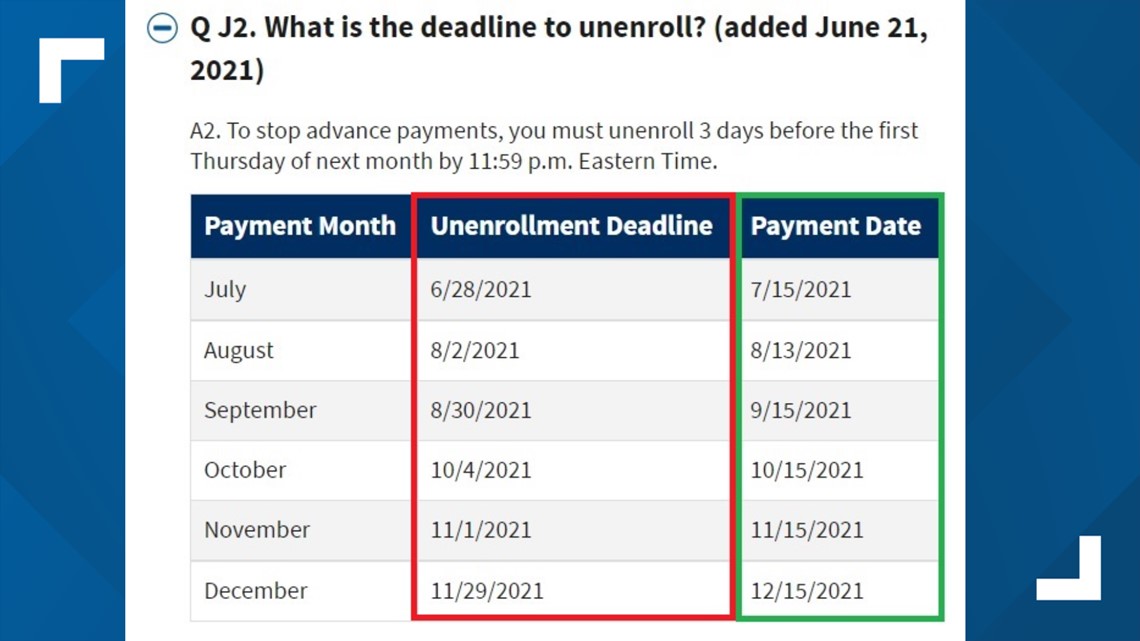

So parents of a child under six receive $300 per month,. Monthly payments continue through december and a payout comes during tax season next year. The 2021 child tax credit payment dates — along with the deadlines to opt out — are as follows:

For 2021 ( and only 2021 ), the child tax credit was substantially improved. By claiming the child tax credit (ctc), you can reduce the amount of money you owe on your federal taxes. You claim the other half when you file your 2021 income tax return.

$250 monthly per eligible child age 6 through 17. Important changes to the child tax credit are helping many families get advance payments of the credit: Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer of 2021.

9:02 et, nov 11 2021. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. That means you’ll receive six payments of up to:

15 (opt out by aug. Here are the basic rules: Even though child tax credit payments are scheduled to arrive on certain dates, you may not have gotten the money as expected for a few reasons.

This is the same total amount that most other families have been receiving in up to six monthly payments that began in july. The next child tax credit payment is coming to eligible parents' bank accounts in just a few days. The law increased the 2021 child tax credit from a maximum of $2,000 to up to $3,600, and allows families to receive 50% of their child.

After that, only two more checks will be sent in 2021 for november and december, with the rest of. Children who are adopted can also qualify if they're us citizens. For 2021 only, the child tax credit amount is increased from $2,000 for each child age 16 or younger to $3,600 per child for kids who are.

For tax year 2021, the child tax credit is increased from $2,000 per qualifying child to: The amount of credit you receive is based on your income and number of qualifying children you are claiming. Children born in 2021 make you eligible for the 2021 tax credit of $3,600 per child.

Your payment dates tax credit payments are made every week or every 4 weeks. 15 (opt out by nov. You choose if you want to get paid weekly or every 4 weeks on your claim form.

Half the total credit amount is being paid in advance monthly payments. 15 (opt out by oct. Under the american rescue plan, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17.

Child Tax Credit Update Families Will Get Paid 7200 Per Child In 2022 By Irs – Fingerlakes1com

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

November Child Tax Credit Deadline To Opt Out Near Irs Reveals Updated Payment Dates – Fingerlakes1com

Irs Child Tax Credit 2021 Non Filers Cahunitcom

2021 Child Tax Credit – Crippen

Advance Child Tax Credit Payments Begin July 15

Ed Markey On Twitter The Next Advanced Child Tax Credit Payment Arrives This Friday August 13 Families Can Now Receive Their Monthly Payments Faster By Adding Or Updating Banking And Direct Deposit

The Deadline To Unenroll Or Opt-out Of The Child Tax Credit Wfmynews2com

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out – Cbs News

What Is The Child Tax Credit And How Much Of It Is Refundable

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What To Know About The First Advance Child Tax Credit Payment

Child Tax Credit 2021 8 Things You Need To Know – District Capital

Parents Will Be Receiving The Last Monthly Cash Payment Of The Year Soon Heres What We Know

Payments For The New 3000 Child Tax Credit Start July 15 Heres What You Should Know – Brinker Simpson