The premium for your benchmark plan minus your contribution amount. You will need to provide the number of children you have in two age brackets, 5 and younger, and 6 to 17;

Budget 2019 – Revised Section 87a Tax Rebate – Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

The child tax credit was only partially refundable prior to 2021, with this being up to $1,400 per qualifying child, and you needed at least $2,500 of earned income to qualify for that.

Child tax credit 2022 calculator. If you pay an irs or state penalty or interest because of a turbotax calculation error, we’ll pay you the penalty and interest. Advance payment of the 2021 child tax credit. Key points the expanded child tax credit provides payments of up to $3,600 per child.

Changes to the child tax credit could be extended into 2022, making some parents eligible for continued payments. This year, the child tax credit will rise to $3,600. For tax years before 2021, the irs allowed you to claim up to $2,000 per child under 17.

How much is the child tax credit worth?. The advance child tax credit calculator will provide you with the estimated credit amount you can expect as your child tax credit for 2021. The premium tax credit is the lesser of:

Estimate how much tax credit (including working tax credit and child tax credit) you could get every 4 weeks during this tax year, 6 april 2021 to 5 april 2022. Ages five and younger is up to $3,600 in total (up to $300 in advance monthly) ages six to 17 is up to $3,000 in total (up to $250 in advance monthly) additionally, a portion of your amount is reduced by $50 for every $1,000 over certain income limits (see the. The child tax credit can be worth as much as $3,500 per child for tax year 2021.

It’s combined with a dependent’s calculator, so you can also add other dependents in your. The maximum credit is $3,733 for one child, $6,164 for two. Icalculator aims to make calculating your federal and state taxes and medicare as simple as possible.

The child tax credit is a credit that can reduce your federal tax bill by up to $3,600 for every qualifying child. Your adjusted gross income (agi) determines how much you can claim back. The eic reduces the amount of taxes owed and may also give a refund.

The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The child tax credit provides a financial benefit to americans with qualifying kids. Child tax credit calculator for 2021, 2022.

The bill signed into law by president joe biden increased the child tax credit from $2,000 to up to $3,600 and allowed families the option to receive 50% of their 2021 child tax credit in the form. You can calculate your credit here. The child tax credit will begin to be reduced below $2,000 per child if an individual reports an income of $200,000.

The maximum is $3,000 for a single qualifying person or $6,000 for two or more. For married couples and joint filers, the credit will dip below $2,000 if their. The maximum benefit per child under 6 is $6,833.

The fully refundable credit is usually up to $2,000 per qualifying dependent and will increase to $3,600 in 2021. Your amount changes based on the age of your children. The child and dependent care tax credit is worth anywhere from 20% to 35% of qualifying care expenses.

The benefits are indexed to inflation and are adjusted each year in july. Irs statistics indicate that 36 million americans may be eligible for the child tax credit, or ctc, this year as part of the american rescue plan (trp). There are also maximum amounts you must consider.

This calculator lets you estimate the canada child benefit you will receive between july 2021 and june 2022 based on your total family income reported on your 2020 tax returns. Our online annual tax calculator will automatically. The child tax credit is intended to offset the many expenses of raising children.

You can use this eic calculator to calculate your earned income credit based on the number of qualifying children, total earned income, and filing status. Two more child tax credit checks are on the schedule for this year, with the second half of the payments arriving during tax season in 2022. The thresholds for monthly payment ineligibility are.

2022 earned income tax credit (eitc) the maximum earned income tax credit (eitc) in 2022 for single and joint filers is $560 if the filer has no children (table 5). The child tax credit calculator will show you exactly how much you can claim this year. The contribution amount is the amount you are considered to be able to afford to pay for health insurance.

It would be the amount you pay. Earned income tax credit (eic) child tax credits; The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

The premiums for the plan in which you and/or your family members enroll, or. With a new layout you can access important information and common tasks directly from your myir homepage. The alerts tab reminds you of your most important tasks.

As new information is released, we will update this page. The children ages are as of december 31, 2021. Log in to myir to see the improvements.

Under the build back better act, you generally won't receive monthly child tax credit payments in 2022 if your 2021 modified agi is too high. You’ll notice some changes in myir.

Federal Income Tax Calculator 2020 Credit Karma

Irs Tax Brackets Calculator 2022 What Is A Single Filers Tax Bracket Marca

How To Calculate Agi From W-2 Tax Prep Checklist Tax Prep Income Tax Return

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Child Tax Credit Calculator How Much Could You Receive – Abc News

Tax Calculators Taxtim Sa

Personal Income Tax Calculator In Indonesia Free – Cekindo

September Child Tax Credit Payment How Much Should Your Family Get – Cnet

Solar Investment Tax Credit Explained Energysage Tax Credits Investing Solar

Quarterly Tax Calculator – Calculate Estimated Taxes

Child Tax Credit 2022 How Next Years Credit Could Be Different Kiplinger

September Child Tax Credit Payment How Much Should Your Family Get – Cnet

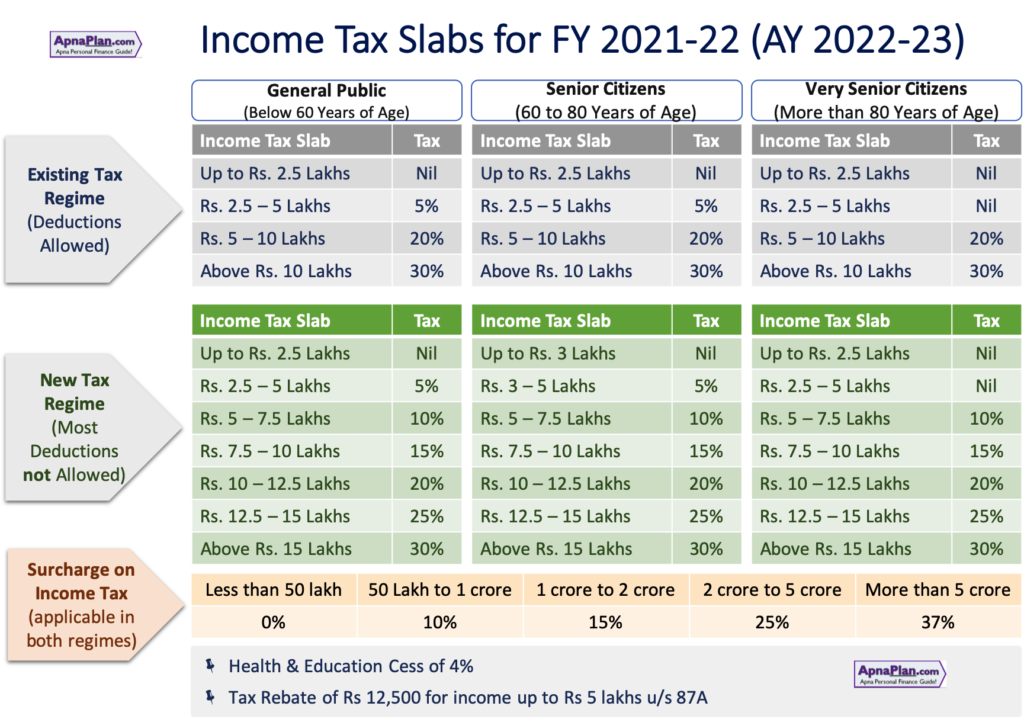

Income Tax Calculator India In Excel Fy 2021-22 Ay 2022-23 Apnaplancom Personal Finance Investment Ideas

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Fbr Called For Income Tax Proposals For 2021 2022 Budget In 2021 Budgeting Income Tax Proposal

The Solar Tax Credit Is Expiring Heres What You Should Expect Solar Panel Cost Tax Credits Solar Panel Installation

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

Aca Penalty Calculator Health Insurance Coverage Employment Full Time Equivalent

Download Income Tax Calculator Fy 2021-22 Ay 2022-23 In 2021 Income Tax Tax Income