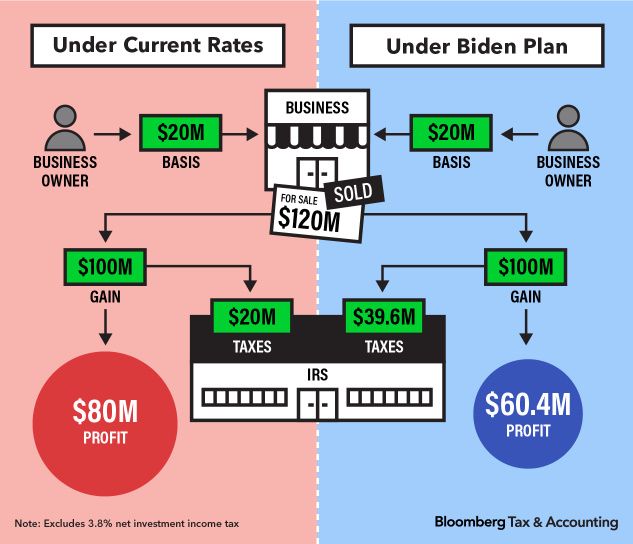

Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. At this point, though, it’s looking like the earliest the biden tax plan will be passed is.

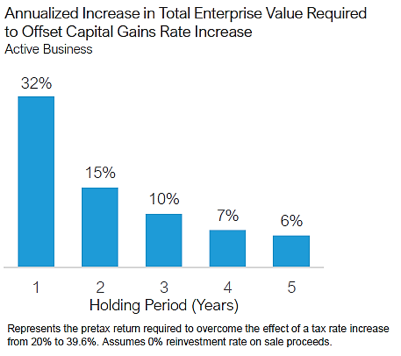

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Under the current proposal, “gains realized prior to sept.

Chances of retroactive capital gains tax. A natural reaction to a looming tax hike is to sell quickly before the new law takes effect. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law. In another case relevant to retroactive tax legislation, the court in estate of cherne v.

Possible retroactive capital gains hike panics investors, qsbs holders could be at risk by qsbs expert in the months since president biden announced his tax reform proposal that included a tax hike on income recognized from capital gains, investors have been keeping a close eye on the political climate and the likelihood that this change would be enacted. Maybe then you retroactivity might have made some sense to capture things that were done for purely tax reasons. Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of the year) would have been greater.

Although congress has the constitutional authority to make retroactive tax increases, they have historically been the exception rather than the rule. If you add state taxes like california’s current 13.3% rate the government gets most of your gain. Still another would make the change to capital gains tax retroactive, with a start date of april 2021.

Still another would make the change. President joe biden released his proposed 2022 fiscal year budget on friday, which calls for an increase of the top capital gains tax rate. Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021.

The capital gains rate increase could be significantly lower than proposed; The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over $1 million, with those high net families paying a higher tax rate of 39.6%, nearly double the current 20% rate for individuals, explains the article “capital gains strategies to keep clients on track for retirement” from wealth management.com. Myers adds he thinks the likelihood of retroactive taxes is greater than 50 percent but notes the biden administration may settle on a lower rate for capital gains —.

Perhaps the most newsworthy item in the treasury department greenbook was the biden administration's proposal to increase taxes on capital gains on a retroactive basis. Perhaps the most newsworthy item in the treasury department greenbook was the biden administration's proposal to increase taxes on capital gains on a retroactive basis. United states followed the carlton test and upheld a retroactive increase in the federal estate tax rate from 53 percent to 55 percent, finding that the increase was rationally related to the legitimate legislative interest of raising revenue.

While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging. The top rate for 2021 is 37%, plus the medicare surtax of 3.8% (plus state tax). Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of the year) would have been greater.

Wages can face federal tax of 40.8% once you include payroll tax, but hiking the top 23.8% capital gain rate to 43.4% would be a staggering 82% increase. Gains realized after that date would be taxed at a. Put another way, if democrats enact a tax increase in the second half of 2021, how likely is it that the effective date of the tax increase will be january 1, 2021?

Capital gains planning opportunities exist; I can shed some light on one of the most significant issues for many: Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more.

13 will be taxed at top rate of 20%; Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though congress must ok any hikes and retroactive effective dates, the. But retroactive capital gains taxes.

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive – Bloomberg

Wall Street Panicking That Bidens Tax Hikes Will Be Retroactive

A Retroactive Tax Increase – Wsj

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Capital Gains Tax Hike And More May Come Just After Labor Day

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk – Qsbs Expert

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Bidens Capital-gains Tax Plan May Be Retroactive Worrying Top Bank Ceos Fox Business

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

Advisors Look For Ways To Offset Bidens Retroactive Capital Gains Tax Hike

Markets Eerily Silent Amid Surprise Report On Capital-gains Tax Hikes

Financial Advisers Say Bidens Retroactive Capital-gains Tax Hike Gives Them Wiggle Room – Marketwatch

Can Congress Really Increase Taxes Retroactively

Wall Street Panicking That Bidens Tax Hikes Will Be Retroactive

Bidens Tax Plan Goes Back To The Future With Retroactive Capital Gains Hikes

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

A Retroactive Tax Increase – Wsj

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others