The payments phase out for people with income over $75,000 for an individual or $150,000 for a married couple. Married taxpayers will get $2,400;

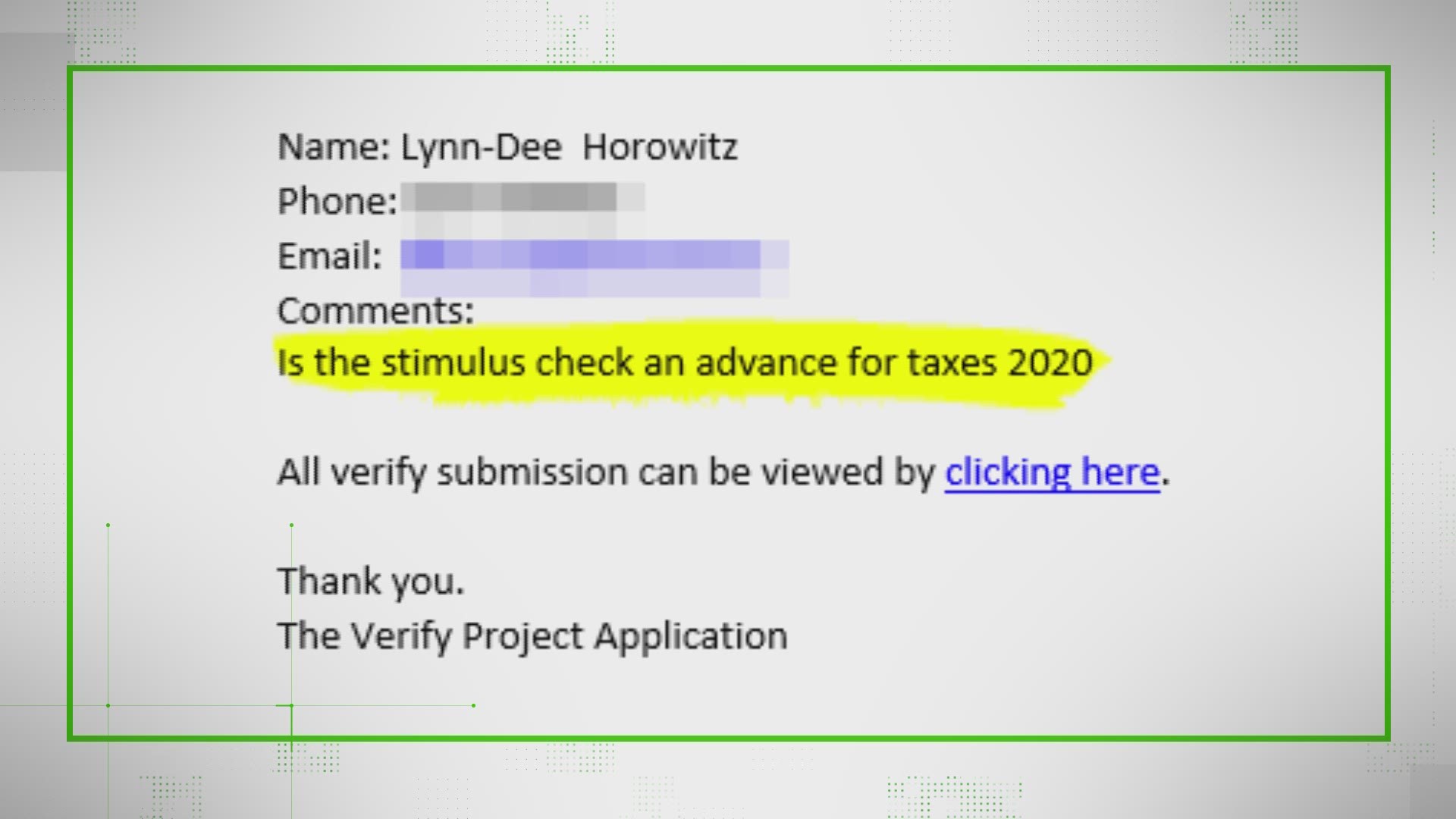

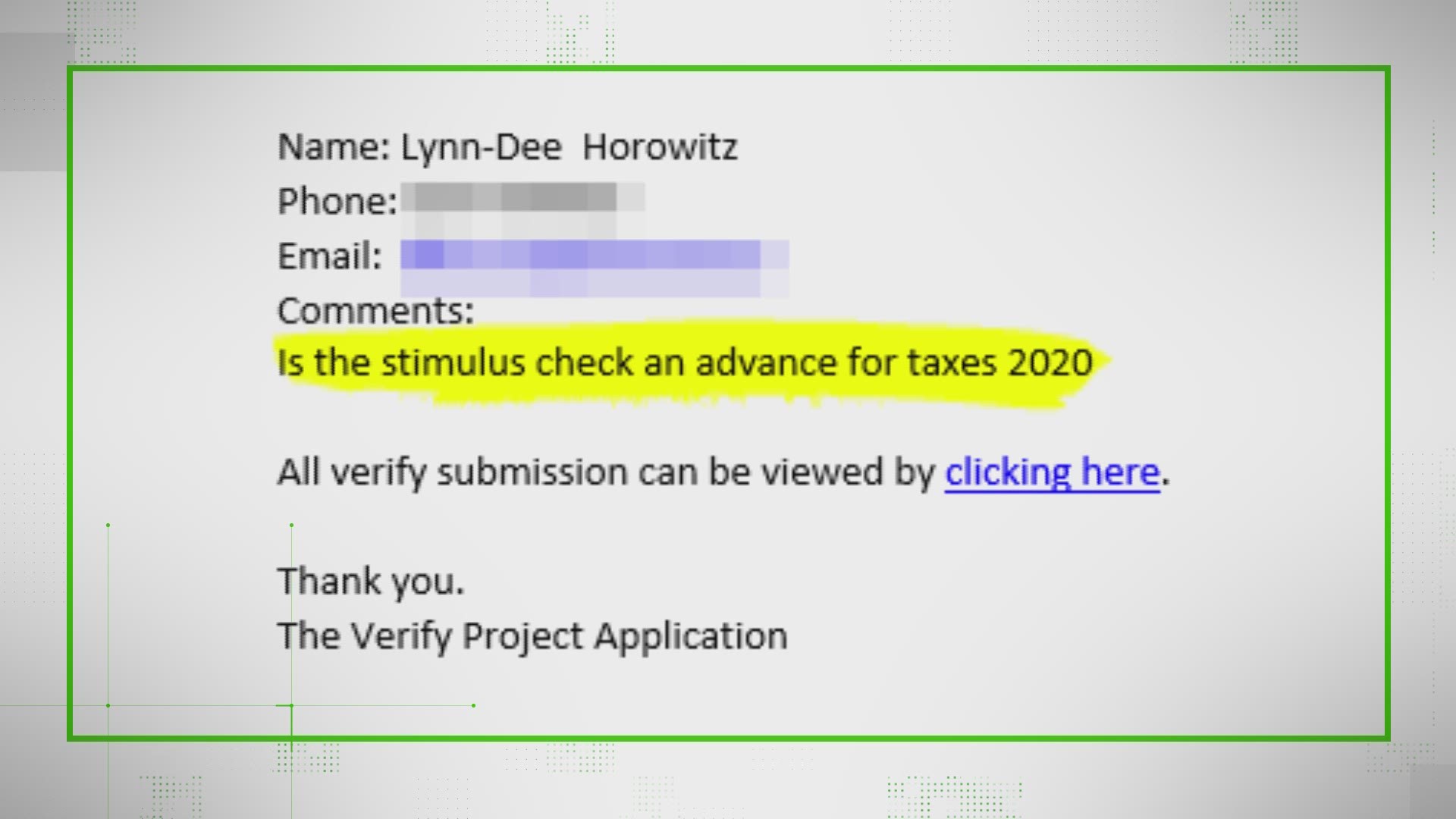

Still Didnt Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Dont Owe Taxes

The irs online where's my refund service does not keep track of amendment refunds, but you can click on the check.

Cares act stimulus check tax refund. Single taxpayers will get $1,200; If you make less than $75,000 a year (or $150,000 for married couples), you'll receive $1,200 (or $2,400 for married couples filing jointly) — and another $500 per child under 17. Those who file their own taxes but can be claimed as a dependent, however, are not eligible for a stimulus payment—so adults who are claimed by another taxpayer (like college students, elderly parents, etc.) aren’t eligible for an eip.

Will the stimulus check impact my future tax refunds? Info on covid 19 stimulus payments. Learn more in the sections below.

Were not accounted for in the budget most recently approved as of march 27, 2020 (the date of enactment of the cares act) for the state or government; Of course, there are some stipulations. However, if you did receive the stimulus money already, once you enter that amount on your tax forms, it will change your refund or what you owe.

The cares act created a stimulus check for many americans and the irs is calling them economic impact payments the cares act directs the irs to use your 2019 tax return to determine how much you. Income phaseouts start at $75,000 for single filers, $150,000 for joint returns, and. This stimulus check is essentially a 0% interest advance from the government for a credit on your 2020 tax return.

That basically just means that the cares act lowers your tax liability according to your financial status and rather than getting a larger refund in 2021, the irs is sending you part. Married taxpayers will get $2,400; Each taxpayer would get $1,200, joint filers would get $2,400.

Have your social security number filing status and the exact whole dollar amount of. And for each child under the age of 17 pare The amount of your initial third payment will no longer show in your online account.

If you received any stimulus check or got a direct deposit of economic impact payments (eip ) or through a stimulus eip debit card, a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021. As a result of the cares act, which became law on march 27, 2020, most americans will receive stimulus checks. When will i get my check?

It gives groups of americans special benefits during the upcoming months, too. That basically just means that the cares act lowers your tax liability according to your financial status and rather than getting a larger refund in 2021, the irs is sending you part of that refund now. This law gives americans the chance to get stimulus checks from the government.

The first stimulus payment sent out under the march cares act allocated up to 1 200 for qualifying american adults and 500 for the dependents listed on their 2019 tax returns so long as they. If you are entitled to a tax refund on your 2020 or 2021 taxes, your entire refund will be sent to you after your taxes are filed. An economic impact payment (or eip) is a stimulus payment provided to taxpayers by the cares act.

As a result of the cares act, which became law on march 27, 2020, most americans will receive stimulus checks. The internal revenue service said on wednesday that it had delivered 90 million payments valued at $242 billion in its first batch of checks, while the irs created this portal last year for the $1,200 stimulus checks directed by the coronavirus aid, relief and economic security, or cares, act. And for each child under the age of 17, parents will get $500.

Each taxpayer would also get $500 per qualifying child, with no limit on the number of children. If they are getting a refund, the refund will get. On your 2020 tax return, to be filed in 2021, the credit will be calculated based on your 2020 income, with any amount additional amount taken as a credit then.

Single taxpayers will get $1,200; President trump signed the cares act into law on march 27, 2020. By tupperis 15 jul, 2021.

Your refund will not be reduced by any portion. The simple answer is no. Anyone aged 17 and older who can be claimed as a dependent cannot.

In short, the cares act can be claimed by us citizens, permanent residents and residents for tax purposes (individuals who can pass the substantial presence test) who have a valid social security number (ssn) and who have filed their 2018 tax return (in 2019), or their 2019 return (in 2020) and who will be considered a qualifying resident alien for the 2020 tax year.

Stimulus Check Taxes Will Stimulus Payments Impact Your Taxes

Us Expats Coronavirus Stimulus Checks Top Faqs Hr Block

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Eip Card Stimulus Check Can I Transfer It To My Bank Account Everything You Need To Know How To Get Money How To Find Out Visa Debit Card

Stimulus Check Live Updates Novembers Changes To Child Tax Credit Payments Medicare Coverage Tax Refunds Marca

How To Find Out Your Tax Refund Status Tax Refund Irs Taxes Tax

Will The Stimulus Money Be Deducted From Your Refund Next Year Ktvbcom

5 Reasons You Didnt Get A Stimulus Check In 2021 Filing Taxes Tax Refund Social Security Benefits

How To Get A Stimulus Check If You Dont Have An Address Bank Account

Stimulus Payments May Be Offset By Tax Debt – The Washington Post

Pin On Tech Social Media

President Donald Trump Signs 22 Trillion Coronavirus Stimulus Package Into Law Carokim Consulting Llc

Third Stimulus Check Updates April 29 March – Ascom

2000 Stimulus Checks Blocked By Gop 600 Payments Are More Likely

Psa Didnt Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Stimulus Payments Have Been Sent Irs Says – The New York Times

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs – The Washington Post

3rd Stimulus Check Tax Filing Impact The Child Tax Credit And Other Faqs – Abc7 Chicago