The lessee will be taxed on rebates received. Output tax should be accounted for, and input tax can be recovered in full.

Does The 50 Vat Restriction On A Car Lease Effect You – Caseron Cloud Accounting

Requires a flat rate disallowances of 15 per cent of the amount of deduction that would otherwise be allowed (see bim47740);

Car lease tax deduction hmrc. You may be able to calculate your car, van or motorcycle expenses using a flat rate (known as. Nevertheless, for cars with co2 emissions above 130g/km, there's a. 45p for the first 10,000 miles and 25p thereafter.

Depending on whether you’re leasing for personal or business use, there are certain taxes that you will either be exempt from, or can claim back through hmrc. So, how can car leasing offer tax relief for businesses and individuals? Referencing both the tables above, you may have noticed that zero emission vehicles will be taxed a rate of 0% for 2020/21, followed by a 1% rate in 2021/22 and then 2% in 2022/23.

You can deduct all your car lease costs (less the lease rental restriction, if applicable) from your company's tax return. View our van car leasing prices. Because your client is an employee the only tax deduction she can claim is hmrc's approved mileage allowance payments (amaps), i.e.

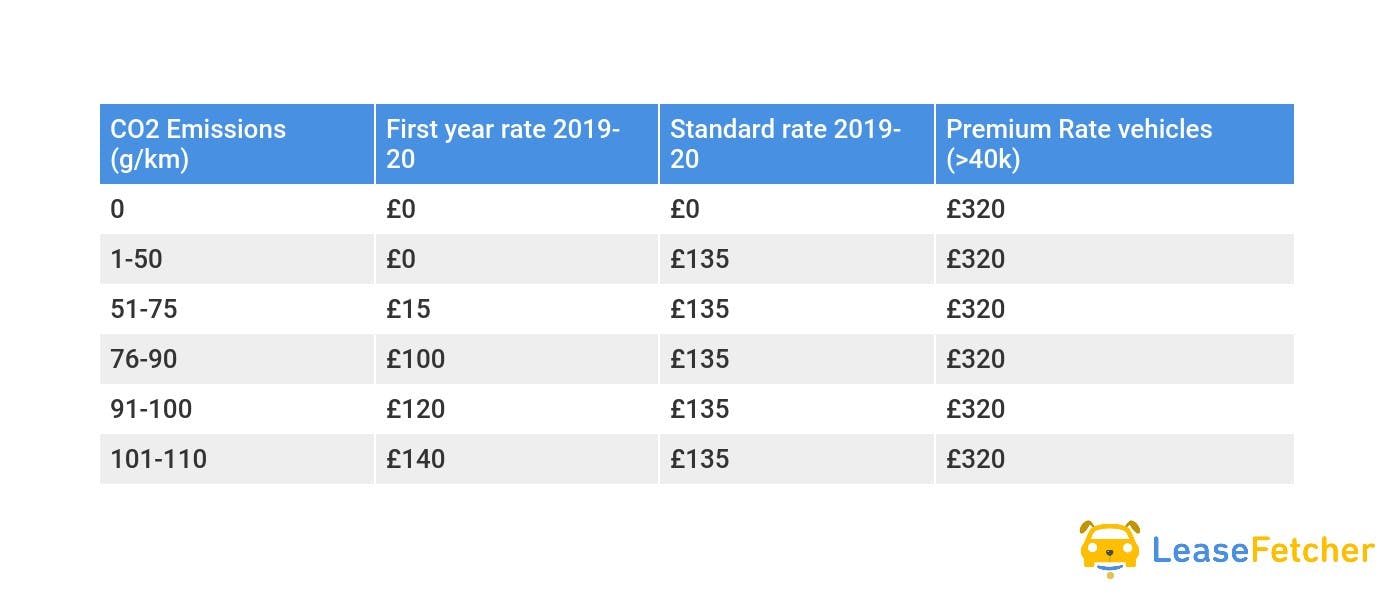

To deduct your car lease payments from your llc's tax return: If you lease a car, you can usually claim 50% of the vat. A 15% restriction applies to cars with co2 emissions of more than

In certain cases, the deduction for the cost of hiring a car which can be made in calculating the profits of a trade is restricted. She can claim a relevant percentage of the costs of running the car, including leasing, fuel, tax, insurance and maintenance backed up by suitable mileage. Applies to only one lease in a chain of leases (in most cases this will.

However, if the car’s emissions are above 110g/km, then 15% is blocked, so only 85% can be claimed for income tax or corporation tax purposes. The period of hire is more than 45 consecutive days so there is a restriction on the allowable deduction for the hire of the car. Travel between home and work.

Where a trust operates a salary deduction scheme, the input vat can be recovered in full under cos, though output tax is due on the contribution made by the employee towards the cost of the lease car. Road tax for electric cars. You may be able to reclaim all the vat if the car is used only for business and is not available for private use, or is mainly used:

In order to make tax deductions on a leased car you need to submit a final vat return form to hmrc which can be done either online or via compatible accounting software. Let's see how the hmrc treats car leasing when it comes to tax relief.if your company is leasing a vehicle, you don't own it. In some cases, the cost of your lease payments can also be.

You can claim a car lease tax deduction in a couple of ways which we outline below. The annual restriction is £3,000 x 15% = £450. That means that you can claim your monthly lease payments as a business expense.

Evs costing less than £40,000 are free from paying road tax. For example, leasing a vehicle through a vat registered company allows you to claim back 50 per cent of the vat on monthly payments and up to 100 per cent of the vat on the maintenance agreement. One of the many benefits of leasing a car is the tax reductions that come with it.

Tot up your car lease payments plus any other expenses, such as insurance and petrol, which you paid through the company. 2.5 all cars (including zero emission cars) with a list price above £40,000 also attract a supplement of £310 in addition to the sr for the first 5 years in which the sr is paid. For contracts entered in to from april 2021, tax relief for leased cars is limited according to the co 2 emissions per below:

Business expenses can rack up fast, so it’s crucial that you keep a record of all your motoring expenses that you have collected so you have proof to provide to the hmrc when you claim them back at the end of the year. This is to account for the private use of the vehicle. If your car has a list price of over £40,000, you’ll have to pay a £310 surcharge for the first five years.

When filling in your form you must account for any personal miles which may have been put on the car by employees, as you will either only be able to reclaim vat for business mileage or reclaim vat for all mileage but need to pay a fuel. But, what about if you're leasing a car. For businesses that hire or lease their cars, tax relief is limited for higher emitting vehicles.

For all the details specifically related to car leasing through your company, head over to our “how does business car leasing work?” guide. You know by now that you can get tax deductions for the personal use of a business car.

Can I Save Money By Leasing A Car Through My Company Accountants Thetford Bury St Edmunds – Knights Lowe

Hmrc Loses Company Car Tax Case Employee Benefits

Are Car Lease Payments Tax Deductible Moneyshake

Essential Guide To Company Cars And Tax Money Donut

Company Car Tax On Electric Cars – How Much Do You Pay Lease Fetcher

Guide To Company Car Tax Cash Allowance And Salary Sacrifice

Are Car Lease Payments Tax Deductible Lease Fetcher

The Tax Advantages Of Car Leasing Complete Leasing

Tax Benefits Of Business Car Leasing

Pendragon Fined 35000 Over Staff Lease Car Deals Fleet Industry News

How To Deduct Car Lease Payments As An Llc

Changes To Company Car Tax Wltp For Ulevs A Move Back To Company Cars

Company Cars Business Vehicle Expenses – Income Tax Issues For Limited Company Directors – Youtube

Is A Car Lease Tax Deductible

A Guide To Company Car Tax For Electric Cars – Clm

Are Car Lease Payments Tax Deductible Lease Fetcher

Business Tax Relief On Leased Vehicles – Car Lease 4 U

Hmrc Loses Car Lease Benefit In Kind Tax Tribunal Appeal Accountancy Daily

Are Car Lease Payments Tax Deductible Lease Fetcher