Consist principally [more than 50% of the entire assets] of immovable property situated in the philippines. Consider a transaction involving the sale of shares of a philippine company between two nonresidents, or between a nonresident seller and a philippine buyer.

Qa What Is Capital Gains Tax And Who Pays For It Lamudi

Please note that there is an exception to the application of the cgt, and that is the sale of a principal residence (your own home).

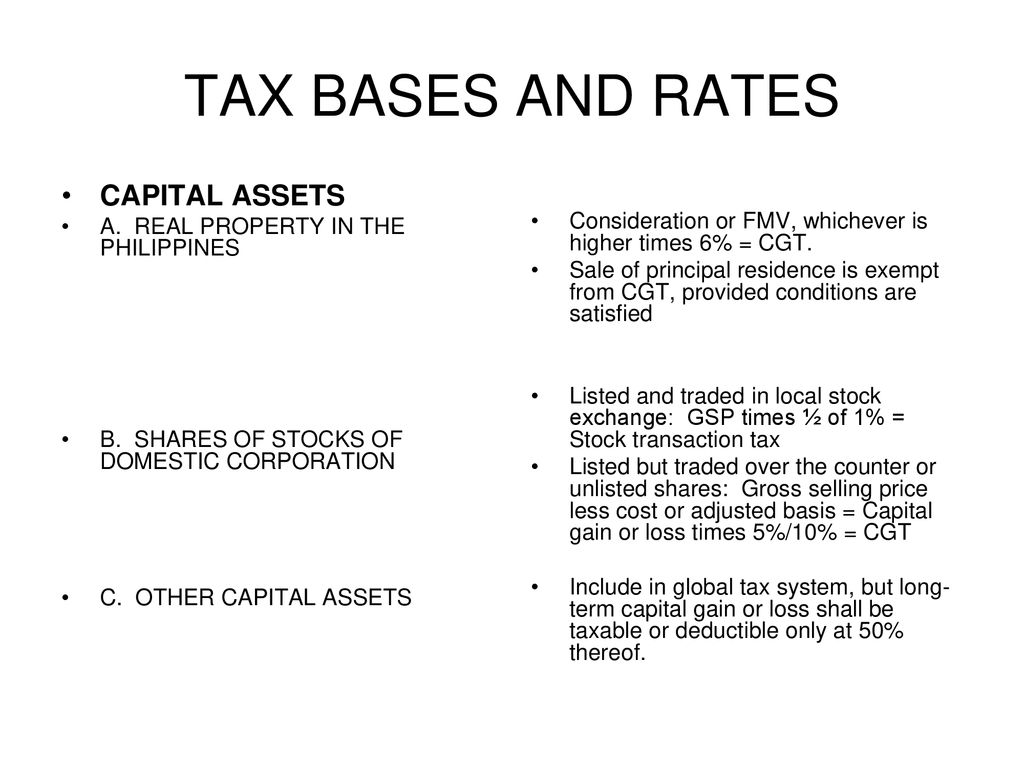

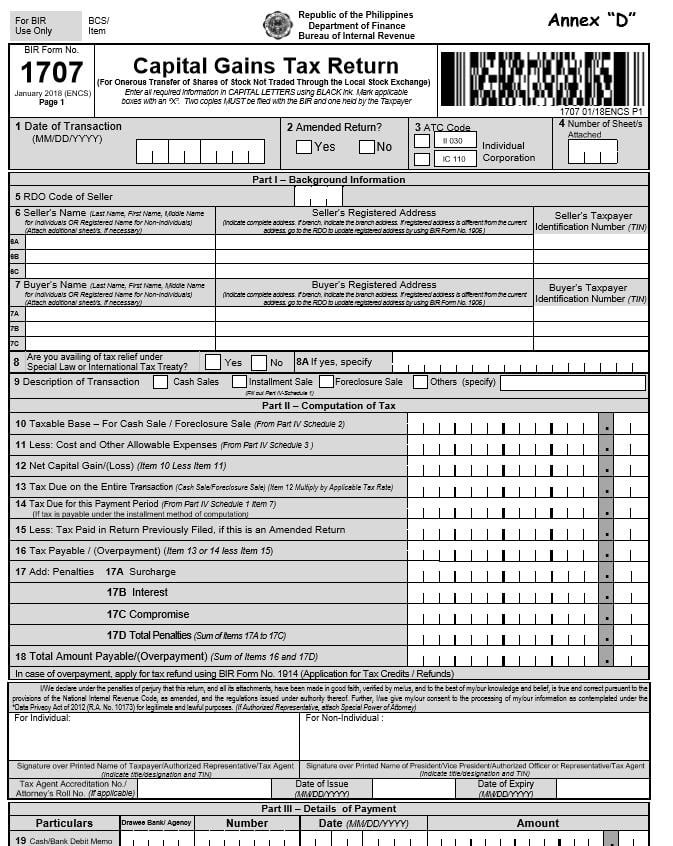

Capital gains tax philippines. If your losses exceed your gains, then you can deduct up to $3,000 of your net losses each year from the rest of your ordinary income. Gains on the sale of shares listed and traded on the stock exchange are taxed at 0.6% of the gross selling price. Capital gains derived by a domestic corporation will be subject to 15% capital gains tax.

Capital gains tax is charged at a flat tax rate of 6% of the gross selling price , and must be. 9337, the rcit is now 30% on net taxable income (beginning on january 1, 2009, down from 35%). In arriving at effective capital gains tax rates, the global property guide makes the following assumptions:

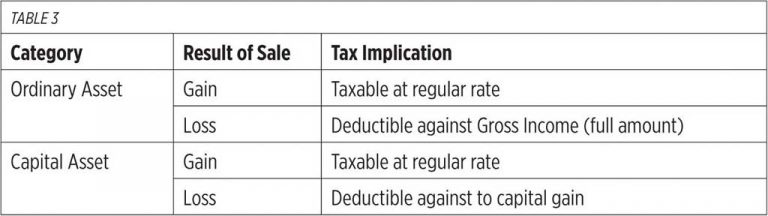

Capital gains tax capital gains tax refers to what an individual or a business pays upon making profits out of selling a valuable asset. Headline individual capital gains tax rate (%) see the philippines individual tax summary for capital gain rates. This tax is imposed on the gains that have presumed to be realized by the seller from the exchange and sale or the disposition of any other capital assets located in the philippines, including forms of conditional sale.

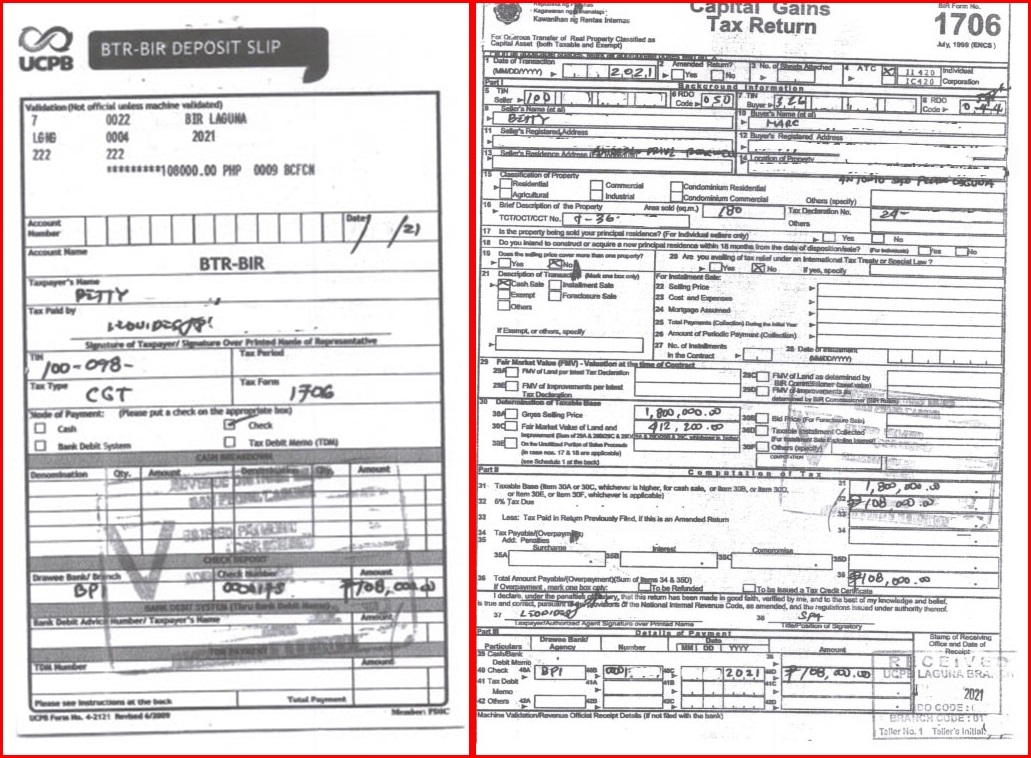

When you sell a property, the philippine government is requiring you to pay capital gains tax for the purpose of paying money in the form of tax for the transfer of the property in the philippines. A tax treaty relief application (ttra) must be filed before availing of the exemption under the applicable tax treaty. For a p10 million property, the cgt is p600,000.

Capital gains tax is imposed on gain that the seller gets from a sale, exchange or other transfer of capital assets that are located in the philippines. This includes capital gains from the sale of real estate property located in. Percentage tax is a business tax imposed on merchants or businesses that lease/sell products, services, and properties.

Any capital loss can be used to reduce your net capital gains. Under sections 24c, 24d, 27d(2), 27(d5), 28(a)(7)(c), 28(b)(5)(c), and 39a of the philippine bureau of internal revenue (bir), capital gains tax is imposed tax on the profit by the seller from the sale of real estate properties identified as capital assets. Capital gains from the sale of real property located in the philippines classified as capital assets by individuals are subject to a capital gains tax of 6 percent based on gross selling price or the current fair market value, whichever is higher at the time of sale.

Headline net wealth/worth tax rate (%) na. They have owned it for 10 years; Inheritance and gift tax rates.

Capital gains tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the philippines, including pacto de retro sales and other forms of conditional sale. On the other hand, dividend income is taxed at 10% while interest income is taxed at 20%. What is the capital gains tax rate in the philippines?

Just to give you an idea, for the sale of a p1 million property (assuming this is the fair value), the cgt is p60,000. Tax treaties generally provide for exemption from capital gains tax on the part of the seller, whose home country has a treaty with the philippines, subject to the condition that the requirements under the tax treaty. According to the philippine tax code, capital gains tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets.

Cgt is computed at 6% of the highest among the bir zonal value, tax declaration value, or selling price, so the tax savings may be significant. Please take note that you only pay capital gains tax when the property sold was not use for business such as rental property. It is their only source of capital gains in.

The regular income tax for individuals remains at 32%. If your net losses exceed $3,000, then you can use the excess deduction in subsequent years. Gains derived from the sale of real property not used in a business are subject to a 6% final withholding tax based on the higher of the sales price or the fair market value.

Subject to a 15% capital gains tax. Headline inheritance tax rate (%) there is no inheritance tax in the philippines. Pacto de retro sales and other forms of conditional sales are included in this.

Capital gains tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the philippines, including pacto de retro sales and other forms of conditional sale. The property is directly and jointly owned by husband and wife;

How To Compute Capital Gains Tax Train Law – Youtube

Capital Gains Tax In The Philippines How To Compute File And Pay

Income And Withholding Taxes – Ppt Download

12 Ways To Beat Capital Gains Tax In The Age Of Trump

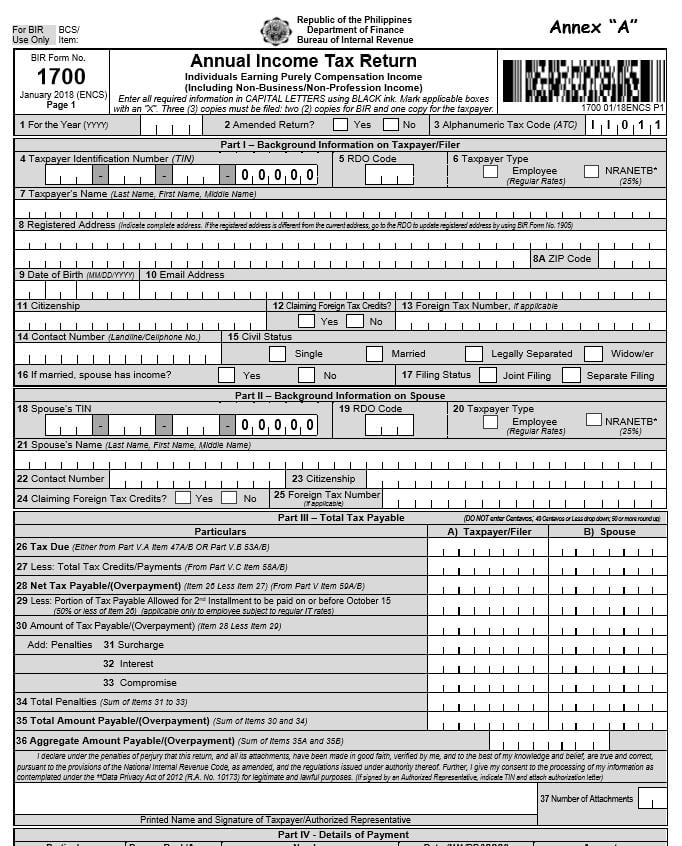

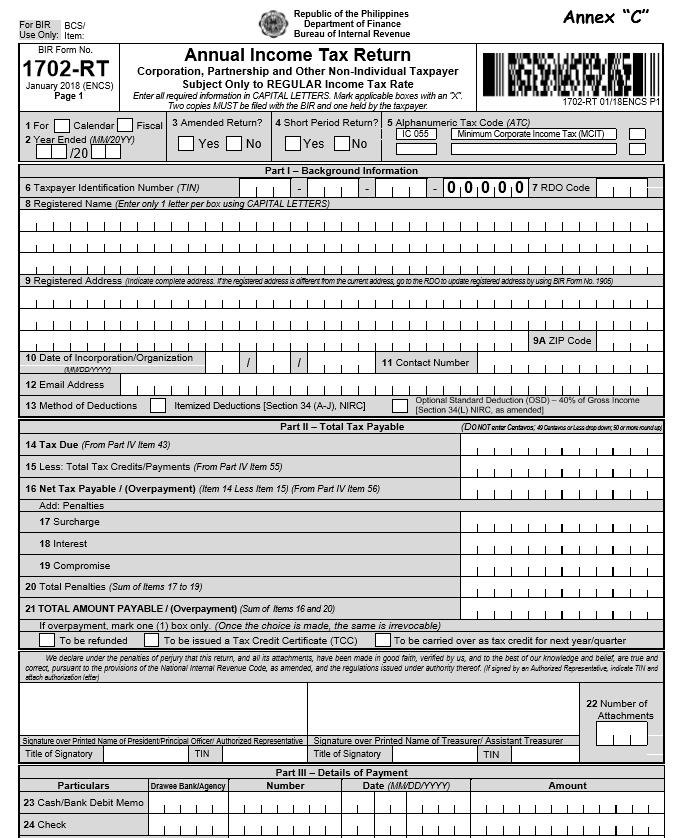

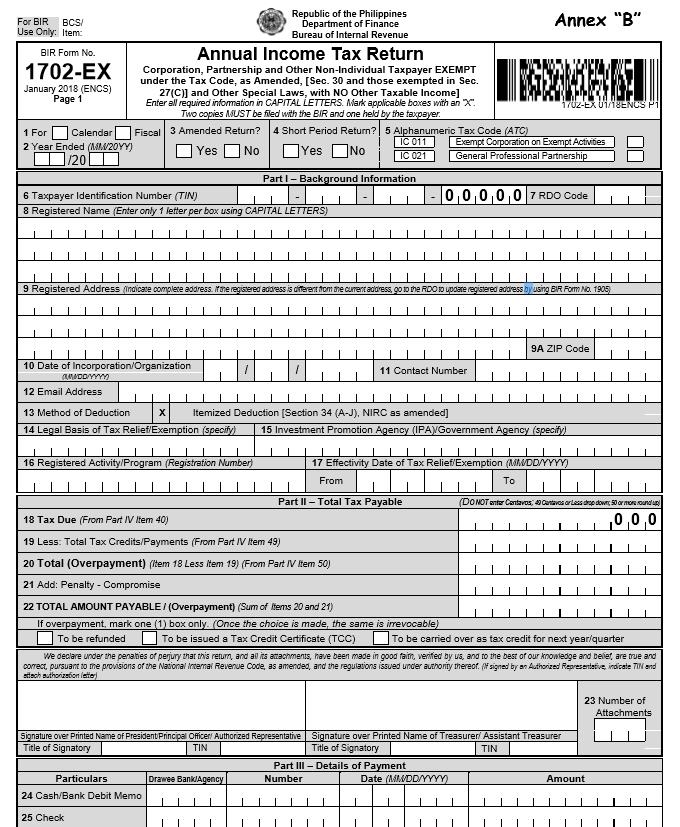

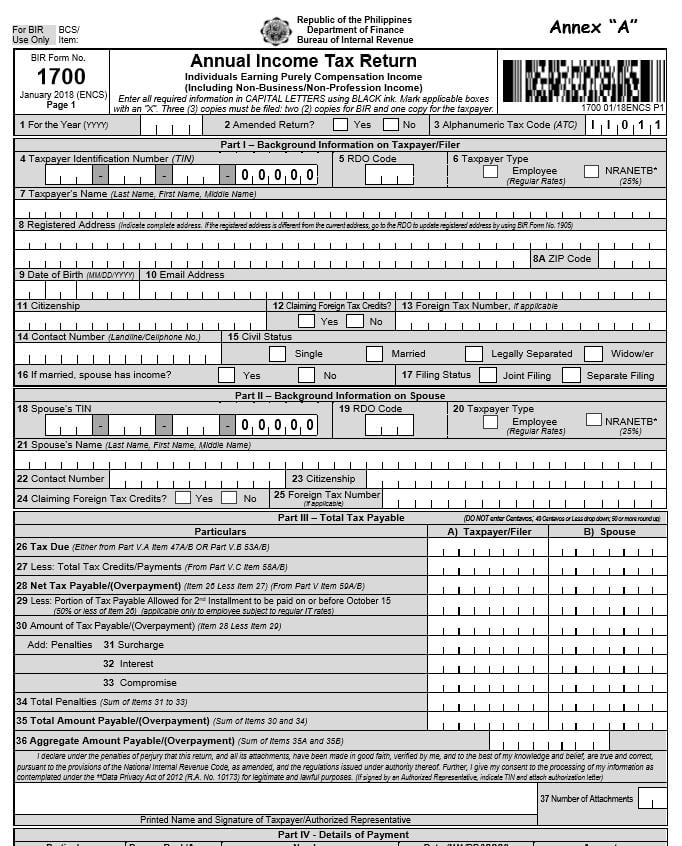

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Autumn Budget 2021 What Happened To Capital Gains Tax Crowe Uk

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Accounting And Tax Perspectives For Financial Instruments Part 2 Grant Thornton

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

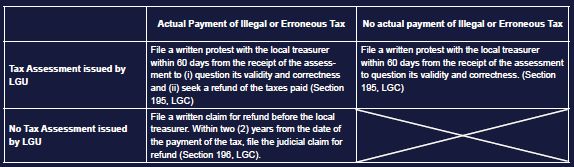

Tax Updates July 2021 Syciplaw Tax Issues And Practical Solutions Tips Vol 11 – Tax – Philippines

Taxes And Title Transfer Process Of Real Estate Properties This 2021

National Tax Research Center

How To Calculate Capital Gains Tax Hr Block

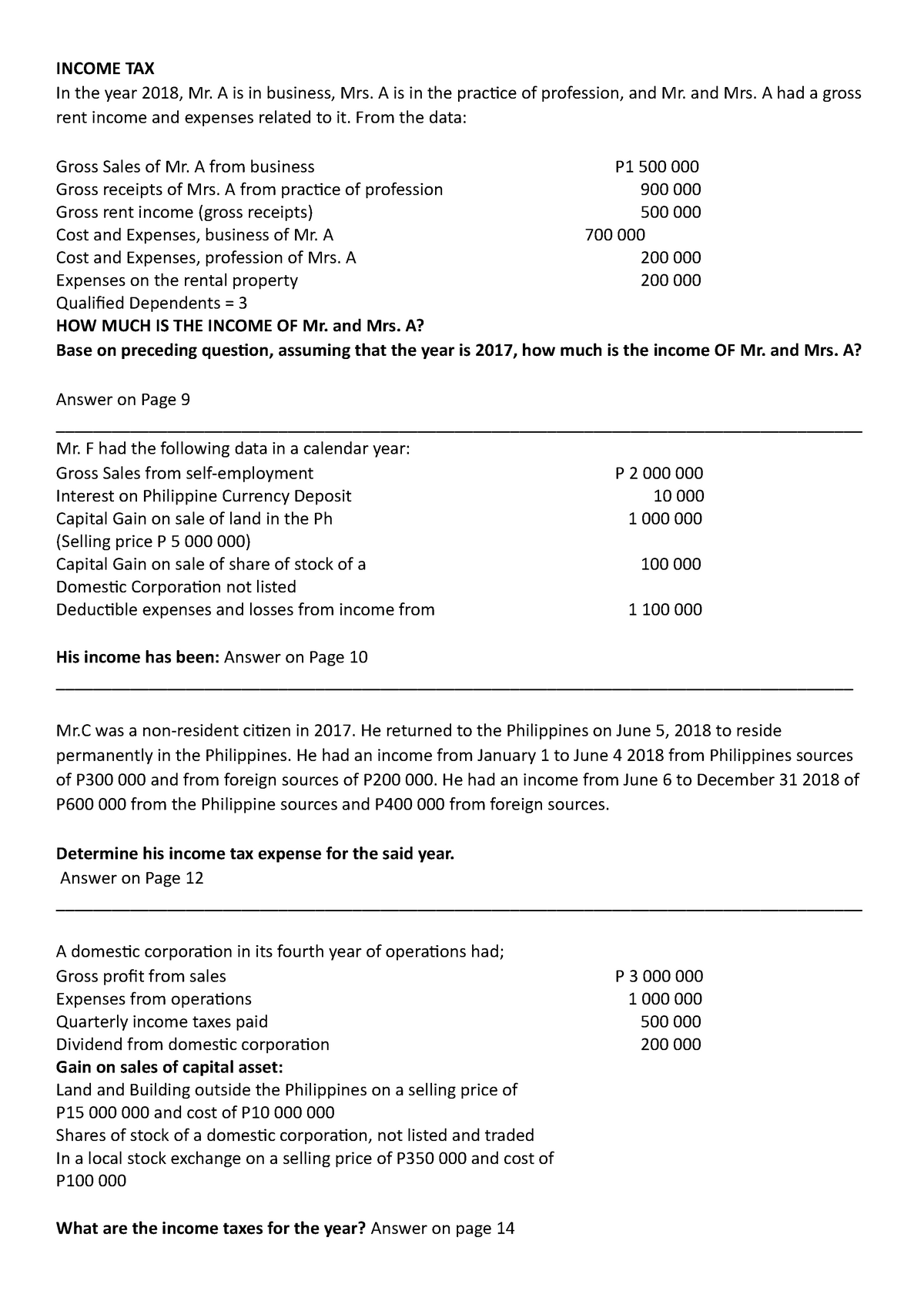

Income Tax Problems – Bachelor Of Science Nursing – Bsn – Studocu

Effect Of Train Law In The Philippine Tax Taxguro

Taxation History Of Taxation – Ppt Video Online Download

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Capital Gains Tax How To Fill-up Bir Form 1706 – Youtube