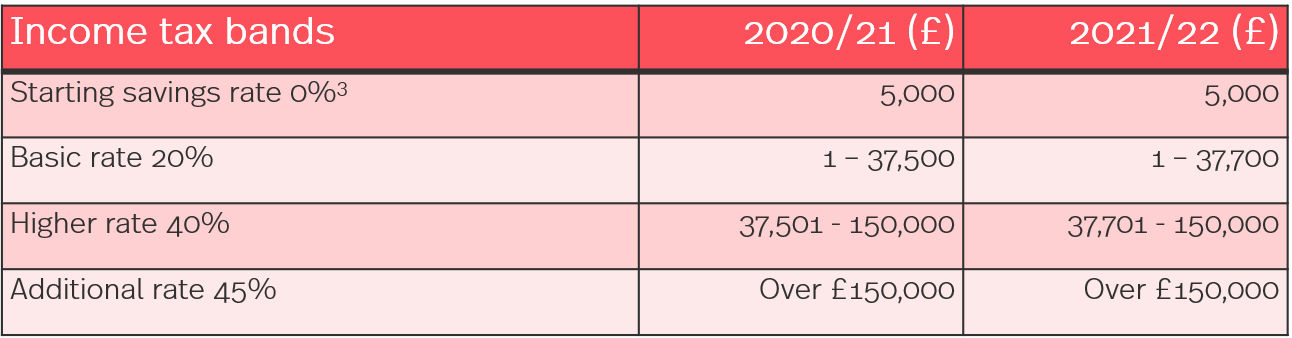

Because the combined amount of £20,300 is less than £37,500 (the basic rate band for the 2020 to 2021 tax year), you pay capital gains tax at 10%. How much is capital gains tax?

Capital Gains Tax Latest News Advice – The Telegraph

20 per cent on your gains from other chargeable assets

Capital gains tax increase 2021 uk. Cgt is charged at 10 per cent for basic rate taxpayers and 20 per cent for higher and additional rate taxpayers, or 18 per cent. For months now there has been speculation that capital gains tax rates will go up in the forthcoming budget. Capital gains tax is a pretty confusing subject.

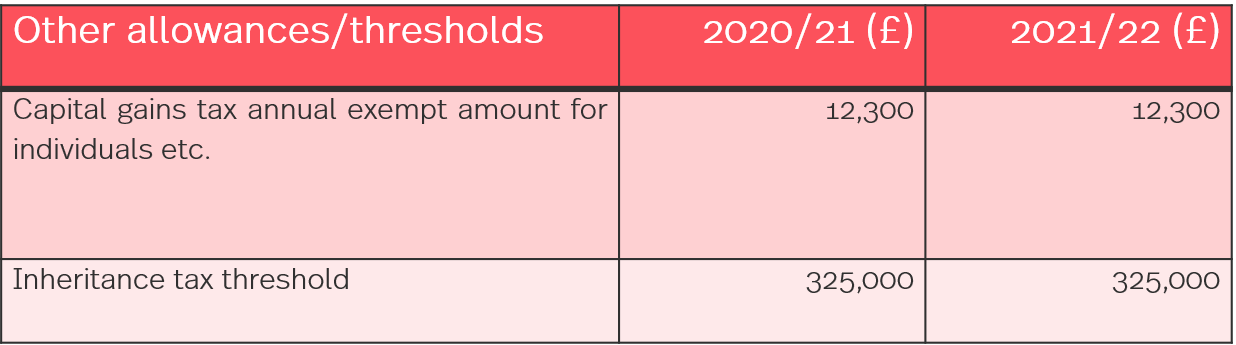

Capital gains tax will rise this year (2021) in the us and the uk. The government has shelved proposals to raise capital gains tax but has agreed to make technical tweaks to simplify the process. The first £12,300 of capital gains each year is exempt from tax.

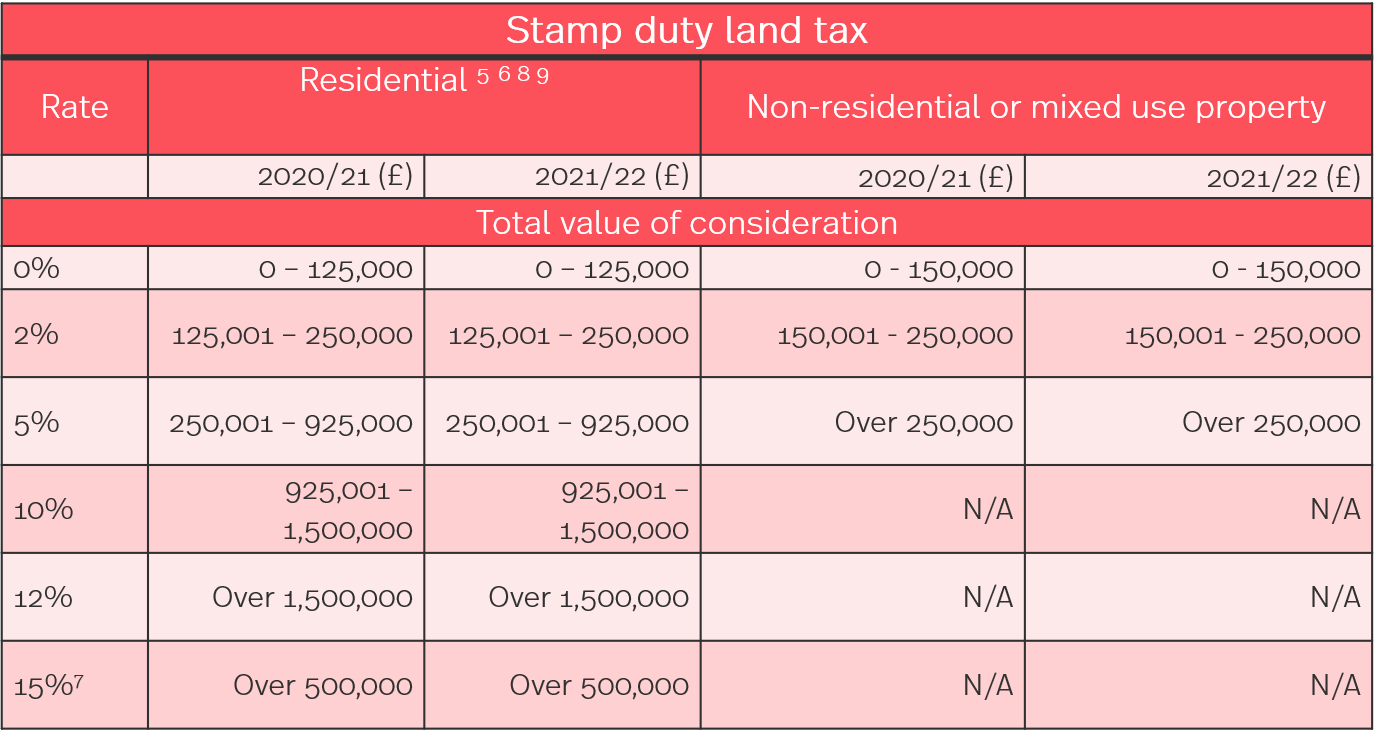

As far as residential property is concerned, cgt is currently charged at 18% on for basic rate taxpayers and 28% on any amount above the basic rate. Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022.

Ots proposals suggested bringing capital gains tax in line with income tax, currently charged at a basic rate of 20 percent, and rising to 40 percent for higher rate taxpayers. Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. The amount chargeable to income tax is £35,000 minus (£35,000 × 45) ÷ 50 = £3,500.

In particular, continued talk of a capital gains tax (cgt) reform in the uk has been widespread and resounding for some time. Higher or additional rate taxpayers pay 28% on any gains from residential property, along with trustees or personal representatives of someone who has died. Capital gains tax rate 2022.

You’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year, depending on your annual taxable income (for more on how to calculate your long. If you are on the higher rate on income tax you pay: Uk government shelves proposals to increase capital gains tax rate by:

28 per cent on your gains from residential property; However, the office of tax simplification had called for cgt to increase in line with income tax rates to 20 per cent at the basic rate and 40 per cent at the higher rate, while also lowering the initial amount exempt to just £2,000. It comes amid ongoing silence from the treasury around rumoured changes to capital gains tax (cgt), which had been expected to feature in the chancellor’s spring budget 2021 on 3 rd march.

The consideration for capital gains tax is. Bringing capital gains tax rates more in line with income tax could mean a switch to 20 per cent rates for people on the basic rate, 40. Once again, no change to cgt rates was announced which actually came as no surprise.

Will the capital gains tax rates increase in 2021? But if you’re planning to sell your online business, it’s essential that you know about it, especially in the uk right now where you could qualify for entrepreneurs relief, which is essentially a capital gains tax relief. To fund the bbb, original drafts included widespread tax increases on individuals and corporations, including an increase in the capital gains rate for transactions occurring after september 13, 2021.

Tax on capital gains would be increased to 28.8 per cent by house democrats. Cgt on property sales ranges from 18 per cent to 28 per cent depending on the rate band, with sellers required to inform hm revenue & customs (hmrc) about the sale and pay any tax on the capital. In the wake of the unprecedented, but necessary, public spending throughout the pandemic, the treasury will certainly need to find ways to reduce the deficit and rebalance the uk’s finances.

The value of the freehold subject to the lease was £50,000.

Autumn Budget 2021 Dividend Tax Rises Which News

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Autumn Budget 2021 Dividend Tax Rises Which News

Uk Capital Gains Tax For British Expats And People Living In The Uk – Experts For Expats

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

Tax Advantages For Donor-advised Funds – Nptrust

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Simmons Simmons Hmrc Tax Rates And Allowances For 202122

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunaks List Autumn Budget 2021 The Guardian

Capital Gains Tax Latest News Advice – The Telegraph

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceaseds Death Low Incomes Tax Reform Group

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

Do I Have To Pay Capital Gains Tax When I Gift A Property