Perhaps the most newsworthy item in the treasury department greenbook was the biden administration's proposal to increase taxes on capital gains on a retroactive basis. At this point, many ideas are being considered as.

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Capital gains tax increase 2021 retroactive. Up until now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income. A retroactive tax increase is patently unfair and cannot be constitutional, right? If this were to happen, it may not only.

Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. Joe biden campaigned on raising the capital gains tax rate to 39.6% from 20.0% on those earning more than $1 million. Still another would make the change to capital gains tax retroactive, with a start date of april 2021.

The current maximum 20% rate will continue to apply to gains earned prior to september 13, 2021, as well as any gains that originate from transactions entered into under binding written contracts prior to september 13, 2021. The later in the year that a democratic tax bill (if any) is passed, the less likely it will have any retroactive effect. Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021.

In some cases, you add the 3.8% obamacare tax, but at worst, your total tax bill is 23.8%. Still another would make the change to capital gains tax retroactive, with a start date of april 2021.1,2. It's entirely possible that a capital gains tax hike could be passed retroactive to january 1, 2021.

If this were to happen, it may not only seem unfair, but it is also bad tax policy. To take the capital gains top rate to 25% for people earning more than $400,000 per year and making. At this point, many ideas are being considered as legislators look for ways to raise revenue to help pay for the build back better plan.

On the capital gains side, “the idea is. As described in the greenbook, this date will likely fall in april of 2021. Since the democratic majority is so thin, there is little chance any tax increase will be made retroactive to january 1, 2021.

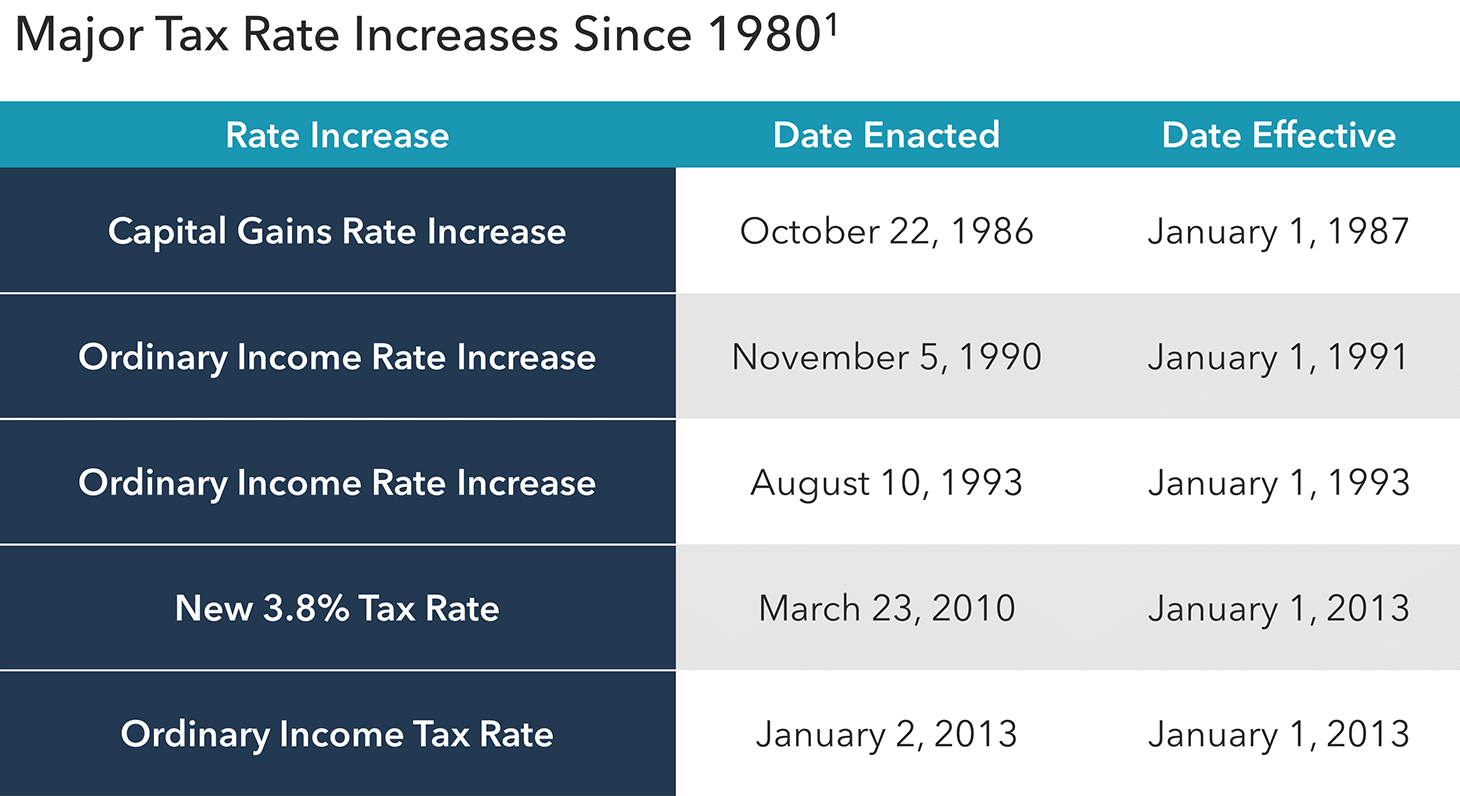

However, history tells us that isn't the most likely scenario. One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.[9] president biden’s budget proposal suggested raising the rate on such capital gains to 43.4 percent for households with income over $1 million, effective for all sales on or after april 2021. Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021.

It is important to note that it would not be retroactive to january 1, 2021, so all previously recognized portfolio activity or any sale agreed upon prior to october 1 st but executed post october 1 st (i.e., signed real estate contract or agreed upon business sale) would still be subject to the 20% capital gains rate. One idea in play is a retroactive capital gains tax increase, raising the top tax rate, currently 23.8 percent, imposed on the gain from the sale of assets held longer than a year.9 president biden’s budget proposal suggested raising the rate on such capital gains to 43.4 percent for households with income over $1 If the democratic tax bill passes, will it be retroactive to january 1, 2021?

Are retroactive tax increases constitutional or even fair?

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

List Of Potential Retroactive Airdrop Projects In 2021-2022

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Bidens Proposed Retroactive Capital Gains Tax Increase White Sands Tax Solutions

What Is Retroactive Airdrop The Best Returns With Minimal Investment

Bidens Tax Plan Goes Back To The Future With Retroactive Capital Gains Hikes

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

What Is Retroactive Airdrop The Best Returns With Minimal Investment

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Bidens Capital Gains Tax Hike Plan Could Legally Become Retroactive

A Retroactive Tax Increase – Wsj

Wall Street Panicking That Bidens Tax Hikes Will Be Retroactive

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains Rsuperstonk

Bidens Proposed Retroactive Capital Gains Tax Increase White Sands Tax Solutions

What Is Retroactive Airdrop The Best Returns With Minimal Investment

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

What Is Retroactive Airdrop The Best Returns With Minimal Investment

.png)

Bidens Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp – Jdsupra

Would Teachers Strike In Clark County Mirror Labor Wins Elsewhere Teachers Strike School District Boards National Education Association