Instead, as an investor one would pay the income tax on part of the gain that they make. The same rules apply in the case of a change of use (i.e.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The below outlines the current tax treatment of capital gains in canada and the u.s., the appetite for change in each country, and a few questions to ask your financial planner about realizing capital gains before december 31, 2020.

Capital gains tax changes canada. Tax base, improving tax enforcement and levying new taxes. Lifetime capital gains exemption limit. For qualified property, there is a lifetime capital gains exemption that allows for a certain amount of the gain to be tax exempt.

Your income tax rate bracket is determined by your net income, which is your gross income less any contributions to registered investment accounts. The federal government's 1971 decision to include capital gains in income was part of a sweeping change to the canadian income tax system. Before this time any capital gains were not subject to tax.

Over the years, the taxation of capital gains has been normalized. In this case, the cra allows owners to file an election to defer the payment of tax until a true sale takes place, provided you do not claim cca. The rate of capital gains in tax in canada has changed several times since it was introduced in 1972.

The canada revenue agency (cra) imposes capital gains tax on investment gains realized through the sale of certain assets. What is the capital gains tax rate in canada? When the tax was first introduced to canada, the inclusion rate was 50%.

Increasing the capital gain inclusion rate may be one tax change the canadian government could consider in order to boost tax revenues. Please select all that apply: For more information, see what is the capital gains deduction limit?

Owners feel this will unfairly target them. In order to provide relief to the exchequer, the canada revenue agency (cra) has made changes to a few tax breaks in 2022. In canada, 50% of the value of any capital gains are taxable.

The inclusion rate is the amount of capital gains that is added to your income to determine your final tax bill: They have increased the lifetime capital gains exemption limit (lcge) “for dispositions in 2020 of qualified small business corporation shares, the lifetime capital gains exemption (lcge) limit has increased to $883,384.” For the past 20 years, capital gains in canada have been 50% taxable.

The rates do not stop there. Candidates and their political parties are proposing several changes to the current tax schemes. Election platform, the ndp proposed to increase the capital gains inclusion rate to 75% from 50%.

In the income tax act, there is no special tax relating to gains you make from investments and real estate holdings. However, the cra recognizes that property owners may face difficulty paying capital gains tax when a sale has not occurred. Although the concept of capital gains tax is not new to canadians, there have been several changes to the rate of taxation since its introduction in 1972.

The capital gains tax rate in canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50% capital gains inclusion rate. This has canada speculating, again, if a hike to the capital gains inclusion rate may occur in the upcoming federal budget. They are also one of the most beneficial, since they are taxed at a very low amount for individuals.

The federal government website says the following about capital gains changes in 2021. For dispositions in 2020 of qualified small business corporation shares, the lifetime capital gains exemption (lcge) limit has increased to $883,384. In canada, the current capital gains inclusion rate is 50%.

Additionally, a section 1250 gain, the portion of a gain on a sale that. Canada first introduced a capital gains tax in 1972. This strategy largely involves hitting them with a 75 percent capital gains rate.

This has canada speculating, again, if a hike to the capital gains inclusion rate. The new democratic party (ndp), in particular, pledges to. The federal budget date has not yet been announced, but if a change is

This increased to 75% in 1990 and was then reduced back to 50% in 2000, where it has remained for the last 20 years. In canada, capital gains are one of the most common types of income that taxpayers report. The cra has increased indexation rates.

The department of finance canada has released their proposed changes aiming to close perceived income tax loopholes relating to the use of private corporations. Should you sell the investments at a higher price than you paid (realized capital gain) — you'll need to add 50% of the capital gain to your income. The tax base includes profits or losses made by selling investments such as stocks, bonds, mutual funds, and listed.

The notion that capital gains should form a part of the tax base has largely been accepted, both in canada and globally. This week the ndp’s jagmeet singh promised to crack down on “big money” house flippers. Canadian real estate and capital gains taxes are once again in the spotlight.

Report a problem or mistake on this page. The history of capital gains in canada starts in 1972. Specifically, finance has targeted strategies designed to multiply access to the lifetime capital gains exemption.

Possible Changes Coming To Tax On Capital Gains In Canada – Smythe Llp Chartered Professional Accountants

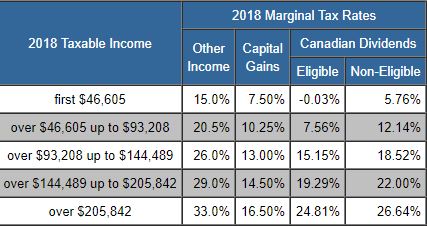

Taxtipsca – Canada Federal 2017 2018 Income Tax Rates

Capital Gains Tax Calculator For Relative Value Investing

House Democrats Tax On Corporate Income Third-highest In Oecd

Taxtipsca – Ontario 2019 2020 Income Tax Rates

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

Understanding Taxes And Your Investments

Capital Gains Tax Capital Gain Integrity

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Tax Tips 2016 Investment Income Capital Gains And Losses – Tax – Canada

Capital Gains Tax Calculator For Relative Value Investing

Tax Tips 2016 Investment Income Capital Gains And Losses – Tax – Canada

How Do Capital Gains And Losses Affect Your Income Tax

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Possible Changes Coming To Tax On Capital Gains In Canada – Smythe Llp Chartered Professional Accountants