In theory, it would be straightforward to ‘simplify’ many iht rules with. The annual exemption for 2021/2022 will remain at £12,300 and the chancellor announced that the annual exemption will remain at this amount for the tax years 2021/22 to 2025/26.

Capital Gains Tax Commentary – Govuk

Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the.

Capital gains tax changes 2021 uk. There is an annual allowance of an initial £12,300 on which no cgt would be paid. Chancellor rishi sunak’s budget did not ignore capital gains tax after all. Videos you watch may be.

No changes were announced to the rates of capital gains tax with the higher rate remaining at 20% and the basic rate at 10%. If you own a property with a partner, you both get that personal capital gains tax allowance. Capital gains tax changes in 2021 | what do uk investors need to know?

Which is not their first home. Capital gains tax uk changes are coming. If playback doesn't begin shortly, try restarting your device.

You have made a taxable gain of £2,000. A recent report from the uk office of tax simplification (ots) following a review of the capital gains tax (cgt) has outlined some recommended changes to capital gains tax. Currently, the taxable rate for chargeable assets is 20% for higher rate taxpayers, so you would be charged £400 in capital gains tax, leaving you with £1,600 profit.

The chancellor will announce the next budget on 3 march 2021. Each year at the moment, there is a personal capital gains tax allowance. The capital gains tax annual exemption is £12,300 for the year 2021/2022.

The biggest question asked of private client advisors over the past couple of years is when do we expect capital gains tax (cgt) to increase. This was not immediate issue in 2015, 2016 but as the years have elapsed, the potential for larger taxable gains has increased. Reduce the current capital gains.

Capital gains taxes on collectibles. The chancellor could decide to reduce this allowance, with these changes being tapered over a number of years. Because the combined amount of £20,300 is less than £37,500 (the basic rate band for the 2020 to 2021 tax year), you pay capital gains tax at 10%.

However, the office of tax simplification had called for cgt to increase in line with income tax rates to 20 per cent at the basic rate and 40 per cent at the higher rate, while also lowering the initial amount exempt to just £2,000. Bringing capital gains tax rates more in line with income tax could mean a switch to 20 per cent rates for people on the basic rate, 40. It comes amid ongoing silence from the treasury around rumoured changes to capital gains tax (cgt), which had been expected to feature in the chancellor’s spring budget 2021 on 3 rd march.

Once again, no change to cgt rates was announced which actually came as no surprise. The proposed capital gains tax reforms, of which any budget. The second part of the report is due in 2021.

Cgt on property sales ranges from 18 per cent to 28 per cent depending on the rate band, with sellers required to inform hm revenue & customs (hmrc) about the sale and pay any tax on the capital. Additionally, a section 1250 gain, the portion of a gain on a sale that was previously depreciated, is.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunaks List Autumn Budget 2021 The Guardian

Making Tax Digital Accountant In 2021 Accounting Services Bookkeeping Services Accounting

Capital Gains Taxes Are Going Up Tax Policy Center

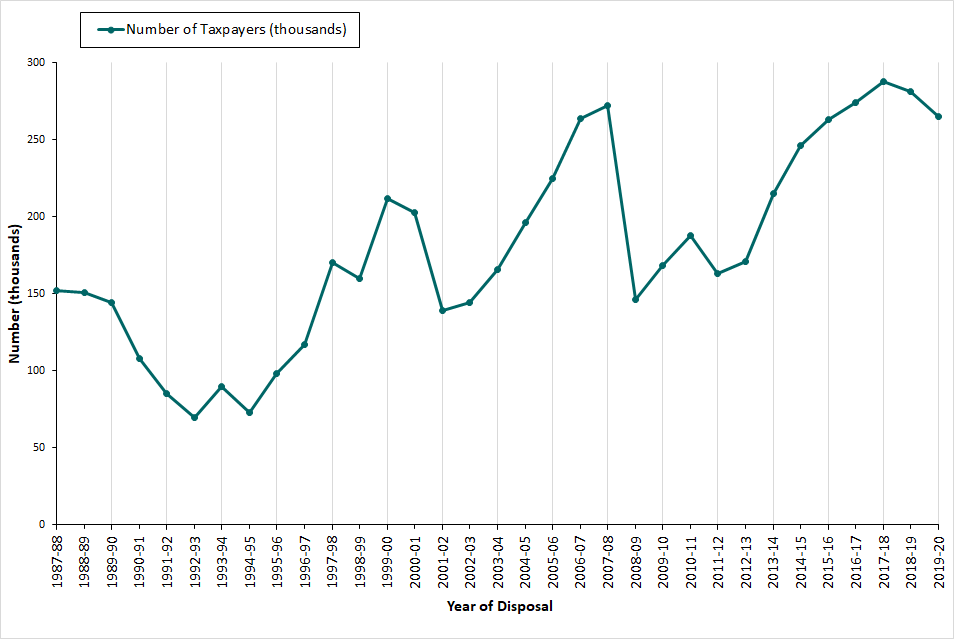

Capital Gains Tax Commentary – Govuk

Main Residence Property Sale – New Capital Gains Tax Implications Kirk Rice

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

How To Avoid Or Cut Capital Gains Tax By Using Your Tax-free Allowance Getting An Isa And More Lovemoneycom

Hmrc Will Answer Your Questions In 2021 How To Apply Moving To The Uk Interactive Brokers

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

How Much Is Capital Gains Tax – Times Money Mentor