March 31 april 30 june 30 july 31 september 30 october 31 december 31 january 31 For business and occupation (“b&o”) tax purposes, taxpayers earning apportionable revenue calculate their taxable washington revenue by applying a “receipts factor” apportionment methodology.

Citumwaterwaus

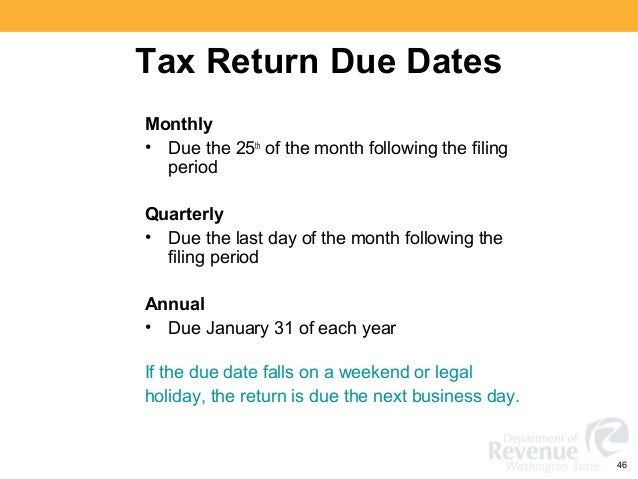

Monthly returns are due on 25th of the following month;

B&o tax due dates. December 31 for tax period ending november 30) january, february, march april 30 tax due april 15 april, may, june july 31 july, august, september october 31 october, november, december january 31 15, 2021, and pay any tax due. For purposes of the b&o tax, business activities have been divided into

Annual b&o tax apportionment reconciliation due october 31st for washington state. Monthly returns are due the last day of the month following the tax month (e.g. If a due date falls on a weekend or holiday, returns are due the next business day.

Quarter 1 tax return is due april 30.) 31, 2019, can provide answers to many questions. Many washington state cities such as seattle, bellevue, and tacoma use the filelocal website for b&o taxes, a convenient way to pay.

Cities with a b&o tax must calculate interest and provide for refunds, assessments for additional taxes, and penalties in accordance with chapter 82.32 rcw. Seattle businesses must file for b&o taxes on a periodic basis depending on their estimated annual income; B&o tax returns are due within one month following the end of the taxable quarter.

If you file quarterly, your return is due in april, august, october, or january (the month after the quarter ends). Changes since then in the city code or state law may. B&o tax schedule tax returns must be filed for each period, even if no tax is due.

If yes, then continue to 2. Only first and second quarter 2020 b&o tax filings qualify. Penalty and interest will be applied against any return that is received after these months.

Regardless of the frequency, they are always due on the last day of the month. Quarterly returns and payment are due on or before the end of the month immediately following the end. B&o tax is a gross receipts tax measured on gross proceeds of sales or gross income for the reporting period.

For this automatic due date extension, a “small business” is defined as any taxpaying business that reported taxable income of $5 million or less during the 2019 tax year. Quarterly payments are due in april, july, october and january. City taxes are based on your revenue.

The following section discusses the most common exemptions and deductions from the b&o tax. Any arrears in the payment of the quarterly tax shall bear interest of 12% per annum from the date due until paid. Posted on sep 10, 2020.

Business and occupation tax is payable on the following schedule: And the due date for the annual returns changed from jan. May 1, august 1, november 1 and february 1 for the preceding quarter.

The city’s business & occupation tax is payable each quarter when taxable gross receipts do not exceed $50,000 per month. Annual due dates are listed below for the combined excise tax return, business & occupation activities return, and retailing & other activities return. June tax return is due july 31) quarterly returns are due the end of the month following the tax quarter (e.g.

Due dates are as follows: Quarterly filers who believe they may qualify to be an annual filer may contact a city of issaquah b&o team member at bando@issaquahwa.gov to request to become an annual filer. Gross income includes business activities conducted both within and outside the city of tacoma, regardless of your businesses’ physical location.

Looking for the due date for the 2020 annual return? * all businesses must file a business & occupation tax form even when no payment is due. If yes, then continue to 3.

Tax guide and other resources. Monthly filers of course file every month. The third quarter tax returns and payments were due on oct.

Those who report for 2021 annual taxable gross receipts of $170,000 or less are exempt from the b&o gross receipts tax, and will be placed on an annual filing status for the following year. Quarterly returns are due by the end of the month following the close of the quarter; The b&o tax guide, with information current as of dec.

The b&o tax is calculated on the gross receipts of the business. Annual filers’ returns are due january 31st each year. If you file quarterly, your return is due in april, august, october, or january (the month after the quarter ends).

A business and occupation tax is imposed on any persons (s) engaging or continuing with the state in any public service or utility business, except railroad, railroad car, express, pipeline, telephone and telegraph companies, water carriers by steamboat or steamship and motor carriers. Utility tax and report due: Tax period due date tax due the last day of the following month (example:

These taxpayers will receive an annual business and occupation tax form by mail in december and must report and pay any tax due by april 15 of each year. Shall be assessed at one percent of the amount due if return is filled late. Did your business gross $20,000.00 or more inside burien?

If no, enter gross amount $_____, sign below and return this form to the city. Did your business gross $200,000.00 or more in all locations? Exemptions and deductions allowed for certain business activities:

Important due dates for businesses january ,description 15,payroll taxes due for december payroll (monthly depositors 1) 25,washington state b&o tax due for december revenue (monthly filers 2) 31,washington state b&o tax due for previous quarter revenue (quarterly filers) 31,washington state b&o tax due for previous year revenue (annual filers) 31,final day to mail. B&o tax is calculated on gross receipts at a rate of 0.1% for all classifications. Employers must report income tax withholding and fica taxes for first quarter 2021 (form 941), if you deposited on time and in full all of the associated taxes due.

Www2deloittecom

Www2deloittecom

Slt Adapting To New Federal Tax Returns Due Dates In New York – The Cpa Journal

When Are Washington State Bo Taxes Due In 2021

Coborg

Business Occupation Tax Bainbridge Island Wa – Official Website

Tax Due Dates – Goodwin Accounting Tax Co Inc

Dont Miss The Washington State Tax Reconciliation Deadline

Assetskpmg

Washington State Sales Use And Bo Tax Workshop

Www2deloittecom

Issaquahwagov

When Are Washington State Bo Taxes Due In 2021

A Guide To License Business And Occupation Tax Bo

When Are Washington State Bo Taxes Due In 2021

Bo Tax Return – City Of Bellevue

When Are Business Occupationbo Taxes Due

Coborg

Coborg