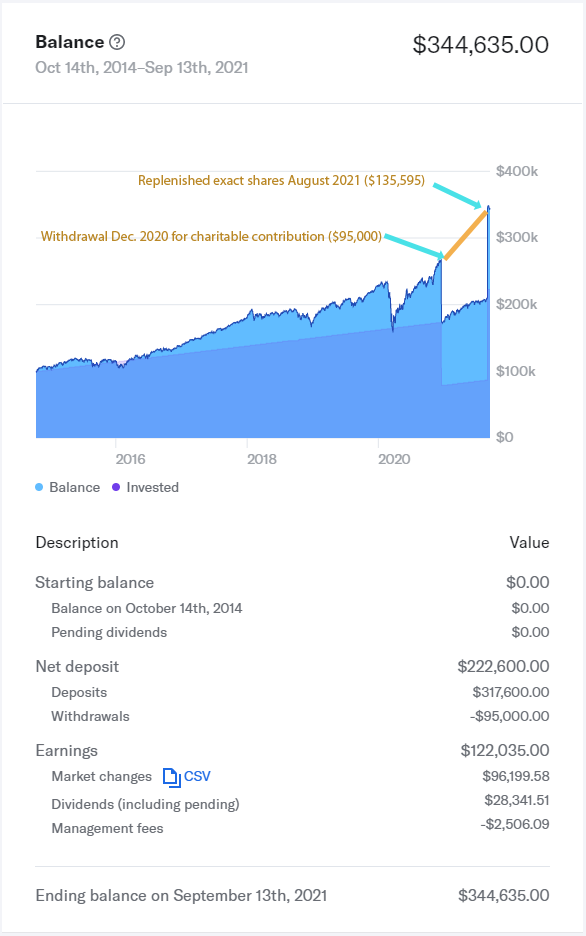

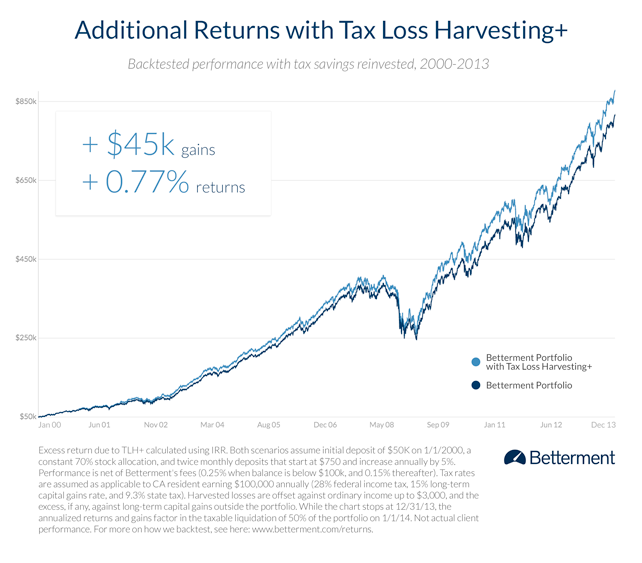

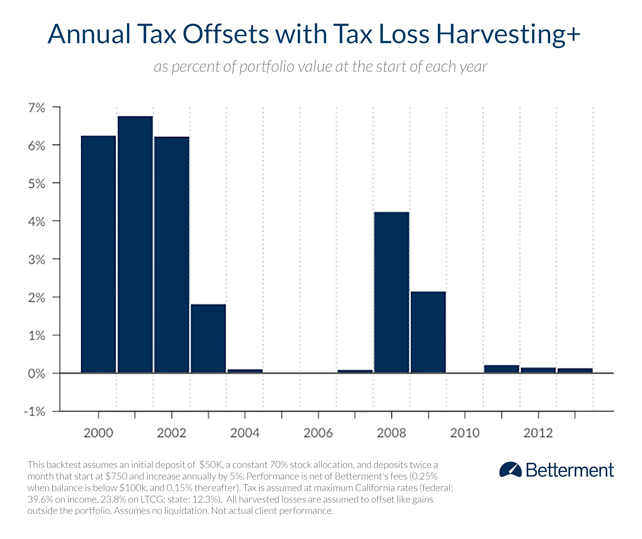

In this white paper, we introduce betterment’s tax loss harvesting+™ (tlh+™): (the company’s own white paper, though, suggests an estimated 0.77% boost for a typical customer.)

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

It allows the investor to realize, or “harvest” a valuable loss while keeping the portfolio balanced at the desired allocation.

Betterment tax loss harvesting white paper. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize betterment’s tax loss harvesting+ (“tlh+”) feature. Betterment’s primary and secondary stock etfs for tlh+ if you own any of the above stock etfs in an external taxable account, you need to both watch for wash sales manually and potentially disable dividend reinvestment. Tax loss harvesting with betterment.

If you want to learn more, the betterment white paper on tax loss harvesting is a superb resource. Tax law, losses incurred in the sale of securities and other assets provide potential tax benefits for investors. Tax loss harvesting is the practice of selling a security that has experienced a loss.

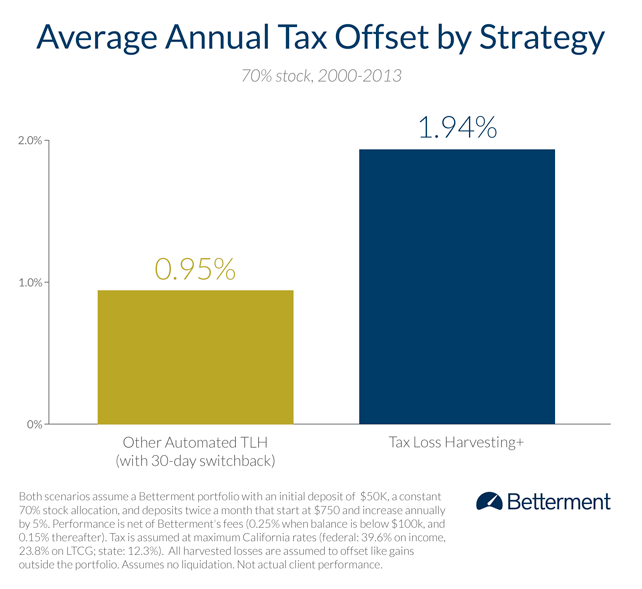

Betterment wrote a white paper on tlh+, which presents data that suggests their algorithm, with very reasonable assumptions on marginal tax rates given an attending physician audience, will produce gains of about twice that of simpler automated tax loss harvesting algorithms extant. Typically, this involves selling assets that are in a portfolio that are currently worth less than you paid for them. For details on the operation of tlh+, you.

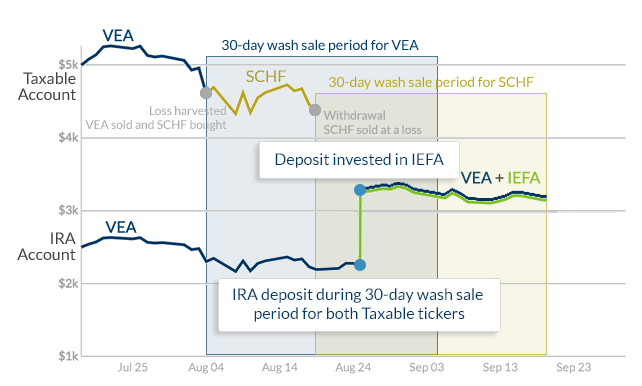

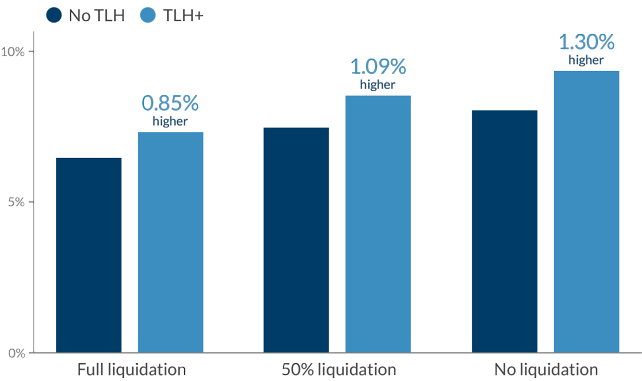

Tax loss harvesting is a complicated subject in it’s own right, so if you’re interested in learning more about it, check out betterment’s tax loss harvesting white paper on the topic. Betterment and wealthfront claim that tax loss harvesting gives an extra.77% vs 1% respectively which would more than offset their.15% and.25% respective fees. This strategy takes advantage of different tax treatments between taxable and ira accounts.

In its white paper on the betterment tax loss harvesting program, betterment goes into detail about many issues surrounding etf investments and how its program works better than an individual or other computer programs on the market. For reference, here are the primary and secondary stock etfs subject to tax loss harvesting plus per betterment’s white paper: Betterment charges a percentage fee on the amount of money that you have under management on the platform.

The sold security is replaced by a similar one, maintaining an optimal asset allocation and expected returns. By realizing, or harvesting a loss, investors are able to offset taxes on both gains and income. Moreover, the goal will be rebalanced entirely to match the new desired target allocation, regardless of tax consequences.

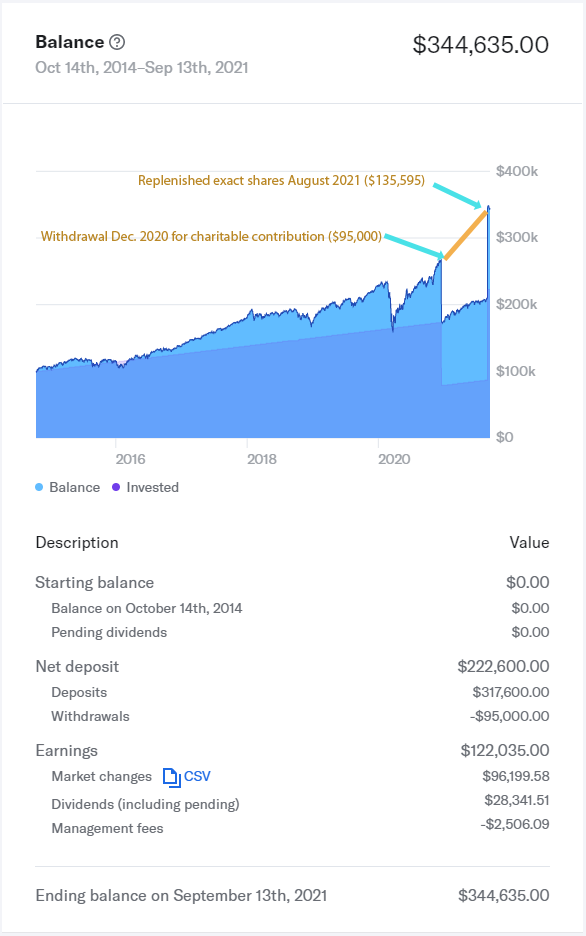

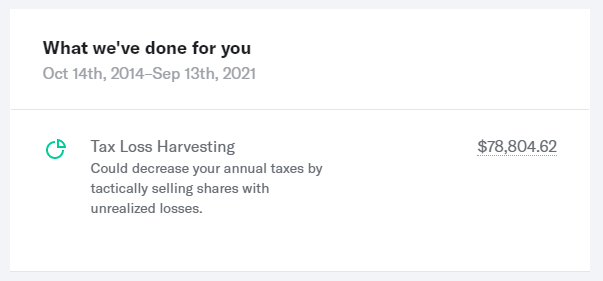

The fee has three pricing tiers: Betterment’s tlh+ service scans portfolios regularly for opportunities (temporary dips that result from market volatility) to realize losses which can be valuable come tax time. As with all sell trades, we will utilize taxmin to reduce the tax impact as much as possible.

For the cynics, these predicted gains are roughly an order of. In highlighting the betterment tax loss harvesting program, the company points out: The switch does two things:

So if you’re in the 25% tax bracket, and your extra fees are now an additional 0.35% higher (from a higher 401k er to avoid wash sales, a higher er in the portfolio betterment gives you, the betterment fee…etc), once you have more than $214,285 saved up you will be paying more in extra fees than you’ll be getting back in tax loss harvesting. If this is true, then these services pay for themselves and i might as well take advantage of the better user experiences (imo). This sells securities and could possibly realize capital gains.

Lastly, despite the benefits associated with tax loss harvesting, i think investors place too much emphasis on tax optimization relative to other financial priorities. A sophisticated, fully automated service for betterment customers.

Tax Loss Harvesting Methodology

Tax Loss Harvesting Methodology

Ieorcolumbiaedu

Betterment Tax Loss Harvesting – White Coat Investor

Tax Loss Harvesting

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Tax Loss Harvesting Methodology

Physician On Fires Tax Loss Harvesting Tips White Coat Investor

Tax Loss Harvesting Methodology

Assessing The True Value Of Tax-loss Harvesting

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Tax Loss Harvesting

![]()

Tax Loss Harvesting Methodology

Tax Loss Harvesting Methodology

Tax Loss Harvesting Methodology

The Betterment Experiment Results Mr Money Mustache

Tax Loss Harvesting Methodology

The Betterment Experiment Results Mr Money Mustache

Bud Fox Wealthfront Tax Loss Harvesting White Paper – A Case Study In How Not To Calculate Tax Alpha