The top rate for 2021 applies to individuals earning more than $523,600, or more than $628,300 for married couples filing jointly. This is a conversation you should have.

Tax Reduction Strategies For High-income Earners 2021

For taxable income levels between $180,000 and $273,000, the tax saving will be 34%.

Best tax saving strategies for high income earners. How to reduce taxable income for high earners. Find out how to lower your tax bill for 2020. Under the tcja, the irs allows you to deduct cash contributions to eligible charities, with the deduction maxing out at 60% of adjusted gross income (agi).

However, lawmakers change tax code regularly, both temporarily and permanently. Clearly, the less income that is taxed, the lower your tax bill. A hypothetical example of this tax strategy

For example, your parents bought a home for. Your best bet is to talk with your accountant and financial advisor to get their input based on the current year. Potential changes coming up the legislative pipeline could also:

Income protection insurance should also be considered for people who earn a salary over $180,000 as the premiums are tax deductible. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. Charitable giving can be one of the most attractive tax shelters for high income earners who want to do good while getting a tax break.

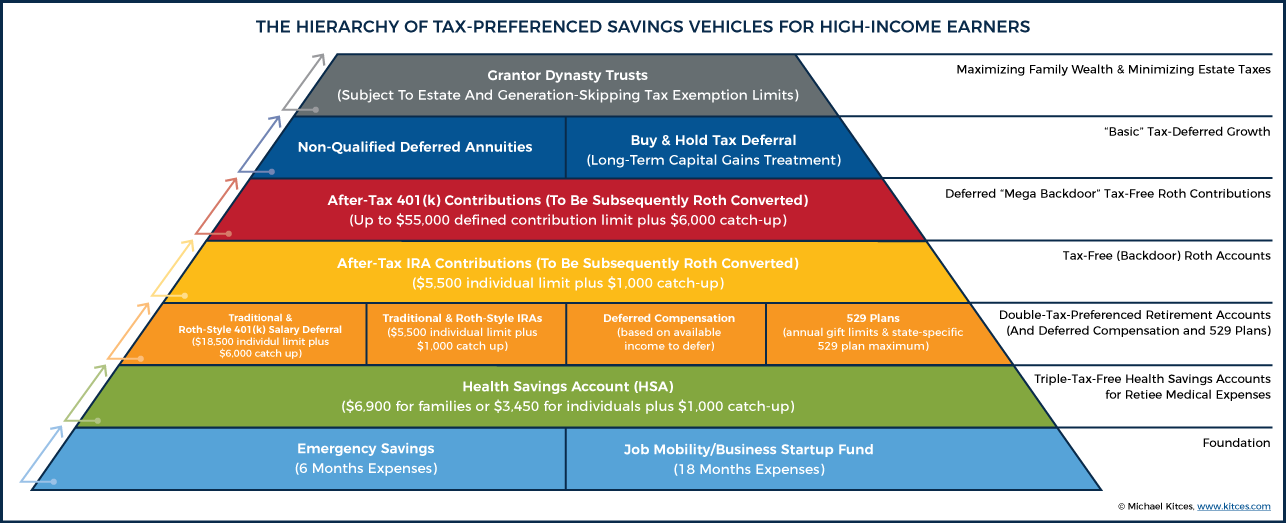

One smart tax strategy for high net worth investors is therefore to take larger withdrawals from your 401k and other plans before you turn 72, and thus reduce your rmds when they arrive. Specifically, contribute to a traditional 401(k) or ira. High earners should invest the maximum in a 401 (k) or 403 (b).

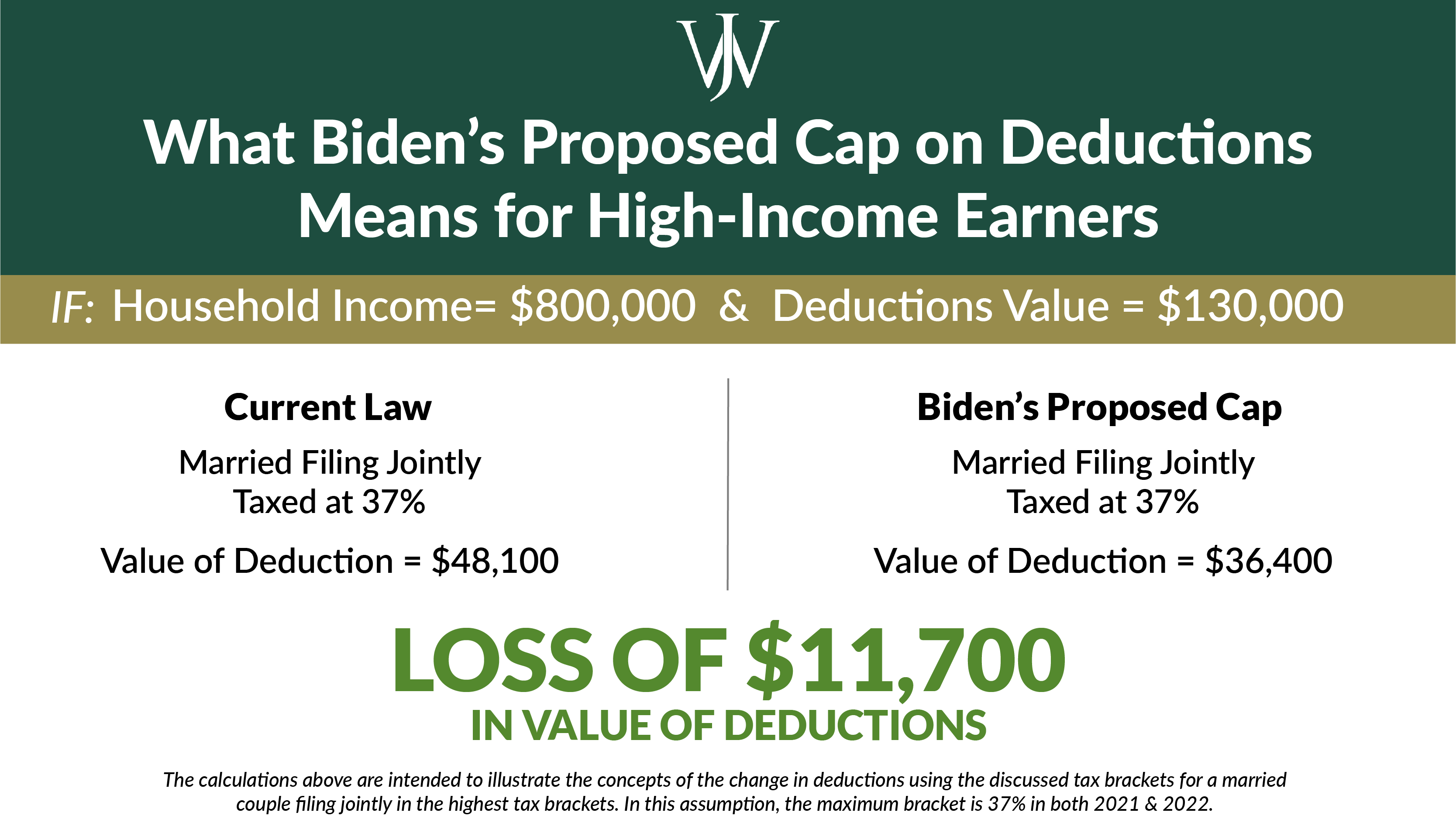

Raise the top marginal income tax rate to 39.6 percent from 37 percent, starting with those earning more than $400,000. The problem is that the earnings on those tax savings would be subject to taxes. Because his income is so high, any extra income will be taxed at the highest rate, currently at 46.5%.

Because she stays at home, she only has to pay $13,500 in taxes. In australia, the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Next, if eligible, high income earners should fully fund a health savings account each year, to further shelter income.

Income on these funds and pay taxes at their lower marginal tax rate. You might also be ahead with the roth contributions if your. Cut tax on your savings 11.

For income levels between $273,000 and $300,000 it will be between 34% and 19% and for income levels above $300,000 the saving will be 19%. The family company, also known as a holding company or bucket company, is taxed at 30%, so that’s another $9000. Also, municipal bond interest for bonds purchased in the state where you live is exempt from state income taxes, too.

So, the money was distributed to mary. Overview of tax rules for high income earners. Any interest you earn is not subject to federal income tax and from medicare surtax calculations.

Another very common scenario is that high income earners have a negatively. Best tax saving strategies for high income earners. Maximise your personal savings allowance.

For example, in 2020, we plan to deduct all of the following from our taxable income:

Tax Reduction Strategies For High Income Earners Pure Financial

The Best 3 Long-term Tax Strategies For High Income Earners – Sd Mayer

Tax Minimisation Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark – Monument Wealth Management

Tax Reduction Strategies For High-income Earners 2021

Tax Reduction Strategies For High Income Earners Pure Financial

2021 Tax Changes Bidens High-income Families Income Capital Gains Taxes Proposal

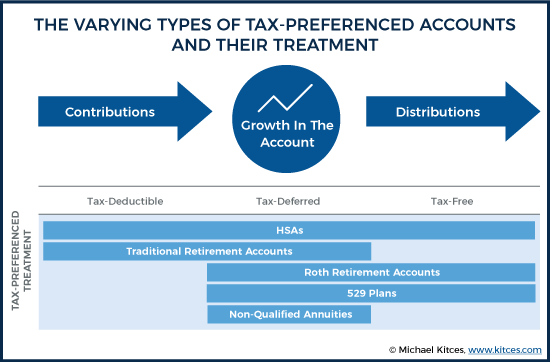

The Hierarchy Of Tax-preferenced Savings Vehicles

Tax Reduction Strategies For High-income Earners 2021

The Hierarchy Of Tax-preferenced Savings Vehicles

6 Ways For High Earners To Reduce Taxable Income 2021

Tax Strategies For High Income Earners

What Are The Tax Strategies Of High Income Earners – Dinks Finance

Top 2021 Tax Strategies For High Income Earners Pillarwm

The Top 9 Tax Planning Strategies For High Income Employees

5 Outstanding Tax Strategies For High Income Earners – Debt Free Dr – Dentaltown

5 Outstanding Tax Strategies For High Income Earners

Tax Saving Strategies For High Income Earners – Ubos

The 4 Tax Strategies For High Income Earners You Should Bookmark – Monument Wealth Management