If you do not have the adobe acrobat reader on your computer please download it first because you will need this program to view and print our forms. Website real estate tax and per capita tax contact:

Berkheimer Pa Tax Administration Services

We are pennsylvania's most trusted tax administrator.

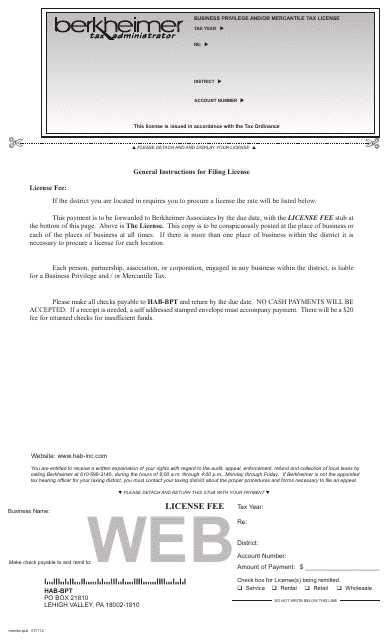

Berkheimer tax innovations business privilege. The tax is levied on gross receipts at the following rates: For registration or questions, please contact: Click here to download the adobe acrobat reader.

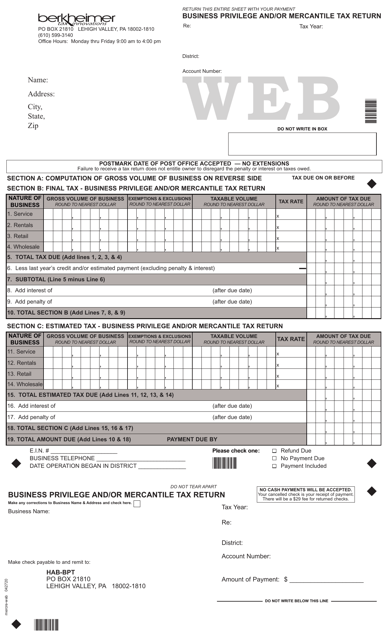

Per capita, earned income, local services, and mercantile tax collector: For assistance in filing the business privilege/mercantile tax, please call: If you operate a business in a municipality and/or school district in which a business privilege and/or mercantile tax has been levied on gross receipts, you are required to answer the following questions in order to comply with act 511 of the pennsylvania state legislature (and the law in.

Jordan tax service incorporated 102 rahway road mcmurray, pa 15317 phone number to call for. Our services include the collection of current business privilege/mercantile, earned income, local services, per capita, occupation and real estate taxes. You will need your h.a.

We specialize in all pennsylvania act 32 and act 50 tax administration services. Wholesale business 1 mill (0.001) retail business 1 ½ mill (0.0015) service business 1 ½ mill (0.0015) rental business 1 ½ mill (0.0015) all businesses must also pay a $10. Note that the [ * ] fields are required.

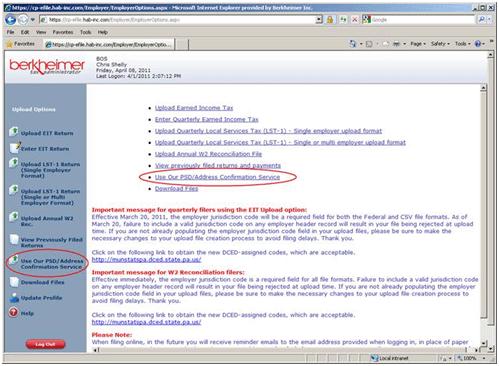

Failure to do so will constitute filing an incomplete return. Berkheimer account number, federal tax id number (ein), and psd code in order to file. If you have any questions or need tax forms please contact them directly.

Business privilege tax / mercantile tax: Berkheimer tax innovations 50 north 7th st. * if you are required to file eit on a monthly basis, you must use the file upload method to.

Montgomery township businesses will receive forms from berkheimer by january 20, 2021 that must be filled out and returned to berkheimer by march 15, 2021. Choose the form you would like to download. Past year tax bill or discrepancy tax bill.

If you need to change your official employer information with hab, please use the 'complete your employer registration, or update your employer information' link that appears on the left after you have logged in. I don’t know how or why we owed money to berkheimer tax administrator but the moment i got a letter in the mail i paid $77. A third party, berkheimer associates,.

Business privilege and mercantile tax contact: Every business is required to file a business privilege/mercantile tax return by april 15th of each year. Employer registration for business privilege / mercantile if you are human, leave this field blank.

May 15 of the current year for the privilege of doing business in cranberry township that year assessed rate: To use this method, log in and choose the option labeled data entry tax services. 8 rows earned income tax:

Mercantile and/or business privilege tax license and tax return general information be sure to submit all information requested by berkheimer tax innovations. 1 mill (or $1.00 on every thousand dollars generated in gross receipts) opening a new account, visit the berkheimer tax administrator website. The business privilege tax (bpt) and mercantile tax (mt) are gross receipts taxes levied for the privilege of doing certain types of business in middletown township.

The board of supervisors have contracted with berkheimer tax administrators to collect the business privilege tax. Using this form will not affect your official employer information with h. Business tax the montgomery township board of supervisors has appointed berkheimer innovations (berkheimer) as the business privilege/mercantile and amusement tax collector effective january 1, 2021.

Delinquent tax (bill presentment) enter the requested information in the box below. The montgomery township board of supervisors has appointed berkheimer innovations (berkheimer) as the business privilege/mercantile and amusement tax collector effective january 1, 2021. Return the form, any tax due, and required documentation.

Each person who exercises such privileges for any length of time shall pay the tax when an individual has gross annual earnings of $12,000 or more during the subject calendar year. Montgomery township businesses will receive forms from berkheimer by january 20, 2021 that must be filled out and returned to berkheimer by march 15, 2021. Be sure to include signature and date where applicable.

We are the trusted partner for 32 tcds and provide services to help individuals, employers,. Click the continue button to proceed. Business privilege and mercantile taxes.

Berkheimer tax innovations is the industry leader in collection of current and delinquent taxes levied by school districts throughout the commonwealth. Persons or businesses who are required to pay the business privilege tax must register with berkheimer tax innovation, the borough’s tax collector for this tax. Final business privilege and mercantile tax return tax year 2020 gross volume of exemptions & exclusions taxable volume tax rate amount of tax due 1.

Psd Confirmation Service Berkheimer

2

Fill – Free Fillable Mercreweb 2fpm Mercreweb-2fpm Mercreqxd Berkheimer Tax Innovations Pdf Form

2

Pennsylvania Business Privilege Andor Mercantile Tax Return Download Fillable Pdf Templateroller

Pennsylvania Business Privilege Andor Mercantile Tax Return Download Fillable Pdf Templateroller

Earned Income Tax Springfield Township

Employer Registration For Business Privilege Mercantile Berkheimer

Berkheimer Pa Tax Administration Services

2

Berkheimer Tax Administrator Forms Pdf Templates Download Fill And Print For Free Templateroller

Middletown Township Delco – In Order To Help Our Local Businesses Middletown Township Council Has Extended The Business Privilege And Mercantile Tax Filing Deadlines To Coincide With The Revised Federal And State

Berkheimer Pa Tax Administration Services

2

Taxpayer Resource Center Berkheimer

Forms Overview Berkheimer

Berkheimer Tax Innovations – Psba

2

About Us – Berkhr