The most common place to map an item to a tax code is the place where you maintain your master inventory list, which is typically in your business application. Access a database of tax content, rates, and rules for 190+ countries.

Software Sales Tax Use Tax – Avalara

Apply tax codes for multiple products and variants

Avalara tax codes mapping. We recommend mapping items to tax codes in either your business application or avatax but not both. Support your compliance with artificial intelligence and machine learning. You can use this search page to find the avalara codes that determine the taxability of the goods and services you sell.

The most common place to map an item to a tax code is the place where you maintain your master inventory list, which is typically in your business application. Review the recommendations and choose the tax code that is the best match for each product or service. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction.

Find your business application or system for specific instructions. The closest match is in the code_1 column. Simply click on your state below and get the state sales tax rate you need.

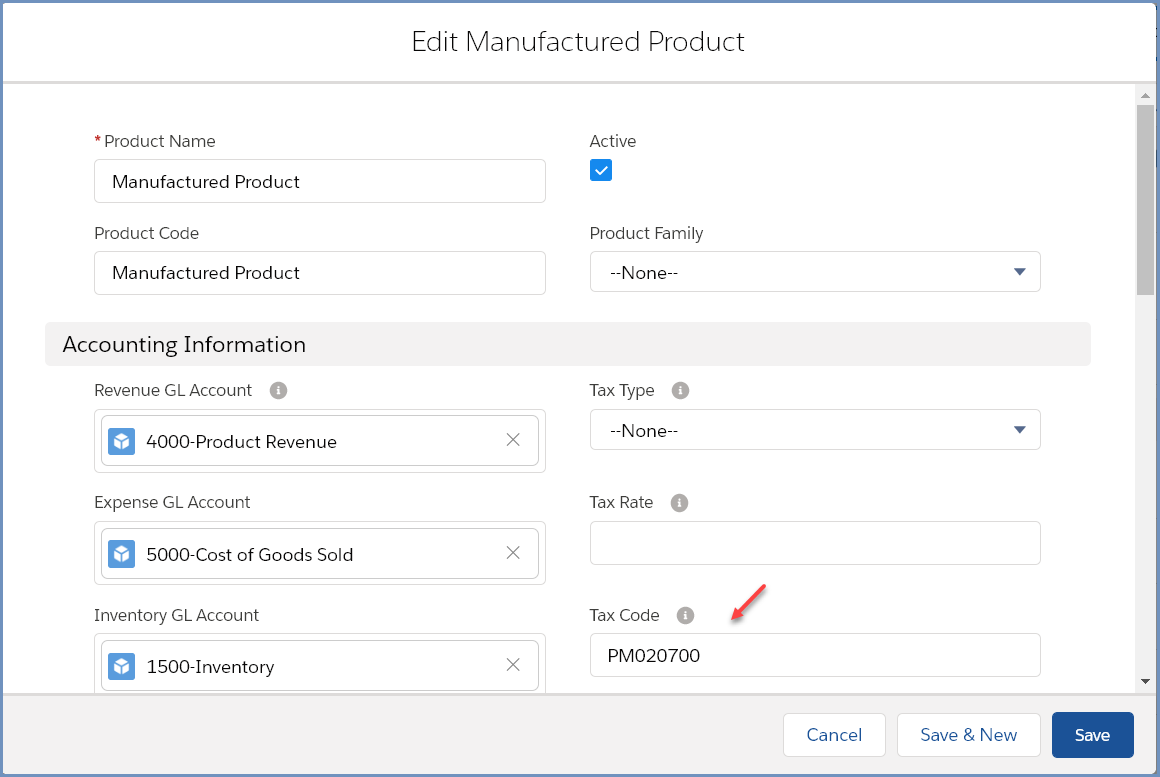

Determine where you want to map items to avalara tax codes. Protect your data with a 24/7 security operations center. If you leave the product code blank, then avalara avatax assigns the default code for physical goods tax, p000000, to your product or variant.

Send avalara a list of items you sell so avalara can map them to harmonized system (hs) tariff codes. Take advantage of our state sales tax calculator to look up a rate for a specific address. We recommend mapping items to tax codes in either your business application or system or avatax, but.

For each avatax company, use the items option to map your items to tax codes. Find your business application or system for specific instructions. In addition to automating the process of identifying and mapping tariff codes to goods, avalara can help you with registration, calculating customs duties and import taxes, vat returns and reporting, and fiscal representation.

Maintaining regulatory compliance with the fcc can be a frustrating ordeal. The most common place to map an item to a tax code is the place where you maintain your master inventory list, which is typically in your business application. P0000000 and u0000000 are generic codes that are used when you have items that aren't mapped to an avalara tax code.

This level of accuracy is important when determining sales tax rates. The most common place to map an item to a tax code is the place where you maintain your master inventory list, which is typically in your business application. We recommend mapping items to tax codes in either your accounting software or avatax but not both.

Any mapping you define in avatax will override the mapping in the working with tax product code cross references (wtpc) menu option. These tax codes are taxed at the full rate. Find your business application or system for specific instructions.

Mapping items in avatax overrides mapping them in. The file includes three tax code recommendations for each item. Note, mapping tax codes to products using webgility is optional.

Determine where you want to map items to avalara tax codes. You can copy and paste a code you find here into the tax codes field in the items or what you sell areas of avatax when you are logged into the service, or into the appropriate field in your accounting or pos system. Tax code mapping in webgility does not import or transfer into avalara avatax.

Tax compliance for saas and software companies Alone has more than 13,000 sales and use tax jurisdictions. The best place to map your items to tax codes depends on your business.

We recommend mapping items to tax codes in either your accounting software or avatax, but not both. To begin this process, go to the tools menu heading and select avalara, then select product tax code. Tax code mapping should be done within the active company within the avalara avatax account.

On the review tax code recommendations screen, select download recommendations to download a spreadsheet with avalara's tax code recommendations. Telecom regulatory provides you with new and current rates in addition to historical rates. Product classification software streamlines mapping domestic and international tax codes.

Items in avatax should have both a tariff code and a tax code to ensure that imported and exported products are taxed properly when shipped between countries. In the pricing section, click the tax code field and enter the appropriate tax code. Avalara’s international tax solutions make it easier to sell anywhere in the world.

The issue has been reported to connectwise. Classification becomes even more complex if. At avalara, we have over 100 people who are responsible for.

Determine where you want to map items to avalara tax codes. Use the working with tax product code cross references (wtpc) menu option as your master list for mapping;

Avalara Integration Fast-weigh

Cross-border By Avalara – Woocommerce

Cross-border By Avalara – Woocommerce

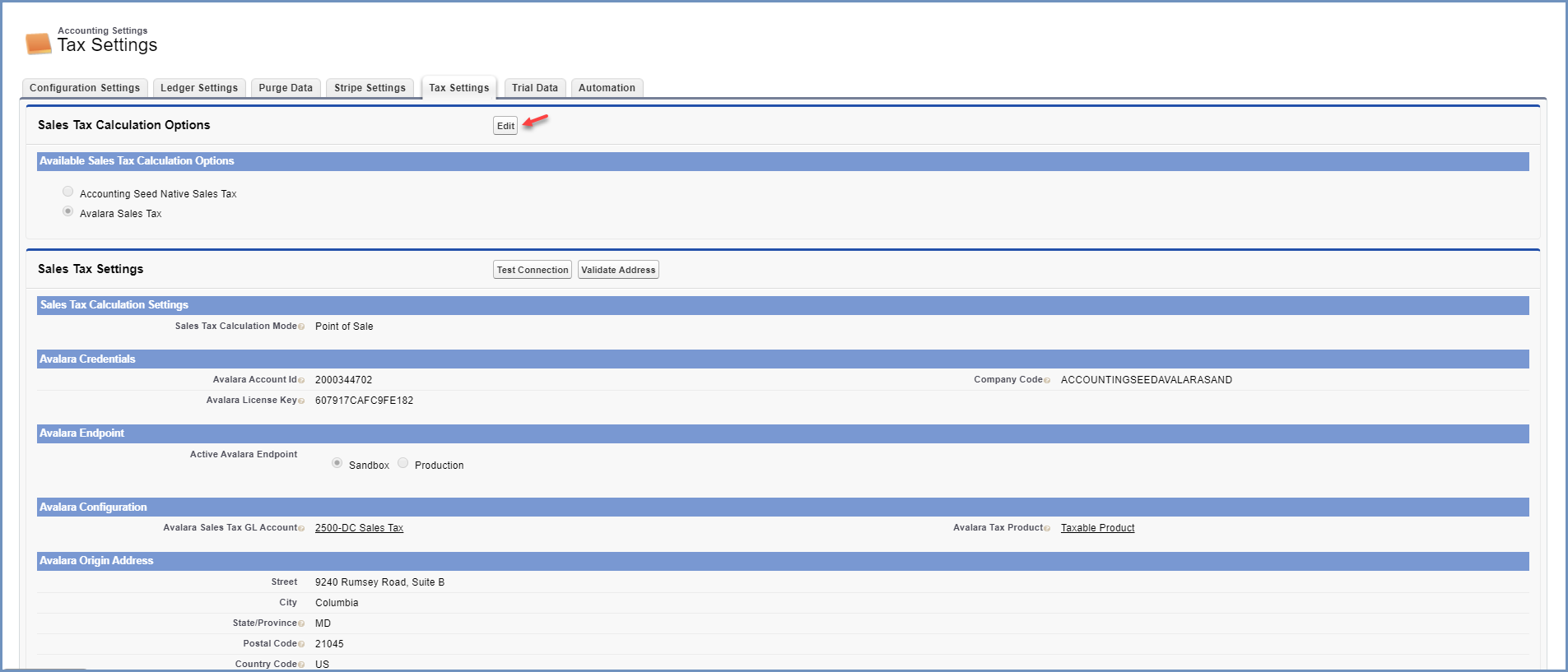

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Understanding The Avatax For Communications Tax Engine – Avalara Help Center

The United States Of Startups The Most Well-funded Tech Startup In Every Us State William Altman Pulse Linkedin Tech Startups Start Up Plexus Products

Avalara And Economic Nexus An Overview Of The

Enablement Steps For Advanced Taxation – Nimble Ams Help

Cross-border By Avalara – Woocommerce

Cross-border By Avalara – Woocommerce

Map Groups Of Items To Avalara Tax Codes In Netsuite – Avalara Help Center

Set Up Avalara Avatax Integration Accounting Seed Knowledge Base

Avalara Application By Kibo Ecommerce

Avatax For Intacct Implementation Checklist Overview Winifer Cheng Winifer – Ppt Download

Set Up Avalara Avatax

Get Ready To Pay Sales Tax On Amazon Amazon Tax Amazon Sale Amazon Purchases

Avatax For Intacct Implementation Checklist Overview Winifer Cheng Winifer – Ppt Download

Magento 2 Marketplace Avalara Tax Avatax Multi Vendor Integration – Webkul

Avalara Avatax Applied To Shipping Only Not Applied To Products – Taxes Translations Laws – Prestashop Forums