All other codes are flagged not in use. While we try to make these tools as accurate as possible, please.

Wix Stores Collecting Tax In Canada Using Avalara Help Center Wixcom

Navigate rapidly changing sales tax rates and rules with avalara’s advanced tax software that integrates with your online store and any other existing business applications your business has.

Avalara tax codes canada. Communications tax management for voip, iot, telecom, cable With accurate tax rates and compliant invoices, avalara’s integration with chargebee ensures your business meets the various tax requirements. Avatax adds a default tax code to each product in your shopify store.

Run the retrieve tax codes by zip code program. 5% provincial sales tax (pst) if you are domiciled in the province of alberta or in one of the three territories (northwest territories, nunavut or the yukon), you do not need to collect sales tax on goods and services beyond the 5% gst. For each product or variant in your shopify admin, make sure that the tax code is set to the avalara tax code for that product.

You can copy and paste a code you find here into the tax codes field in the items or what you sell areas of avatax when you are logged into the service, or into the appropriate field in your accounting or pos system. Avalara is software for online businesses to automate tax compliance. Provinces with harmonized sales tax have combined federal and provincial sales taxes for easier registration and filing

These tax codes are taxed at the full rate. Avalara can calculate your taxes and file your returns for both federal and local sales tax in any province in canada. This change was effective in avalara products on april 1, 2018.

This code may produce a fully taxable result in states where no such reason for. P0000000 and u0000000 are generic codes that are used when you have items that aren't mapped to an avalara tax code. Talk with our avalara representative to figure out what the appropriate tax codes are for your products in order to achieve the eu vat digital services distinction.

Set up tax rules to calculate gst for your tax codes. Look up the tax codes for your product in. Canada only has federal and provincial sales tax;

Tax code tax code name additional information; Federal gst is levied by the canadian revenue agency, and the tax code is contained within the excise acts. To retrieve tax codes (rates):

The rules for gst broadly follow the european union and oecd vat models. 9.975% quebec sales tax (qst) saskatchewan: Odoo provides integration with avatax, a tax solution software by avalara which includes sales tax calculation for all us states and territories and all canadian provinces and territories (including gst, pst, and hst).

O the avalara tax code field is flagged for the codes retrieved from avalara. There are a couple of different ways to learn which rate to use for what you sell. Communications tax management for voip, iot, telecom, cable

Use your existing tax codes or create custom tax codes. To view the tax codes, enter the taxes form. Us medical device excise tax with taxable sales tax.

Keep a few things in mind that make canadian sales tax unique: The default tax code for physical goods is p000000. Canada operates a range of goods & services tax (gst) across the federal and 13 provinces.

Effortless sales tax management easy and reliable sales tax calculation across the us, canada and the eu with efficient product taxability rules with reduced efforts on tax filing & tax liabilities. Us medical device excise tax with exempt sales tax med2. If you choose to be prompted for either missing tax codes or labor tax codes, you will skip the address validation steps and be brought to step 3 of the wizard (see below).address validation will display or not display based on the enable address validation setting as.

Digital audio visual works (with rights of less than permanent use) *see additional avatax system tax code information dv029398 digital audio visual works sold to users other than the end user If you want to create custom tax codes, use india's central board of indirect taxes and customs website. If items are missing an avalara tax code, your default codes will be used:

You can modify the behavior of these codes (and create your. Gst was introduced into canada in 1991. You can use this search page to find the avalara codes that determine the taxability of the goods and services you sell.

This feature uses avalara’s artificial intelligence engine and global compliance content database to generate landing cost pricing and determine tariff. 15 rows canada gst, pst and qst rates province: Although quebec’s gst is under the.

If you have customers in canada, manually record tax codes in the taxes form.

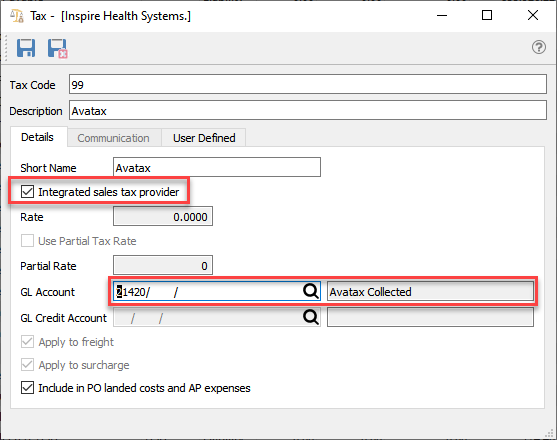

Avalara Sales Tax – Spire User Manual – 35

Cross-border By Avalara – Woocommerce

Setup

Github – Spree-contribspree_avatax_official The New Officially Certified Spree Avatax Avalara Extension

Avalara Application By Kibo Ecommerce

Cross-border By Avalara – Woocommerce

Avalara And Vertex Integration In Sap Business Bydesign Sap Blogs

Overcoming Tax Management Challenges Through Automation Within Dynamics 365 Business Central Video – Encore Business Solutions

Avalara Avatax For Enterprise

Understanding The Avatax For Communications Tax Engine – Avalara Help Center

Avalara Managed Sales Tax

Avalara Linkedin

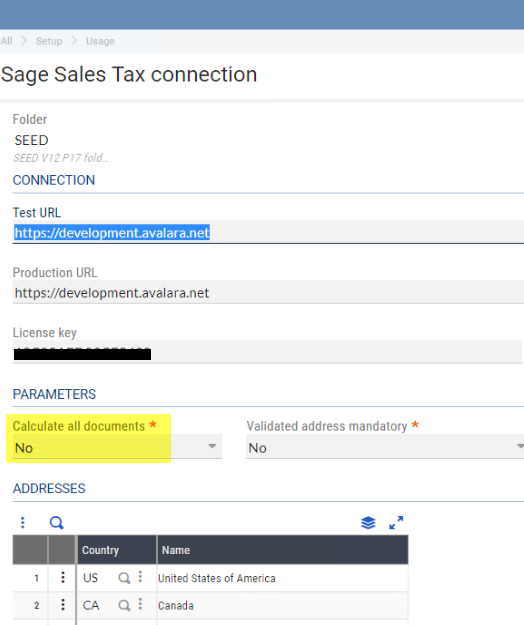

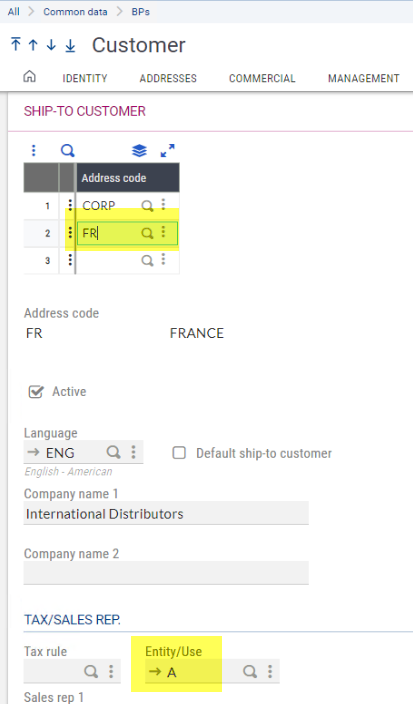

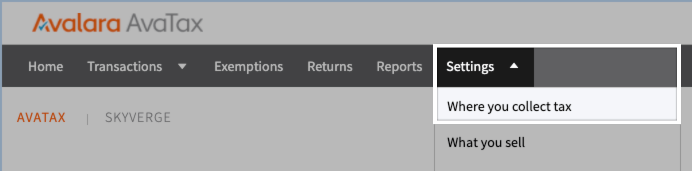

Sage X3 Support How To Bypass The Avalara Tax Calculation For Unsupported Countries In Sage X3 V12 – Sage X3 Support – Sage X3 – Sage City Community

Cross-border By Avalara – Woocommerce

Setup

Cross-border By Avalara – Woocommerce

Spree-contribspree_avatax_official The New Officially Certified Spree Avatax Avalara Extension – Github

Sage X3 Support How To Bypass The Avalara Tax Calculation For Unsupported Countries In Sage X3 V12 – Sage X3 Support – Sage X3 – Sage City Community

Cross-border By Avalara – Woocommerce