Protect your data with a 24/7 security operations center. An order with some taxable items (with no tax code, or a taxable tax code), some nontaxable items(using tax code nt, or another nontaxable code), and a shipping line (using.

Avalara And Ca Partial Tax On Mfg Machinery – Erp 10 – Epicor User Help Forum

Advanced | learn how locations are leveraged and impacted within the excise platform and how to maintain this functionality.

Avalara tax code nt. Avalara avatax has been updated effective october 28, 2020 to retroactively return an exempt sales and use tax calculation for tax code nt beginning october 1, 2020; Find the avalara tax codes (also called a goods and services type) for what you sell. Maintaining regulatory compliance with the fcc can be a frustrating ordeal.

However, we recommend following the steps below. Avalara avatax free trial frequently asked questions; These tax codes are taxed at the full rate.

Take advantage of our state sales tax calculator to look up a rate for a specific address. Sales and use tax transactions in vermont using tax code nt may show an unexpected taxable calculation instead of an exempt calculation. More avalara for excise workshop recording.

Add avalara to your wa state dor account; Telecom regulatory provides you with new and current rates in addition to historical rates. Advanced | learn how to use product and mode codes and best practices.

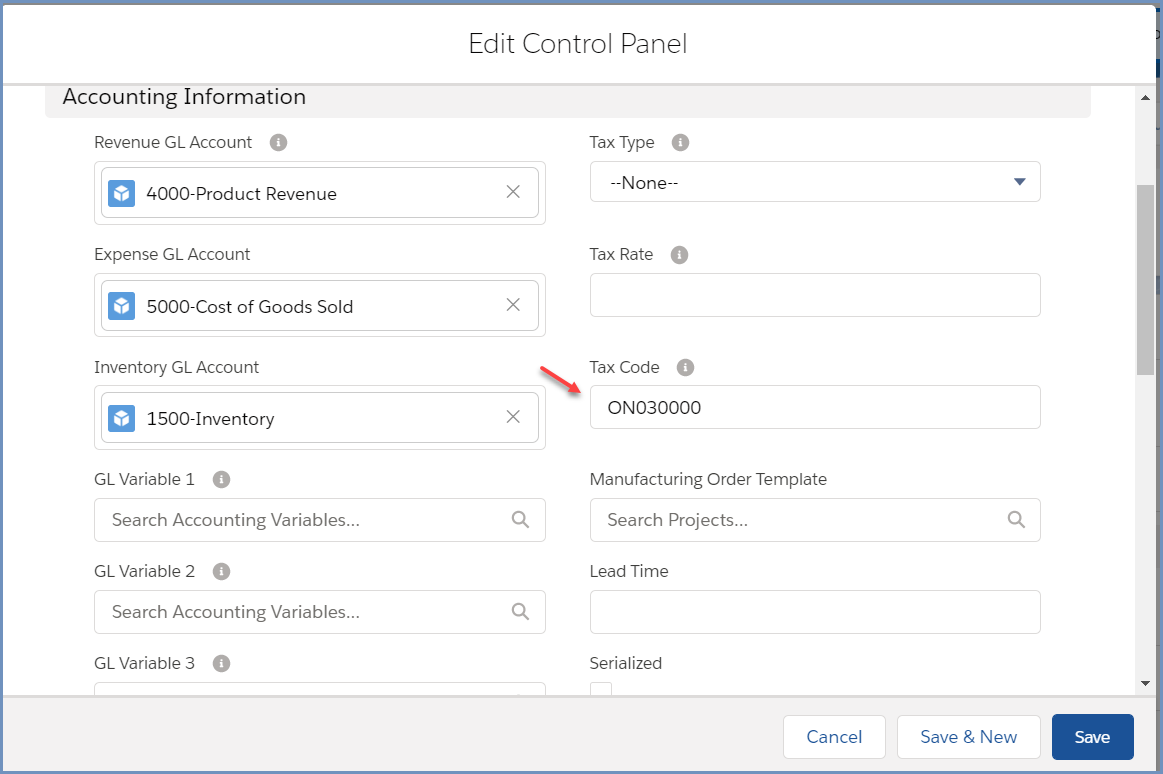

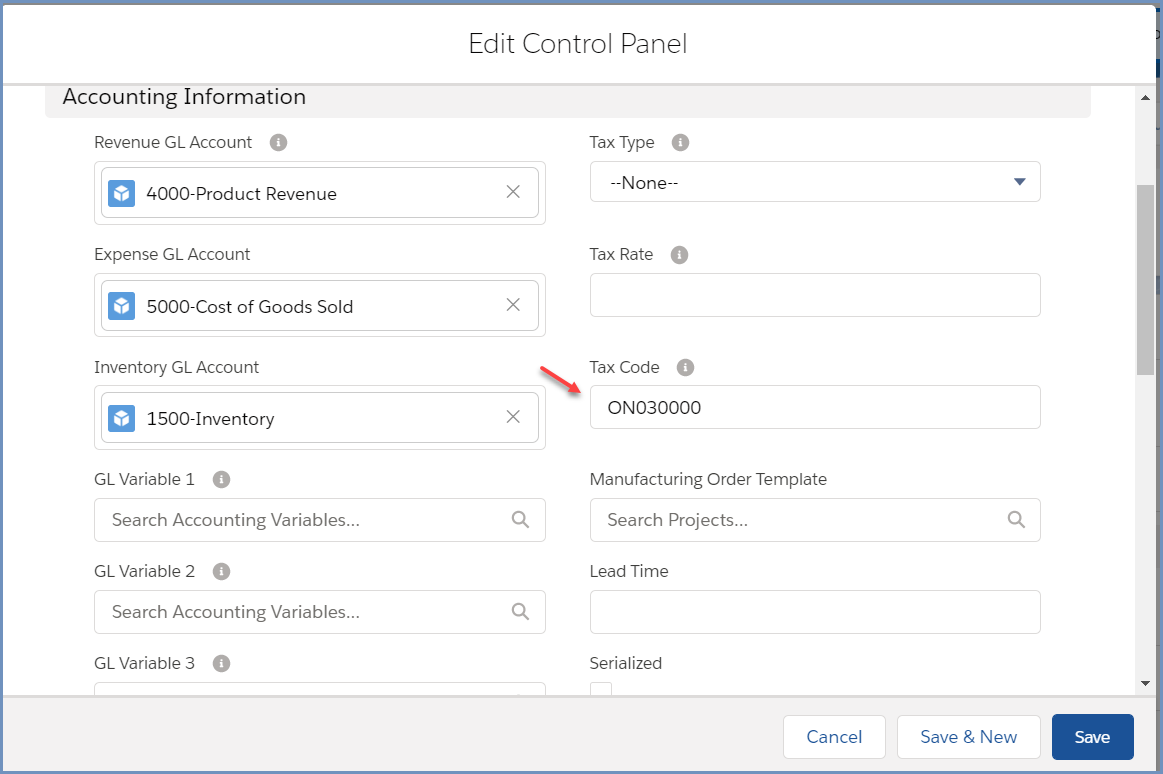

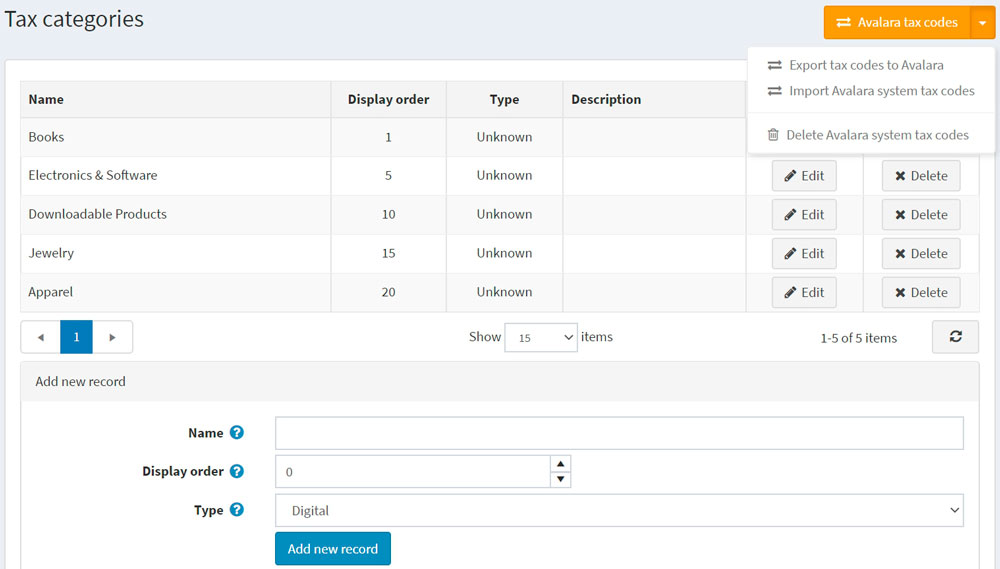

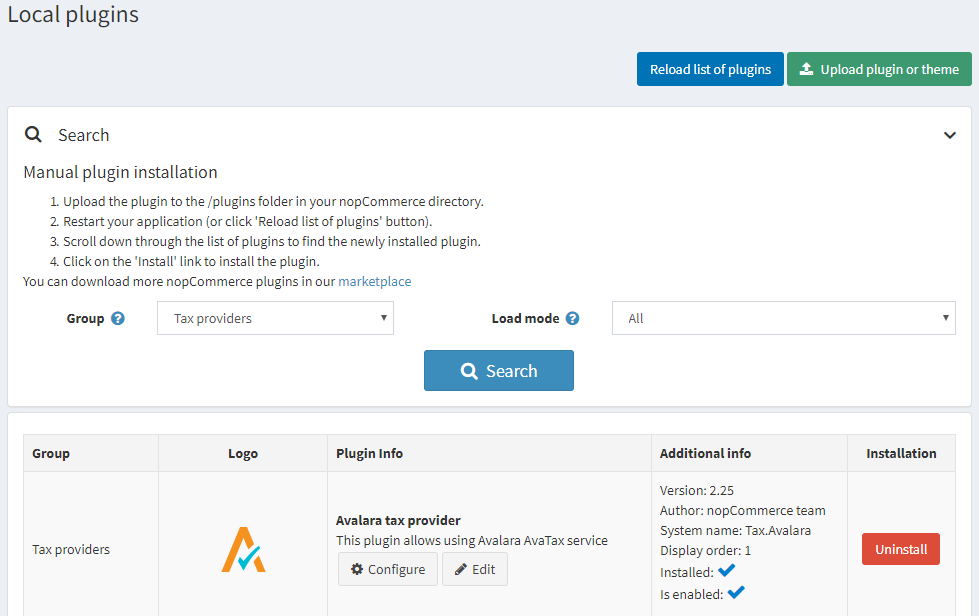

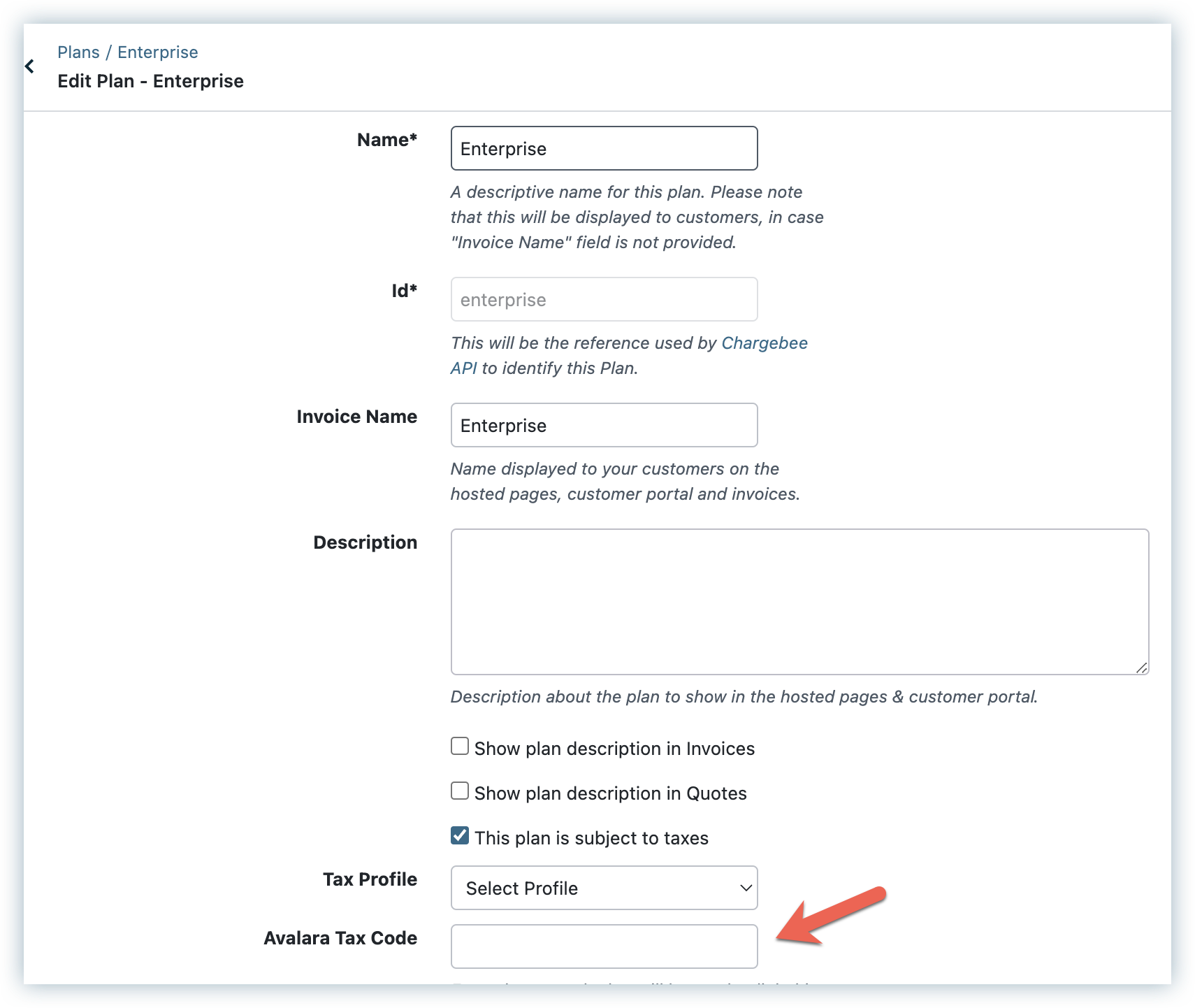

Avalara bagged the company of the year 2019 award for tax compliance by silicon india. You can use this search page to find the avalara codes that determine the taxability of the goods and services you sell. If you are planning to use specific tax code per product, provide field id on avalara tax code field and provide tax code on that specific field of a product.

If you are planning to use upc code instead of sku, please check the box use upc. Canon city, co sales tax will be collected by the state of colorado effective january 1, 2021 P0000000 and u0000000 are generic codes that are used when you have items that aren't mapped to an avalara tax code.

Support your compliance with artificial intelligence and machine learning. Simply click on your state below and get the state sales tax rate you need. Access a database of tax content, rates, and rules for 190+ countries.

The avatax basic service offers limited use of the avatax sales tax codes, in particular p0000000 for personal taxable goods, shipping tax codes and nt for not taxable goods. By default, each shipment line item will be imported into avalara with the tax code fr if the ts checkbox is checked, and nt if it is not. For example, put 17 and use field17 of the product to specify tax code.

Look up the tax codes for your product in the avalara avatax system. The avatax pro service offers full use of the avatax sales tax codes. While we try to make these tools as.

This tells avalara to apply the sales tax rate for freight when the ts checkbox is checked, and not to tax the shipment if ts is left unchecked. Access to a development account can be requested by contacting avalara, inc. For each product or variant in your shopify admin, make sure that the tax code is set to the avalara tax code for that product.

You can copy and paste a code you find here into the tax codes field in the items or what you sell areas of avatax when you are logged into the service, or into the appropriate field in your accounting or pos system. Use master data product and mode codes. You can use this search page to find the avalara codes that determine the taxability of the goods and services you sell.

Avatax adds a default tax code to each product in your shopify store. Make sure your connector's calculation agrees with a calculation on the avatax website for the following use cases: Check setup > accounting > tax schedules.

Ensure it's set to 'new and existing customer (s)'. The default tax code for physical goods is p000000. If the default taxcode to in the avalara configuration (tax calculation tab) is blank.

At avalara, we have over 100 people who are responsible for. Action needed by november 10, 2020 for overcollection of tax using avatax tax code nt in vermont; You can copy and paste a code you find here into the tax codes field in the items or what you sell areas of avatax when you are logged into.

Sales tax calculation can create a number of different interesting edge cases. This can happen if your item also happens to be mapped as a tax schedule. If you have items that use p0000000 or u0000000, map them to an avalara tax.

Avatax For Sales – Subscription Flow

Smartercommerce Help

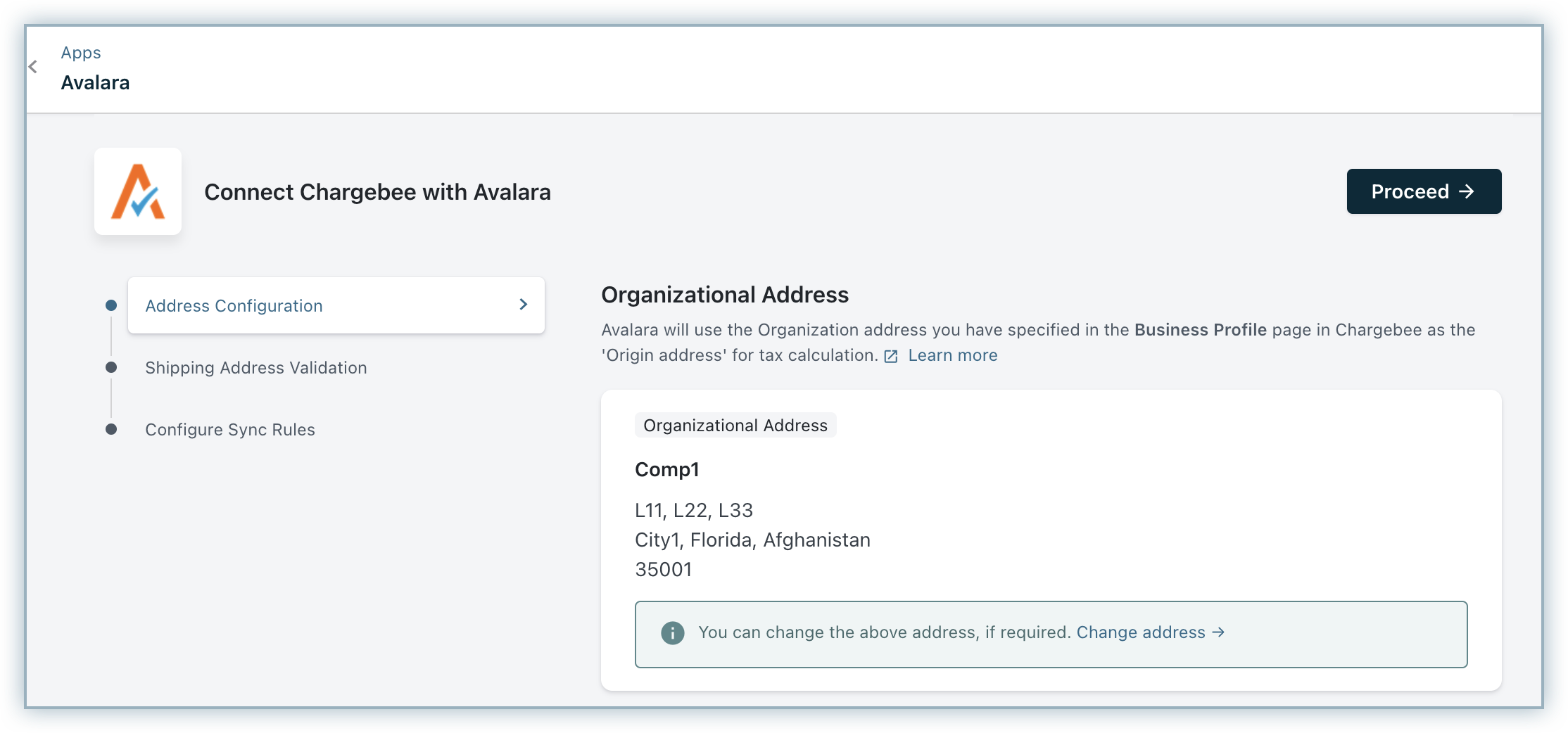

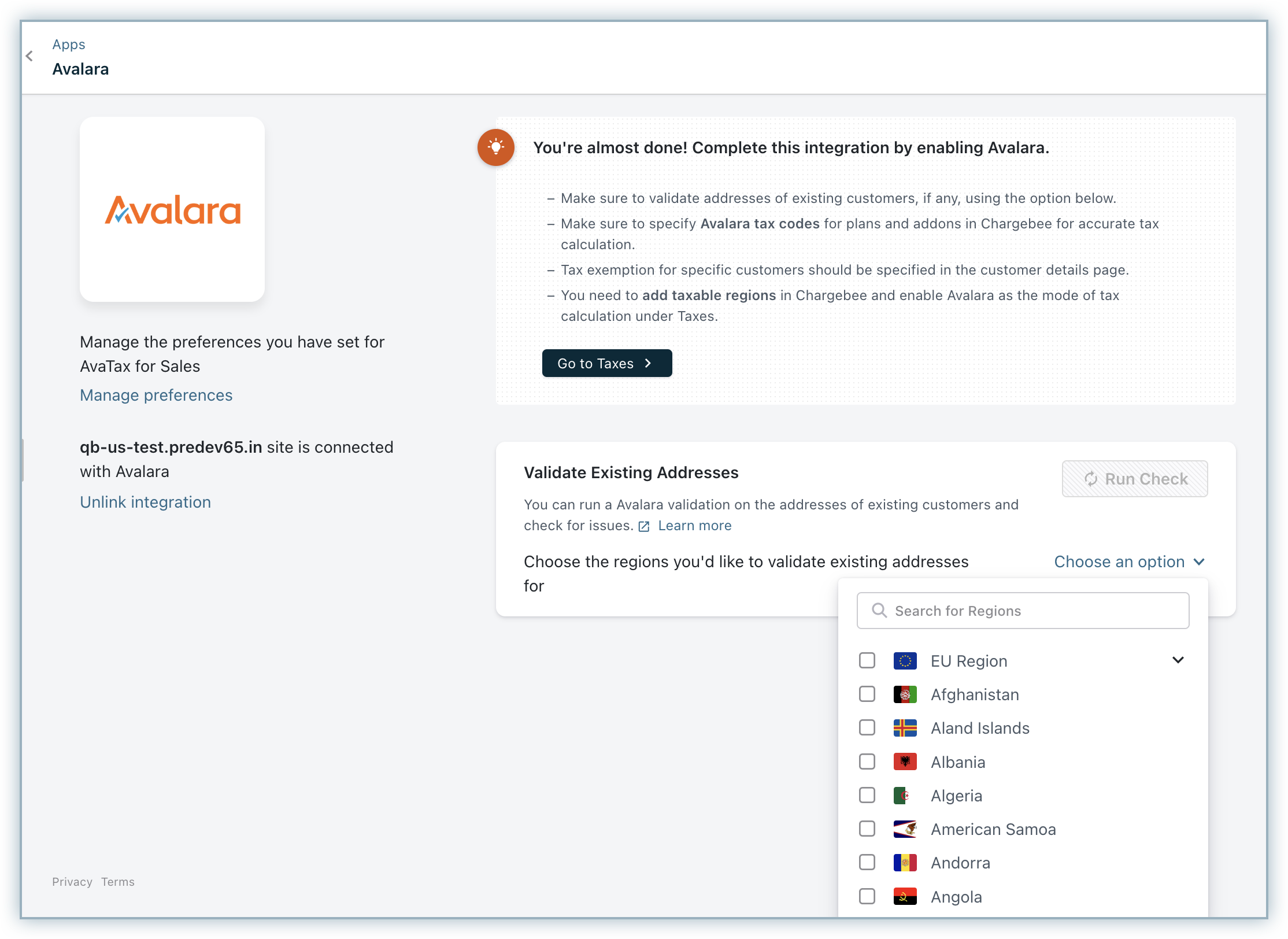

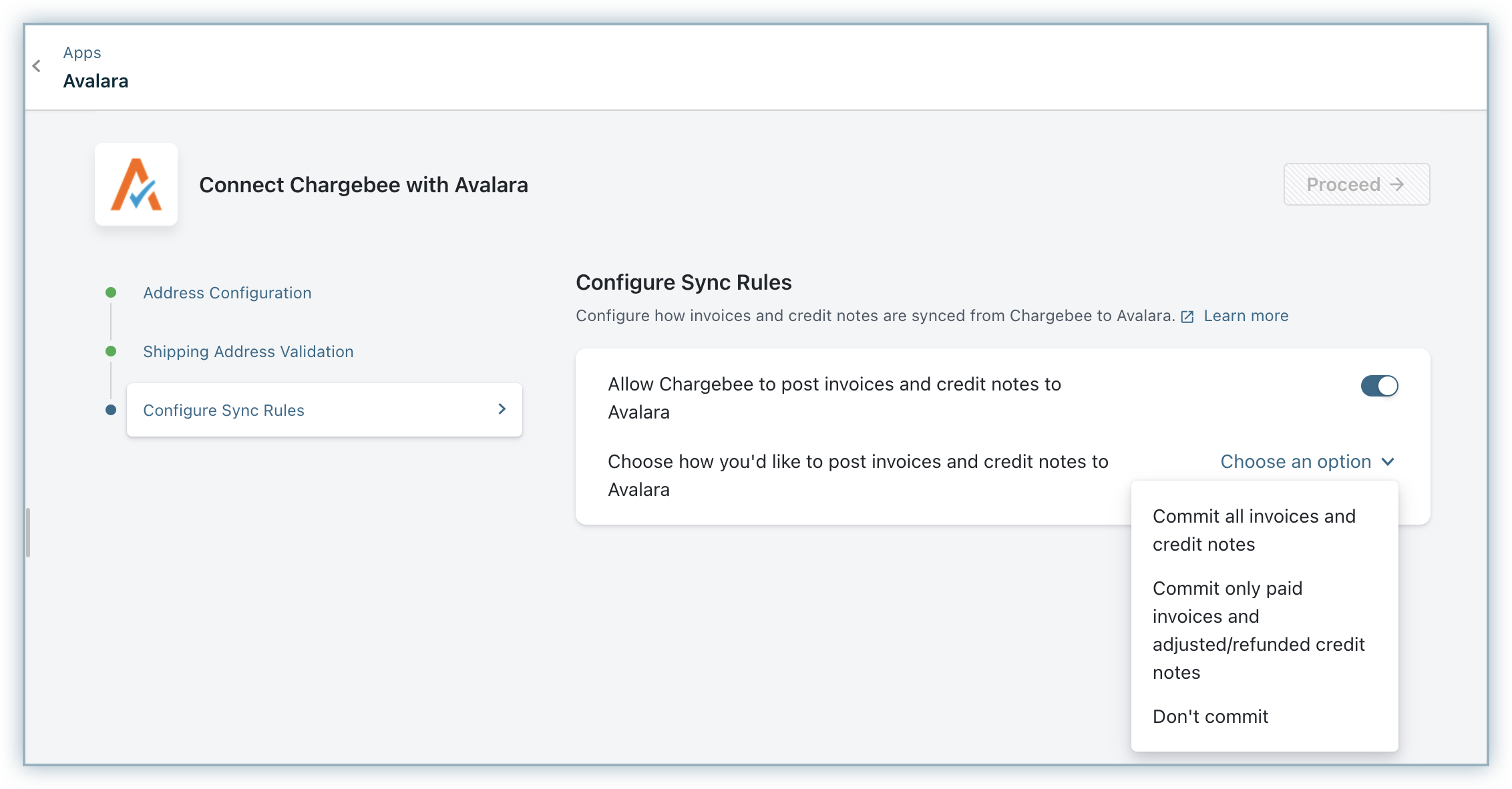

Avatax For Sales – Chargebee Docs

Avalara Avatax

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base

Avatax For Sales – Chargebee Docs

Product Business Partner And Freight Taxability With Avalara In Sap Business Bydesign Sap Blogs

Avalara Tax Integration

Understanding Freight Taxability – Avalara Help Center

Avatax For Sales – Subscription Flow

Why Is Netsuite Sending My Items Over As Non-taxable Even Though They Are Not Mapped To A Tax Code – Avalara Help Center

Understand Sales Tax Holidays In Avatax – Avalara Help Center

Why Is Netsuite Sending My Items Over As Non-taxable Even Though They Are Not Mapped To A Tax Code – Avalara Help Center

How To Set Up Avalara With Paladin Point Of Sale

Avalara

Avatax For Sales – Chargebee Docs

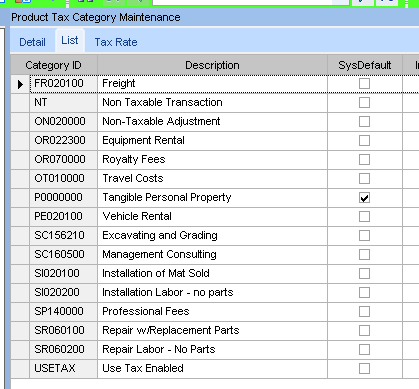

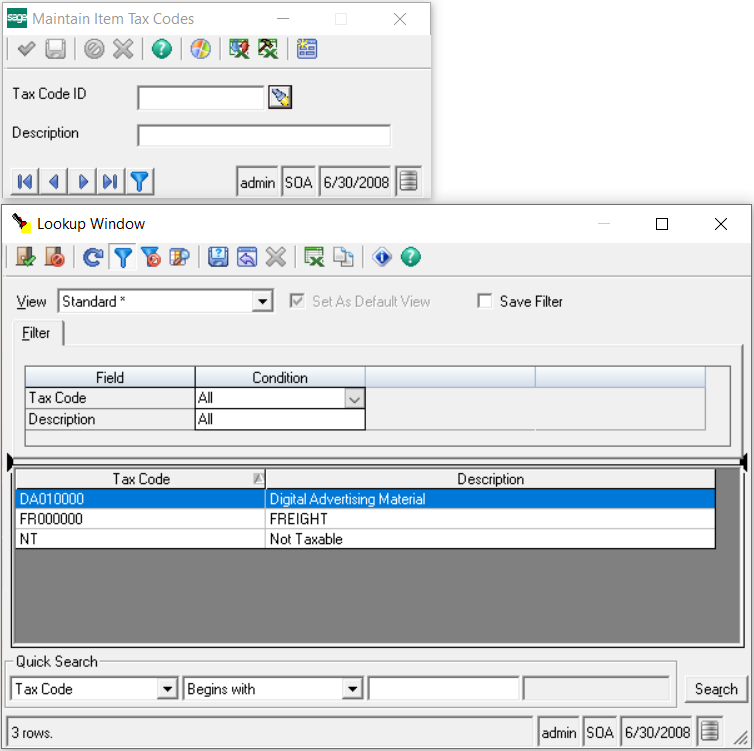

Avatax For Sage 500 Erp Mapping Items To Product Tax Codes

Avalara

Avatax For Sales – Chargebee Docs