You can search and read the code here. Settling an estate in arkansas.

How Is Tax Liability Calculated Common Tax Questions Answered

If an estate is worth $15 million, $3.6 million is taxed at 40 percent.

Arkansas inheritance tax laws. When a person does not leave a will, naming beneficiaries to inherit his estate, arkansas' intestacy laws set forth the order in which his heirs have a right to inherit. The process, however, can take longer for contested estates. Inheritance laws of other states may apply to you, though, if you inherit money or assets from someone who lives in a state that has an inheritance tax.

The amount exempted from federal estate taxes is $11.19 million for 2019, but if you do not plan properly, then your family or other heirs could end up getting far less of your assets than you intended. In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely. In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely.

See where your state shows up on the board. Each state sets its own exemption level and tax rate. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will.

Commercial for sale in other ar, arkansas, 10736301 river. The following table outlines probate and estate tax laws in arkansas Arkansas does not have an inheritance tax.

You cannot distribute any assets to heirs until the estate goes through the legal process of probate. The inheritance laws of another state may apply to you if you inherit money or property from a person that lives in a state that has an inheritance tax. The fact that arkansas has neither an inheritance tax nor an estate tax does not mean all arkansans are exempt when it comes to tax consequences as part of an estate plan.

The executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Arkansas' intestacy laws dictate that the parents of a decedent receive a share of their child's assets. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will.

Arkansas does not have a state inheritance or estate tax. Of those seven states, maryland and new jersey are the only ones that have both types of state level taxes. In this article we go over laws specific to arkansas as well as ways that you can receive your inheritance cash now.

This does not mean, however, that arkansas residents will never have to pay an inheritance tax. The laws regarding inheritance tax do not depend on where you as the heir or beneficiary live. Of those seven states, maryland and new jersey are the only ones that have both types of state level taxes.

Arkansas also does not assess an inheritance tax, which is the second type of tax seen at the state level. This is a quick summary of arkansas probate and estate tax laws. Arkansas also has no inheritance tax.

In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely. Below is a brief overview of the dower and curtesy rules under arkansas law: Chinese officials last talked about an inheritance tax in 2013, when the.

Estates worth less than $25,000;. Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024. There are only seven states that have an inheritance tax.

The federal government does not impose an inheritance tax, so the recent tax changes from the trump administration did not affect the inheritance taxes imposed by the states. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if. Arkansas does not have a state inheritance or estate tax.

Arkansas inheritance and gift tax. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will. Arkansas does not have a state inheritance or estate tax.

Federal gift and estate tax codes change, and a skilled attorney keeps abreast of all the changes in the probate process and laws that could affect the distribution of your estate. The will must be filed with the circuit court in the county where the decedent lived. This article covers probate, how to successfully create a valid will in arkansas, and what happens to your estate if you die without a will.

Arkansas also does not assess an inheritance tax, which is the second type of tax seen at the state level. Arkansas probate and estate tax laws. Doing so before the probate is closed can lead to legal issues for the executor and cause headaches for everyone involved.

Arkansas does not have a state inheritance or estate tax. Four years later, finance ministry officials said the inheritance tax law could pass as soon as 2000, but it never did. Decedent survived by spouse and one or more children—the spouse is endowed with:

Parents are not entitled to a share of their children's personal property, however, if their child leaves a surviving spouse and was married for three years or more. They must be followed to ensure the estate is distributed as required by law. However, it is still possible that an arkansas resident may be subject to an inheritance tax if he or she inherits property located in another state that does impose an inheritance tax.

Arkansas does not impose these taxes on its residents. Many of the steps for probate in arkansas are the same as in other states. Though your estate will not be subject to arkansas estate or inheritance tax, it is possible that federal taxes could affect your estate.

As of 2019, if a person who dies leaves behind an estate that exceeds $11.4 million. For more about estate planning, go to the wills, trusts & probate section of nolo.com. First and foremost, residents of arkansas are not subject to state mandated estate or inheritance tax.

Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025. Arkansas does not have a state inheritance or estate tax. There are only seven states that have an inheritance tax.

How To Avoid Estate Taxes With A Trust

Living Will Form Online Template – With Free Living Will Sample Living Will Template Power Of Attorney Form Online Templates

How Is Tax Liability Calculated Common Tax Questions Answered

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Is There An Inheritance Tax In Arkansas

House Democrats Tax On Corporate Income Third-highest In Oecd

Why Are Texas Property Taxes So High Home Tax Solutions

How To Avoid Estate Taxes With A Trust

Recent Changes To Estate Tax Law Whats New For 2019

Is There A Federal Inheritance Tax Legalzoomcom

Digital Estate Plan With Legacy Assurance Plan For More Information Httpslegacyassuranceplanwordpr Estate Planning Checklist Estate Planning How To Plan

State Income Tax Understanding How Arkansas Texas And Surrounding States Impact Retirement Income – Brownlee Wealth Management

Digital Estate Plan With Legacy Assurance Plan For More Information Httpslegacyassuranceplanwordpr Estate Planning Checklist Estate Planning How To Plan

25 Percent Corporate Income Tax Rate Details Analysis

Property Tax Comparison By State For Cross-state Businesses

Thankyou Lord Amen Faith Quotes Inspirational Quotes Quotes About God

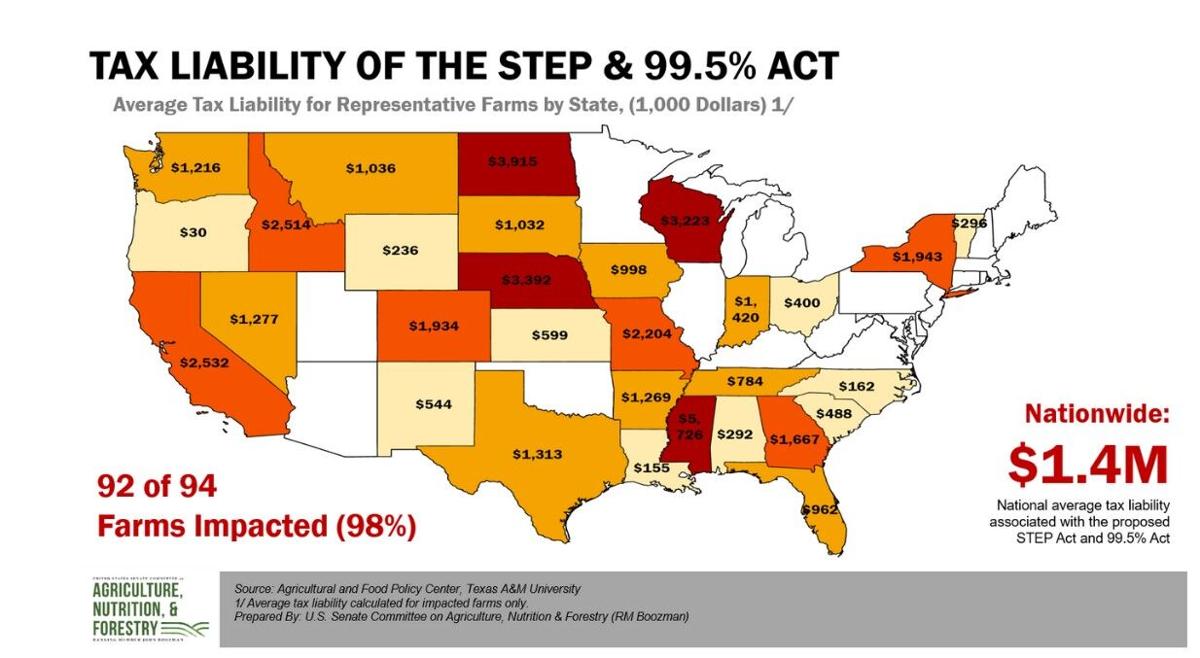

Texas Am Study Analyzes The Impact Of Inheritance Tax Code Changes On Farmers National Farmweeknowcom

States With Highest And Lowest Sales Tax Rates

Muesterilerimizin Kusursuz Bir Sekilde Dedektif Hizmeti Alabilmesini Hedeflemekteyiz Firmamiz Bu Alanlarda Basarili Law Firm Law Firm Marketing Business Lawyer