Retirees are generally not very affected by the az income tax, as social security income is not taxable in arizona. You are allowed to subtract the amount you received or $2,500, whichever is less.

Here Are The 10 Best Cities In Nevada To Retire In Best Cities Nevada Small Towns

People who live in nevada typically pay more for groceries, healthcare, and transportation than the average consumer.

Arizona vs nevada retirement taxes. However, other types of retirement income are taxed, either partially or fully. Nevada has no estate or inheritance tax. Both arizona and nevada have a meager cost.

The average couple in retirement can manage to live in arizona for about $1,500 per month. The average total sales tax rate is 8.23%. A retirement program established by the board or regents or another community college district.

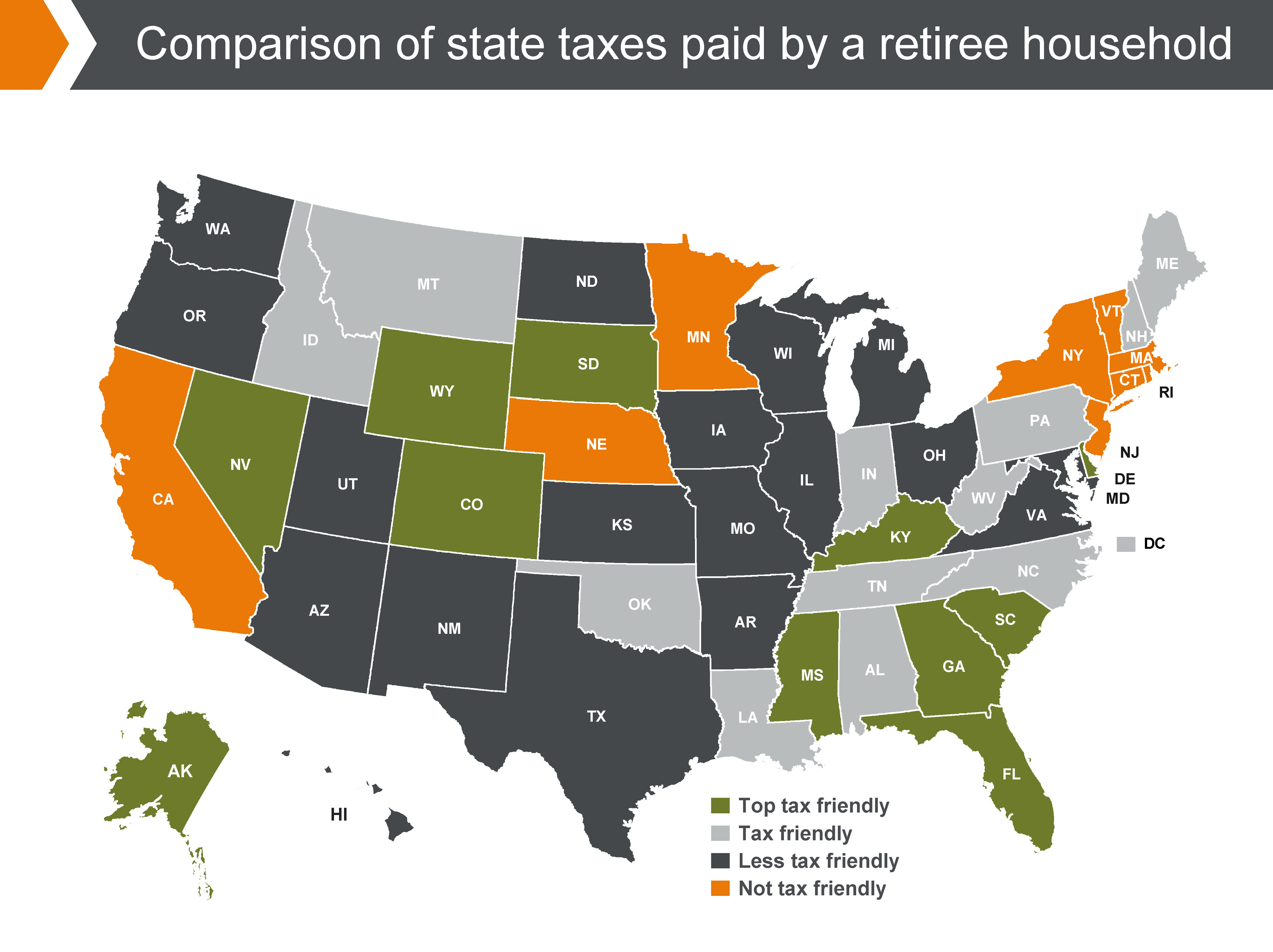

From a tax standpoint for retirees nevada is the best choice, since it has no income tax. Arizona’s average state and local sales tax rate is 8.4%. The main thing people seem to be concerned about when choosing a place to retire is property taxes.

State retirement guides gulf coast retirement: Nevada has no state income tax or inheritance tax, making it the ideal state for someone who has a high income in retirement or a substantial 401(k) or ira that they will be forced to distribute at 70.5. In combination with the low cost of living in rural.

Phoenix, arizona vs henderson, nevada. 2021 cost of living calculator: Is social security taxable in nevada?

Distributions from retirement savings accounts like a 401 (k) or ira is taxed as regular income, while income from a pension is eligible for a deduction. There’s no escaping the fact that the vast majority of retired americans are on some sort of fixed income. The cost of living in arizona is reasonable for most households.

Social security benefits are not taxed. While that income may be high or low, it’s very important to check out arizona vs nevada taxes. That is higher than the national average, but it is the only relevant tax that is higher in nevada than in most of the rest of the country.

Considering the national average is 100, retirement here is going to cost more than some other states. Social security retirement benefits, even those taxed at the federal level, are not taxed in nevada. When you add housing costs to that figure, then it can double if you decide to live in flagstaff or phoenix.

Click on any state in the map below for a detailed summary of state taxes on retirement income. Arizona is next, with no tax on social security and the lowest income tax (although the highest property tax rate). However, arizona exempts social security from taxation.

State tax rates and rules for income, sales, property, estate, and other taxes that impact retirees. A salary of $68,116 in phoenix, arizona should increase to $76,585 in henderson, nevada (assumptions include homeowner, no child care, and taxes are not considered. According to the tax foundation, the median property tax on arizona’s median home value of $166,000 is a.

See our florida and arizona retirement guides for more on taxes. You can only include the amount that was included on your federal return.

10 Most Tax-friendly States For Retirees Retirement Locations Retirement Advice Retirement Planning

Arizona Retirement Tax Friendliness – Smartasset

Arizona Vs Nevada Which State Is More Retirement Friendly 55places

Arizona Vs Nevada Wheres Better To Retire

Lowest To Highest Taxes By State No Kill Animal Shelter Animal Shelter Catholic

Arizona Vs Nevada Wheres Better To Retire

Moaa – 2 More States Exempt Military Retirement Pay From State Income Tax

Which States Pay The Highest Taxes Family Money Saving Business Tax Economy Infographic

Leaving California Best Places To Retire Cost Of Living Prescott

Arizona Vs Nevada Wheres Better To Retire

37 States That Dont Tax Social Security Benefits The Motley Fool

States With The Highest And Lowest Taxes For Retirees Money

Moving From California To Nevada Or Arizonawhich Is Better – Rpa Wealth Management

Pin On Retirement

Kiplinger Tax Map Retirement Tax Income Tax

Map Of Arizona California Nevada And Utah Arizona Map Nevada Map Utah Map

States With Highest And Lowest Sales Tax Rates

Arizona Retirement Tax Friendliness – Smartasset

Arizona Vs Nevada Which State Is More Retirement Friendly 55places