The arizona department of revenue (ador) is. Recently, congress passed a bill that extends the solar incentive through the end of 2022 so that means homeowners can still get the full 26% federal tax credit this year.

More Money In Your Pocket Congress Extends The Solar Investment Tax Credit Itc At 26 Until End Of 2022 Solar Wolf Energy

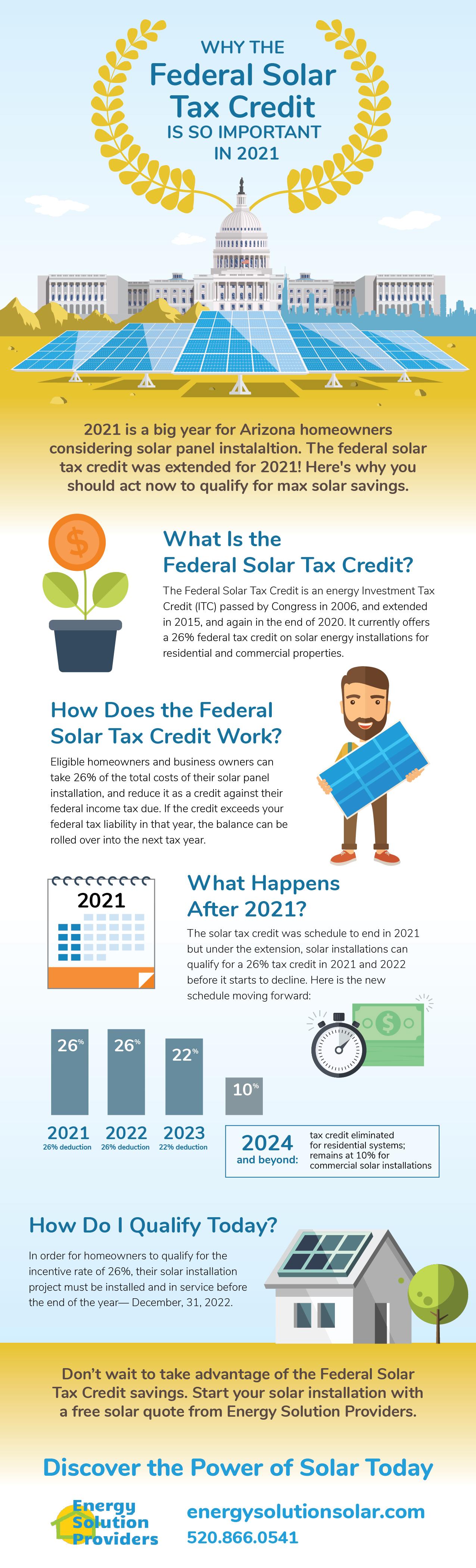

Instead of expiring at the end of 2020, the 26% solar tax credit will renew in 2021 and remain in place through 2022.

Arizona solar tax credit 2022. Arizona residential solar energy tax credit. If you buy and install solar panels in arizona in 2021, you can now earn a 26% federal tax credit. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 26% = $5,200.

The 26% federal solar tax credit is available for purchased home solar systems installed by december 31, 2022. The federal tax credit falls to 22% at the end of 2022. It is scheduled to reduce to 22% in 2023 and may not be extended thereafter.

For any solar systems installed before the end of 2022, 26% of the cost of the system is available as an income tax credit. The arizona state tax credit is 25% of your solar pv system costs, up to $1,000. Commercial owners can deduct 10% of their commercial solar panel costs from taxes starting in 2022 and onward.

Equipment and property tax exemptions. The deadline for making a donation and claiming a tax credit under the az charitable tax credit for 2020 has been changed from april 15, 2021 to may 17, 2021. Thanks to the solar equipment sales tax exemption, you are free from the burden of any arizona solar tax.

The consolidated appropriations act of 2021 bill extended the 26% investment tax credit through 2022. The 26% solar tax credit is available through the year 2022. There is currently a 26% federal solar tax credit, called an investment tax credit (itc), available for homeowners who install residential solar panels between 2020 and 2022.

The solar investment tax credit is the single largest incentive for going solar. What is the solar tax credit for 2022? New bill extends 26% solar tax credit.

What is the solar tax credit for 2022? Residential arizona solar tax credit. The residential arizona solar tax credit reimburses you 25 percent of the cost of your solar panels, up to $1,000, right off of your personal income tax in the year you install the system.

There’s a simple one word answer to that question. If you haven’t started the switch to solar, it’s time to talk to a solar panel installer in phoenix, az. The renewable technologies eligible are photovoltaics, solar water heating, other solar electric technologies, wind, fuel cells, geothermal and heat pumps.

After 2022, the tax credit will then drop to 22% in 2023. The arizona state tax credit is 25% of your solar pv system costs, up to $1,000. Ad ever wondered why solar is so expensive?

2022 is the year to move forward to maximize savings. Your solar system cost will also depend on the net metering policy of your local utility company. The 25% state solar tax credit is available for purchased home solar systems in arizona.

Federal solar tax credit anyone in the u.s., including arizona, is able to take advantage of the federal solar investment tax credit, or itc. This enticing tax credit will drop to 22% in 2022 and will end in 2024. There’s a simple one word answer to that question.

Before you calculate your tax credit. Ad ever wondered why solar is so expensive? 22 rows license renewal:

The 26% federal solar tax credit is available for purchased home solar systems installed by december 31, 2022. With the arizona solar tax credit, the credit caps at $1,000 or 25 percent of the value of the system, whichever is lower. Net energy metering in arizona

The newly signed legislation removes the originally established timeline for the solar tax credits. The federal tax credit will remain at 26% until the end of 2022, and there is no maximum amount. The federal tax credit will remain at 26% until the end of 2022, and there is no maximum amount.

5 arizona residential solar energy tax credit the 25% state solar tax credit is available for purchased home solar systems in arizona. The tax credit amount was 30 percent up to january 1, 2020. As 2022 approaches its end, more and more homeowners will be trying to complete their projects.

This incentive is causing solar companies to book up quickly so be sure to contact us soon so you can get installed in time for the hot summer months when electricity bills are at their highest. In 2023 it drops down to 22% before ending permanently for homeowners beginning on january 1,. The arizona tax credit for solar panels is 25% of your system costs or $1,000, whichever amount is less.

Like the other credits in this article, it will also roll over if you don’t use the full amount in a single year, with a maximum of five years. There are additional incentives other than the federal itc program, available throughout arizona.

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Us Will Be Hard-pressed To Meet Its Biofuel Mandates Mit Technology Review

Everything You Need To Know About The Solar Tax Credit Palmetto

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

The Federal Solar Tax Credit Energy Solution Providers Arizona

Solar Panels For Your Home What To Ask In 2020 – Chariot Energy

Breaking 26 Solar Tax Credit Extended Through End Of 2022

The Extended 26 Solar Tax Credit Critical Factors To Know

Renogy 400 Watt 12 Volt Polycrystalline Solar Starter Kit W 40a Mppt Charge Controller Solar Panel Kits Solar Solar Panels

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Biden Seeks 10-year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Solar Tax Credit In 2021 Southface Solar Electric Az

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Pin On Solar Pv Racking Systems

Federal Solar Tax Credit 2021 How Does It Work Sunpro Solar