If you are an oregon resident or nonresident and work for a business in oregon, your employer is required by law to withhold the stt from your wages automatically. These are entered as unreimbursed employee expenses on line 21 of schedule a (form 1040) itemized deductions.

2

Union and professional dues are reported on schedule a and subject to the 2% agi limitation.

Are union dues tax deductible in oregon. For tax years 2018 through 2025, union dues—and all employee expenses—are no longer deductible, even if the employee can itemize deductions. The amount of union dues that you can claim is on box 44 of the t4 slip issued by your employer. This would give you an additional $100 charitable contribution to deduct on your federal tax return, and it would give you a $100 oregon tax credit.

To claim union dues as a deduction you must use the long form 1040. Thanks to the recent changes in the tax law, 2017 will be the last year you can deduct union dues on your federal income tax return. Can i put this amount as.

You can only deduct certain types of union dues or professional membership fees from your income tax filings. You can pay them manually or by deductions from wages. Membership in the workplace organizations has, at best, stalled.

Some portion of union assessments are tax deductible your union dues, plus any initiation fees you pay when you join the union, count toward your unreimbursed employee expense deduction on your taxes, just like travel expenses and other employee expenses. As a union member, know your union is here for you. $1.35 per month for professional union members.

The deduction must meet the limitations on miscellaneous itemized deductions (deductible when miscellaneous itemized deductions exceed two percent of adjusted gross income). So if your adjusted gross income is $40,000, anything beyond the first $3,000 of medical bills — or 7.5% of your agi — could be deductible.12 avr. Tax reform changed the rules of union due deductions.

Effective july 1, 2017 the oregon nurses association's dues rate will increase by: Over 1,000 technical and engineering employees working for the state of oregon are represented by the association of engineering employees (aee). Did you know you can deduct union dues?

Effective in 2019, union members can now deduct their union dues from state taxes provided they itemize deductions. Go to screen 25, itemized deductoins (sch. Learn more about a few of the many supports that oea provides for you.

Ideally, members should look at their final paystub in 2013 to find their annual union dues paid. Scroll to the section state miscellaneous deductions (subject to 2% agi limitation). Approximately 62% of the total of nea, oea and local association dues may be included as a miscellaneous itemized deduction on 2017 tax returns.

Artist's charitable contribution (reported on the nonresident return form) And they lost a tax break in last year's tax reform bill. $3.26 per month for fair share payers.

When we stand together as members of a strong union, we have. Prior to the act, they were partially deductible as a miscellaneous deduction under the 2% rule. To report manually paid dues:

Are rnao fees tax deductible? Members may be able to deduct their union dues on their 2016 income taxes. You may be able to deduct your union dues if you itemize deductions (schedule a).

You can claim a tax deduction for these amounts on. You can deduct dues and initiation fees you pay for union membership. Question from susan april 8, 2011 at 11:15am richard, my husband teaches high school and paid $900 in union dues in 2010.

To enter your union dues in turbotax: Politicians and the public tend to view them unfavorably. Where do i claim union dues on my taxes?

Rnao membership satisfies this requirement for rns and nps, thus your rnao fees paid may be. Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the tax cuts and jobs act. Union dues no longer deductible under new tax law.

Please note that tax payers can now itemize deductions on state taxes even if they do not itemize on federal taxes. This includes nea, oea and pat dues. For tax returns filed in 2021, taxpayers can deduct qualified, unreimbursed medical expenses that are more than 7.5% of their 2020 adjusted gross income.

If you take the state tax credit here, you must back out any amount taken as an itemized. For years, state employees were required to pay union dues to aee as a condition of employment and the state automatically deducted union dues from workers’ paychecks. The amount of the deduction will be based on the actual dues paid in 2013.

$0.87 per month for professional association members. Labor day 2018 doesn't bring much good news for unions. The 2018 tax reform act changed the rules of union due deductions.

Oregon law allows a tax credit for political contributions.

2

Your Pay Stub Portland State University

Oregongov

Zpay Payroll Systems Inc Support Forum

Deducting Union Dues Drake17 And Prior

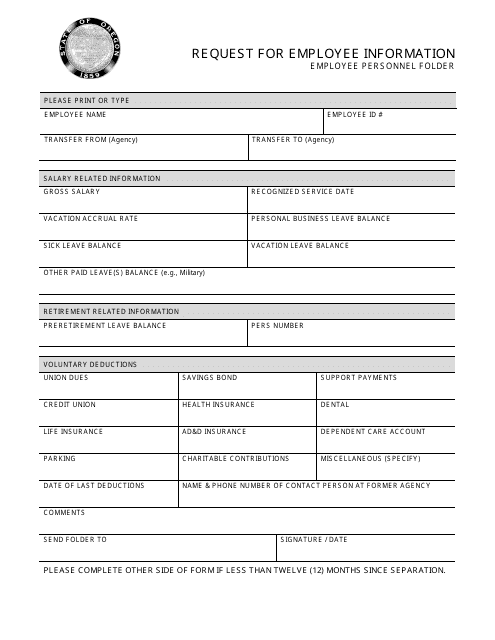

Oregon Request For Employee Information – Employee Personnel Folder Download Fillable Pdf Templateroller

Top Tax Tips For Nurses Ameritech College Of Healthcare

2

Pamplin Media Group – Unions Search For Path Around Dues Deduction Restrictions

2

2

Union Dues Are Now Tax Deductible Foa Law

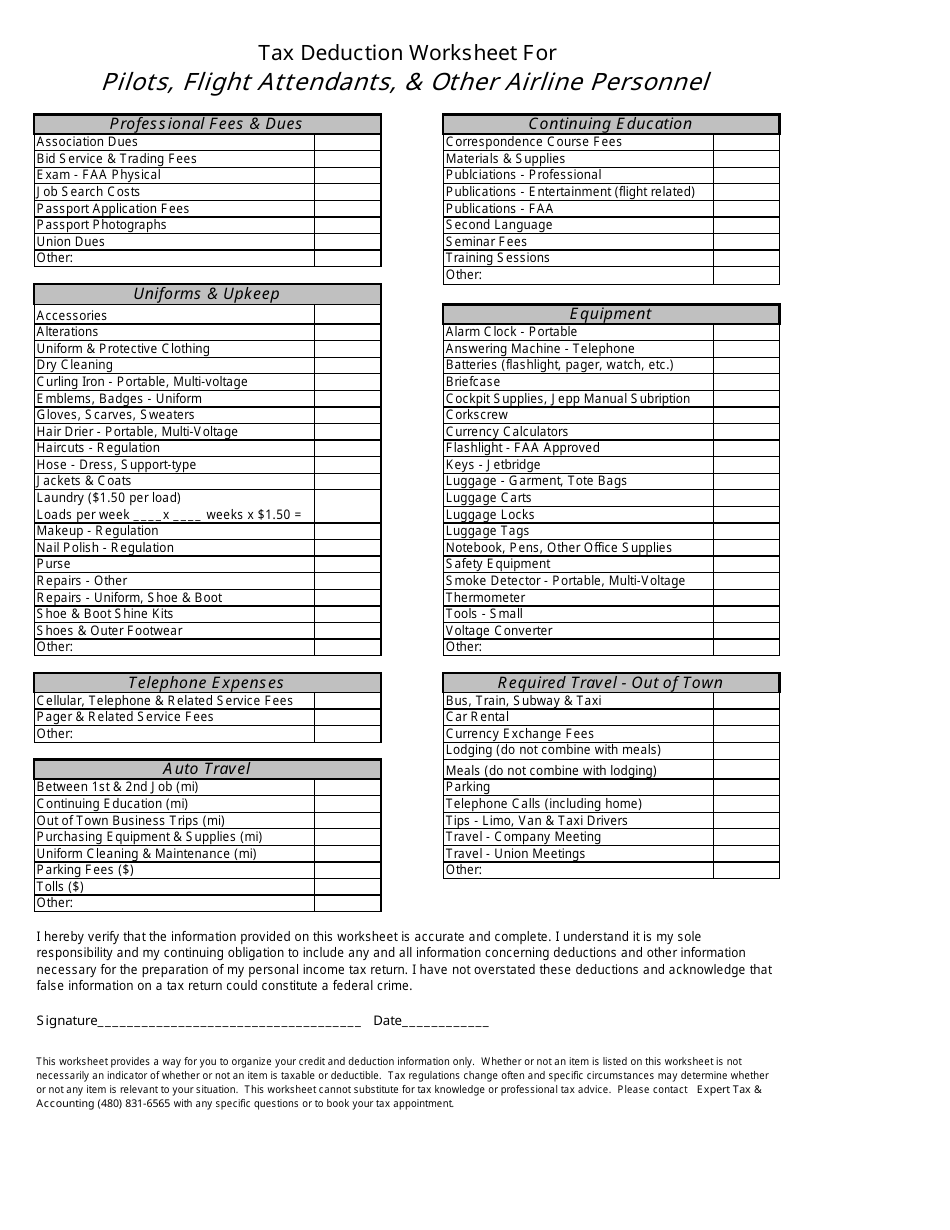

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller

Why All Workers Should Be Able To Deduct Union Dues – Center For American Progress

Ibew48com

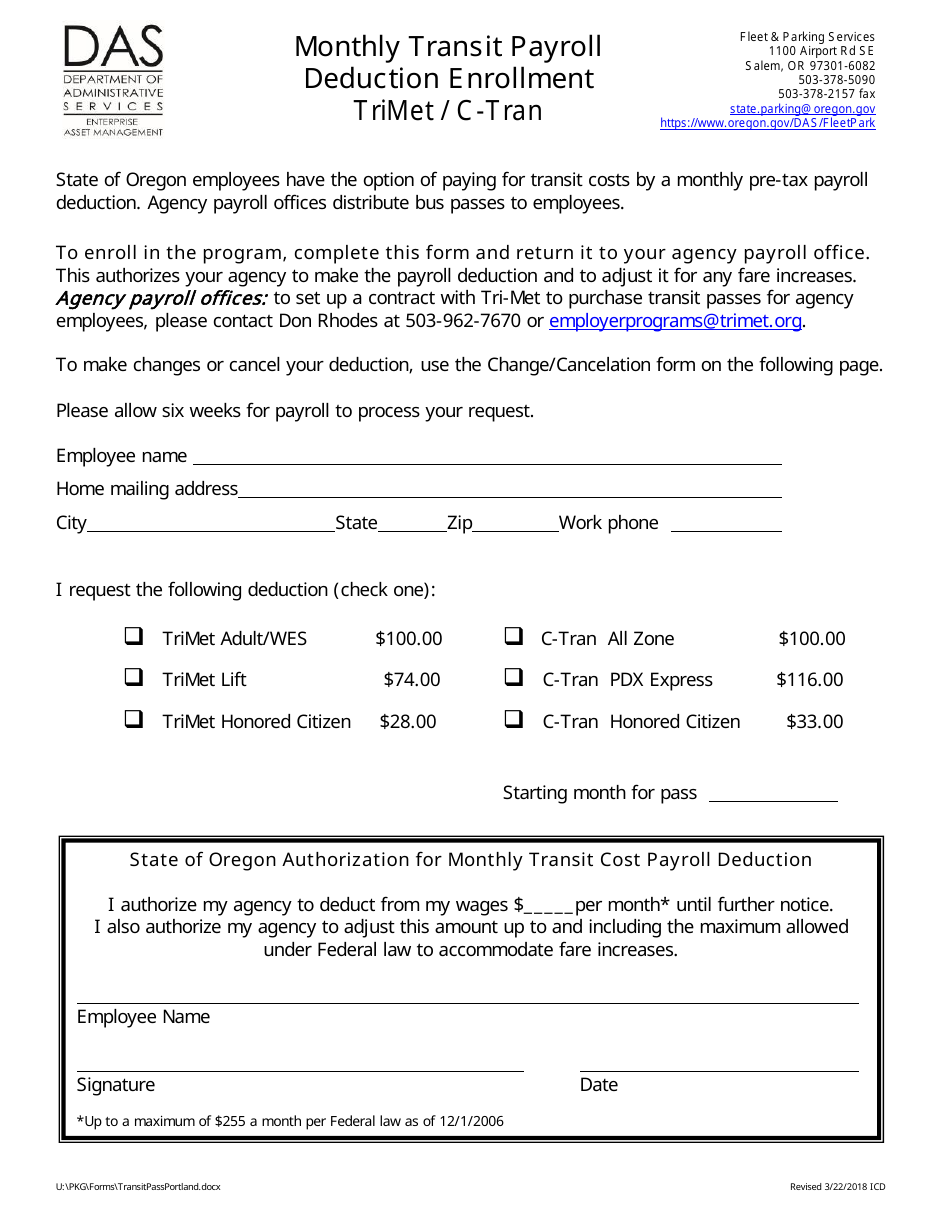

Oregon Monthly Transit Payroll Deduction Enrollment Trimet C-tran Download Fillable Pdf Templateroller

Are Union Dues Deductible

2

Its Tax Time Remember Union Membership Dues May Be Deductible Nteu Chapter 280 Us Epa Hq