The big unions in ontario charge their members a much higher dues rate. Nowu's union dues are 1.4%, one of the cheapest in the labour movement.

Deducting Union Dues Drake17 And Prior

Union dues no longer deductible under new tax law.

Are union dues tax deductible in ontario. Being a member of one of the 'big unions' can be expensive. Please note that income tax legislation does not have any impact on the amount of union dues deducted by an employer. Union dues are fully tax deductible and considering all of the benfits and increases over time in the bargainign process you are much, much further ahead.

In accordance with the relevant collective agreement, the employer must deduct an amount equal to the monthly union dues from the pay of any employee in the bargaining unit. • 100% tax deductible • capped at $99.00 per month • equal to the price of a daily cup of coffee how it all works a union is defined as an organized association of workers formed to protect and further their rights and interests. Union dues are tax deductible.

A tax deduction can then be claimed on line 212 on your tax return for the amount found in box 44. For each full time equivalent teacher, the four affiliates remit an annual fee of $30.40 to otf. 8.1.2 should labour relations circumstances warrant it, tbs will notify pwgsc to automatically cease union dues deductions for employees in the bargaining unit.

The otf fee is included in the tax deductible dues a teacher pays to his/her federation. Line 21200 was line 212 before tax year 2019. 8.1.1 tbs is responsible for notifying departments of changes in the administration of union dues and in union dues deduction rates.

The chart below shows weekly opseu union dues calculated at $10 intervals. You can deduct any union dues paid by you from your taxable income. These include professional board dues, which may be.

Membership in the workplace organizations has, at best, stalled. Opseu dues are calculated at 1.375 per cent of all wage income, wage allowances and lump sum payments. Union dues, like professional fees, are tax deductible.

Annual union dues for membership in a trade union or association of public servants. We work for free until we have an angreement that greatly improves your working conditions. And, because dues are tax deductible, it works out to be much less.

As for your ona dues, does your employer pay this on your behalf, or do you pay it personally? Also, $3.50 per month of your ona dues Politicians and the public tend to view them unfavorably.

Furthermore, you cannot claim a tax deduction for paying membership dues as a member of a pension plan. Union dues are set and approved only by the membership at our convention, which is held every four years. You cannot claim a tax deduction for initiation fees, licences, special assessments or charges not related to the operating cost of your company.

How about professional membership dues? Union dues or professional membership dues you cannot claim. They ought to listed in your t4 in box 44.

Labor day 2018 doesn't bring much good news for unions. Similar to union dues, you are also eligible for tax deductions on certain other items. Do i get a deduction for union dues on my tax return?

And they lost a tax break in last year's tax reform bill. Union dues and professional association fees are tax deductible. Therefore, union dues may have to be adjusted retroactively.

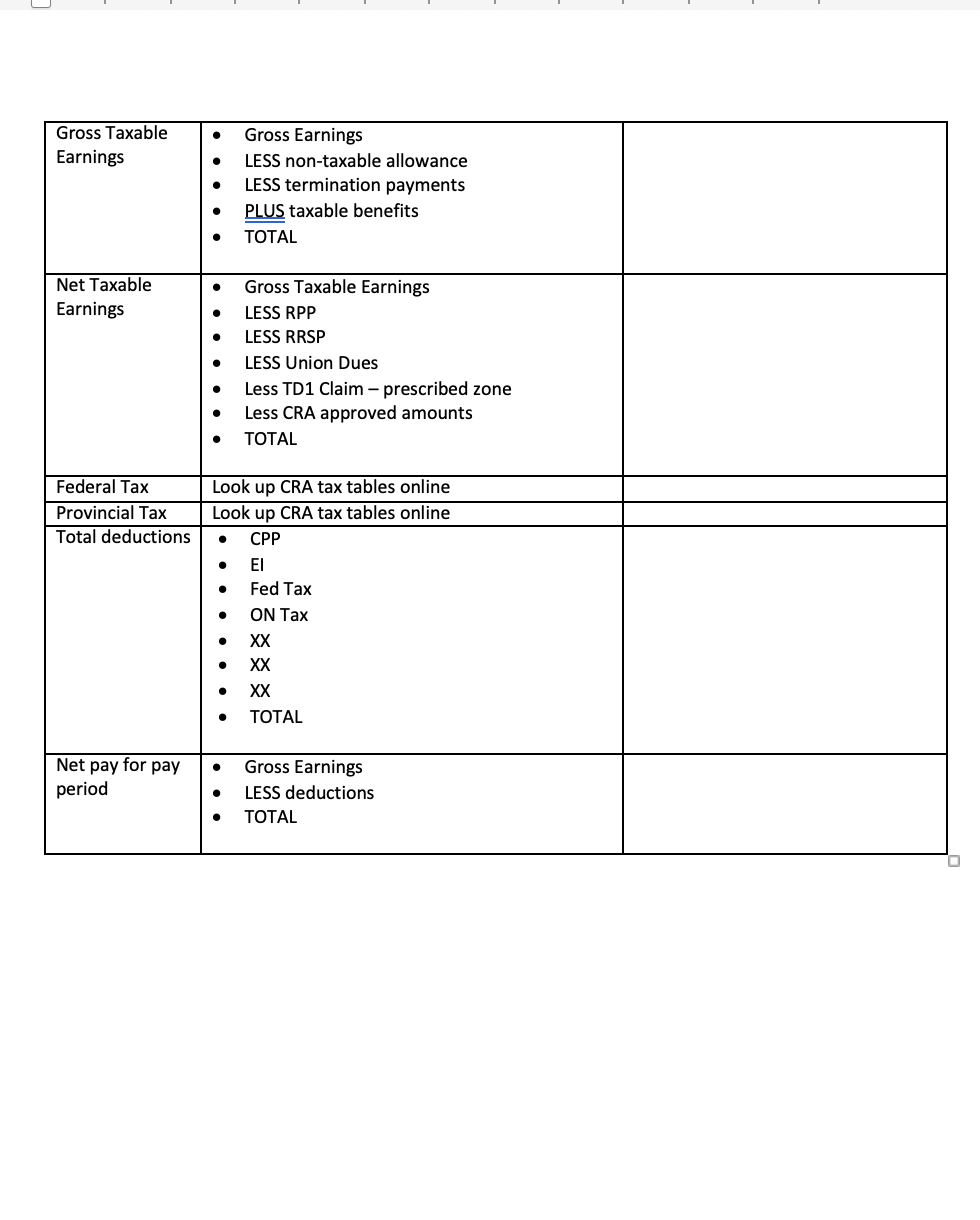

Dues are in investment in the improvements in pay, benefits and fair treatment won through collective bargaining. The combined federal and ontario marginal income tax rates for 2020, allowing for the basic personal amount credit of $13,229, are as follows: Union dues and professional fees.

Membership dues for trade unions or public servant associations may be deducted on income tax returns. Dues are completely tax deductible. Professional dues which must be incurred under provincial and territorial laws.

Dues structure opseu dues are calculated at 1.375 per cent of all wage income, wage allowances and lump sum payments. For example, if your annual income is $40,000 and you paid $1,000 as union dues, your taxable income will be only $39,000. Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees.

The union dues you pay will be recorded on your t4 slips and are a deduction from your taxable income. Claim the total of the following amounts related to your employment that you paid (or that were paid for you and reported as income) in the year: * for or under a superannuation fund or plan;

Weekly salary dues $50 $0.69 $60 $0.83 $70 $0.96 $80 $1.10 $90 $1.24 $100 $1.38 $110 $1.51 $120 $1.65 $130 $1.79 $140. Annual dues for membership in a trade union or an association of public servants. However, the act provides that annual dues of a member of a trade union or association are not deductible, to the extent that they are, in effect, levied:

Unemployed teachers do not pay fees. You can claim a deduction for the amount of union dues if they are included in box 44 of the t4 slip issued by your employer. The core work of otf is supported entirely by these fees, which are approved annually by the board of governors.

Dues are completely tax deductible. Dues pay the cost of contract negotiations, grievance and arbitrations, training for members, legal fees, and much more so employees no longer have to go at it alone. At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions.

They are charging their members as much as 1.8% in union dues. Sometimes they charge additional money for an. Effective january 1, 2021, dues paid to ona for the dues months of january 2021 to december 2021 are as follows:

At 1.5 per cent of total earnings, moveup’s dues are lower than most canadian unions. The chart attached shows weekly opseu union dues calculated at $10 intervals. The eligible moving expenses must be deducted from income earned at the new location.

However, most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the tax cuts and jobs act (tcja) that congress signed into law on december 22, 2017. Ontario nurses’ association (ona) members pay a flat rate based on their hourly rate of pay. Certain moving expenses incurred to move are tax deductible.

Trade licensing necessary to practice a profession.

Your Union Dues Plain And Simple

Union Dues Opseu Sefpo

D3n8a8pro7vhmxcloudfrontnet

Professional Dues

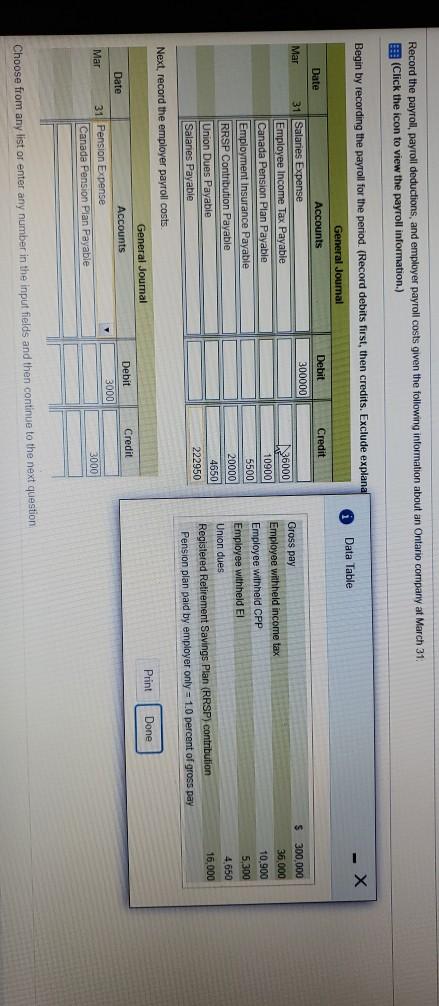

Solved Record The Payroll Payroll Deductions And Employer Cheggcom

Membership Dues Tax Deduction Info – Teachers Association Of Long Beach

Claiming A Deduction For Professional And Union Dues

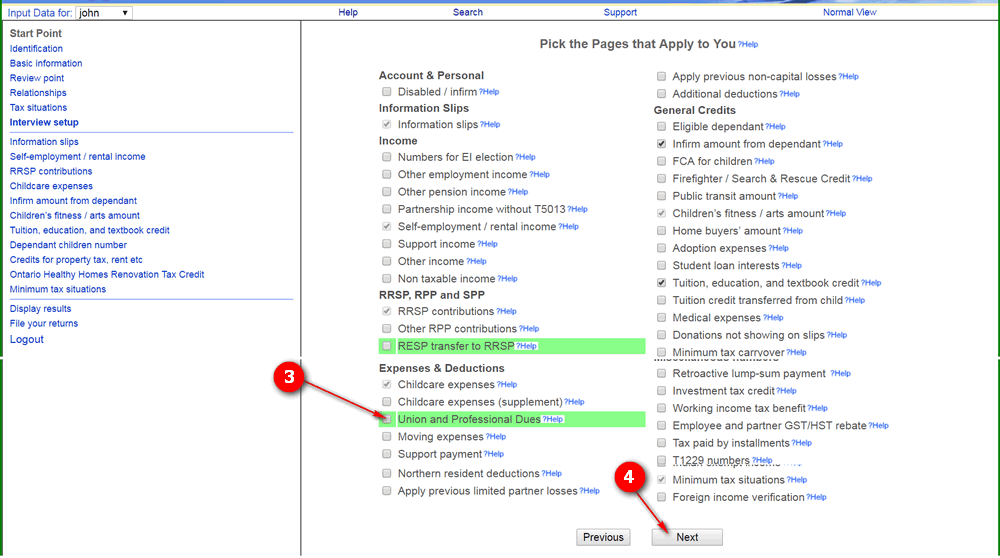

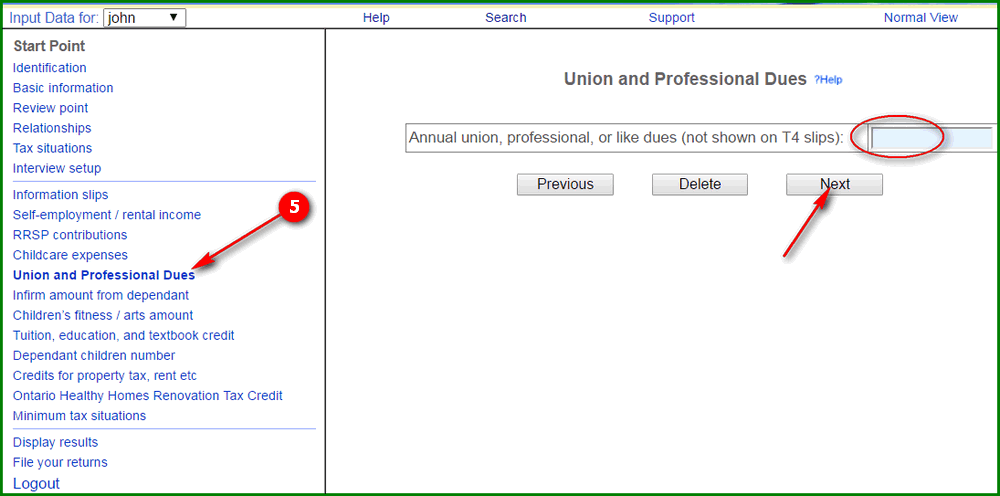

Where Do I Enter My Union And Professional Dues Hr Block Canada

Professional Dues

Giving Dues Their Due Opseu Sefpo

Union Dues Opseu Sefpo

Claiming Union Or Professional Dues On Your Income Tax Return

Chapter 11 Payroll And Shortterm Liabilities Accounting For

Just Got A Letter From Cra They Want My Union Dues Receipts Union Wont Give Them To Me Because They Are Not Dues They Are Admin Fees Ontario Canada Rpersonalfinancecanada

Union Professional And Other Dues For Medical Residents – Md Tax

Are Our Union Dues Tax-deductible In Canada Express Digest

Our Members Dues Usw Canada

Claiming A Deduction For Union Or Professional Dues – Virtus Group

Hemal Thomas Is An Employee In Ontario The Net Pay Cheggcom