As a result of the legislation passed and signed into law in april 2017, union members in the state of new york will have the opportunity to deduct their union dues from their state income taxes. Will my dues be used for political reasons?

Deducting Union Dues Drake17 And Prior

Prior to 2018, an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses, if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

Are union dues tax deductible in ny. Bill seeks to make union dues tax deductible. This paragraph, union dues are those amounts that are deductible as union dues and agency shop fees under section 162 of the internal revenue code. Are union dues tax deductible in ny?

Thanks to new legislation, union members can now deduct their union dues in full from their new york state income taxes. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. Well, you can thank your union for this benefit.

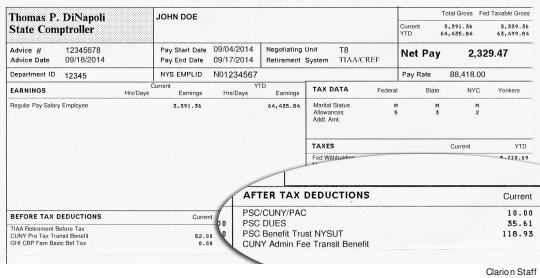

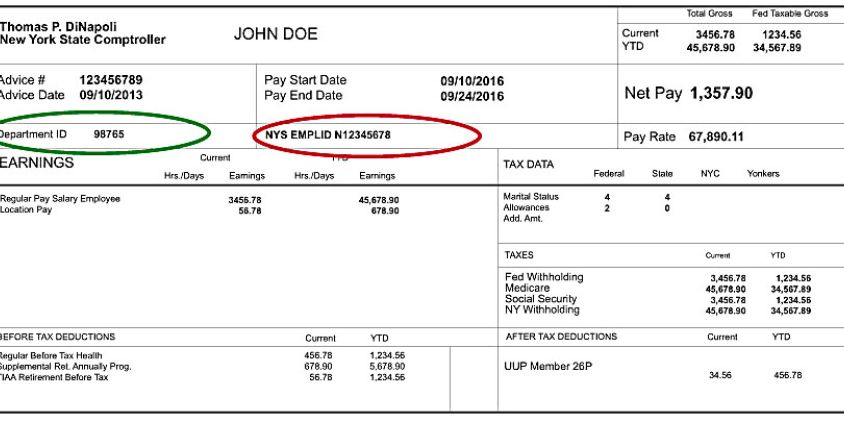

If that number is a zero, that is a good indicator your union dues were not being deducted. New york union dues are now fully tax deductible under a state budget provision backed by gov. “out of the clear blue sky, a provision making labor union dues fully.

Deduct your union dues from your new york state income taxes. (1) partners and shareholders of s corporations which are not new york c corporations. Union dues pay for the csea child care resource center, conference calls, mailings, lobbying, legal assistance, members training and meetings.

In the final package was a provision that makes union dues tax deductible when filing your new york state tax return. The amount of union dues that you can claim is shown in box 44 of your t4 slips, or on your receipts and includes any gst/hst you paid.you can claim a tax deduction for these amounts on line 21200 on your tax return. Also, the deduction opportunity has been expanded to union members and agency fee payers who do not itemize deductions on their taxes.

Effective in 2019, union members can now deduct their union dues from state taxes provided they. Are dues and subscriptions deductible in 2019? The ability for unions to deduct dues from their state personal income taxes.

Bill seeks to make union dues tax deductible may 2, 2021 the 2019 tax season was the first time union members could no longer deduct the cost of items such as tools, uniforms, subscriptions to trade journals, and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. Andrew cuomo slipped in a sweetener for unions: Previously, only union members who itemized deductions on their taxes received a small deduction for union dues or agency fee payments.

(e) modifications of partners and shareholders of s corporations. Cuomo on friday ceremonially signed a bill. How do i enter union dues on my ny tax return.

For certain new york itemized. If you belong to a union or professional organization, you can deduct certain types of union dues or professional membership fees from your income tax filings. If the total of your itemized deductions is below the standard deduction, you will not be able to deduct your union dues.

I listed them under an unreimbursable expense on my federal return but nothing seems to have changed on my state return? New york standard deduction amounts. At a combined federal and state tax rate of 35%, when you pay $300 in dues, the real cost to you in only $195.

Dues are a fully tax deductible business expense. That deduction has been increased. New york makes union dues tax deductible.

Dues fully deductible from state taxes. Governor cuomo signed the law in our union. In order to take advantage of this new law, union members must itemize their deductions on their new york state tax filings.

Lift the suspension of the deduction for unreimbursed employee expenses, including money spent out of pocket on tools, uniforms and other necessary supplies, travel costs and job. Did you know that your union dues are now tax deductible? (although depending on other adjustments, it is possible for that number not to be a zero and.

If your itemized deductions exceed the standard deduction, please comment so we can assist you further. No, employees can’t take a union dues deduction on their return. The new york state assembly passed a 'final' budget' on friday, with the senate reconciling and passing that same budget bill sunday night.

Make the deduction for union dues “above the line,” meaning union taxpayers can claim it without itemizing. **say thanks by clicking the thumb icon in a post.

Let Your Accountant Know Union Dues Are Tax Deductible Cwa 1109

Law Makes Union Dues Deductible On State Taxes New York Law Journal

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Tax Time Remember These Deductions Your Union Won For You

Deducting Union Dues On Nys Taxes – Uup Buffalo Center

Union Dues Are Now Tax Deductible Ibew 1249

Are You A Union Member Psc Cuny

Nys Afl-cio Union Dues Now Deductible From State Income Taxes Twu Local 100

Deduct Your Union Dues From Your New York State Income Taxes Hotel Trades Council En

Union Dues Now Tax Deductible Ibew 1249

Bill Seeks To Make Union Dues Tax Deductible – Iam District 141

2

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

Union Representation Faculty Handbook Purchase College

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Union Dues Are Tax Deductible In Ny Ibew 2032

Deduct Your Union Dues At Tax Time New York State Afl-cio

Union Dues Are Now Tax Deductible Foa Law

Nys New Tax Breakfor A Few – Empire Center For Public Policy